SEI Poised for a Breakout After Bold 23andMe Acquisition Bid !Sei (SEI), the innovative layer-1 blockchain designed for high-speed trading and decentralized finance (DeFi), is flashing strong bullish signals both fundamentally and technically. The recent news that the Sei Foundation is exploring the acquisition of 23andMe, the leading personal genomics company, has sparked excitement in the market. If successful, this strategic move could position Sei at the forefront of the multi-billion-dollar genomic data industry — combining blockchain’s security and transparency with the rapidly growing demand for data privacy.

Why This Is Huge

23andMe recently filed for Chapter 11 bankruptcy protection, opening the door for a potential buyout. The Sei Foundation’s plan to migrate genetic data onto the blockchain would give individuals direct control over their data, allowing them to decide how it’s used and even monetize it. This taps into a massive and underserved market where data security and privacy are becoming critical issues.

Bullish Chart Setup

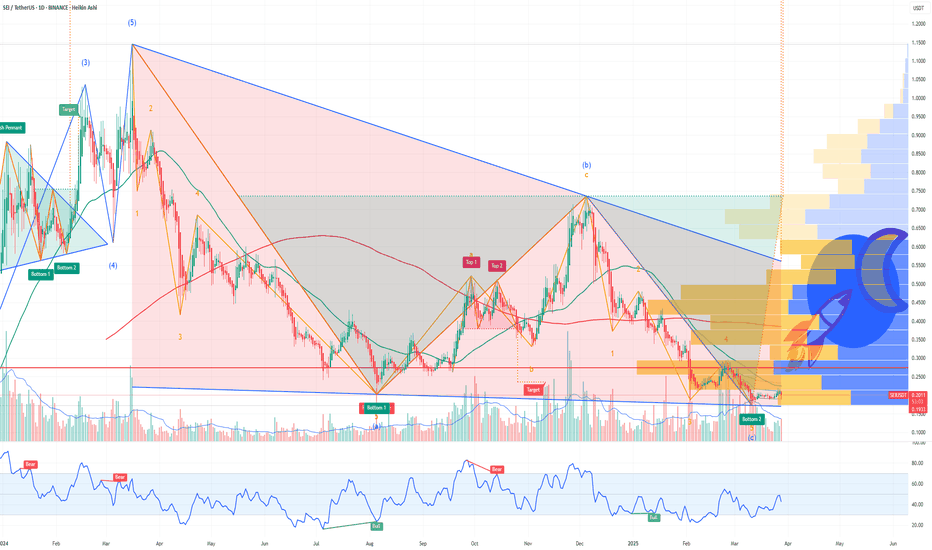

From a technical perspective, Sei’s chart is showing signs of a major breakout:

✅ Double Bottom: SEI has recently formed a clear double bottom pattern, signaling a strong reversal from recent lows. This is a classic bullish pattern that suggests the selling pressure has been exhausted and buyers are stepping in.

✅ Falling Wedge: SEI is also breaking out of a falling wedge, a high-probability bullish formation. Falling wedges typically lead to strong upside moves as downward momentum fades and buying pressure builds up.

✅ Volume Increasing: Recent spikes in volume confirm that smart money could be accumulating in anticipation of a breakout.

Perfect Storm for a Rally

With a bullish technical setup aligning with a game-changing fundamental catalyst, Sei could be on the verge of a major breakout. A successful acquisition of 23andMe would not only give Sei real-world utility in the health data sector but also drive increased adoption and network activity. If SEI clears key resistance levels, this combination of technical strength and strategic growth could send the token to new highs.

Sei isn’t just another DeFi project — it's positioning itself to be a leader at the intersection of blockchain, health data, and privacy.

This could be the beginning of a powerful new trend for SEI. 🚀

SEIUSDT

#SEI/USDT#SEI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.1880.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.1944

First target: 0.1979

Second target: 0.2017

Third target: 0.2059

SEI ANALYSIS (1D)SEI appears to be in the C leg of a corrective structure. The correction for this coin is not yet complete in terms of time and price. Wave C is a time-consuming wave, and it is expected to push the price down to the green zone. After reaching this area and accumulating orders, the price is likely to start its move in the form of Wave D.

The targets for the next wave are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SEI will reach at 1.4$

Price Movement and Trend:

The chart shows a significant upward movement starting around mid-2024, peaking at a high (likely around $1.14-$1.20 based on the vertical scale), followed by a sharp decline.

