SEIUSDT

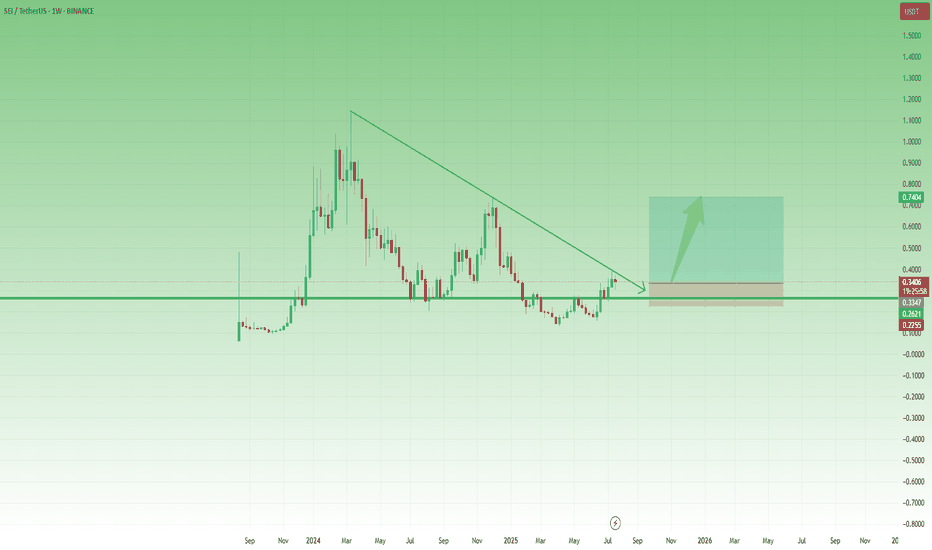

SEI ANALYSIS (1D)SEI is currently moving into a channel which is providing a very specific outlook.

At the moment, it is hard to determine if the outlook is bullish or bearish in the mid term.

If we ignore BTC and the possible altcoin bull run to cut out the noise, I believe this asset is either getting ready to pump 10x or is on a one-way ticket to hell.

The orange arrow on the chart represents the most likely path for this asset for now.

Thanks for reading.

SEI/USDT at a Critical Level Golden Pocket Reaction Will Define?🔍 Technical Analysis:

1. Market Structure:

SEI/USDT is in a recovery phase after a significant downtrend.

Price is currently testing a crucial area between the Fibonacci retracement levels of 0.5 (0.2778) and 0.618 (0.2515) — known as the Golden Pocket Zone.

2. Key Support & Resistance Levels:

Strong support lies within the highlighted yellow zone (0.2515 – 0.2778), a historical support-resistance flip level.

Key resistance levels to watch:

🔸 0.3521

🔸 0.4715

🔸 0.5936

🔸 0.7025

🔸 0.9407

🔸 1.1361

---

📈 Bullish Scenario:

If price holds above the golden pocket:

A strong rebound is likely, forming a higher low structure.

Bullish confirmation occurs if price breaks and closes above 0.3521 with strong volume.

Upside targets: 0.4715 → 0.5936 → 0.7025 in sequence.

🔹 Additional Confirmation: Bullish reversal patterns (e.g., bullish engulfing or pinbar) around 0.25–0.28 would strengthen the bullish outlook.

---

📉 Bearish Scenario:

If the price breaks below the 0.2515 level:

It could trigger a deeper move toward 0.22 – 0.18 support area.

Further breakdown may bring price below the psychological level of 0.15.

🔻 Bearish confirmation if the price gets rejected from the 0.30–0.35 region with strong bearish candles.

---

📊 Pattern Insight:

Potential Double Bottom formation near the golden pocket zone.

A break above the 0.3521 neckline would validate this bullish reversal pattern.

---

🔖 Conclusion:

This zone (0.25–0.28) is a make-or-break area for SEI. A strong reaction from this golden pocket will determine whether SEI is ready to rally further or fall to new lows.

#SEI #SEIUSDT #CryptoAnalysis #AltcoinUpdate #TechnicalAnalysis #Fibonacci #SupportResistance #GoldenPocket #CryptoTrading #SEIpriceprediction

#SEI/USDT The best future belongs to this coin.#SEI

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.2967.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.2950, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3080.

