ETH’s Secret Pattern Exposed! Why Is No One Talking About This ?Hello Traders 🐺

When I opened the ETH chart today and switched to the weekly timeframe, I saw something unbelievable with my own eyes! 🤯 That’s why I decided to share it with you, my friends. I truly believe there’s a very high chance for ETH to explode to a new ATH! Let’s break it down:

Why am I still bullish and not talking about anything bearish these days? 🤔

✅ The BTC.D Chart – The Most Important Factor

BTC.D is sitting at its most critical resistance level. Not just one, but two bearish divergences have already formed on the weekly chart, signaling a potential reversal. I will also update my last idea about BTC.D, so make sure to follow me for upcoming updates! 🔔🔥

Other Reasons to Stay Bullish on ETH & Altcoins 💎

📉 Weak hands are leaving the market

💰 Inflation is falling, which means we could see rate cuts very soon

🏦 Quantitative Tightening (QT) is ending soon

🇨🇳 China is printing money, and the FED will likely turn the printers back on

📍 ETH/BTC is sitting at a key monthly demand area

📊 Binance has increased its ETH holdings by over $600 million just this week!

These are the reasons why I remain extremely bullish on ETH and Altcoins. And now, let’s dive into the ETH chart—because that’s exactly why you’re here!

ETH’s Repeating Pattern – A Bullish Setup! 🔄🔥

As you can see on the chart, ETH has a history of repeating the same pattern over and over again. 🌀 Back in 2020-2021, before the massive ETH & Altcoin rally, we saw a huge weak hands shakeout. Just before the shakeout, everyone thought ETH had formed a double bottom and was ready to fly—but then BOOM! 💥 A huge shakeout happened, followed by a rally to new all-time highs. 🚀

Now, the same pattern is unfolding again! We have an Inverse Head & Shoulders, which is a bullish pattern. Then, we saw a massive shakeout just below the previous low, causing a bullish divergence on RSI—and now, things are starting to change! 🔥📈

✅ Make sure to act accordingly, my friends!

🐺 KIU_COIN 🐺

Seasonality

The Reality of Bitcoin HODL. The odds of 100k AGAINLet's break down this CRYPTOCOM:BTCUSD BTCUSD chart and discuss the potential scenarios for 2025, considering current world economic conditions.

**Chart Analysis:**

* **Timeframe:** Daily (1D) chart, showing price action from early 2024 to March 2025.

* **Key Levels:**

* **Resistance:** $109,590 (recent high), $100,000 (psychological level).

* **Support:** $80,000 (recent low), $72,000 (previous consolidation), $68,000 (strong support zone).

* **Price Action:**

* **2024:** A period of consolidation and accumulation, with a clear upward trendline from May to November. This suggests growing bullish momentum.

* **Late 2024/Early 2025:** A significant rally, pushing BTC above $100,000 and reaching the $109,590 high.

* **Recent Correction:** A sharp pullback from the highs, indicating profit-taking and potential trend reversal. The price is currently hovering around $86,000.

* **Grey Box:** A highlighted area around $80,000 - $88,000, which represents a key support zone.

**Most Likely Scenario for 2025 (Given Current World Economic Conditions):**

**Current World Economic Conditions (Considerations):**

* **Inflation:** Persistently high inflation in many countries is a major concern. Bitcoin is often seen as a hedge against inflation.

* **Interest Rates:** Central banks are raising interest rates to combat inflation, which can negatively impact risk assets like Bitcoin.

* **Geopolitical Uncertainty:** Ongoing conflicts and tensions create market volatility and uncertainty.

* **Regulatory Landscape:** The regulatory environment for cryptocurrencies is still evolving, with potential for both positive and negative developments.

* **Economic Slowdown/Recession:** Growing concerns about a global economic slowdown or recession.

**Scenario:** **Range-Bound Trading with Potential for Further Correction**

Given the current economic climate, the most likely scenario for 2025 is a period of range-bound trading for Bitcoin, with potential for further downside correction. Here's why:

* **Uncertainty and Risk Aversion:** Economic uncertainty and rising interest rates make investors more risk-averse, reducing demand for volatile assets like Bitcoin.

