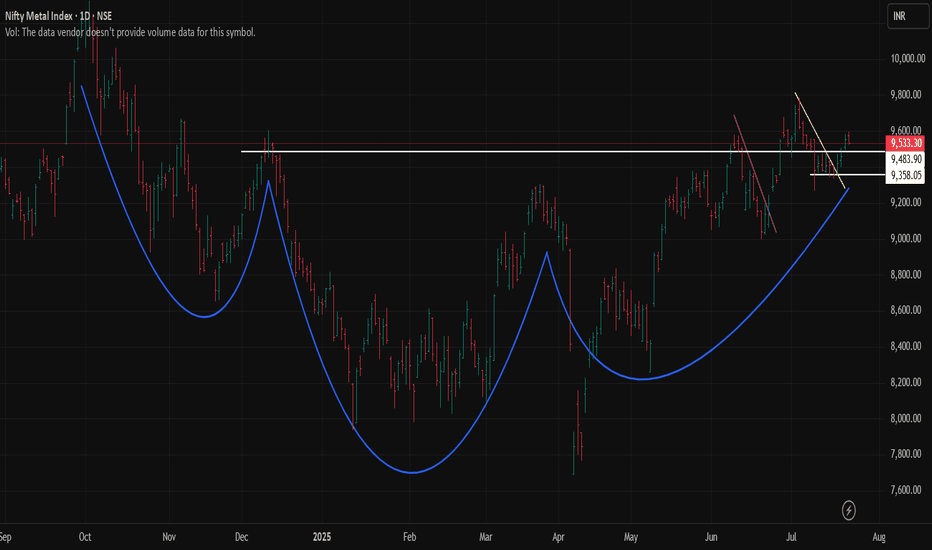

Nifty Metal: Heating Up or Just Polishing the Armor?After a healthy consolidation phase, the Nifty Metal Index is finally starting to flex some muscle. While it’s been behaving like a shy warrior at a dance-off, the structure now looks technically stronger and poised for a potential bullish breakout.

We’ve seen two failed breakout attempts (clearly marked with trendlines)—both classic cases of “all hype, no flight.” But this time, after a tight range consolidation between July 9th and July 18th, it has stepped out of its shell and is teasing a real move.

Next resistance around ₹9,675—and maybe even beyond, if momentum supports the story.

Until then, sitting tight, sharpening the filters, and scouting for individual metal stocks showing relative strength!!!

Sectors

SPDR Sectors Rolling Down as Anomaly Event Sets UpSPDR sectors appear to be forming a Head-n-shoulders pattern after the US elections.

It appears the markets are stalling into a congestion phase - possibly leading to my Anomaly breakdown event.

This video will help you understand how the financial and real estate sectors could collapse to deflate the current market trend.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

Market (Sectors) Performance OutlookSince November 6th, we’ve witnessed a seismic shift in the market landscape, with crypto breaking through and outperforming the broader market. 📈

The sectors leading the charge against the S&P 500 are XLY, XLE, XLF, XLC, and XLK. Notably, the MAG 7 have also been outpacing the market since November 7th. 💪

Smart money seems to be flowing into crypto, contributing to the sell-off in the S&P 500.

From a macroeconomic perspective, XLK and XLC have been market leaders for the past few months. However, it might be time to pivot towards the Energy sector, especially after a stellar earnings season where major E&P companies smashed their earnings estimates. ⚡️

Stay tuned and ready to capitalize on these dynamic market movements! 📊💼

Sectoral Scanner study 8 Nov for the upcoming 46th Week 11 NovSectoral Analysis vis-à-vis the Nifty 50

Observations of the sectors and example of individual sectoral analysis with stock screening.

and Bullish and Bearish picks amongst them.

Along with a couple of homework to be submitted before the next session.

May Market Outlook, Sectors Rotation, Relative Strength AnalysisSince February, the commodities asset class has surged ahead, overshadowing the S&P 500's faltering performance. This notable shift in market dynamics underscores the resilience and strength exhibited by commodities during this period.

Of particular interest are the XLE and XLU sectors, which have emerged as frontrunners since early March. This transition coincided with the decline in momentum of previously dominant sectors like XLK and SMH (refer to Fig. 2). Notably, XLE and XLU, characterized as growth defensive sectors, have thrived amidst market downturns. Investing in commodities and energy/utility sectors during these phases could have yielded significant profits, with select energy stocks boasting returns exceeding 25%, while the S&P 500 experienced an approximate 10% decline.