First target: 0.3221.

Second target: 0.3343.

Third target: 0.3522.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI : The best future belongs to this coin.Hello friends🙌

Given the rapid growth that this coin has had and I think it will continue, now that the price is correcting, there is a good opportunity to buy in stages with risk and capital management and move with it to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

SEI Breakout Setup: Buy the Dip Before the Next Leg UpAfter the low around 0.13 in April, SEI started to recover, and although the first attempt to reclaim the 0.25–0.26 zone failed in mid-May, that key area—a former support from last year—was finally broken at the end of June.

Now, this previous resistance has turned into support, and even though gains have so far been capped by the falling trendline, price is consolidating above support – which could be a sign of bullish pressure building.

If we get a clean break above this descending trendline, momentum could accelerate, opening the way for a push toward the 0.75 resistance.

This is exactly the scenario I’m working with.

I'm looking to buy dips, with an ideal entry around 0.30, while keeping in mind that a move below 0.25 would invalidate the setup.

✅ Risk-reward? With a stop below 0.25, this setup offers a 1:4 R:R, and even a realistic chance at a 2x trade, which would be quite reasonable under current market conditions.

Sei · Technical Analysis · Beyond Trading —The Soul in the ChartThis is a nice chart. It is well structured. It is also basic and standard. You can know where a project is at based on the drawings (patterns) on the chart. When you look at hundreds of charts, for years, you can see the signature of the trading bots on each chart. Each exchange has a different set of algorithms doing the trading. It is fascinating to say the least. Once you learn their language and understand their behaviour, you can time the market and predict market moves. I've seen the same patterns, actions and reactions repeating thousands of times, over and over, again and again. This is good, it helps us predict the market.

Even if humans are the ones doing most of the trading, their habits and customs will show up on the chart. These will appear as different sequences, fractals and patterns. People act based on instincts, emotions, impulses and intuitions. These come based on the weather, the environment, our relations, physical chemistry and the effect of the astros on our bodies and minds. If we can put all these things together we can time the market. Doing it consciously sounds (feels/looks) like a very hard task but most of it is done subconsciously, like driving. You learn to perform the craft consciously but once you have practice and engage in it then it comes out naturally; you don't have to think about changing gears or pressing on the gas, you just do it; like riding a bike. That's technical analysis for you, that's trading. It can be approached in the same way. If you engage the market long enough, with an open mind always ready to adapt and accept new input, eventually you move with the market and this movement will tend to be the right choice when it comes to making a decision.

This or that? Your intuition is when solutions and answers come forth from a vast array of subconscious material. So we read, we trade and we participate and our minds take care of the rest. The way to organize all this subconscious information and make it useful—and available to the conscious mind—is through meditation.

I am going to go with the volume signal. The highest volume ever happened in June after a higher low. The main low from the March 2024 high happened in 2025-April, the market bottom. There was a low in August 2024 and this becomes an important level. When the action moved below, it activates signals for buyers; when the action moves back above, we are in the bullish zone. Current price action confirms this, SEIUSDT is long-time bullish now. Rising for months but momentum is yet to show. This is only the start.

The action is happening above EMA55 below EMA89. Support and resistance.

Considering the bigger picture and the overall growth potential we can say the market is still trading at the bottom. I am using the linear chart to make this clear.

After the highest volume ever the market cannot start dropping. After more than a year of bearish action, between March 2024 and April 2025, seeing a full green candle with the highest volume ever after a higher low means that the bulls are in. Coming from a technical analysis perspective, this means that the bullish bias is confirmed.

The break and close above EMA55 weekly gives this signal additional strength, and what is happening across the altcoins market; every single day several pairs are growing more than 100%, in just one day; reveals what the future holds.

This is not speculation. This is not my speculative opinion. This is a translation of actual price data, which is the action the market participants are taking, that says we are going up.

It is not "I" that is saying "we are going up." It is the chart, the market, the data. It is inevitable, it is already confirmed based on the information that I've been showing you month after month after month.

