SCTY

SCTY: Breakout is comingWe can long SCTY here, I think we can expect a breakout very soon.

Risk 0.5-1% on the position.

Good luck!

Ivan Labrie.

TSLA shortAroon = bullish, other indicators mixed. I would have my stop losses around 19.8 and expect a rise of .38 to 20.20 if SCTY goes up

SCTY: Bottom or bust?On an absolute level, the price of SCTY -0.61% has declined to around 80% of its all time high. The question then becomes: is company's equity price going to stabilize at this level or is this the calm before the storm (a path to zero)? The company has a great story and in the eyes of many a visionary founder and ceo at the helm. The proposed merger may be partially attributable to the downward slide in the price of its equity . I believe in what they are doing and have confidence in the net benefit to all stakeholders - even shareholders for pushing forward with this vision of the future. However,this should not detract from the problems the company may or may not be facing and understanding if there is a value from purchasing equity at current price levels.

I intend to answer this question from both a fundamental and chart perspective. On a fundamental valuation, I will stick to the process Prof. Damodaran (NYU Stern) uses in determining value. The intent of this analysis will be to determin a view on trading/investing in this company for a long term holding (+6 month). If both views show a basis agreement, it would be prudent on my part to put my capital to work on those findings.

From a chart perspective, my opinion is a sell - and that has been the case for the past couple of months when looking at a weekly price trend. However, a monthly price chart will reveal the share price has been knocked down to relative lows and nearing ranges not since it IPO'ed. From that view it would be time to start considering opportunities, if they present themselves to go long, and seeing if the trend manages to reverse. Initiating shorts may less fruitful now given that the price drop has panned out in terms of magnitude and time.

I will update this in some time to include the valuation based on the fundamentals.

SCTY: Nearing bottom or bustOn an absolute level, the price of SCTY has declined to around 80% of its all time high. The question then becomes: is the company's equity price going to stabilize at this level or is this the calm before the storm (a path to zero)? The company has a great story and in the eyes of many a visionary founder and CEO 1.38% at the helm. The proposed merger may be partially attributable to the downward slide in the price of its equity . I believe in what they are doing and have confidence in the net benefit to all stakeholders - even shareholders for pushing forward with this vision of the future. However,this should not detract from the problems the company may or may not be facing and understanding if there is a value from purchasing equity at current price levels.

I intend to answer this question from both a fundamental and chart perspective. On a fundamental valuation, I will stick to the process Prof. Damodaran (NYU Stern) uses in determining value. The intent of this analysis will be to determin a view on trading/investing in this company for a long term holding (+6 month). If both views show a basis agreement, it would be prudent on my part to put my capital to work on those findings.

From a chart perspective, my opinion is a sell - and that has been the case for the past couple of months when looking at a weekly price trend. However, a monthly price chart will reveal the share price has been knocked down to relative lows and nearing ranges not since it IPO'ed. From that view it would be time to start considering opportunities, if they present themselves to go long, and seeing if the trend manages to reverse. Initiating shorts may less fruitful now given that the price drop has panned out in terms of magnitude and time.

I will update this in some time to include the valuation based on the fundamentals.

Will Solar City soon prove us all wrong?This graph assumes a prolonged wave 4 starting around 33.4 and bringing us to current at 23.5 Wave 1 assumed to start at 16.43. If a wave 5 impulse wave does continue the overall trend, it could bring the price well above 36. I could technically see it trading at 48 equilibrium price. I understand this is risky! What do you think about the TSLA/SCTY deal? Will SCTY attract TSLA investors?

SCTY RIDDING ITS RESISTANCE LINENASDAQ:SCTY is running its resistance line at 27.36. While it does seem to be also following its channel. With both trends in mind I would say SCTY may fall tomorrow, but still follow its resistance line until August 1st. It may start to increase slightly and then fall.

SCTY High may stay till tomorrow or it may drop NASDAQ: SCTY may rise to around 27.40 by the end of trade on July 20th, before resistance takes over and starts to fall by July 21st. Or it may rise to a higher resistance level around 29.40. But the trend looks in favor of resistance at 27.40 where 29.40 was last reached back in April 12th 2016. Check it out.

Solarcity $scty. Follow for more updatesRisk/reward ratio: 4.1 (good)

resistance: 34, support: 24.07

Catalyst; raised 345 mill in tax equity +future plans, release date july 18

Follow for more updates

Showing signs of accumulation. I chose the daily timeframe; however, it is labeled to reflect 60 min, 240 min TF as well. This is useful because you can begin to appreciate how accumulation and distribution of different timeframes influence others.

