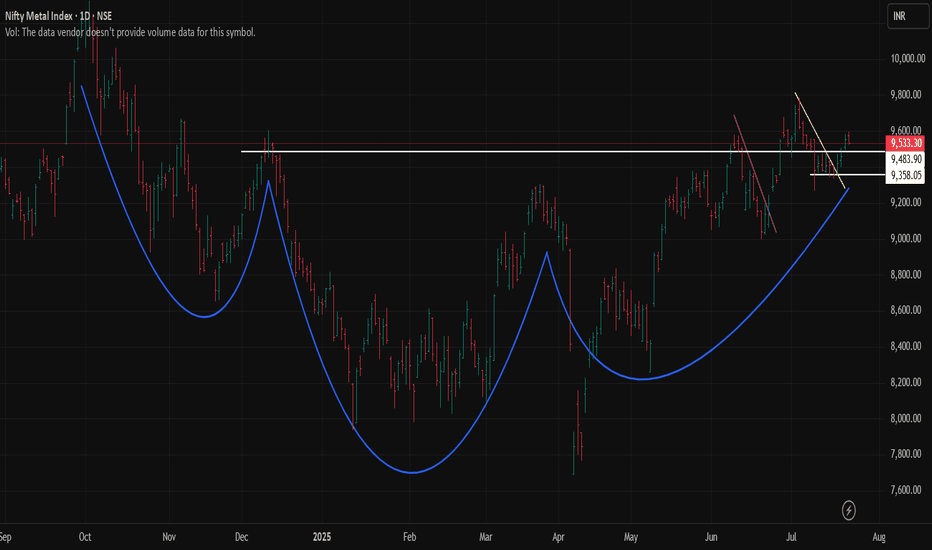

Nifty Metal: Heating Up or Just Polishing the Armor?After a healthy consolidation phase, the Nifty Metal Index is finally starting to flex some muscle. While it’s been behaving like a shy warrior at a dance-off, the structure now looks technically stronger and poised for a potential bullish breakout.

We’ve seen two failed breakout attempts (clearly marked with trendlines)—both classic cases of “all hype, no flight.” But this time, after a tight range consolidation between July 9th and July 18th, it has stepped out of its shell and is teasing a real move.

Next resistance around ₹9,675—and maybe even beyond, if momentum supports the story.

Until then, sitting tight, sharpening the filters, and scouting for individual metal stocks showing relative strength!!!

Sectorrotation

Market Crash? No: Sector Rotation!The news is catching up (two weeks late) to the stock market heading into bear territory but that is NOT the whole picture! Investors need to know that there are winners out there in quality stocks as the risky YOLO plays (tech, crypto) are losing. This specific rotation perfectly fits the model of the stock market rolling over into bearish territory.

Follow the money!

Sector Rotation Analysis: A Practical Tutorial Using TradingViewSector Rotation Analysis: A Practical Tutorial Using TradingView

Overview

Sector rotation is an investment strategy that involves reallocating capital among different sectors of the economy to align with their performance during various phases of the economic cycle. While academic studies have shown that sector rotation does not consistently outperform the market after accounting for transaction costs, it remains a popular framework for portfolio management.

This tutorial provides a step-by-step guide to analyzing sector rotation and identifying leading and lagging sectors using TradingView .

Understanding Sector Rotation and Economic Cycles

The economy moves through distinct phases, and each phase tends to favor specific sectors:

1. Expansion : Rapid economic growth with rising consumer confidence.

- Leading Sectors: Technology AMEX:XLK , Consumer Discretionary AMEX:XLY , Industrials AMEX:XLI

2. Peak : Growth slows, and inflation may rise.

- Leading Sectors: Energy AMEX:XLE , Materials AMEX:XLB

3. Contraction : Economic activity declines, and unemployment rises.

- Leading Sectors: Utilities AMEX:XLU , Healthcare AMEX:XLV , Consumer Staples AMEX:XLP

4. Trough : The economy begins recovering from a recession.

- Leading Sectors: Financials AMEX:XLF , Real Estate AMEX:XLRE

Step 1: Use TradingView to Monitor Economic Indicators

Economic indicators provide context for sector performance:

GDP Growth : Signals expansion or contraction.

Interest Rates : Rising rates favor Financials; falling rates benefit Real Estate.

Inflation : High inflation supports Energy and Materials.

Step 2: Analyze Sector Performance Using Relative Strength

Relative Strength RS compares a sector's performance against a benchmark index like the

SP:SPX This helps identify whether a sector is leading or lagging.