It is not predicting the future. It is simply pointing out the logical conclusion of a series of events. If someone has an idea to build a house and from this idea starts to work; accumulate the necessary money, hire an engineer and take all the necessary steps to build a house, you can easily say, if you have access to this information, that a house will be built at some point. You don't have to be genius to do it, but you know this person has been putting the money and effort, has been taking all the steps that are necessary to get it done. Knowing this, you can say with a high level of certainty that it will be done, based on the data of course. Crypto is going up. Only a Black Swan event can stop this, and you can't predict those. So we go with what is possible and what we know. Just watch!

Thanks a lot for your continued support.

It might be hard to be 100% right or predict minor swings and changes short-term, but when it comes to the bigger picture? It is impossible to miss.

Thank you for reading.

Namaste.

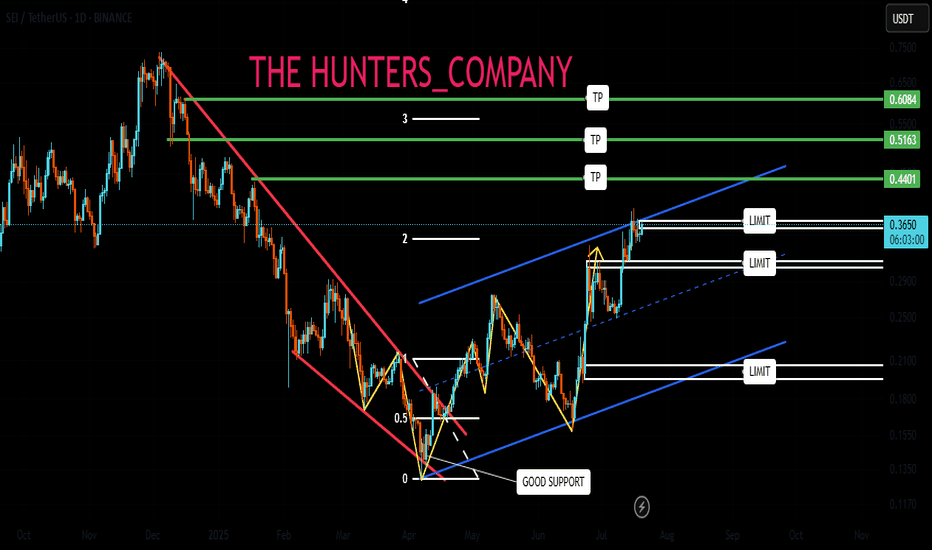

SEI BUY LIMITHello friends🙌

📉According to the downward trend we had, you can see that a reversal pattern was formed at the specified support and buyers entered and raised the price, which caused the formation of an ascending channel.

👀Now that we are at the ceiling of the ascending channel, because there is a possibility of price correction, we will place two more buying steps down and buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

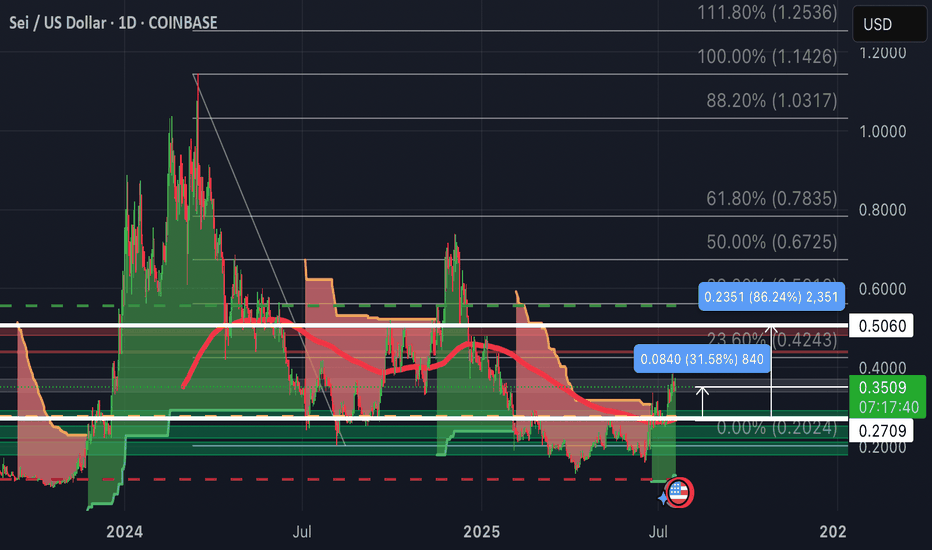

SEI-Update:Up 31% so far as we wait for the big retest back @ $1Entry was at $0.27, made a dip below this support line then recovered.