* **Technical Indicators:** The recent sharp pullback suggests a potential trend reversal. The $80,000 support level is crucial. A break below this level could trigger further selling pressure.

* **Inflation Hedge Narrative:** While Bitcoin is seen as an inflation hedge, its correlation with traditional markets has increased in recent times, making it susceptible to broader market sentiment.

**Buy/Sell Recommendations (General Guidance):**

* **Long-Term Investors:** If you're a long-term investor with a high-risk tolerance, consider dollar-cost averaging (DCA) into Bitcoin during periods of weakness. The $72,000 and $68,000 levels could provide attractive entry points.

* **Short-Term Traders:** Short-term traders should exercise caution and wait for clear signs of a trend reversal before entering long positions. Look for confirmation signals like a break above key resistance levels with strong volume.

* **Risk Management:** Always use stop-loss orders to limit potential losses. Never invest more than you can afford to lose.

**Important Notes:**

* **This analysis is based on the provided chart and general economic conditions. The cryptocurrency market is highly volatile and unpredictable.**

* **Do your own research and consult with a financial advisor before making any investment decisions.**

* **Keep an eye on key economic indicators, regulatory developments, and market sentiment.**

**In conclusion, while Bitcoin has shown strong bullish momentum in the past, the current economic climate suggests a more cautious approach. Expect range-bound trading with potential for further correction in 2025.**

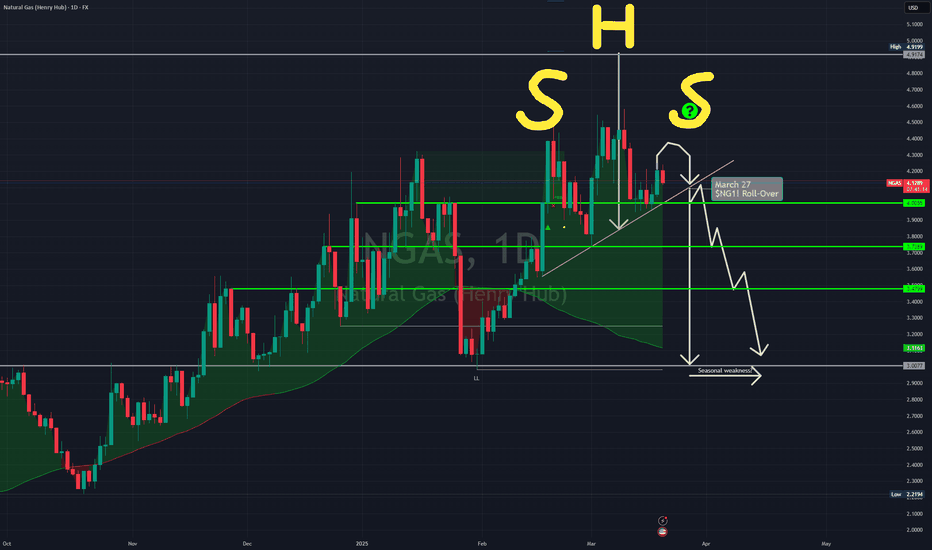

My Daily $NGAS / $NG1! Idea Because of Absent Seasonal WeaknessSeasonal weakness in FX:NGAS / NYMEX:NG1! is absent so far but it could come into play if war-related concerns are fading with Putin and Ukraine set under "friendly pressure" to end this war.

Still, the gap between ending heating period and beginning demand for cooling is big enough to see a seasonal weakness period, imo.