How to Calculate RS in TradingView

Open a chart for a sector TSXV:ETF , such as AMEX:XLK Technology.

Add SP:SPX as a comparison symbol by clicking the Compare ➕ button.

Analyze the RS line:

- If RS trends upward, the sector is outperforming.

- If RS trends downward, the sector is underperforming.

Using Indicators

e.g.: You may add the Sector Relative Strength indicator from TradingView’s public library. This tool ranks multiple sectors by their relative strength against SP:SPX

Additionally, you can use the RS Rating indicator by @Fred6724, which calculates the Relative Strength Rating (1 to 99) of a stock or sector based on its 12-month performance compared to others in a selected index.

Example

In early 2021, during economic recovery, AMEX:XLK 's RS rose above SP:SPX , signaling Technology was leading.

Step 3: Validate Sector Trends with Technical Indicators

Technical indicators can confirm sector momentum and provide entry/exit signals:

Moving Averages

Use 50-day and 200-day Simple Moving Averages SMA.

If a sector TSXV:ETF trades above both SMAs, it indicates bullish momentum.

Relative Strength Index RSI

RSI > 70 suggests overbought conditions; <30 indicates oversold conditions.

MACD Moving Average Convergence Divergence

Look for bullish crossovers where the MACD line crosses above the signal line.

Example

During the inflation surge in 2022, AMEX:XLE Energy traded above its 200-day SMA while RSI hovered near 70, confirming strong momentum in the Energy sector.

Step 4: Compare Multiple Sectors Simultaneously

TradingView allows you to overlay multiple ETFs on one chart for direct comparison:

Open AMEX:SPY as your benchmark chart.

Add ETFs like AMEX:XLK , AMEX:XLY , AMEX:XLU , etc., using the Compare tool.

Observe which sectors are trending higher or lower relative to AMEX:SPY

Example

If AMEX:XLK and AMEX:XLY show upward trends while AMEX:XLU remains flat, this indicates cyclical sectors like Technology and Consumer Discretionary are outperforming during an expansion phase.

Step 5: Implement Sector Rotation in Your Portfolio

Once you’ve identified leading sectors:

Allocate more capital to sectors with strong RS and bullish technical indicators.

Reduce exposure to lagging sectors with weak RS or bearish momentum signals.

Example

During post-pandemic recovery in early 2021:

Leading Sectors: Technology AMEX:XLK and Industrials AMEX:XLI

Lagging Sectors: Utilities AMEX:XLU

Investors who rotated into AMEX:XLK and AMEX:XLI outperformed those who remained in defensive sectors like AMEX:XLU

Real-Life Case Studies of Sector Rotation

Case Study 1: Post-Pandemic Recovery

In early 2021, as economies reopened after COVID-19 lockdowns:

Cyclical sectors like Industrials AMEX:XLI and Financials AMEX:XLF outperformed due to increased economic activity.

Defensive sectors like Utilities AMEX:XLU lagged as investors shifted away from safe havens.

Using TradingView’s heatmap feature , investors could have identified strong gains in AMEX:XLI and AMEX:XLF relative to AMEX:SPY

Case Study 2: Inflation Surge in Late 2022

As inflation surged in late 2022:

Energy AMEX:XLE and Materials AMEX:XLB outperformed due to rising commodity prices.

Technology AMEX:XLK underperformed as higher interest rates hurt growth stocks.

By monitoring RS lines for AMEX:XLE and AMEX:XLB on TradingView charts, investors could have rotated into these sectors ahead of broader market gains.

Limitations of Sector Rotation Strategies

Transaction Costs : Frequent rebalancing can erode returns over time.

Market Timing Challenges : Predicting economic cycles accurately is difficult and prone to errors.

False Signal s: Technical indicators like MACD or RSI can produce false positives during volatile markets.

Historical Bias : Backtested strategies often fail when applied to future market conditions.

Conclusion

Sector rotation is a useful framework for aligning investments with macroeconomic trends but should be approached with caution due to its inherent limitations. By leveraging TradingView ’s tools, such as relative strength analysis, heatmaps, and technical indicators, investors can systematically analyze sector performance and make informed decisions about portfolio allocation.

While academic research shows that sector rotation strategies do not consistently outperform simpler approaches like market timing or buy-and-hold strategies, they remain valuable for diversification and risk management when used judiciously.