Macro retest would be 100% Fibonacci Correction back to $1.00.

First we shall break thru the $0.50 Resistance (will be a 86% gain).

Then push up past 50% Fibonacci at $0.6725, then $0.7835.

SEIUSDT Rebounds from Key Support - Pump Loading?BINANCE:SEIUSDT Rebounds from Key Support - Pump Loading?

BINANCE:SEIUSDT just touched a major support level on the 4H chart and is now showing signs of a bullish reversal after breaking above the descending trendline. This setup looks similar to previous price actions where NYSE:SEI delivered sudden explosive moves post-breakout. If history repeats, we could be looking at another strong rally ahead.

Entry looks promising, but as always, manage your risk wisely and set a proper stop loss to protect your capital.

BINANCE:SEIUSDT Currently trading at 0.265

Buy level : Above $0.263

Stop loss : Below $0.243

Target : $0.337

Max leverage 5x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

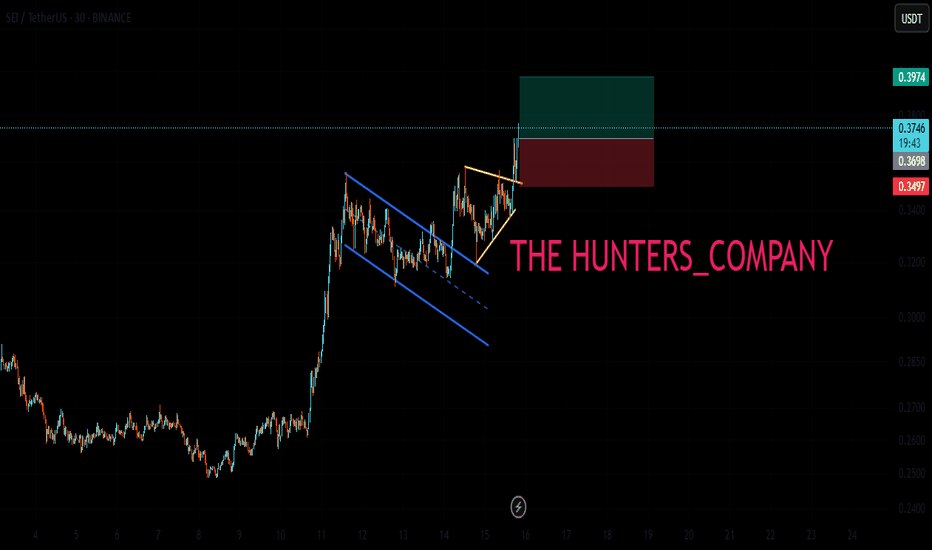

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 0.3450.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.3380, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3580

First target: 0.3684

Second target: 0.3850

Third target: 0.4016

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI Bulls Target 38% Gains — Are You In?📈 SEI/USDT – 4-Hour Chart Technical Analysis

SEI has developed a constructive bullish pattern on the 4-hour chart. After a prolonged sideways phase, price broke out of the consolidation range and climbed above the prior swing high around $0.3359, now sitting just under the critical resistance near $0.3435.

This region has been tested multiple times historically, with clear rejection wicks and prior sell pressure, marking it as an important threshold. The recent breakout momentum suggests buyers are gaining confidence, especially after the sharp impulse from the $0.3120 support zone.

If the market holds this level on a closing basis and confirms with some follow-through volume, the setup remains primed for further upside.

Even if a retracement occurs back toward $0.3120, the overall structure stays bullish while price trades above $0.2750, which has been the broader accumulation range for several weeks.

