SDOW

Risk for Stocks increasing again $VIX $DJI

$VIX in middle of range, normal for now

RSI RARELY oversold

Maybe 1x per year & we're @ lower end

$DJI Comparison to last peak

In overbought territory

"2.5% upside" - ??? downside

Reducing longs

Our LARGEST position $TWTR = cash now

As we go higher raising more cash again

If you like Sushi you need to read this!Betting against the market has increased significantly!

In the past 2-4 weeks the volume of the 4 inverse ETFs has increased significantly (+2x)!

This means lower prices are more likely!

What could happen in the next 3 weeks if prices pass the Red lines?

Market Reversals and the Sushi Roll Technique:

In his book "The Logical Trader," Mark Fisher discusses techniques for identifying potential market tops and bottoms.

Capturing trending movements in a stock or other type of asset can be lucrative. However, getting caught in a reversal is what most traders who pursue trendings stock fear. A reversal is anytime the trend direction of a stock or other type of asset changes. Being able to spot the potential of a reversal signals to a trader that they should consider exiting their trade when conditions no longer look favorable. Reversal signals can also be used to trigger new trades, since the reversal may cause a new trend to start.

One technique that Fisher discusses is called the "sushi roll." While it has nothing to do with food..!

The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock.

When the sushi roll pattern emerges in a downtrend, it alerts traders to a potential opportunity to buy a short position, or get out of a short position.

When the sushi roll pattern emerges in an uptrend, it alerts traders to a potential opportunity to sell a long position, or buy a short position.

A test was conducted using the sushi roll reversal method versus a traditional buy-and-hold strategy in executing trades on the Nasdaq Composite during a 14-year period; sushi roll reversal method returns were 29.31%, while buy-and-hold returned 10.66%.

Sushi Roll Reversal Pattern

Fisher defines the sushi roll reversal pattern as a period of 10 bars in which the first five (inside bars) are confined within a narrow range of highs and lows and the second five (outside bars) engulf the first five with both a higher high and lower low.3 The pattern is similar to a bearish or bullish engulfing pattern, except that instead of a pattern of two single bars, it is composed of multiple bars.

Best,

Moshkelgosha

DISCLAIMER

I’m not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA, an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this site are for informational purposes only and do not constitute financial, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using this site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this site.

Reference Article:

www.investopedia.com

Betting Against the market..!Monitoring the volume of reversed ETF shows increased volume against S&P 500 and Dow Jones in the past week!

I will monitor these for possible buy opportunities and benefitting from a possible market correction!

a 3-5% correction could push these higher 9-15%..!

They need to complete a reversal pattern above the green lines first!

Best,

Moshkelgosha

DISCLAIMER

I’m not a certified financial planner/a certified financial analyst, an economist, a CPA, an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this site are for informational purposes only and do not constitute financial, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using this site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this site.

$SDOW Target 18.27 for 44.2% Or next add level is at 7.07$SDOW Target 18.27 for 44.2%

Or next add level is at 7.07

Sometimes you just have to look at it from a weekly candle?? Up from here... it's time.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

BULL WANDERING INTO A BEAR DENPRICE vs MOMENTUM forming a compression divergence. Notice the lower indicator and the trend on both sides. Price has been broadening the last few years while momentum/strength has been compressing. This is a hidden bull diverging into a massive bear divergence with the potential for a 3x touch here soon. Hidden divergences are historically weaker than regular divergences so the odds are in the bear's favor. We'll just have to see which one the CB's are rooting for.

[SPXU] Another Way to Profit on a Crash (Part 1)- DO NOT ATTEMPTSPXU is a very complex financial instrument and you should never trade this. It goes up when the market goes down. It resets everyday, unlike the VIX which functions more like a traditional stock.

Honestly I don't even know how to chart this thing as it seems to function similar to a logarithmic scale but man look at that upside!

There's barely any details on the internet about this thing but it is intended to be a day trade play and NOT intended to hold for more than a single day. Something to do with your daily increase or decrease compounding each day. Every new day it resets and this can really make the trade extremely volatile (please if anyone can explain this better, chime in!).

I tested this out today. Was pretty certain the market was going to go down so I bet 1.5% of my portfolio on the SPXU and SDOW (same thing for either market).

SPXU:

Bought - $14.10

Sold - $14.38

SDOW:

Bought - $30.04

Sell - $30.28

This doesn't look like much I know but if you extrapolate, that's 2% ROI on the SPXU in one day and 1% ROI on the SDOW in one day. What a return!

Instead of day trading it though, which can be quite time consuming and brutal, I want to try to angle for a swing trade.

Keep in mind everything says this is NOT INTENDED TO BE HELD MORE THAN ONE DAY and for the reason why they just say because your winnings or losses compound over time.

But that sounds fantastic if I'm very confident the market will drop in much greater proportion on average each day than it rises over the next 30 days (I do believe this now).

So lets see what happens if I swing trade this bucking bronco. My big market crash bet is on the TVIX (3x the VIX) but SPXU and SDOW could potentially be quite lucrative with a small investment if the market does crash.