It's just an idea. As always, do your own research. You are solely responsible for your trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations

The Fed Cuts Balance Sheet Runoff by 80% - BULLISH!RISK-ON 🚨

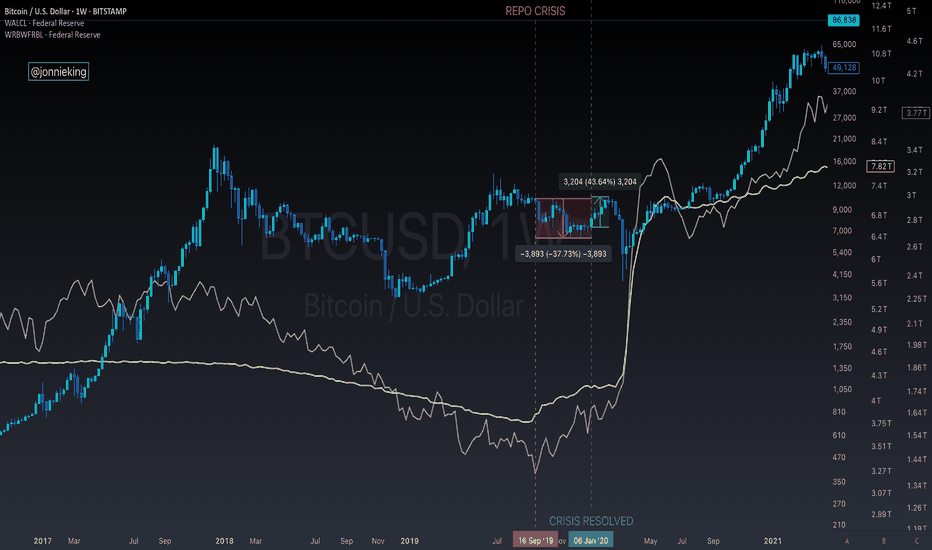

I’m seeing so many people incorrectly analyzing the September 2019 emergency repo OMOs, which were short-term liquidity injections from the Fed, and then comparing it to the price of BTC going down, before QE officially started in March 2020 because of the pandemic.

Here’s what really happened.

September 15, 2019 was a tax deadline, pulling ~$100B out of markets as large corporations paid the IRS and funds flew into the TGA.

Meanwhile, the Treasury issued new T-Bills to rebuild cash reserves following the post-debt ceiling resolution in August, draining another $50-100B as big banks and institutions absorbed the securities.

During this time, the Fed continued reducing its balance sheet (QT) down to $3.76T, but the balance sheet did not leave enough slack for unexpected cash drains to the system, such as corporate taxes and Treasury issuance.

Unfortunately, the Fed was flying blind and did not have a hard number estimate for “ample reserves” in the banking system.

These reserves were largely hoarded by a few of the larger banking institutions due to Liquidity Coverage Ratio (LCR) rules and a higher IOER at 2.1% vs the ON RRP rate of 1.7% - a 40 bp spread.

This caused a liquidity crisis in the US repo market because bank reserves held at the Fed ($1.36T) were too low and repo lending dried up. Banks weren’t able to access each other’s reserves to fund daily operations.

SOUND FAMILIAR !?

The US just resolved its CR to avoid a government shutdown, and they will be refilling the TGA by issuing new T-Bills. The reverse repo facility is also nearly drained.

Today, we heard the Fed will be reducing its securities runoff from $25B - SEED_TVCODER77_ETHBTCDATA:5B on April 1st, an 80% adjustment.

One of the main drivers is they wanted to get ahead of another 2019-style repo crisis (although they won’t say this), rather than being reactive and having to perform emergency OMOs once again.

Now to go back to my original point with people saying the Fed reducing its balance sheet runoff is a big nothingburger based on BTC price action in 2019.

BTC dumped because of the repo crisis, NOT because markets needed QE.

By early 2020, the liquidity crisis was resolved, and BTC pumped ~45% before the pandemic hit in March and nuked the chart.

Proof is in the pudding - just look at the 2017 bull market.

QT started in October 2017, and the market ripped until early 2018.

The Fed reducing its balance sheet runoff by 80% is definitely a signal of risk-on for educated market participants, as it leaves more reserves in the financial system, which gives banks more liquidity to loan the market.

i.e. M2 go up.

