Sector_analysis

STOCK-PICKING-BY-SECTOR-PERFORMANCEContinuing the series of stock selection:

Last time i shared the idea to select stocks by indices :

Now, this time i am attaching the screenshot of sectorial performance on different time frames.

It gives us clear idea , where momentum is bullish right now.

If we combine these 2 results , it further narrow down the search for quality shares.

LOOK..ANALYSE..PICK..ENJOY :)

PLEASE LET ME KNOW YOUR THOUGHTS IN COMMENT SECTION.

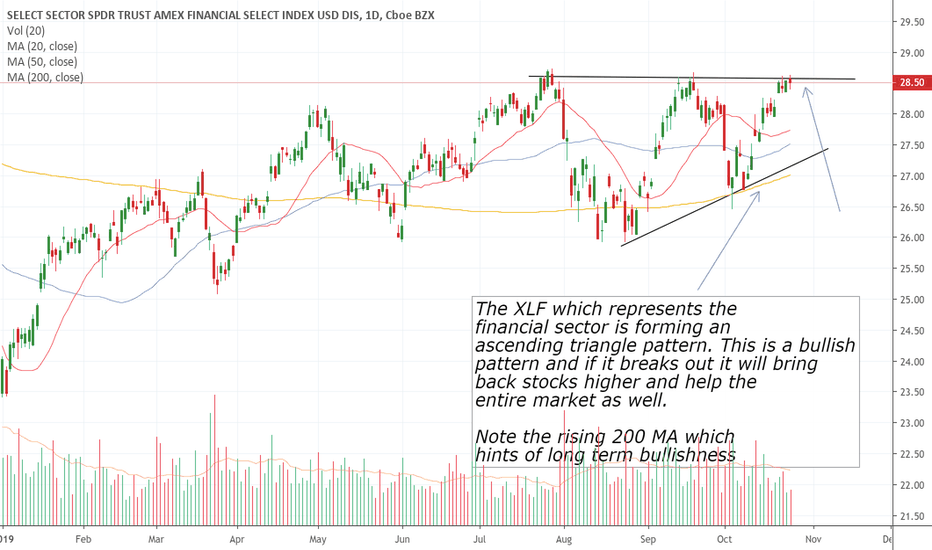

XLF - Financial sector SPDR S/R zonesHello traders,

Description of the analysis:

The financial sector is showing an attempt at stabilization, but so far there is no talk of stabilization. We see gaps up and down. It is necessary to wait for a clearly defined volume distribution. Gaps tend to fill sooner or later. The way up again will be hampered by marked resistances. At the moment, I would be very careful to invest in this sector.

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (4 000 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

Potential Upside 60%! Which counter?! SPSETIA!! STRATEGY - PRICE VOLUME ANALYSIS:

SPSETIA, bottom formed. As mentioned few weeks back before the property sector boomed, one of the most potential sector for now is PROPERTY Sector!

When we involve in trading activities, we should select only the leader which will generate a huge upside in a more powerful and faster way, such as SPSETIA and ECOWORLD. PVA (Price-Volume-Analysis) helps a lot in decision making. Learn and earn together!

SPSETIA, a W-bottom was formed obviously, indicating a reversal in the trend in this counter, together with the recovery of the whole property sector. Last Friday, it made a further Bollinger Band breakout after the W bottom breakout! Huge momentum.

A near target has been analysed to be RM1.70 zone, and a stronger one at RM1.87 and RM2.00. We remain the final target price of RM2.25 after RM2.13 to complete the whole trend reversal. This indicates a huge upside of 60% from the strong breakout at RM1.40!

ShareWorldConsulting has strongly believed that Property sector should be in focus for now.

Gentle reminder: Plan the trade and trade the plan. Trade at your own risk. Stay tune!

Guys, if you like the idea, please "like" it, this will be the best thanks.

If you have any questions or trading ideas, please post them in comments!

Thank you for your support, we appreciate it.

EPISODE 10/11: US COMMUNICATIONS-CUP & HANDLE TARGETS TA(XLC)Episode 10/11 : US (SPX) Sectors Technical Analysis Series - 31st of July 2019

Brief Explanation of the chart(since everything is labelled on there): (30 seconds read)

First and foremost : Similarly to the XLRE Index, the XLC was formed even more recently(2018), so obviously due to the lack of data this analysis should be seen at most as informative . In addition, I am not as interested in this particular sector. That doesn't take away from the objective of holistically analysing the whole market in the greatest of details. Now- time to break down the chart based on the current data:

XLC chart shows a very distinctive Cup & Handle pattern . Breaking above the purple square , will result in a bullish confirmation ; targeting #1: 55$ and later on 60$ as Target #2 .