SDOWI noticed a few things happening in the markets.

1. The DJIA has dropped from 29k all the way down to 18k in couple days.

2. SDOW has hit record lows while DJIA puts in lower Highs

3. VIX is still above 30 and has been above 60 during this crash.

The market is pumped up by all these stimulus packages the Don keeps creating, but is still struggling to get back above 25k, while the SDOW is priced as if the DJIA is above ATH's on the DJIA, mix this with the large div between the VIX & SDOW got me thinking when the market crashes (when I said) SDOW will need to play catch up, even if the crash is not as bad % wise as the most recent crash. I am looking for $24 to enter but may close all my longs and enter soon, depends on how the market reacts today. We could stay flat today then open on Monday for 1 last pump to 26-27k next week or we could just start crashing B4 this. So I am monitoring all this as we speak.

SDOW breaching this wedge soonLooks like a huge descending wedge, seems like they're going to continue to push the Dow higher, but I personally don't see much more room to run past 28500. I like the 3X weighting on this position for a short play to hedge against any downturn. I do believe we may head to higher highs and push this market through Q1, but I'm not confident we can keep it afloat much longer. I also like SDS against the S&P

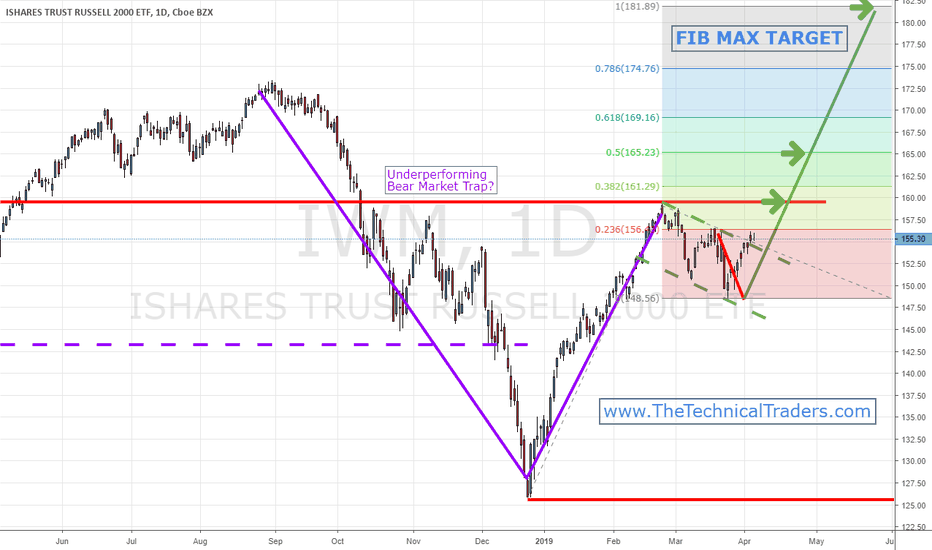

$IWM $RUT $TNA $TZA Small Caps About to Lead The Markets!While the large-cap stock indexes like the $SPY $SPX $QQQ $DIA have been running higher, they are now at resistance and should stall out or at least slowdown. Small-cap stocks have been building a base for a mega rally that could make the large-cap run look like chump change!

See more analysis on the small cap sector: www.thetechnicaltraders.com

Small Cap Stocks with Bearish daily and weekly chartsThe Russell 2000 ETF continues to deliver critical technical and longer-term price patterns for skilled technicians. Combining the IWM chart with the Transportation Index, Oil, Gold, and others provide a very clear picture of what to expect in the immediate future.

Recently, we posted a research article about the Head-n-Shoulders pattern setting up in the $INDU. Again, the IWM chart is also showing a very clear Head-n-Shoulders pattern with critical resistance near $159.50 and support near $144.25. Our researchers, at Technical Traders Ltd., believe this right Shoulder will prompt a downside market move towards support near $144.25 before a downward sloping wedge pattern sets up. This first downward price leg will setup and congesting wedge formation that will, eventually, break to the upside and drive market prices higher.

We authored a research article about this pattern setup on February 17, 2019. You can read it here.

Skilled traders watch all the charts to assist them in identifying characteristics that can assist them in understanding price moves, key support/resistance levels, and price patterns. This IWM chart should be on everyone’s radar at the moment. Where the IWM finds support, so will the other US stock market indexes.

The IWM setup indicates we may only see a 5~7% downside price swing before support is found. We’ll have to watch how this plays out over the next few weeks/months to determine if the $144.25 level is true support or if the lower $137.00 level will become support. Either way, the downside price swing appears poised to unfold over the next few days/weeks – so be prepared.

Please take a minute to visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trades in 2019. We have already positioned our clients for this move and we believe we can help you stay ahead of these markets.

US MAJORS COMBINED INDEX PAINT CLEAR PICTUREPrevious significant market top that formed a mini double top and drop looks to be happening again.

Monday we should see another gap down and continued follow-through selling, or at least next week which should create a spike in the vix as shown here: www.thetechnicaltraders.com