Sbishort

SBI Levels & Strategy for next few daysDear traders, I have identified chart levels based on my analysis, major support & resistance levels. Please note that I am not a SEBI registered member. Information shared by me here for educational purpose only. Please don’t trust me or anyone for trading/investment purpose as it may lead to financial losses. Focus on learning, how to fish, trust on your own trading skills and please do consult your financial advisor before trading.

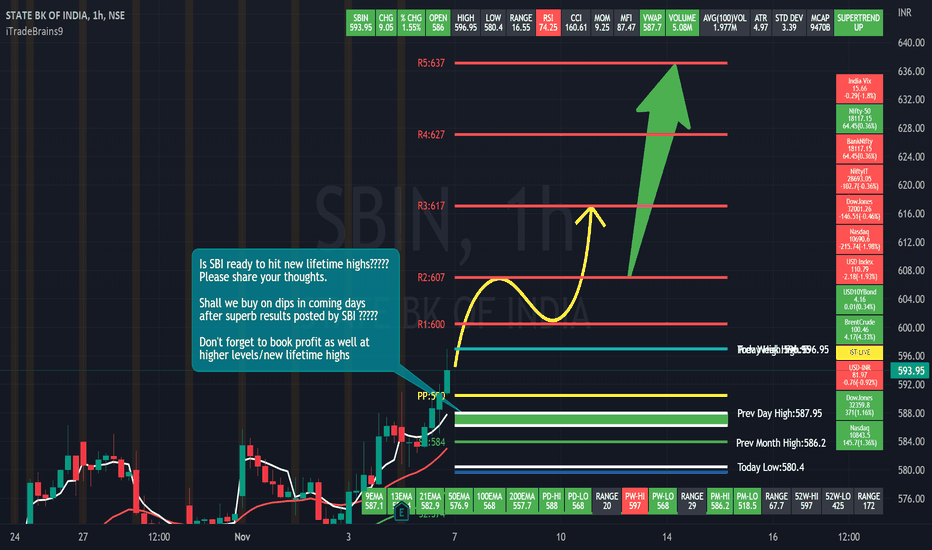

SBI has posted excellent results and clearly beat the market expectations. I am feeling quite happy for long term investors who are consistently getting rewarded. SBI is trend is positive & momentum on buying side is strong. Buy on dips strategy is working well in SBI, however traders must be careful near new lifetime highs and work level by level with strict stoploss and maximize the profit using trailing stop loss.

Shall we wait & look for buy on dips opportunity in SBI in coming days?????

Yes, I think so.

Shall we book profits near major resistance levels/near new lifetime high?????

Yes, I think so.

Shall we short SBI near new lifetime high?????

We should avoid to short.

Is correction in coming days due to imported weakness in Indian market/RBI rate hike to curb inflation, likely to be buying opportunity for traders & long term investors????

Yes, I think so.

Please share your thoughts as well. Good luck to traders & investors for profitable trading in SBI.

State Bank Of India - Price may fall.Hi Traders,

The price of SBI has broken the upper channel which is an indication of exhaustion. There is a key zone at 297 - 314 levels which is in confluence with a Fibonacci retracement level, So we can expect the start of a bearish cycle from these zones. The price can react with the golden zone but the overall momentum will be bearish. If price manage to break the key market structure, we can confirm the start of the bearish cycle which will result in the break of the trendline.

Note:-

1. The key market structure can change if price tests the Key zone at 297 - 314 levels.

2. This analysis can be used only for long term positions.

3. This analysis is done based on technical analysis without considering any fundamentals.

Pls comment below for any queries.

Happy trading....