After the peak, the price enters a consolidation phase with lower volatility, fluctuating around the "Accumulation zone" marked at approximately $0.196746.

A recent upward trend is suggested, with the price appearing to approach or break above the $1.143922 level (labeled as "Target 1.4$"), indicating potential bullish momentum.

Accumulation Zone:

The "Accumulation zone" is identified around $0.196746, which seems to act as a support level where the price has stabilized after the decline. This zone likely represents a range where buyers have been accumulating the asset, potentially preparing for the next upward move.

The prolonged consolidation in this range suggests a period of low selling pressure and possible buying interest.

Target 1.4$:

The chart highlights a target price of $1.4, with the current price nearing $1.143922. This suggests that the analyst or trader anticipates a potential rise to $1.4 if the current upward trend continues.

The upward arrow and the proximity to this target indicate a bullish outlook, possibly driven by a breakout from the accumulation phase.

Volume and Candlestick Patterns:

While the chart doesn’t explicitly show volume bars, the candlestick patterns (green for bullish, red for bearish) indicate periods of buying and selling pressure. The recent green candles suggest increasing buying interest.

The sharp drop after the peak and the subsequent consolidation could indicate profit-taking followed by a base-building phase.

Timeframe and Context:

The chart covers a period from mid-2024 to March 2025, with the current date being March 14, 2025. This long-term view suggests the analysis is focused on a medium-to-long-term trend rather than short-term fluctuations.

The upward trajectory toward $1.4$ might be based on technical analysis (e.g., resistance levels, Fibonacci extensions, or historical price action), though specific indicators are not visible.

Interpretation:

The chart suggests that SEI/USDT has undergone a significant rally, followed by a correction and consolidation in the accumulation zone around $0.19-$0.20. The recent upward movement toward $1.14 indicates a potential breakout or continuation of an uptrend.

The target of $1.4$ could represent a resistance level or a projected price based on the analyst’s strategy (e.g., a measured move from the accumulation range).

Traders might interpret this as a buying opportunity if the price holds above the accumulation zone, with a stop-loss potentially set below $0.19, aiming for the $1.4 target.

SEI (Y25.P1.E1) 2 scenarios. Hi Traders,

This is not trading advice, only hypothesis on ABC move where length of A = BC, hence confluence to previous accumulation range in 2023.

The other is breakout trade where this is an accumulation range and we use the fib fan to find main resistance trend line.

Lets see how this turns out... I'm not interest in trading this as yet until I see more parts to the puzzle.

All the best,

S.SAri

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.36

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2166

First target 0.2300

Second target 0.2400

Third target 0.2530

SEIUSDT Target is $0.8888!SEIUSDT – Eyeing a Breakout to $0.8888! 🚀🔥

SEI has been consolidating after a strong downward trend, but is this the beginning of a major reversal? The 4H chart is showing some key signals that traders should keep an eye on. Let’s break it down:

🔹 Current Market Structure

SEI is currently trading at $0.2719, holding above the key support zone at $0.2438. This level is crucial—if it holds, we could see bullish momentum building up.

🔹 EMA Break & Trend Shift?

The price is testing the Exponential Moving Average (EMA), which has acted as resistance in the past. A clean break above this EMA could confirm a trend reversal and push prices higher.

🔹 Major Resistance & Breakout Level 🚀

The ultimate target on my radar? $0.8888 📈. This level represents a key resistance area where a major breakout could occur. If SEI gains enough traction, we could see a strong push towards this price point in the coming months.

🔹 What’s Driving SEI’s Future?

Beyond the charts, SEI remains a game-changing Layer 1 blockchain, optimized for decentralized exchanges (DEXes) and NFT trading. With growing adoption and strong fundamentals, SEI has long-term potential, with analysts forecasting prices reaching $1.12+ in 2025 and $3+ by 2030!

Key Levels to Watch 🔥

✅ Support: $0.2438

✅ Breakout Zone: $0.30 - $0.35

✅ Major Resistance: $0.8888

✅ Long-term Target: $1.12+

Final Thoughts 💡

SEI is showing signs of life, and this could be the start of a bullish move. If momentum picks up and price reclaims key resistance levels, we could see explosive growth in the coming months. Are you watching SEI? Let me know your thoughts in the comments! 🚀

📢 Follow for more market insights!