________________________________________

🟢 Trade Setup Summary

Entry Zone: $0.3359–$0.3435 (on breakout confirmation)

Stop Loss: Just below $0.3120 support

Target 1 (TP1): $0.3553 – Initial reaction zone

Target 2 (TP2): $0.4247 – Mid-term resistance

Target 3 (TP3): $0.4769 – Extended target

Risk: Approx. 9.17% downside if invalidated

Reward Potential: Up to 38.84% upside if the extended target is reached

Risk-Reward Ratio: ~4.23

________________________________________

From a broader perspective, this is a well-balanced setup with a tight invalidation point and clear upside roadmap. As long as the price continues to respect the $0.3120 floor, any short-term pullbacks can also be considered for spot reaccumulation or DCA entries.

Should the market push through $0.3435 with strong momentum, SEI will likely test the $0.3553 area quickly, followed by attempts to reclaim the higher ranges near $0.42–$0.47 over the coming sessions.

Let me know if you’d like to refine this further or prepare a version for publication or sharing with your community. 🚀

#SEI/USDT Ready to Fly? Breakout #SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.3140.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.3050, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.3246

First target: 0.3381

Second target: 0.3521

Third target: 0.3673

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEI/USDT Ready to Fly? Breakout from Accumulation Zone Signals🧠 Market Overview:

SEI/USDT has just delivered a powerful technical signal — a clean breakout from a major accumulation zone that has been holding price action for several months. With increasing volume and bullish price structure, this breakout could mark the beginning of a sustained upward trend.

The $0.24–$0.27 zone acted as a strong accumulation base. Now flipped into support, this area could serve as the launchpad for the next leg higher if price continues to hold above it.

📌 Pattern Breakdown:

🔸 Pattern: Accumulation Base Breakout

SEI traded sideways for nearly 6 months within a tight consolidation range.

This behavior is typical of institutional accumulation (smart money phase).

A strong bullish breakout above $0.27 has occurred.

Price has successfully retested the breakout level, confirming it as new support.

📈 Bullish Scenario (Primary Bias):

As long as SEI holds above the breakout zone ($0.26–$0.27), bullish continuation is likely.

🎯 Upside Targets:

$0.3521 → Minor resistance and key breakout validation.

$0.4715 → First major historical resistance.

$0.5900 → Strong price memory zone.

$0.5936 – $0.7025 → Key supply zone from previous market cycle.

$0.9407 up to $1.1450 → Long-term extension targets if bullish trend accelerates.

💡 Potential ROI from support to top target: Over 300%

📉 Bearish Scenario (Alternative View):

If price falls back below the breakout zone:

It could signal a false breakout (bull trap).

Price may re-enter the previous range and lose bullish momentum.

Downside levels to watch:

$0.21 (mid-range)

$0.17 (range low)

Failed breakout retest = bearish warning for long positions.

⚖️ Validation & Risk Strategy:

Breakout occurred with strong bullish volume → confirmation signal.

Ideal stop-loss: just below $0.25 to protect against invalidation.

Strategy: Buy on successful retest → Add if price breaks and holds above $0.35.

🧠 Pro Tip for Traders:

This setup is ideal for swing traders and mid-term investors.

The current breakout pattern is consistent with the Markup Phase in the Wyckoff Cycle.

Monitor market sentiment and volume to validate trend continuation.

If Bitcoin remains stable or bullish, altcoins like SEI may strongly outperform.

#SEI #SEIUSDT #BreakoutTrade #CryptoSignals #AltcoinAnalysis #ChartPattern #VolumeBreakout #TechnicalAnalysis #PriceAction #CryptoTraders

SEIUSDT on the Brink of a Major Explosion… or Total Breakdown?Yello Paradisers! Are you prepared to act with precision—or will you get trapped like the rest before the real move begins? #SEI has entered a highly reactive price zone where one wrong candle could invalidate the entire bullish structure. The market is whispering its next move, but only those who understand structure and timing will be ready to capitalize.

