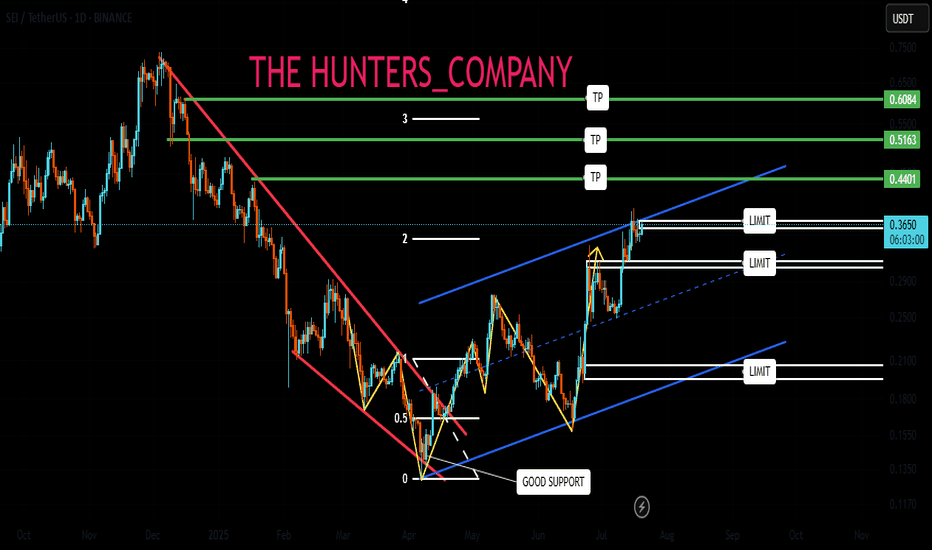

SEI BUY LIMITHello friends🙌

📉According to the downward trend we had, you can see that a reversal pattern was formed at the specified support and buyers entered and raised the price, which caused the formation of an ascending channel.

👀Now that we are at the ceiling of the ascending channel, because there is a possibility of price correction, we will place two more buying steps down and buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

Seianalysis

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.2942.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.3062

First target: 0.3151

Second target: 0.3290

Third target: 0.3421

SEI Trend Reversal? Breakout + Higher Low ConfirmedNYSE:SEI has broken above the key descending resistance line, signaling a shift in momentum after an extended downtrend. The price also rebounded strongly from the support zone marked in the chart, forming a clear higher low.

Currently, SEI is pushing through a critical zone where support previously flipped into resistance, now testing the 50 EM as the next challenge.

If the price can hold above this zone and close with strength, the next leg up could target $0.30–$0.50, as shown on the chart.

DYOR, NFA

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1754.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.1823

First target: 0.1847

Second target: 0.1884

Third target: 0.1942

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.1600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1614

First target: 0.1625

Second target: 0.1642

Third target: 0.1665

SEI ANALYSIS (1D)SEI appears to be in the C leg of a corrective structure. The correction for this coin is not yet complete in terms of time and price. Wave C is a time-consuming wave, and it is expected to push the price down to the green zone. After reaching this area and accumulating orders, the price is likely to start its move in the form of Wave D.

The targets for the next wave are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SEIUSDT Bullish Flag Pattern!SEIUSDT Technical analyssi update

SEIUSDT is breaking out of a bullish flag pattern on the daily chart with high volume. We can expect a continuation of the bullish trend from the current level. It took 50 days to form the bullish flag pattern, and the price is trading above the 100 and 200 EMAs, providing additional confirmation of the uptrend. A sustained breakout above this pattern could lead to further gains.

Regards

Hexa

SEIUSDT - SHORT TERM Support in DANGERSEI is retesting a key support zone, and losing this support zone may lead to a hard drop.

The opening prices of SEI has not yet been retested, and in most cases for newly released altcoins the price will return to "retest" the opening price. In some cases, it even falls under - but it is quite common for he price to return to these zones.

I discuss a similar situation on NOTUSDT, which is showcasing a similar situation:

IF the price cannot keep closing daily candles ABOVE the current support zone, it's likely that a hard plummet will follow, since the price has lost the 200d moving averages in the daily, which equals short term bearish.

____________________

COINBASE:SEIUSD BINANCE:SEIUSDT

SEIUSDT: Strong Support, Ready to Climb!!BINANCE:SEIUSDT has recently bounced back from a major support level, demonstrating resilience in its price action. After a brief retracement from a small resistance, the coin is currently trading at the Fibonacci 0.618 level, a significant point often associated with bullish reversals. Given SEI’s reputation as one of the fastest Layer 1 blockchains, coupled with its robust community support, we anticipate a potential uptrend from this level.

On the fundamental side, SEI has established itself as a leading Layer 1 blockchain, known for its speed and efficiency. The strong community backing further enhances its growth potential. With these fundamentals in mind, we can confidently expect SEI to aim for a new all-time high (ATH) in the near future.