AI vs. Software: Is Software Ready to Reclaim Tech Leadership?Introduction:

The rapid advancements in artificial intelligence (AI)—especially with China’s DeepSeek—are reshaping the tech investment landscape. However, with all the focus on AI, could traditional software stocks be staging a comeback?

To answer this, we’re analyzing the Software CBOE:IGV vs. Technology AMEX:XLK ratio, a key indicator of relative strength within the tech sector.

Analysis:

Investment Flow Shift: Over the past few years, capital has largely rotated away from traditional software and into AI-driven sectors.

Bottoming Formation: The IGV-to-XLK ratio appears to have bottomed in June 2024, followed by a steady uptrend.

Breakout Watch: After a strong move in November, the ratio formed a higher low, a constructive sign of strength. Now, it is attempting to break out from a broadening bottom pattern—a significant technical development.

Potential Leadership Change: If this breakout holds and continues higher, software stocks could regain leadership within the tech sector, signaling a shift in investor sentiment.

What to Watch:

Bullish Confirmation: A sustained breakout above resistance would suggest software is regaining dominance within tech.

Bearish Rejection: If the breakout fails, AI-driven themes may continue to overshadow traditional software.

Conclusion:

The software sector appears to be making a strong case for resurgence within tech, especially if this breakout holds. A decisive move higher could mark a major sector rotation back into software stocks, challenging AI’s recent dominance. Will software reclaim its throne, or will AI continue to steal the spotlight? Let’s discuss in the comments!

Tags: #Software #Technology #IGV #XLK #AI #SectorRotation #TechLeadership #MarketTrends

PG slow and steady long term winner with earnings coming LONGPG on the weekly chart gained 15% in a year and had a dip in the past two weeks with earnings

at the end of this week. PG persistently and consistently beats earnings estimates and pays a

dividend. Moreover, it consistently has a bit of a surge after earnings. I see this as an

opportunity to get a good stock on a 4% dip of a discount and hold it through earnings for

perhaps a 10% profit in two weeks while also picking up the quarterly dividend. Some traders

including those institutionally based believe that buying near to the middle line of the Bollinger

Bands is a good entry for getting fair value. I am one of them.

S&P Sector rotationPut together information on what is happening in major S&P sectors

Majority of sectors are strong on the daily chart. There are some short-term problems on lower timeframe but they can be overcome.

This is good for buyers as it shows that money is not leaving the market but moving from one sector to another. A lot will depend on tech bulls. XLK must clear 212 resistance to help market move higher.

You can find my market overview here

AMEX:XLK AMEX:XLV AMEX:XLF AMEX:XLY AMEX:XLC AMEX:XLI AMEX:XLP AMEX:XLE

Sector Rotation Before CPI (SPY, QQQ)Clear sector rotation has been observed a day before CPI data release on Tuesday morning. It seems traders are getting out of Technology ( AMEX:XLK ) stocks and defensive sectors like Utilities ( AMEX:XLU ), Basic Materials ( AMEX:XLB ) as well as Industrials ( AMEX:XLI ) have been climbing up.

HIGHLIGHT:

The chart depicts S&P 500 ETF ( AMEX:SPY ) along with a ranking of all the major sectors at the bottom of the chart in an hourly setup. During the final hours of the last trading day (Monday) there has been a sharp sell-off of tech stocks as the industrials and basic materials have climbed up in strength.

A slow decline in Health Care ( AMEX:XLV ) and gradual rise in Financials ( AMEX:XLF ) over last few days have also been observed.

Please note that the first CPI of the year (January) usually creates volatility in the market. Which has also been observed in above 3% rise in the Volatility Index ( CBOE:VIX / AMEX:UVXY ) looking into the CPI release.

s3.tradingview.com

Rounding bottom pattern almost complete in Nifty IT SectorNifty IT sector has almost completed the rounding bottom pattern. This consolidation phase was more than 2 years long. Thus, the probability of a sustainable breakout is high. I will look to go long in IT sector leaders via call options/ cash buys. What about you all?

PS: Typical targets are the depth of the rounding bottom pattern which is 29%. This can be achieved by the end of the year.

Bear Market, Bull Market, or Sector Rotation? KNOW THE ROTATION!

What Is Sector Rotation?

Investors are always looking for opportunities to boost returns and reduce risk in their portfolios. One way to do this is by understanding and utilizing sector rotation.