Furthermore, the structural supports have been labelled. Although due to the lack of data, they will mostly depend on the negative momentum and very little on the currently labelled squares. Likewise as in the previous EPISODES , the same conditional events(trade deals/elections) apply to this sector. This concludes the technical analysis on the US communications(XLC) sector.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Step_Ahead_ofthemarket-

Previous episodes on the US Sectors :

EPISODE 9 : US REAL ESTATE ( XLRE )

EPISODE 8 : US CONSUMER STAPLES ( XLP )

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me through any of my channels.

US SECTOR SERIES FINALE 11/11: UTILITIES(XLU)+ESSENTIAL TA NOTESSERIES FINALE ; Episode 11/11 : US (SPX) Sectors Technical Analysis Series - 31st of July 2019 (4 Minute Read)

Since this is the Series Finale I will try to holistically summarize the whole series of 11 Episodes on all the US sectors.

The essential notes from this chart are the following(also included in the comments) :

1 . Compared to the previous expansion of 2002-2007 ; the current expansion of US Utilities has yielded a much slower growth . This can be seen from the chart as the current bullish channel is at the bottom range of the pitchfork. Despite this fact, the volume has kept growing continuously from which statement several indications can be derived. To keep it simple and as obviously as it can be, a good portion of the volume growth can be attributed to the funds flow from asset classes that are based on inflation( pension funds, real estate, fixed income securities etc etc ) into equities characterised as defensive as part of XLU, XLP, XLV .

2 . From the cycle lines it can be seen that we narrowly escaped a recession in 2015-2016 . However, I do not think that this will be the case come by the next drop in the cycle circa-2021. Fundamentally, due to the low global growth that dominated the 2015-2016 correction particularly in the emerging markets-in effect due to President Trump the cycle extended . Despite my disagreement with his absurd trade and tax policies , I have to give credit where credit is due. Now at the same time, I do not think that a cycle extension is necessarily good; in a way it means that the fundamental & structural issues that develop in the economy during an expansion continue to build up even more. The higher it tops= the lower it will bottom (% wise).

3 . Elections 2020 , US/China trade deal and Brexit will dominate the negative momentum in the upcoming months and years. Global growth has slowed down quite a bit and it's way overdue for a recession. In fact, past June 2019, we have been in the longest expansion on record, lasting more than 10 years(122 months now).

Regarding the key takeaways from the XLU chart are all labelled above: structural supports, channel supports and bullish targets . I do not see a need to continually repeat myself . Make sure to check out the comments for detailed indicator analysis.

This episode concludes the show . Hope you enjoyed it- I certainly did.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research. For any use of this show for references to any corporations or individuals that get inspired from my ideas, I'd appreciate it I am being given credit for my efforts .

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Step_Ahead_oftheMarket-

Make sure to check all the previous episodes on the US Sectors for more holistic understanding :

EPISODE 10 : US COMMUNICATIONS ( XLC )

EPISODE 9 : US REAL ESTATE ( XLRE )

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me through any of my channels.

EPISODE 9/11: US REAL ESTATE:WAVE VARIATIONS& INDICATOR TA(XLRE)Episode 9/11 : US (SPX) Sectors Technical Analysis Series - 31st of July 2019

Brief Explanation of the chart ( since everything is labelled on the chart ): (1 minute read)

First and foremost : The XLRE Index was formed very recently(2016), so obviously due to the lack of data this analysis should be seen at most as informative . Now, let's break down the chart :

Weekly XLRE chart labelled with 2 large structural supports as blue( 30$ ) & purple( 34-35$ ) rectangles. Furthermore, the wave/cycle variation can be broken down to 3 most probably variations :

Variation #1 ( Purple ): If the economy continues to be in a great state. US-China deal goes through and Trump wins 2020. Most bullish Scenario.

Variation #2 ( RED ): Trump wins 2020, but the global economy slows down/Deal takes too long to be completed. Still a bullish scenario either way.

Variation #3 ( Blue ): Bearish scenario . Dems win 2020, in which case we will have a recession in the nearby future, thereafter.

This is it. I do not think there's anything more to be said. I always let my charts speak the words that I am not willing to put the effort to say/write.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

Step_Ahead_ofthemarket-

Check my Previous episodes on the US Sectors :

EPISODE 8 : US CONSUMER STAPLES (XLP)

EPISODE 7 : US CONSUMER DISCRETIONARY ( XLY )

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me.

EPISODE 8/11: US CONSUMER STAPLES:WAVE+CHANNEL&INDICATOR TA(XLP)Episode 8/11 : US (SPX) Sectors Technical Analysis Series - 18th of July 2019

Brief Explanation of the chart:

XLP : Consumer Staples has relatively been one of the worst performing sectors since the last recession. However, recently due to the many uncertainties in the economy(US/CHINA Trade relations), staples have performed quite well (+18.1% for 2019 so far) .

