SBIN SBIN is currently trading around ₹800 and is positioned at a crucial support/resistance zone (around ₹790–₹800). This level previously acted as resistance and may now act as strong support.

Before taking a trade, two scenarios should be clearly considered:

1. Upside Confirmation (for a Bullish Trade):

If SBIN closes above ₹805–₹810 with strong buying momentum, a long (buy) position can be initiated.

Target: ₹840 / ₹870

Stop Loss: Below ₹788

2. Downside Confirmation (for a Bearish Trade):

If SBIN gives a daily close below ₹790 and the support breaks, a short (sell) trade can be taken.

Target: ₹765 / ₹740

Stop Loss: Above ₹805

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

Sbinview

SBIN : at Wave C completion zoneSBIN Analysis (20th Dec 2024)

The chart of SBIN (State Bank of India) illustrates an extended retracement to mitigate liquidity, a failed breakout (BO), and a corrective wave completion. Let us dive into a step-by-step educational breakdown of actionable levels.

Current Structure:

The price has recently formed a corrective wave structure (A-B-C) and is trading near a potential demand zone around 818-834.

The first target zone lies between 850-852. Further breakout could lead to an extended target between 900-912.

The stop-loss is below 814, where failing the deep retracement may result in bearish continuation.

Action Plan:

Buying Opportunity: Consider entering near 818-834, as this aligns with the golden retracement zone. This is a low-risk entry given the confluence of previous support and corrective wave completion.

Targets: Book partial profits around 850-852. If momentum sustains, trail stop-loss to 845 and aim for 900-912 as the extended target.

Stop Loss: Place a stop-loss below 814 to manage risk. A failure here could invalidate the setup, resulting in further downside risk.

Risk-Reward Ratio: Buying around 830 with a target of 850 (initial) and 900 (extended) offers a risk-reward ratio of approximately 1:3, making it a favorable trade setup.

Key Educational Note:

Green trendlines denote bullish movement, while red illustrates potential bearish risks. The yellow trends indicate a sideways range, highlighting consolidation zones.

Disclaimer: This is not financial advice. Always consult with a SEBI-registered advisor before trading. Like and share if you find this analysis helpful!

SBIN--Rally Base Rally or ReversalThis stock is continuously rising...

we have a demand zone lies at 700 levels...

observed rally base rally is going to observe in this stock.

if failed to go long from this place price will test the demand zone at 700 levels...

keep looking for long side from this demand zone for the target 840.

BUY SBIN AROUND 440 TGT 495/535/580/640 SL BELOW 380 AVG @ 425Currently it is trading below 100 DMA and it is supposed to make a minor pull back before taking support around 200 DMA and will resume its further uptrend. As budget session is also approaching and the previous quarterly results were also stable and is supposed to perform better in the current quarter. Any breakout above the price action line will make it to go for above mentioned target with given SL.

SBIN--Test of Supply is Needed??Observations::

price clears all the demand zones on bottom side...

now price is coming back to test the previous demand zone may acts supply zone

or to test strong fall area to again fall...

POI are marked on the chart please look at these areas...for sell

Keep track these levels. 580 and 590 Zone

SBIN--Bullish Outlook to Long ??Observations:: SBIN

--->> Price is trading in a channel...

if we see the difference between the HH is decreasing gradually...

which is a sign of reversal in this stock...

clearly price created a gapdown as well, indicating a bearish sign....

we are clearly in an uptrend, price tries to go upside from 570-555 range,

but that not move too much..only 20-30 points we can expect.

Look for buy when price comes back to the below levels,

We have a demand zone,@540 levels, and strong movement to the upside is observed at 530 levels,

if we enter long in this area we will ride the trend again and only be exited at 630 levels only.

Keep a note on this levels, and also track this levels.

SBIN--Drop base drop formation??Observations::

This is a continuation post to my previous post about SBIN::

Consolidation Happens between the demand zone and supply zones. Price restriction is happens between the zones.

While breaking the previous demand zone, price leaves a supply zone @586-590 range,

if price wants to test this supply zone and falls below or continue to fall down.

A Drop -Base-Drop is going to be observed, we have left with drop formation, if price breaks the smaller trendline will observe a fall towards target 1 and target2.

keep track this instrument.

SBIN--Fake Breakout @590 range.----->> after strong fall from 588-590 range, price again coming back to supply zone with consolidation to upside,

if failed to create a new high and falls below 575 range then sell for the target of 565 range.

the demand zone @ 575 range acts as support and the demand zone created at 582 becomes resistance, hence price is in consolidation.

if price consolidation to downwards price again rise from 565 range.

Monthly expiry is between 590 to 565 range.

keep track of these levels.

SBIN--Which is Support Trendline or Resistance??Observations::

the stock is trending upwards.

------>>Today SBIN is showing Bearish pressure.

-------->>Bearishness is continue or Reversal May Happen at 570 levels.

---------->>Previously A strong selling pressure is observed at 570 level ,look at the reaction at these levels to go upside or downside.

---------->>Previous Resistance if turned as Support again, price will rise.