Looking ahead to May, it's anticipated that XLE and XLU will maintain their market leadership, albeit with a slight loss in momentum. However, investors are advised to remain vigilant as these sectors may soon witness a change in dynamics. It's crucial to employ stop limit orders to safeguard profits in such volatile conditions.

Following the current trajectory, XLY, XLRE, and XLF are poised to emerge as significant players in the market cycle (refer to Fig. 3&4). However, it's important to note that these sectors are susceptible to rapid momentum shifts, particularly when XLK and XLC regain momentum.

Looking towards June, indications suggest that XLK and XLC will likely regain prominence in the market. For buy-and-hold investors, this presents an opportune moment to consider purchasing assets during market dips.

Considering these market dynamics, my top investment picks are (TSLA), (GOOG), (AAPL), (ORCL), and Cisco Systems, Inc. (CSCO). These companies demonstrate strong growth potential, especially when timed strategically to align with sector rotation leadership shifts.

Sector Rotation Before CPI (SPY, QQQ)Clear sector rotation has been observed a day before CPI data release on Tuesday morning. It seems traders are getting out of Technology ( AMEX:XLK ) stocks and defensive sectors like Utilities ( AMEX:XLU ), Basic Materials ( AMEX:XLB ) as well as Industrials ( AMEX:XLI ) have been climbing up.

HIGHLIGHT:

The chart depicts S&P 500 ETF ( AMEX:SPY ) along with a ranking of all the major sectors at the bottom of the chart in an hourly setup. During the final hours of the last trading day (Monday) there has been a sharp sell-off of tech stocks as the industrials and basic materials have climbed up in strength.

A slow decline in Health Care ( AMEX:XLV ) and gradual rise in Financials ( AMEX:XLF ) over last few days have also been observed.

Please note that the first CPI of the year (January) usually creates volatility in the market. Which has also been observed in above 3% rise in the Volatility Index ( CBOE:VIX / AMEX:UVXY ) looking into the CPI release.

s3.tradingview.com

Inside quarter for SPY and many others Current environment seems hard to trade in. If you zoom out every now and then, you'll find a lot of Inside Quarterly candles, like $SPY.

Not saying market is expected to go up or down, but it's seeking for a (clear) direction.

Check your internals/sector ETFs, currently lots of inside's on the quarter:

DIA IWM OIH SLX SMH XBI XHB XLB XLC XLE XLF XLI XLP XLU XLV XLY XME XOP XRT

Review-Trading plan for 27th March 2023- Long term analysisNifty future and banknifty future analysis and intraday plan in kannada.

Long term technical analysis of market.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Learning to stay ahead of market trends - 2023 & BeyondFollow my research. Learn why I expect 2023 to be a very difficult year for active traders and how you can avoid all the risks by modifying your capital allocation levels RIGHT NOW.

You don't have to stand in front of a freight train or try to force trades when they are not opportunistic. You could just wait for the better setup in July/Aug 2023 and ride out Wave-3.

Do you want to gain profits or just try to gamble your capital away?

Sure, if you are a day trader, you may be able to trade some of the bigger price swings over the next 5+ months. But, most of the price action is going to be in ETFs and select US stock sectors.

Learn to position your trades to capitalize when opportunities are the RICHEST for success. Wave-1 has nearly ended. You are trying to catch the last 5% to 7%+ of an uptrend before the US markets will slide into a Wave-2 correction.

Are you sure you want to risk a boatload of capital at the end of Wave-1 right now?

Knowing when to trade is important. Knowing when NOT to trade is even more important.

Make sure you are getting reliable information, content, and research.

Trading is not about trying to be the next zero-Billionaire in 25 days - it is about surviving and growing your accounts over the next 5 to 10+ year efficiently.

Follow my research.

Sectors : Outperforming / Underperforming Nifty Sector analysis

Outperformers :

1. PSU Banks

2. Auto

3. Pvt Banks

4. Finance

5. PSE

6. Metal

7. Infra

Underperformers :

1. Energy

2. Commodities

3. Pharma

4. Realty

5. Media

6. IT

Daily Sector WatchNo good picks for today. Still not breaking the bear market.