In simple terms, sector rotation is the process of moving money from one sector to another. In order to take advantage of positive market trends investors will want to pay close attention to these rotations. In general, there are two types of market conditions that investors need to be aware of: bull markets and bear markets.

Sector rotation is a strategy that investors use to take advantage of these market conditions. The idea is to rotate your investments into sectors that are doing well in the current market conditions and away from sectors that are not.

For example, in a historical bull market, you would want to be invested in sectors such as technology and healthcare. In a bear market, you would want to be invested in sectors such as utilities and consumer staples.

Sector rotation can be a helpful tool for investors to boost returns and reduce risk. However, it’s important to understand how it works before implementing it in your own portfolio. Keep reading to learn more about sector rotation and some current YTD chart examples of what it looks like.

Lets start with a philosophical question in regards to the market; is there really such thing as a bull and bear market? One could argue that there is not, and the market is in fact a cycle of sector rotations. Liquidity going out one, to another, again and again. Take for example the 4 tickers of the main post image MSFT , NASDAQ:TSLA , NASDAQ:GOOGL , NASDAQ:AAPL - these are considered Tech Stocks (yes TSLA is a tech stock!). YTD performance of all these stocks are in the red. Please take the time and study their trends. To the novice that had a portfolio made up of 80% tech, they would look at this chart and scream BEAR MARKET. But is it? It is impossible for the average trader to tell, but not all that money was "lost" in a bear market. It simply was rotated to defensive sectors. Sure, some money was taken out of the overall system I am sure but logic dictates that the majority of the money just found a new home. Investors in tech in these cases could ride the storm and average down (dollar cost averaging), write call options, or purchase puts (along with many other strats) - aka play a bear market in THAT sector. The terms "bull" and "bear" market are used to describe market conditions where prices are either rising or falling. Some people believe that there is a fundamental difference between the two types of markets, while others believe that they are simply two sides of the same coin. Ultimately, there is no right or wrong answer, and it is up to each individual to decide what they believe.

So where did the Tech money rotate to? For those of you that need only bull markets to trade, find the rotation and follow it. Never marry a stock or sector - money moves fast and is prone to jumping ship when major events happen. Here are 3 charts that show areas that bulls have had success:

EX1: Staples and Consumer; NYSE:HSY , NYSE:MCD , NASDAQ:OLLI , NYSE:WMT

EX2: Energy, Industrial, Insurance; NYSE:KMI , NYSE:CAT , NYSE:OXY , NYSE:ABBV

EX3: Defensive and Insurance; NASDAQ:HON , NYSE:RTX , NYSE:AFL , NYSE:CI

If you take the time and study the charts above you will see that not all is bearish when you know where to look. Looking at these rotations can start to paint a larger picture when studying ETFs or the overall market in a national/global economy. Especially when it comes to finding a fair value area in the middle of a downed market. Recovery off of a bear market should be equitable across multiple sectors. In the current case (today) we see that the rotation into "defensive" stocks (all the stocks mention in EX1, EX2, and EX3). As there is a small pinch of hope that inflation could be slowing, the moves have been liquidity into these defensive sectors - not a sign of a healthy recovery (yet) in my opinion. Right now we are seeing more institutional interest in companies like HSY, MRK, CI, HON and less interest in Energy. Energy is a great sector to look at currently to start to see that shift. We can look at commodities like GOLD and see the increased attention and bullish run it has had recently. Remember, intuitions want to create the largest positions they can , but over time so as not to raise a flag to others.

To find sector rotation:

1) Familiarize yourself with the S&P sector funds like the AMEX:XLF , AMEX:XLP , AMEX:XLE , AMEX:XLU , etc

START LARGE - look at the Monthly, Weekly, and Daily

2) Scan for stocks with rapid price drops and identify sectors that may be hurting

3) Scan for stocks with rapid rising price WITH higher than average volume (preferable increasing volume as well)

4) Visualize the sectors in a heatmap. Size by Volume (Monthly) and Color by Performance (Monthly). Since this is constantly changing, I suggest taking a screen shot of this map every week - this will be the best way to "see" the money rotate.

5) When going through 2-4 consider comparing small and large cap companies as well - as this too can hold its own rotation.

6) Stay on top of news, read read read read. Understand the world around you and rely on change.

7) Utilize Smart Money Concepts. Please visit LUX ALGO's page for this, as he has made a beautiful indicator and strategy based around SMI and institutional order blocks.

8) Conduct an RSI or Stochastic RSI study to identify divergences in OVERBOUGHT or OVERSOLD conditions.

