ENA possible Ascending triangle breakout playLook for confirmation above the Resistance line in Pink... maybe wait for a breakout, then a pullback touching the Prior Resistance line before entering... and then note the size of the triangle as a possible TP zone.

It is however, Entirely possible that the structure falls apart as a candle deviates from this pattern and falls to the bottom... just be careful on your entry.

Not Financial Advise... duh..

#ENA #scalptrade #leveragetrading #leveragetrade #eth BINANCE:ENAUSDT.P

Scalp

BTC Bleeding, Scalpel Please💣 Price just nuked back to our OG S1 zone and buyers are throwing hands at $113k 🥊

This is a quick scalp play while the dust settles

🎯 Entry: 113,159

🛡 Stop: 113,111 (just below S2's base. you can tighten this up, to the base if desired.)

📈 Scalp Target 1: 114,444

🚀 (Swing Trade) Target 2: 116,588

🧠 Setup: Reclaim after wick trap

📐 Structure: Bullish continuation off demand

📍 Zone: Micro-range base + sweep low trap

Scalpel sharp ✂️

Clean. Tight. Ruthless.

⚠️ Heads up — 30m still trending down

So lock those stops and stay nimble 🔪

⚠️If $113k fails, watch for a flush to S2 or even S3.

This bounce is a scalp — not a trend shift (yet) 🚨

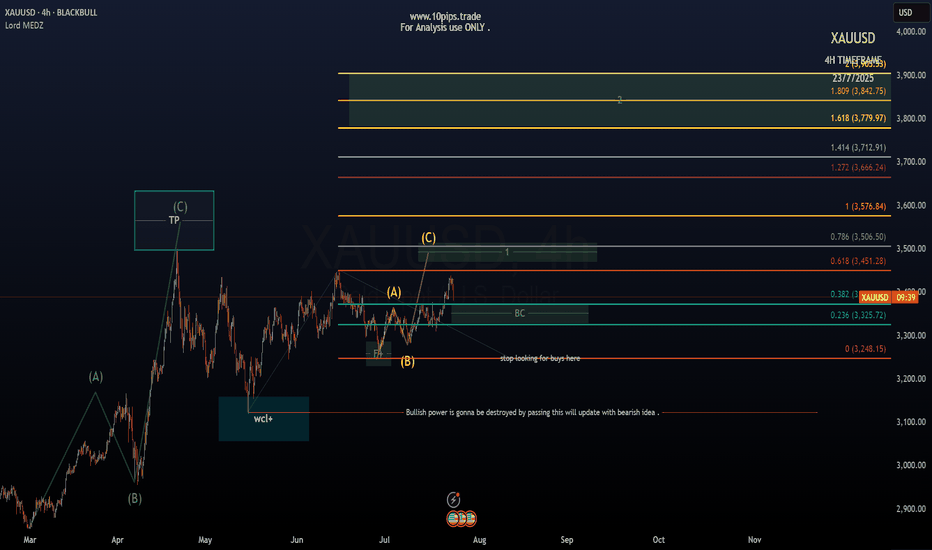

GOLD – Bullish Flag Breakout After Demand Zone Test

Price pulled back into the major demand zone (blue area), rejected with a strong wick, and formed a bullish flag structure. The breakout above the flag channel suggests continuation toward recent highs.

Trade Plan:

✅ Entry:

Above 3344 (breakout confirmation)

✅ Stop Loss:

Below 3332 (last swing low)

✅ Target:

3357–3360 (previous resistance zone)

Context:

• Demand zone respected

• EMA support aligning

• Clear breakout candle with volume

Risk Management:

Max risk per trade: 1%

Zoom in M5:

#Gold #XAUUSD #PriceAction #BreakoutTrading #MJTrading #ForexSignals #CommodityTrading

PRIME TIMEIt’s prime time for PRIME. Very low entry cost good risk to reward ratio, I believe with Bitcoin if it holds we could see PRIME do a very strong and fast push upwards. Not financial advice it’s just what I see. I was told I can’t post links in my ideas,

Long scalp if BTC breaks it’s downtrend, otherwise retrace downward until we get support as we are overbought on the daily but if this peaks we will see some price movement. If you follow me you have gained some scalp trades over 15-25% these past days on PRIME.

Good luck and have fun with it.

NC HAMMER CRYPTO will be my new name.

ChopFlow ATR Scalp Strategy (OBV EMA) on MNQThe ChopFlow ATR Scalp Strategy combines a low choppiness regime filter, on-balance volume with EMA confirmation, and ATR-based exits to capture quick micro-trends on the NASDAQ-100 E-mini (MNQ).

Strategy Logic

1. Choppiness Filter:

-Calculate the Choppiness Index over 14 bars.

- Trade only when chop < 60 (trending or mildly trending market).

2. Order-Flow Confirmation:

- Compute OBV and its 10-period EMA.

- Long when OBV > OBV EMA and chop < threshold.

- Short when OBV < OBV EMA and chop < threshold.

3. ATR-Based Exit:

- Exit at a fixed multiple of ATR (stop and profit target both = 1.5 × ATR).