2016 started with "preliminary supply" (PSY) followed by the Feb "selling climax" (SCLX). The subsequent "automatic rally" or "dead cat bounce" marked a "stopping action to the end of the Markdown following Distribution from 2015. The cumulative selling pressure leading into March did not break support because buyers were absorbing supply. This accumulation resulted in our April highs and "buying climax" (BCLX) and "upthrust after distribution" (UTAD). Following the distribution price breakdown into May where we find another smaller phase of accumulation.

It would appear that theses test and re-test are making up are larger scale 6 MONTH ACCUMULATION PHASE.

If price can hold $20 and close above the 8ema; I will consider a LONG into anticipated resistance at the 150/200 sma.

Good Luck.

SCTY - New Utility vs Old - Introducing Utility & Grid Services.SolarCity will make more than 80% of their income from their new Utility and Grid Services if they continue to grow and update this category. They will get paid more and more by helping their customers manage their energy needs, while selling less and less solar hardware.

Distributed Energy Solution for the 21st century grid & beyond, where customers take control of their energy cost.

This is a good start:

Managed from their GridLogic software platform:

Grid services on the transmission and distribution system include:

- Dynamic capacity and peak shaving

- Frequency regulation

- Voltage and reactive power support

- Enhanced reliability and resiliency

- Grid visibility

NEXT WEEK'S EARNINGS TO WATCH: LC, VRX, M, JWN, NVDAWith broad market volatility ebbing, the place to sell premium is with earnings plays for now.

Next week, look to put on options plays shortly before the earnings announcement to capitalize on post-announcement volatility contraction. This little fellahs currently look best for plays:

LC: 5/9 (Monday) after market close. Due to the price of the underlying, short straddle it, if anything. Neither a short strangle or iron condor will be productive unless you go with a larger number of contracts.

VRX: 5/11 (Wednesday). I don't show it as before or after market right now.

M: 5/11 (Wednesday) before market open.

JWN: 5/12 (Thursday) after market close.

NVDA: 5/12 (Thursday) after market close.

I also looked at a couple of others, but decided that they were problematic for one reason or another:

TEVA ... is scheduled to announce on Monday, is an ADR. I'm not a huge fan of ADR's, since they're basically free to tentatively schedule an earnings announcement and then move it back a week or two. For a volatility contraction play, which I want to put on immediately before the announcement, this does me no good ... . Moreover, the spreads are wide on the options; if they're wide going in, they're going to be wide trying to get out ... .

SCTY ... will announce on 5/9 after close. I would love to play this little fellow, as it's plenty full of premium given its relatively modest price. That being said, it's another "spread wide" situation ... .

AGN ... announces on 5/10 before market open. You would think an underlying that trades 4.9 million shares on a daily basis would have fairly decent spreads on their options. Nunh-unh ... .

RAX ... 5/9 after market close is the announcement. You guessed it -- illiquid options.

I'll post actual setups as we get closer to earnings ... .

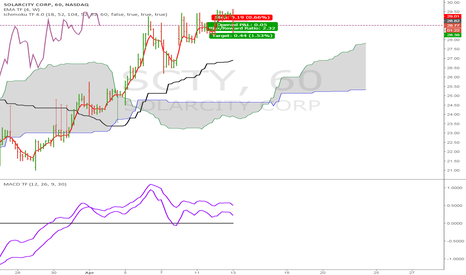

$SCTY Short on 5 min chartGoing off of the 5 minute charts.

Risk Reward 1:2,

- Entry 28.82

-Stop at Kijun-Sen 29.05

-Target 28.38

Intraday Trade. Intraday MACD < 0 and Higher Timeframe MACD turning down but still above zero

SOLD SCTY APRIL 15H 13/16 SHORT PUT VERTWith an implied volatility rank of 99 and an implied volatility of 182, selling a little premium here at market open.

I'm operating on the assumption that 16 is the low and that it won't revisit that level for a bit. Ordinarily, I'd strangle or iron condor this, but it's been wild to the topside ... .

Filled for .75 credit ($75/contract).

Notes: Thanks to SpreadEagle for pointing this one out ... .

Future Resistance Levels for SCTYI see promising fundamentals causing SCTY to rise over time, but key resistance levels to watch for are around $28, weak resistance at $38, and a major liquidity bloc around the $50 mark.