💎#SEIUSDT has completed a significant transition from a bearish trend structure to a more bullish one. Earlier, the price formed consecutive Lower Lows (LL) and Lower Highs (LH), confirming bearish momentum. However, that trend shifted once the market printed a Market Structure Break (MSB) around the 0.2121–0.2253 range. This area—previously acting as resistance—has now flipped into a confirmed support zone, marking a critical bullish development.

💎The structure strengthened further when SEI broke above the prior Higher High (HH) and created a Break of Structure (BOS). That move catapulted price into the red resistance zone between 0.2929 and 0.3152, just beneath the last major swing high at 0.3471. This zone is now acting as a ceiling, containing bullish pressure—but the underlying structure remains intact unless we see an invalidation close below key levels.

💎High probability, SEI i retracing back into the 0.618 Fibonacci level at 0.2269, which aligns precisely with the flipped support zone. This is a textbook bullish retest, and as long as the price holds above 0.2121, the probability for continuation remains high. The coming candles will be decisive: they will either confirm strength and fuel continuation—or fail and lead to a complete structure breakdown.

💎If buyers manage to hold the key support zone between 0.2269 and 0.2121, the probability of a bullish continuation increases significantly. The first major target on the upside is 0.3471, which marks the previous swing high and is likely to act as the initial area of resistance. A clean break above that level could open the path toward 0.3812, followed by 0.4086, both of which align with higher timeframe supply zones and represent strong historical resistance. These levels are expected to attract profit-taking and short-term volatility, making them critical decision points for continuation or rejection in the next phase of SEI’s move.

💎However, traders must be alert: any candle close below 0.1554 will serve as a hard invalidation level for this bullish thesis. If that happens, the structure flips bearish, and we would anticipate a deeper correction toward 0.1361 or even lower. That’s the line we are not willing to ignore—structure and discipline come first.

This is not the time to trade emotionally, Paradisers . Retail traders will act impulsively—either FOMOing at the highs or panic-selling at the lows. The smart move here is to observe how price reacts and only execute if there’s clear confirmation and structure support. No guessing. No gambling.

MyCryptoParadise

iFeel the success🌴

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2745.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.2710, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2813

First target: 0.2887

Second target: 0.2983

Third target: 0.3112

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SEIUSDT Forming Falling WedgeSEIUSDT is showing a highly attractive setup with the formation of a classic falling wedge pattern, a structure known for indicating a strong trend reversal. The price action has respected the wedge boundaries, consolidating with lower highs and lower lows before a decisive breakout appears imminent. With the volume profile confirming increased buying interest, this pattern suggests the potential for an 80% to 90% upside move, capturing the attention of traders searching for breakout opportunities in altcoins.

SEI, the native token for the Sei Network — a sector-focused Layer 1 blockchain built for trading — has been drawing steady investor interest thanks to its unique positioning and growing ecosystem. As more projects adopt Sei’s fast and efficient trading infrastructure, market sentiment around SEIUSDT remains positive. This strong fundamental narrative combined with the bullish wedge breakout strengthens the case for significant gains in the near term.

From a technical perspective, traders should watch for confirmation candles and sustained buying volume above the resistance trendline. A successful breakout with retest could trigger a powerful rally, potentially unlocking the anticipated gains. Keeping an eye on key support zones within the wedge will help manage risk while maximizing the reward potential on this promising setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.2470.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.2440, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.2494

First target: 0.2545

Second target: 0.2600

Third target: 0.2690

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Recently Circle launched native USDC & CCTP on $SEIThis enables fast, low-cost stablecoin transfers on the efficient L1 blockchain, boosting liquidity and institutional adoption

This news made me curious about the chart

The price itself is reclaiming and holding a critical HTF level while breaking the bearish structure

The RSI above the 50 level is signaling a regaining of the bullish momentum

Perfect alignment to grab some for the longterm portfolio

SEI Long – Breakout with Relative Strength & Trend ContinuationSEI is showing strong relative strength and has just broken out of recent structure. We’re watching for a higher low to form above the $0.22 zone, confirming trend continuation and unlocking upside liquidity.

📌 Trade Setup:

• Entry Zone: Around $0.22

• Take Profit Targets:

o 🥇 $0.29

o 🥈 $0.39

o 🥉 $0.49

• Stop Loss: Daily close below $0.19