But keep listening to your favorite large accounts who are all of a sudden macro gurus, what do I know 🤓

USDCAD Short Setup – Potential Top Formation & Seasonal WeaknessTechnical: USDCAD has stalled in recent weeks, signaling a potential topping pattern. A recent break of the short-term trend suggests a deeper correction may follow. Key resistance is at 1.4355 , offering a favourable risk-reward short opportunity.

Fundamental: The U.S. dollar remains weak, with commercial participants showing little interest in buying. Meanwhile, the Canadian dollar is seeing increased accumulation, indicating a potential shift in momentum.

Seasonal: Historically, from March 24 – April 30 , USDCAD has declined 76.2% of the time over the past 21 years, with an average drop of 1.30%.

Trade Idea:

Sell: 1.4355

Stop Loss: 1.4551

Target: 1.3948

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NAS100 Potential Intraday Shorts (Technical Analysis)Technical Outlook:

The price action since late February has been decisively bearish, characterized by a significant decline throughout March, indicating a clear mid-term distribution phase. We observed a recent rejection from a 4H and 1H supply zone (which fell within a pronounced drop-base-drop pattern). Notably, the most recent downward push failed to establish new lows. This follows a period of rapid decline with minimal bullish resistance. This suggests two possibilities:

Bulls are strategically allowing sellers to exhaust themselves before a potential countermove.

The prevailing bearish momentum is overpowering any attempts at bullish recovery.

Trading Considerations:

The daily candle has formed a bearish engulfing pattern, confirming strong selling pressure. My trading strategy involves waiting for a price retracement back into the identified supply zone. This pullback would serve to fill existing price imbalances and trigger resting orders above, providing an opportunity to enter short positions with improved risk-to-reward ratios on lower timeframes (LTFs). Currently, there are no indications of significant bullish manipulation. Therefore, I anticipate continued downward momentum this week. It's plausible that we might witness a final bearish surge coinciding with the FOMC announcement before a potential bullish reversal - a hypothetical scenario based on technical analysis.

Final Notes:

The previous instance of the price trading this far below the 200 EMA occurred in December 2022, marking the culmination of a year-long bearish trend. While we are currently only one month into this downward movement, it's crucial to remember that past performance is not indicative of future results. Although a bullish rally is possible, I will maintain a bearish bias and focus on short opportunities until a clear bullish reversal pattern emerges on the 4H and 1H timeframes. When such a reversal occurs, we will be ready to capitalize on the subsequent upward trend! ;)

Undervalued Stock TTD The Trade Desk buy IdeaDo not believe me when I say this stock is undervalued, do your own research.

Do not believe me when I say this stock has shown very high properbility for good upside moves from around end of March until mid of August for the last 10 years, do your own research.

Good upmove today, I am in.

Leave a like or comment, hit the bell, eat some birthday cake, and love what you are doing!

Cheers!

COOKIE’s Sweet Potential: Bullish Continuation Ahead?COOKIE 🍪 has shown strong momentum, and if the bull run isn’t over, we could see another leg up. Price action is forming a structure that suggests further upside potential, with key resistance levels in sight. If volume supports the move, a breakout could lead to new highs. 📈

Watching for confirmation signals—higher lows, strong demand zones, and bullish indicators lining up. A healthy pullback could offer prime entries before the next push. Stay cautious, but don’t ignore the signs of continuation.

I’m bullish on $COOKIE. What’s your take? Let’s discuss potential targets and invalidation points! 🍪

US30 Bullish BiasFundamentals:

Valuation:

Undervalued on the 30d - 13d

Between the mean/Undervalued on 10d (projecting one more drop to undervalued on the 10 days)

Seasonality:

Following the price well. But I've explained that the price of Dow Jones reached a High 2-3 weeks before seasonality Tool predicted.

As per 5y 10y 15y seasonality, the bottom of US30 could be this week, or early next week. Whether we see another drop is something we can't tell. But Seasonality tool was late as per the example I've showed you on Trade Station, could be late this time around, and we could find a bottom within the next 5-6 trading days!

Technically: I've explained why I prefer the lower Daily Demand Zone.

The Demand Zone we are currently at - is where the Equilibrium lies as per Fib Tool - therefore not a good buy level!