🟢WEED STOCKS TOP 10

Teradyne

Curaleaf Holdings

Green Thumb Industries

Trulieve Cannabis Corp

Canopy Growth Corp

Verano Holdings Corp

Cronos Group Inc

Tilray Brands Inc

Cresco Labs Inc

SNDL Inc

🔴CRYPTO COINS TOP 10

Bitcoin

Ethereum

Binance Coin

XRP

Dogecoin

ADA

Matic

Tron

Dot

Solana

🟣INDEXES

US30

S&P 500

FRA40

GER30

NTH25

ASX200

EUSTX50

JPN225

HK50

Banknifty

🔵SPACE STOCKS TOP 10

Iridium Communications Inc

Ses

Rocket Lab USA Inc

Aerojet Rocketdyne Holdings Inc

Viasat

Maxar Technologies

Eutelsat Communications

Astra Space Inc

Sats

Planet Labs

🟤RETAIL FOOD STOCKS TOP 10

Kroger Company

Albertsons Company

Sendas Distribiduira S A

Sprouts Farmers Market

Grocery Outlet Holdings

Weis Market Inc

Ingles Markets Inc

Arko Corp

Companhia Brasileira De Distribuidao American

Beyond Meat

alcohol, cars, big tech

Daily Sector Watch : Will Eutelsat Communications recover?Our 2 leading sectors are Crypto and Space at the moment. While Weed stocks have not shown any sign of recovery yet.

Todays stock pick is ETCMY , a space stock that has been underperforming the rest of the sector for a while and is stuck at a support area.

Let's compare the index to the stock:

Index:

Stock:

Below a closer look at the 5 sectors. Bright color means bullish activity on a stock.

🟢WEED STOCKS TOP 10

Teradyne

Curaleaf Holdings

Green Thumb Industries

Trulieve Cannabis Corp

Canopy Growth Corp

Verano Holdings Corp

Cronos Group Inc

Tilray Brands Inc

Cresco Labs Inc

SNDL Inc

🔴CRYPTO COINS TOP 10

Bitcoin

Ethereum

Binance Coin

XRP

Dogecoin

ADA

Matic

Tron

Dot

Solana

🟣INDEXES

US30

S&P 500

FRA40

GER30

NTH25

ASX200

EUSTX50

JPN225

HK50

Banknifty

🔵SPACE STOCKS TOP 10

Iridium Communications Inc

Ses

Rocket Lab USA Inc

Aerojet Rocketdyne Holdings Inc

Viasat

Maxar Technologies

Eutelsat Communications

Astra Space Inc

Sats

Planet Labs

🟤RETAIL FOOD STOCKS TOP 10

Kroger Company

Albertsons Company

Sendas Distribiduira S A

Sprouts Farmers Market

Grocery Outlet Holdings

Weis Market Inc

Ingles Markets Inc

Arko Corp

Companhia Brasileira De Distribuidao American

Beyond Meat

Sector Rotation Model in TradingviewI have decoded the following model in Tradingview

This is the sector rotation model where different sectors are stronger at different points in the economic cycle.

Here my results in Tradingview by creating this ad-hoc layout

I compare relative strengths of sectors at different points in the economic cycle with sectors which are stronger at previous economic cycle.

- dark red zone = Full Recession

- light green zone = Early Recovery

- dark green zone = Full Recovery

- light red zone = Early Recession

Example: Industrial sectors is seen strong during the early recovery. I want to see it stronger than Tech sector (which is strong during full recession, the previous economic cycle ) for confirmation of the actual early recovery cycle actually priced by investors.

Adding 200-periods and 50-periods simple moving averages (SMA) for better defining the trend.

- chart above SMA50 and SMA200 = bullish = confirmation of the economic cycle

- chart under SMA50 and SMA200 = bearish = not a confirmation of the economic cycle

- chart under SMA50 or SMA200 = neutral = uncertainty, not a confirmation of the economic cycle.

What actually Mr. Market is pricing now?

How you can see in the figure above, we have more confirmations (V symbols) at recovery cycle . No confirmation at Full Recession and one only confirmation at the early recession.

Mr. Market does not want the recession yet…

semiconductors climbing out of the holeright now major indices and the nasdaq especially is banking on semis carrying a significant bounce out of the giant hole they have dug for themselves and us all. it follows that if we can hold 15.80s breaking 16.80s and continue with TRAMA staying over VWMA with both averages rising together that we should hae the go ahead to close the gap around 18.60s (strange that the decimal and integer are inverted 🤔 for either target). should ve a mega green day if we just manage to keep oscillators headed toward overbought with the price making higher lows.

ES: S&P Sector Performance YTDYou can clearly see that Energy has been the leader, and is in fact the only reason why ES isn't below 3600 right now.

Consumer discretionary has taken quite a beating all year, likely due to higher input costs. Worth noting is that consumer staples appears to now be joining consumer discretionary in this downtrend.