9) VIX VIX VIX - yes we are talking sector rotation and the VIX is an "overall" reflection of the market in whole but looking at areas of the VIX (ie 20 and 45) can give signs of upcoming rotation. Although it may not point where, it may describe when these rotations can occur.

If you like this post and would like a more detailed follow up, please comment below so I can see your interest. This is a very extensive topic in which it may take several posts to fully write out in detail. This is post 1 and meant to be an introduction, as I know that almost every line below can be heavily expanded upon.

Happy trading everyone!

Sector Rotation: An OverviewI have wanted to do an overview video of Sector Rotation for Best of Us Investors for a while. In this video I give a high level view of the theory of Sector Rotation and how it can be used to forecast the flows of money into different sectors at different times in the market. I also include my current analysis of where the next sector rotation is likely to occur.

Sector Rotation March 2022: Stocks Winning While Market DownMy last video on Sector Rotation was almost a year ago. The signals for where the money was flowing into and out of stocks was not nearly as clear as it is now. Stocks in Consumer Staples, Healthcare, and Utilities are considered Defensive plays in a market going down. It is clear by the winners and losers across the market and in my own trade calls which stocks are strong against the bearish tide. Traders and investors can use the Sector Rotation model to position themselves in changing market conditions and have an idea of which sector is likely to lead next.

Current Stage in Sector RotationSector rotation is important to gauge the current economical strength that we're in.

This is the 60 day sector rotation summary. (180 day also looks pretty much the same.)

It's very clear that we're in a bear market right now, which doesn't happen often (1-2 every decade)

You can clearly see that that Discretionary / Tech / Industrials / Materials, are all going down where Energy / Staples / Healthcare / Utilities / Financials are going up.

Also, looking at precious metals (not on the charts) you'll notice that gold and silver are breaking out of their flags.

Always look at these 2 charts every couple months to detect where we stand in our economy.

So what now? Cash is king, raise as much as as you can. There's a strong possibility that we might enter a recession, many variables play in this as war tensions from Russia/Ukraine, and China/Taiwan seem real. And the fact that inflation is high and the fed will increase rates faster than we thought.

Sector Rotation July 2020 - Money on Defensive?This week's dip on the AMEX:SPY revealed something important within the Sector Rotation model. For the last quarter the Sector Rotation model has been giving mixed signals following the clear predictive path it forecasted coming out of March 2020. This recent price shock provided a glimpse into where the money is moving right now!

Nasdaq Daily Reversal — Arbitrage & Sectorial RotationAmidst a financial market strongly distorted by the thirst of control from the central banks & their monetary policy craze headed exclusively toward supporting inflating assets valuation, it's become more & more obvious prices no longer represent neither economic reality nor actual asset value (assuming they ever did). Therefore, in such a climate of financial & speculative assets hyperinflation, it's highly interesting not to be too directional, on major indexes as an exemple, and rather seek arbitrage trading between different sectors. Today i'm proposing a Daily Nasdaq reversal short, within the aforementioned framework of arbitrage, as a hedge-trade against the Dow Jones, Tech vs Industrials .

Let's have a look at the Nasdaq/Dow Daily spread-chart FX:NAS100/FX:US30*100 (the *100 in the mnemonic was added to obtain more detailed «Volume profile» data / rows) :

As you can see, the spread between the two sectors has been ranging since summer of last year, showcasing clear arbitrage strategies being put in place between the two assets / indexes. Strategies that were most likely triggered as a result of widespread doubt amongst market professionals about global assets' valuation and their direction. Now addressing the technicalities of our spread, it should be noted that, on that specific timeframe, we've already broken the range' support during early of March. The spread reaching its upper pitchfork/canal boundary in conjunction with a 76,4% Fibonacci retracement right after breaking its range' support, points out toward a pretty good timing to start taking action on the components of spread itself. We can also witness a few enticing overload signals on the momentum/sinewave indicators, but signals on spread-charts are never to be taken too seriously as they're not extremely reliable.

To end with the spread-chart and contextualise a little bit more in-depth, this year long recent hedge trade on the two major U.S indexes becomes even more obvious when you switch to the Monthly timeframe, just to realize that NDX/DOW is a monthly range as well. You can also easily notice that the Daily hedge-trade strategies that have been put in place since summer 2020 coincidently happened to be taken on prices very close from the 2000 highs of the spread-chart (the year 2000 which happened to mark the end of the .com tech crazed bubble). Hesitation on a monthly top, heh.