------------>>price break and acts as resistance more fall is going to observe. keep an eye at these levels.

------>> we have a trendline support as well, keep look at these levels.

Please like, if this information is Helpful.

SBIN Conditional Buy levels 28.03.2023This is conditional buy view on NSE:SBIN . If 45min candle closed above 515, we can make a entry with stop loss of 507. My expected upside target will be 528.00. It would be positional trade for 1-2 days.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

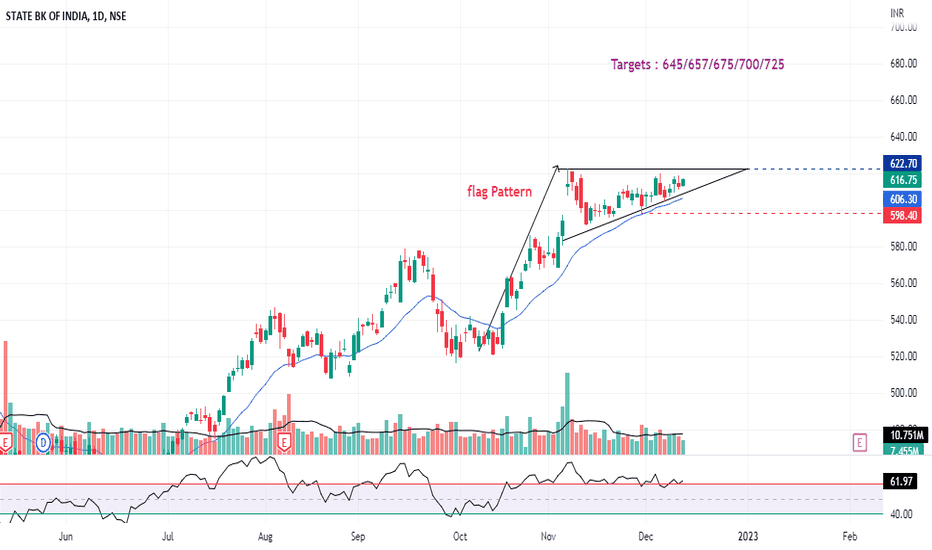

SBIN : Breakout Candidate (Flag Pattern)#SBIN : King of PSU Banks in a kind of Flag structure, Breakout Candidate Soon.

Good Strength in all 3 Time Frame (D/W/M)

Banking Sector will Grow as long as Indian Economy grows.

Take 10% & keep Trailling.

Happy Trading !!!

Keep Sharing, Loving & following to Learn more.

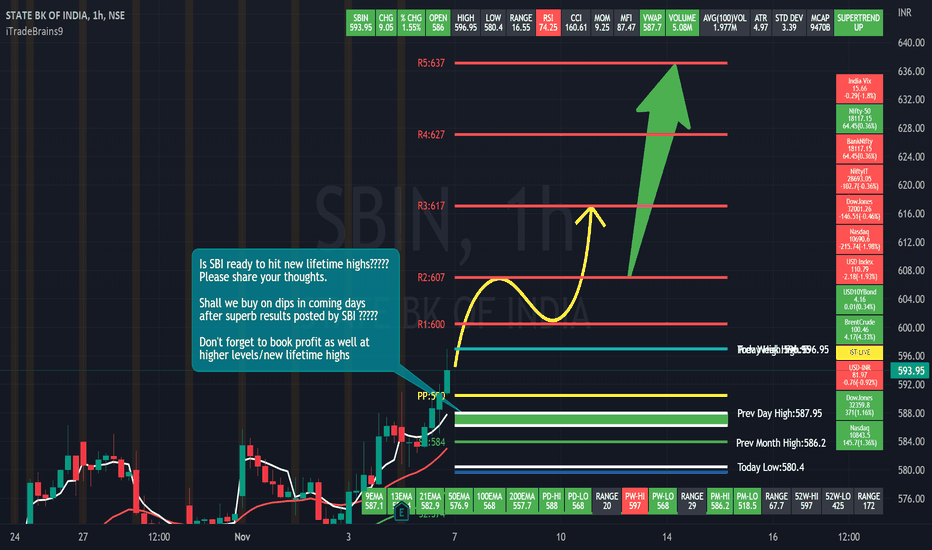

SBI Levels & Strategy for next few daysDear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

SBI has posted excellent results and clearly beat the market expectations. I am feeling quite happy for long term investors who are consistently getting rewarded. SBI is trend is positive & momentum on buying side is strong. Buy on dips strategy is working well in SBI, however traders must be careful near new lifetime highs and work level by level with strict stoploss and maximize the profit using trailing stop loss.

Shall we wait & look for buy on dips opportunity in SBI in coming days?????

Yes, I think so.

Shall we book profits near major resistance levels/near new lifetime high?????

Yes, I think so.

Shall we short SBI near new lifetime high?????

We should avoid to short.

Is correction in coming days due to imported weakness in Indian market/RBI rate hike to curb inflation, likely to be buying opportunity for traders & long term investors????

Yes, I think so.

Please share your thoughts as well. Good luck to traders & investors for profitable trading in SBI.