How to Trade It

1. Confirm time chart with MNQ , preferably1-min chart.

2. Enable only the 17:00–16:00 CME session.

3. Look for low choppiness (< 60), then wait for OBV cross.

4. Enter with one-contract size, tight 1.5× ATR stops/profits.

5. Monitor DOM for liquidity shifts around entry levels.

NQ Live Trade Idea & ExecutionWhat's Up everyone! I know I have been MIA, but that's because I have been focusing on my learning and I realized that content creation takes away a lot of the time I have for that. Once in a while when I see something beautiful I will share it with you guys here. This trade was the perfect example of a beautiful trade idea and management. We were able to profit over $3,000

on a couple trades taken on NQ and this is 2 contracts that I had running, one was taken profit at the highs while the other was stopped out in profits. As you can see they are taking quite a while to go for those Asian highs so they are potentially building liquidity above I believe. We will have to wait and see what the market presents us.

We utilized a 15M Bullish FVG turned inverse as an entry on an earlier trade, then the NWOG 25% PDA level as a second entry and then again inside the NWOG another entry inside of a Bullish FVG turned IFVG as well which lined up perfectly with 50% of the NWOG as well.

These trades were all profitable and netted me over $3000 all together.

Litecoin (LTC) - Long Setup📋 Context:

🔵 Open Interest stable or slightly increasing → healthy position building.

🔵 Top Traders Ratio strongly rebounding → top traders are re-accumulating long positions.

🔵 CVD Spot rising → real spot buying support is coming back.

🔵 CVD Futures rebounding → shorts being squeezed and absorbed.

🔵 Funding Rate neutral → no immediate risk of short squeeze against longs.

🔥 Liquidations:

🔵 95% of potential liquidations are shorts → strong imbalance to exploit.

🔵 Optical Map shows a wall of short liquidations just above the current price → objective is to grab them.

📈 Technical Structure:

🔵 Clean bullish structure on the 15-minute timeframe.

🔵 Stop Loss placed just below the recent swing low.

🎯 Trade Plan

Entry: Current price zone 85.7

Immediate Target (TP1): 87 $ → grabbing short liquidations.

Extension Target (TP2): 88 $ → if momentum remains strong.

Stop Loss (SL): Below 84 $ → invalidation if clean break of structure.

Long setup on AAVE📈 Funding rate is rebounding strongly → bullish sentiment returning, no overheating signs.

📊 Open Interest is rising again after a flush → healthy new market engagement.

⚖️ Top Traders Long/Short Ratio around 1.9 → slightly bullish but still neutral, no extreme greed.

🛒 Spot CVD shows a strong rebound → real spot buyers stepping in (very bullish).

📉 Futures CVD starts recovering slowly → futures are expected to follow the spot trend.

🔥 Kingfisher Data shows heavy short positioning → potential for a powerful short squeeze.

Conclusion:

✅ Confirmed entry after alignment across Open Interest, CVD, Funding, and Long/Short Ratio.

✅ Monitoring Open Interest and CVD for squeeze confirmation.

✅ Managing the position with a tight stop below local structure to minimize risk.

Setup: Long on SOL/USDT🚀 Setup: Long on SOL/USDT Perpetual (15m timeframe)

📈 Context:

Strong divergence between Perp CVD (down) and Spot CVD (up).

_Top Traders accumulating long positions.

_Open Interest stable to slightly rising.

_More than 90% of positions are short — strong imbalance favoring a squeeze.

🎯 Trade Plan:

_Entry: around 148.20 USDT

_Stop-Loss: 145.70 USDT

_TP1: 150.38 USDT (partial profit)

_TP2: 152.30 USDT (full close)

🧠 Notes:

Plan to secure partial profits at TP1.

Will monitor for continuation if breakout occurs.

#BTC #BTCUSDT #BITCOIN #LONG #Scalp #Scalping #Eddy#BTC #BTCUSDT #BITCOIN #LONG #Scalp #Scalping #Eddy

BTCUSDT.P Scalping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Be successful and profitable.

#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy#TON #TONUSDT #TONCOIN #LONG #Scalp #Scalping #Eddy

TONUSDT.P Scaliping Long Setup

Important areas of the upper time frame for scalping are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Be successful and profitable.

Nasdaq Intraday TradeWith the overnight GAP, price jumped above the white Centerline, just to come back in the Asia session.

We see that price broke the white CL and halted afterwards. Do yo see where it halted? Yes, at the Centerline of the yellow Momentum Fork!

And currently it's pushing up through the white CL again...hmmm...

So, we have momentum, clear support at the yellow CL, a potential new push through the white CL and a loooooot of Air...and stop/losses above to be sucked in §8-)

I'm long with a stop below the yellow CL low, and with multiple targets to the upside.

Let's have fun!

Short-Term Uptrend at Risk: Reversal Incoming?Gold's bullish momentum is encountering strong resistance at the 2938–2943 zone, signaling a potential short-term trend break. A failure to hold within the rising channel could trigger a pullback towards the short-term target at 2927, with deeper mid-term targets at 2918 and 2909. RSI is showing weakening momentum—will bears take control? Watch for confirmation!

S-P-E-L-LSpell seems VERY VERY interesting. Looking at spell and comparing it to XCN which had absolutely insane gains this past month. Spell could quite possibly do the same. Nearly 2000% to the top. Just like XCN with is waterfall downward with similar pushes near the bottom.

Also volume is picking up heavily.

one more touch to the top line and we could see a quick 80%+ push (practically a meme coin)

We have 3 taps to the resistance line around $0.0018350.

We could see the first push to

$0.0033701

Small retrace and push all the way to $0.006

This is a risky trade, wait for confirmation before entering. Keep in mind it’s quick percentage up but it’s the same for down.

Good luck and have fun with it.