So we've got short term timing & technical elements aligning with the broader decade long context, good. Now let's take a look specifically at our Nasdaq chart to outline more relevant technical elements that are going to lead to our trade.

Starting with the context : on the Monthly timeframe we can see that our beloved tech sector is no less than a bubble : a parabolic structure perpetually accelerating with increasingly ascending support trendlines, and not materializing any kind of consolidation whatsoever. It should also be mentioned that we havent finished a Monthly momentum cycle since 2012 (2010 for the Quarterly timeframe). Bubble meaning no cycle, consequently meaning a market structure' maturity excruciatingly harder to discern — that is besides the volatility burst & the chaotic range that precedes the final excess leading to the market top. A context to handle with care, to say the least.

Now that we know the broader direction the market is currently taking, we can start to look at our timeframe of reference, the Daily one :

Here are the different technical elements i could outline from that chart :

Prices

Reaching the upper boundary of both the Schiff Pitchfork & the Regular Trend Canal

88.6% Fibonacci extension hit & showing short term price slowdown

138.2% Fibonacci retracement from the last downward consolidating move, supposing a potential running or expanded flat

Signals

Cycle Alignement of both Sinewave & Momentum

Momentum about to print an overload signal (will confirm or not depending on the next Daily closes)

Momentum pointing at a possible triple divergence

Would appreciate an engulfing bearish candle close on the Daily timeframe within the next few days

Risk Management

The invalidation on this Nasdaq Short costs 3%, therefore i won't expose more than half of my capital on this position, that way i'm risking no more than 1.5% of my capital as a speculative loss on this trade (and even less with the Dow long part incoming). Validation levels are showcased on the chart based on «footprints» (historical low volume areas found using volume profile), lower boundaries of channels / pitchfork and Fibonacci retracements. TP 2 means at most a total of 50% profits taken on the original position. The rest will be held for lower targets on the Weekly / Monthly timeframes.

I'll further update this analysis as soon as the Dow Jones reaches its next supports areas (if it does so), especially since those same areas will allow me to start executing the opposite part of this hedge-trade (the long one).

But that's it for now

Hope this idea will inspire some of you !

Go easy on leverage and don't forget to hit the like/follow button if you feel like this post deserves it ;)

Kindly,

J.M.K

Sector Rotation May 2021 - Where is the money flowing?My last video about Sector rotation was in March 2021 where I talked about the Consumer Staples sector. NYSE:PG and NYSE:JNJ have so far performed to expectations. It is worth looking at the model once more now to see where the next potential money flow will be.

From March 2021:

Sector Rotation theory suggests that from market bottoms the two sectors that should lead are Consumer Discretionary and Technology. These two sectors did in fact lead the market out of the COVID crash. The next sectors to lead as the market matures are Industrials and Materials. These too followed the theory through 2020 as the bull market grew. At the market top Energy is supposed to lead and sure enough we have seen quite the run on Energy related stocks. What that means going forward if the theory holds is that Consumer Staples and Healthcare should outperform the market.

Sector Rotation March 2021Recent market sector rotation coming out of the COVID crash has confirmed Sector Rotation theory. I made this video to give viewers a brief introduction to the theory and provide some actionable investing ideas based on what Sector Rotation suggests will be the next stocks to potentially outperform.

Sector Rotation theory suggests that from market bottoms the two sectors that should lead are Consumer Discretionary and Technology. These two sectors did in fact lead the market out of the COVID crash. The next sectors to lead as the market matures are Industrials and Materials. These too followed the theory through 2020 as the bull market grew. At the market top Energy is supposed to lead and sure enough we have seen quite the run on Energy related stocks. What that means going forward if the theory holds is that Consumer Staples and Healthcare should outperform the market.

Long Term JNJThis morning I am putting on positions in NYSE:PG and NYSE:JNJ as long term holds.

They both fulfil my thesis that if Sector Rotation theory holds the next sectors to outperform should be Consumer Staples and Healthcare. Both companies represent these two sectors in ways. I like their chart patterns as they are right now within pullbacks. These are also good dividend paying stocks.

Long Term PGThis morning I am putting on positions in NYSE:PG and NYSE:JNJ as long term holds.

They both fulfil my thesis that if Sector Rotation theory holds the next sectors to outperform should be Consumer Staples and Healthcare. Both companies represent these two sectors in ways. I like their chart patterns as they are right now within pullbacks. These are also good dividend paying stocks.