One Love,

The FXPROFESSOR 💙

#SEIUSDT maintains bullish momentum📈 LONG BYBIT:SEIUSDT.P from $0.2922

🛡 Stop Loss: $0.2867

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:SEIUSDT.P is in an uptrend after consolidating in the support zone, confirming buyer dominance.

➡️ Volume Profile indicates that the main liquidity ( POC ) is positioned at $0.274, confirming volume redistribution towards buying.

➡️ A breakout above $0.2922 and consolidation will trigger further upside movement.

➡️ The nearest targets are in the $0.2980 – $0.3030 range, where profit-taking may occur.

⚡ Plan:

➡️ Long entry upon breaking $0.2922, confirming bullish momentum.

➡️ Stop-Loss at $0.2867—placed below the nearest liquidity zone to minimize risk.

➡️ Main targets: $0.2980 and $0.3030, where partial profit-taking may be considered.

🎯 TP Targets:

💎 TP 1: $0.2980

🔥 TP 2: $0.3030

🚀 BYBIT:SEIUSDT.P maintains bullish momentum — expecting further upside!

📢 BYBIT:SEIUSDT.P is forming a bullish trend, and consolidation above $0.2922 may accelerate the uptrend.

📢 Monitor price reactions around $0.3030, as this could act as a resistance zone for potential corrections.

AUCTIONUSDT UPDATE

AUCTIONUSDT is a cryptocurrency trading at $14.18. Its target price is $26.00, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about AUCTIONUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. AUCTIONUSDT is poised for a potential breakout and substantial gains

SEIUSDT - UniverseMetta - Analysis#SEIUSDT - UniverseMetta - Analysis

The price may rebound from the support level, which may additionally indicate growth: on the lower timeframe, a 3-wave structure is forming. If we look at the higher timeframe, there is a potential formation of ABC formation. The nearest movement may be to the trend line, to retest the previous upward movement. Further we should expect the formation of a 3 wave structure, to increase purchases Potential yield may be 322% from this level.

Target: 0.3755 - 1.0741

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.2138

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2260

First target 0.2300

Second target 0.2350

Third target 0.2400

Sei ABC Correction & 984% Target (2025 ATH Will Be Higher)Based on the MKRUSDT Elliott Wave Theory publication , we know that a bullish impulse comes after a correction.

Here we have SEIUSDT with a classic ABC correction after a 5 up-wave pattern (bullish impulse). After the ABC a new bullish impulse will develop which means five up-waves.

This is very interesting because we are looking at a bottom catch.

SEIUSDT bottomed in February 2025 as a technical double bottom, vs the August 2024 low, and a higher low, vs the October 2023 low.

This is all good but why is this important?

Once we hit bottom, there is no place left to go but upwards.

SEIUSDT just hit bottom and this bottom is very likely to be followed by the strongest bullish wave ever for this project because this is a new project.

The target on the chart is mildly strong but I still feel that I am being conservative here. Since this pair wasn't around in 2021, we don't know its potential for 2025. The only bullish wave we have is that one from late 2023 through early 2024.

So we have 984% potential being conservative, but the truth is that SEIUSDT is likely to peak much higher by the time the bull-market ends. It will be wild. It will be amazing.

Thanks a lot for your continued support.

Namaste.

SEI | ALTCOINS | +150% Bounce Zone TARGETSEI is an altcoin that bounces well from support zones and therefore excellent to trade as a swing trade.

You can confirm that SEI bounces from support zones by taking a look at this post I made in August last year, just before SEI increased 232%:

For the short term, there seems to be no clear indication of a turnaround, but the good news is that a better buy zone is approaching for the next impulse wave up - which could be a really big swing.

_____________________

BINANCE:SEIUSDT

#SEI/USDT#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.2260

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2362

First target 0.2555

Second target 0.2727

Third target 0.2900

SEI Ready to Break Out? Key Levels to Watch!

SEI is showing promising signs after a solid pullback, currently down 60% from its peak. Since early December, the price has remained below the descending trendline. A strong entry opportunity could arise once it breaks above this trendline resistance. Key targets are outlined on the chart.

#SEI/USDT Ready to launch upwards#SEI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.3000

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.3040

First target 0.3200

Second target 0.3400

Third target 0.3617