Lastly, can we see one more heavy move down with A -3.5% on FOMC this Wednesday? We don't know, but it happened in December and it could happen this week!

Q4 effects on BitcoinTIME BASED LONG TERM BITCOIN SPECULATION

First of all,

This analysis is not about to tell you that the bottom is in or not, this is a fun theory which has no confirmation for the future.

As i see every time Bitcoin enters the November zone, it starts to make a bigger move.

In this analytics maybe not the november month is what matters, it can be analysed by quarters or yearly periods too, but i chose the november zone.

2014 november: (A)

-top of the bull market

2015 (little bit after) november: (B)

-bottom of the bear market

2016 november: (C)

-breakout and retest to the fibonacci zones then rally

2017 (little bit after) november: (A)

-Top of the bull market

2018 (little bit after) november: (B)

-bottom of the bear market

2019 november: (C)

-breakout and retest to the fibonacci zones then rally

2021 november: (A)

-Top of the bull market

2022 november: (B)

-Bottom of the bull market?

We can also identify a gap between C and A period because the rally doesn't end in the next november cycle.

This analytics does not say that the bottom is in, but it can be already in or days/weeks away from the current price.

The structure has to be analysed by self, and this chart could give us a clue where should we see the price a year after.

The price should be in the 30k region to see a retest or a breakout from the zone.

in 2024 we should see 30k usd / BTC, but we don't know that if we will have a rally before it.

Hope i gave you something interesting.

Thanks for reading and have a nice trading carrier:)

(Always bullish on BTC)

DFMGI - DFM Index - Seasonal Trends [Good News!]Good Day, Trader!

Our seasonal analysis of the DFM Index over the past 10 years reveals that March has historically been bearish more than 70% of the time.

However, there’s good news on the horizon— April has shown a bullish trend in over 70% of the past decade!

For a complete view of the seasonal and cyclic trend analysis of the DFM Index since inception, check out the full chart.

Happy Trading!

$SOL Dumps 60% - Is it Over !?CRYPTOCAP:SOL DUMPED OVER 60% ‼️

That’s after a 3,500% pump

from the bear market low in ’22.

Is it over!?

TL;DR - NO.

This is common after such an insane pump.

SOL Dec ’20 - May ’21

5,700% pump

71% correction

then another 1,290% pump

Let’s look at previous cycles with $ETH.

Dec ’16 - June ’17

6,380% pump

67% correction

then another 916% pump

Dec ’18 (bear market low) - May ’21

4,860% pump

62% correction

then another 185% pump

So you see my fine feathered friends,

there’s nothing new here.

Targets still remain $700-850 🤠

Don't Panic! Good times around the corner for BitcoinGlobal M2 Money Supply

Global M2 has been leading BTC price action very closely by 10 weeks.

Roughly 12 days from today for upward price action to strongly resume, if the correlation holds.

A wick down to 73-74k is nothing to worry about. In terms of time we are likely very close to the bottom, if it's not already in.

You can use the indicator on your chart for free below.

Shout out to @Mik3Christ3ns3n for the original indicator.

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD (SPX)Clear corralation between EURUSD and SPX (s&p500) movement. Every time EURUSD is in all time high or all time low in the last years shows a clear correlation between the EURUSD and SPX, working EURUSD as anticipated indicator on the next trend of SPX. NOT FINANCIAL ADVICE! THIS IS A REFERENCE ANALYSIS!

#Bitcoin $BTC OutlookCRYPTO:BTCUSD is testing a 2 years old uptrend channel lower wedge extending since 2023 where #BTC price was ~$25k. The wedge is ranging between ~$80k : ~$70k.

Key levels:

~$79k: kind of imminent today.

~$73.5k: The first and the nearest core demand, smart money is concentrated at this level "A bounce is anticipated from here"

~$70k: Is the last bulls haven, breakingdown will unlock the ~$60k mark.

Check my previous BTC analysis, I've been calling for the ~$80k : ~$70k since ATHs.

#AhmedMesbah