BINANCE:SEIUSDT Currently trading at $0.44

Buy level: Above $0.43

Stop loss: Below $0.355

TP1: $0.51

TP2: $0.58

TP3: $0.75

TP4: $1.13

Max Leverage 3x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is sticking to it strongly and is about to break upwards

We have a bounce from the lower limit of the channel at 0.4440

We have a trend hop on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the 100 moving average

Entry price 0.4666

First target 0.4800

Second target 0.4932

Third target .5100

#SEI 1D chart;TSXV:SEI 1D chart;

From April 9th to the present day, it continues to decline below the falling trend line.

The support zone (orange line) just below the current level seems to have worked in the last decline.

If it is crossed, there is a support line below it (yellow) and then the Discount area.

We can say that the direction of the movement will be completely shaped by Bitcoin's stance in the market, as no structure is visible for now until the contraction.

SEI is bearish for at least another 144 days !It looks like a finished zigzag or FLAT pattern (an ABC). Wave C was an accelerated 5-wave.

The big A wave is over and it looks like we are now entering a big B wave.

Wave A has been 226 days.

Wave B is also expected to be at least 226 days, although it may be longer.

The large wave B, which is a correction, is expected to last at least until the vertical line on the chart (November 10).

Closing the daily candle below the invalidation level will violate this analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

SEIUSDT.1DLet's delve into a professional technical analysis of the SEI/USDT (Sei Network against US Dollar Tether) chart based on the image you've provided:

Current Price Action:

SEI is trading at $0.3715, showing a pattern of declining peaks, which suggests a bearish trendline since the highs earlier this year. The current setup provides a critical juncture where the price is testing key resistance and support levels.

Key Levels on the Chart:

Support Levels:

S1 at $0.3343: This level is currently acting as a short-term support, which if broken could lead to a test of lower support.

S2 at $0.2092: Represents a more significant, longer-term support level that aligns with previous lows.

Resistance Levels:

R1 at $0.5140: This is the immediate resistance level, which has previously acted as both support and resistance, indicating its importance.

Technical Indicators:

MACD (Moving Average Convergence Divergence): The MACD line is below the signal line but close, suggesting weak bearish momentum. The histogram is near zero, indicating a lack of strong momentum in either direction.

RSI (Relative Strength Index): The RSI is at 53.4, indicating a neutral market condition. This shows there's neither excessive buying nor selling pressure currently dominating.

Technical Analysis and Trading Strategy:

The SEI/USDT pair is at a crucial point where it’s challenging the resistance near the descending trendline. A breakout above this line and R1 at $0.5140 could signal a reversal of the bearish trend and a potential bullish phase. Conversely, a rejection at this level could see the price retracting back towards support at $0.3343 and potentially lower if the bearish momentum increases.

Buying Strategy: Look to initiate long positions if there is a confirmed breakout above the descending trendline and R1, with a target of higher resistance levels. A stop-loss order should be placed just below the trendline to protect against potential pullbacks.

Selling Strategy: If SEI fails to breach the resistance and shows signs of weakness (such as bearish candlestick formations or a downturn in RSI/MACD), consider short positions or exiting long positions, targeting S1 at $0.3343.

Risk Management: Given the current market conditions, maintaining a conservative approach with tight stop-losses would be prudent to manage the inherent risks. Adjust position sizes accordingly to manage potential volatility.

Conclusion:

This analysis highlights the importance of the upcoming price movements and their implications for future market directions. Traders should remain vigilant and responsive to changes in market dynamics, particularly any shifts indicated by volume, MACD, or RSI, which could signal increased buying or selling pressures.

Trade Details for SEIPattern Formation: SEI is showing signs of a potential inverse head and shoulders pattern, which typically indicates a bullish reversal.

Support Level: The $0.32 region is expected to form the right shoulder, offering an entry point for a long position.

Profit Levels: Targets are set based on key resistance levels and potential price expansions.

Strategy:

Risk Management: By entering around the $0.32 support, the trade aims to limit downside risk with a stop loss placed just below the significant $0.25 level.

Profit Taking: Gradual profit-taking at $0.45, $0.60, and $0.75 to capitalize on upward movement while securing gains at key intervals.

This setup leverages technical analysis to optimize entry points and manage risk effectively, aligning with market conditions and potential bullish patterns.

trade in break ;iquidity level📊Analysis by AhmadArz:

🔗"Uncover new opportunities in the world of cryptocurrencies with AhmadArz.

💡Join us on TradingView and expand your investment knowledge with our five years of experience in financial markets."

🚀Please boost and💬 comment to share your thoughts with us!

SEI Holders! FOLLOW ME~!Good day, guys.

This is ESS team.

Let's check the SEIUSDT chart.

If it strongly breakthrough the GREEN downtrend line, It may try to breakthrough the RED long-term downtrend line.

Even if it fail, It will reach the top of the uptrend line after breaking through the red long-term downtrend line with buy-power at uptrendline.

SEI break out to $1.20 Incoming or break down to $0.59SEI broke out to 1$ and got a pull back as expected on previous post. Because of an overall bullish market, I see it finding some support here already and bouncing back up to test those highs again. If it fails to do so, expect it to lay on the 100sma $0.59 (yellow line) for support.