OH NO GUESS WHAT I FOUND $TSLA HEAD AND SHOULDERThe head and shoulders pattern is a chart formation in technical analysis that signals possible trend reversals, often suggesting a change from a bullish to a bearish trend. It features three peaks: a central "head" that is the highest, flanked by two "shoulders," with a neckline connecting the troughs between these peaks.

Tesla's stock is often viewed as a risky investment for several reasons:

High Valuation: NASDAQ:TSLA stock price is considered very high compared to traditional car manufacturers, with a much higher price-to-earnings ratio.

Market Volatility: The NASDAQ:TLSA price is highly volatile, influenced by factors like CEO Elon Musk's public comments, regulatory changes, and overall market sentiment.

Intense Competition: The electric vehicle market is becoming more competitive, with many established and new companies investing heavily in EV technology.

Production Issues: Tesla has experienced production and supply chain challenges, which can affect its ability to meet demand and maintain profitability.

Regulatory Risks: Changes in government policies and regulations, especially those related to environmental standards and EV incentives, can significantly impact Tesla's business.

While these points highlight potential risks, Tesla also has strengths such as strong brand recognition, technological innovation, and leadership in the EV market. It's important to consider both the risks and potential rewards when evaluating Tesla as an investment.

SELLL NOW!!!!!

SELL

SILVER Will Go Lower From Resistance! Short!

Take a look at our analysis for SILVER.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 33.211.

Taking into consideration the structure & trend analysis, I believe that the market will reach 31.952 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Will Go Down From Resistance! Sell!

Please, check our technical outlook for USDCHF.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.882.

Considering the today's price action, probabilities will be high to see a movement to 0.866.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPAUD Will Go Down! Short!

Take a look at our analysis for GBPAUD.

Time Frame: 5h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 2.056.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 2.044 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GOLD SELLERS WILL DOMINATE THE MARKET|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,027.00

Target Level: 2,815.51

Stop Loss: 3,168.26

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/JPY BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

GBP/JPY pair is in the uptrend because previous week’s candle is green, while the price is obviously rising on the 3H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 191.791 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/NZD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

GBP/NZD pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 5H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 2.240 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/JPY(20250324)Today's AnalysisToday's buying and selling boundaries:

149.18

Support and resistance levels:

150.25

149.85

148.59

148.77

148.51

148.11

Trading strategy:

If the price breaks through 148.59, consider buying, the first target price is 149.85

If the price breaks through 149.18, consider selling, the first target price is 148.77

EURUSD Will Move Lower! Sell!

Please, check our technical outlook for EURUSD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.081.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.068 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURJPY Is Bearish! Short!

Here is our detailed technical review for EURJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 161.513.

The above observations make me that the market will inevitably achieve 160.742 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USOIL SHORT FROM RESISTANCE

USOIL SIGNAL

Trade Direction: short

Entry Level: 68.25

Target Level: 65.67

Stop Loss: 69.99

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

US100 SENDS CLEAR BEARISH SIGNALS|SHORT

US100 SIGNAL

Trade Direction: short

Entry Level: 19,765.3

Target Level: 19,601.3

Stop Loss: 19,874.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CHF BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

Previous week’s green candle means that for us the GBP/CHF pair is in the uptrend. And the current movement leg was also up but the resistance line will be hit soon and upper BB band proximity will signal an overbought condition so we will go for a counter-trend short trade with the target being at 1.126.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/USD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

The BB upper band is nearby so AUD-USD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 0.627.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUSD Potential DownsidesHey Traders, in today's trading session we are monitoring EURUSD for a selling opportunity around 1.08500 zone, EURUSD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.08500 support and resistance area.

Trade safe, Joe.

NZDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring NZDJPY for a selling opportunity around 85.800 zone, NZDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 85.800 support and resistance area.

Trade safe, Joe.

Gold Potential Pullbacks To DowsidesHey Traders, in today's trading session we are monitoring XAUUSD for a selling opportunity around 3035 zone, Gold is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 3035 support and resistance area.

Trade safe, Joe.

USDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 149.500 zone, USDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 149.500 support and resistance area.

Trade safe, Joe.

GOLD Will Go Lower From Resistance! Sell!

Take a look at our analysis for GOLD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 3,028.74.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 2,994.67 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY Will Go Lower! Short!

Please, check our technical outlook for USDJPY.

Time Frame: 8h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 149.408.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 147.585 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY Will Move Lower! Sell!

Take a look at our analysis for GBPJPY.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 193.249.

Taking into consideration the structure & trend analysis, I believe that the market will reach 191.112 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

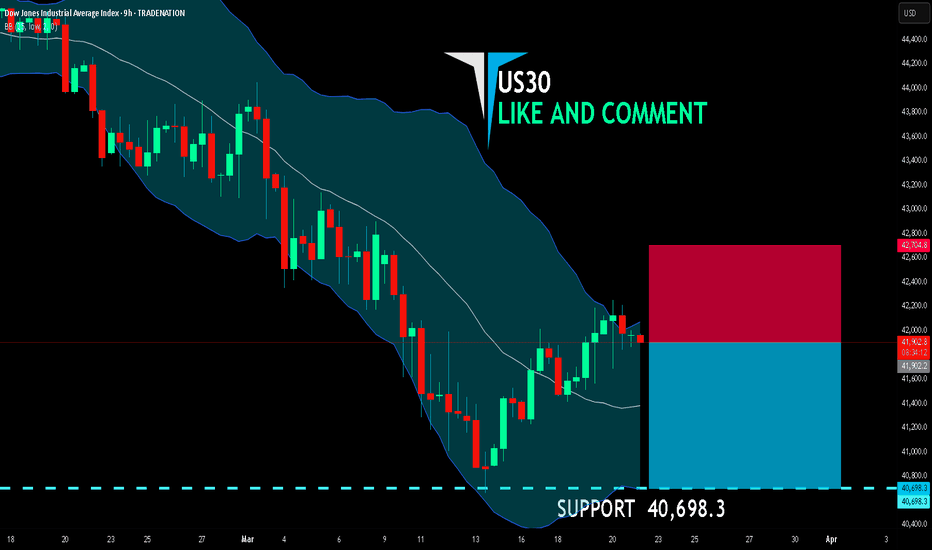

US30 BEARISH BIAS RIGHT NOW| SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 41,902.2

Target Level: 40,698.3

Stop Loss: 42,704.8

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