Utilities are behaving as the sector should be expected to behave during a bear market.

Rallies in ES all year have been hollow, with falling volume and open interest on the way up, and increasing volume and open interest on the way down.

I expect these trends to continue into the summer.

🔬 STOCK MARKET UNDER MICROSCOPE🏦 Fed did not raise rates today!

🙅♀️ It could have happened but it was unlikely . They did walk back their talk a bit, saying a rate hike would "soon be appropriate" which is a ways of saying they will continue to evaluate the situation. All of this should be short term bullish for stocks, ideally into the end of the month. I'll give this a little time to see if there is anything else that makes sense to add here. I want to keep exposure modest .

🧩 SECTOR OVERVIEW

As you can see from the MARKET SCREENER :

⬆️ Outperforming sectors:

SEMIS 📲

TECH 💻

FINANCIALS 💰

ENERY ⚡️

⬇️. Underperforming sectors:

CONSUMER DISC 💍

COMMUNICATION ☎️

REAL ESTATE 🏡

The MARKET SCREENER tell us who is leading and who is lagging. I personally always have it open while trading to get a feel of where money flows and observe sector rotations.

If you like the MARKET SCREENER, it is free to our community - links in bio or signature. Join for instructions.

Energy Sector Showing Inverted Head and ShouldersAMEX:XLE

Scanning through the sectors I noticed something quite clear, an inverted head and shoulders with a possible retest playing out. This is supported by the laguerre rsi below. I'm expecting prices for XLE to go higher and potentially confirm a megaphone pattern.

IXIC: Main catalysts and sector studies!Hello traders and investors! Let’s see how the IXIC is doing today, look at the main catalysts and study some sectors!

The Nasdaq is still in a delicate situation, but it is recovering nicely. We have a gap to fill 14,823, and despite the crash seen yesterday, the situation is under control.

However, if we lose the 21 ema along with today’s low, we might seek the support at 14,511 again. This wouldn’t be enough to reverse the bullish bias, but would weaken it for sure.

Yesterday we just retested the 21 ema in the daily chart, and we are bouncing back up already. There is the possibility of a bearish structure around, but as long as we don’t see a clear reversal occurring, we can’t assume anything yet. The NDX has been doing many bear traps since April last year.

Today is a curious day, as the FAANGs are underperforming the index. If the FAANGs correct more, probably we’ll see the Nasdaq suffering a little bit too, but keep in mind that the bias is still bullish on the Big Ones. The next chart sums all the FAANGs in only one:

Maybe the 21 ema will be the next target in the next few days. But what amazes me is the EV sector, which is beating the IXIC. Aside from TSLA, they are all Chinese, so this makes the reading biased, but it is interesting that the sector seem to be ready for a bullish reversal, and we have a Descending Triangle there:

The most famous Chinese stocks (aside the EV stocks) are beating the market a lot too, going up more than 7%, after yesterday’s crash:

However, what’s interesting is that the gaming sector is also quite strong, going up more than 2% today.

I wouldn’t say that the FAANGs are not strong anymore, because they are. It just seems that today’s volatility made other sectors appear more interesting against them. Yesterday the Chinese stocks underperformed the market, so it seems today’s movement is about right.

There are many good stocks around, trading at appealing levels, even among the tech stocks. We just need to search for them.

If you liked this analysis, remember to follow me to keep in touch with my daily updates, and support this idea if you liked it!

Thank you very much!

Personal Savings Rate - Consumer Spending to DeclineAs the Pandemic progressed, Consumers began to spending on

Durable Goods, Home Improvement, Electronics and a host of

additional Products to improve their nesting conditions.

This dynamic applied to Americans who remained employed

through "Stay at Home" Measures.

Lower Income Consumers paid down Debt and began Investing

via WeBull, CoinBase and Robin Hood. Online gambling began to

increase markedly.

Rents were abated through moratoriums on Real Estate.

Stimulus measures provided Income substitution effects, why

work when you are assure $600 per week for one year.

Demand was brought forward for a number of Sectors.

It is now declining.

Consumers purchased new Computers, Phones, Tablets and

peripherals.

White goods and Construction Materials were extremely strong

for 16 months.

Demand has been sated, the Economy has been contracting for

a number of months.

On sector Watch:

XLE

XLU

XLK

XLB

XLP

XLY

XLI

XLC

XLV

XLF

XLRE

Breadth should be closely monitored in each of these Sectors

as it is in decline once again.