Moreover, this newly found bullish strength can be observed in the Monthly breakout from the RSI/MACD divergence . The potential upside would be in the range of 65-75$ based on Wave 5 variations . There is one major structural support which is marked by the purple square( range of 48-51$) .

Key note from this technical analysis is the growing volume, which can be an indication of several factors. The most outstanding factor to me would be the recent growth in volume . This means that there is an increasing number of investors who are looking for "defensive" stocks that primarily constitute the staples sector. Obviously, this is not a good sign for the future of the economy.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details, every thumbs up or follow is greatly appreciated !

-Step_Ahead_ofthemarket-

Check my Previous episodes on the US Sectors:

EPISODE 7 : US CONSUMER DISCRETIONARY( XLY) :

EPISODE 6 : US MATERIALS ( XLB ):

EPISODE 7/11: US CONSUMER DISC-CYCLICALITY AND BULLISH TRENDLINEEpisode 7/11: US (SPX) Sectors Technical Analysis Series - 18th of July 2019

Brief Explanation of the chart:

XLY- Consumer Discretionary sector index has proven to be one of or if not the best performing sector since 2009. "Rubber-band" theory of recessions does support this bounce in performance based on the negative sentiment in 2009 during which the Discretionary sector was one of the worse performing benchmarks. This is mainly because of the strong correlation of XLY to the economic cycle.

Following the close above 42$ in 2011-12, which top was formed prior to the recession; XLY has been in a bullish channel supported by a strong bullish momentum. This can be seen from the chart as buyers have always found strength in the 14/21 Monthly EMA's (blue lines) . It doesn't get more bullish than this. Part of the reason for the recent good performance since Trump took office is 2016 is the tax cuts , which directly translated into more disposable income available for discretionary investments .

The upside targets have been labelled, but this is with the assumption that a US-China trade deal will go through and Trump will win 2020 . The structural supports are labelled as support zones . There is really not much to analyse based on the chart.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and learn more in the greatest of details, every thumbs up or follow is greatly appreciated !

-Step_Ahead_ofthemarket-

Check my Previous episodes on the US Sectors:

EPISODE 6 : US MATERIALS ( XLB ) :

EPISODE 5 : US INDUSTRIALS ( XLI ) :

EPISODE 6/11: US MATERIALS- WAVE 5 RANGE+CYCLE ANALYSIS (XLB TA)Episode 6/11: US (SPX) Sectors Technical Analysis Series - 17th of July 2019

Brief Explanation of the chart :

Wave Extension 1.618 target reached 64.34 (based on length of drop from 2009). Sin lines represent the stages of the cycle(it can't always overlap perfectly). Current bullish channel recovery since the drop that happened at the end of 2018 seems weak . This is in comparison to other sectors.

Based on the assumption that Trump wins 2020 and/or US/China Trade deal goes through => I have labelled the ranges of potential wave 5 extension. There are 2 primary targets : 70$ and 75$. Otherwise, there aren't many indications that the current top at 64.4 would be broken.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>> I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories .>>

However, if you'd like to support me and learn more in the greatest of details, every thumbs up or follow is greatly appreciated !

-Step_Ahead_ofthemarket-

Check my Previous episodes on the US Sectors :

EPISODE 5: US INDUSTRIALS (XLI) :

EPISODE 4 : Health Care( XLV ) :

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me.

EPISODE 5/11: US INDUSTRIALS-BULLISH CHANNEL + STRUCTURAL XLI TAEpisode 5/11: US (SPX) Sectors Technical Analysis Series - 17th of July 2019

Brief Explanation of the chart:

Squares represent past and future structural supports . Since 2009, the bulls have used Monthly MA 50(Weekly 200) support , labelled as the purple line .

The latest bullish channel leading to wave 5 can have 3 potential targets : 85$, 94.5$ and least likely 100$.

This is just a brief "free" and very detailed analysis. Perhaps in the future I might form a premium group, to whose members I will provide all the details of my research.

>> I do not share my ideas for the likes or the views. This channel is only dedicated to well informed research and other noteworthy and interesting market stories .>>

However, if you'd like to support me and learn more in the greatest of details, every thumbs up or follow is greatly appreciated !

-Step_Ahead_ofthemarket-

Check my Previous episodes on the US Sectors:

EPISODE 4 : Health Care (XLV)

EPISODE 3: TECH (XLK)

Full Disclosure: This is just an opinion, you decide what to do with your own money. For any further references- contact me.

Safe Haven - add dividends REIT sectorReal Estate sector has shown to be safe haven and not oversold sector to other stock sectors, which were way oversold to value.

I give thanks today for understanding enough, but still expect growth here. Mid-term stocks usually do well in ensuing 6 mo.

period, however during bearish times a safe haven is a consideration.

If you have another sector, make it a conversation. FOREX, Crypto, and calls/puts would be only other if considered a sector.

Does anyone have link for history of when shorting (calls/puts) was created and why? Please comment @pokethebear.