GBPJPY Is Going Down! Short!

Take a look at our analysis for GBPJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 193.030.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 192.202 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SELL

NZDCAD Will Fall! Sell!

Please, check our technical outlook for NZDCAD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.816.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.813 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

Bearish trend on EUR/CHF, defined by the red colour of the last week candle combined with the fact the pair is overbought based on the BB upper band proximity, makes me expect a bearish rebound from the resistance line above and a retest of the local target below at 0.948.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/NZD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

EUR-NZD uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 1.885 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the EUR/NZD pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GOLD Will Go Down From Resistance! Short!

Here is our detailed technical review for GOLD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 3,118.23.

The above observations make me that the market will inevitably achieve 3,093.41 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADJPY Will Move Lower! Sell!

Here is our detailed technical review for CADJPY.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 104.000.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 102.916 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Is Going Down! Sell!

Here is our detailed technical review for BITCOIN.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 83,714.88.

The above observations make me that the market will inevitably achieve 81,433.62 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

SILVER BEARS ARE GAINING STRENGTH|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,407.8

Target Level: 3,255.2

Stop Loss: 3,509.1

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/AUD SELLERS WILL DOMINATE THE MARKET|SHORT

EUR/AUD SIGNAL

Trade Direction: short

Entry Level: 1.730

Target Level: 1.720

Stop Loss: 1.737

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CAD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

EUR/CAD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.542 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/CHF SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

AUD/CHF pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 3H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 0.553 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURUSD Is Very Bearish! Short!

Please, check our technical outlook for EURUSD.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.082.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.069 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EUR/GBP SHORT FROM RESISTANCE

Hello, Friends!

We are now examining the EUR/GBP pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 0.831 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDNZD Will Fall! Short!

Take a look at our analysis for AUDNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.100.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.090 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CADCHF Will Go Lower From Resistance! Sell!

Please, check our technical outlook for CADCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.615.

Considering the today's price action, probabilities will be high to see a movement to 0.611.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

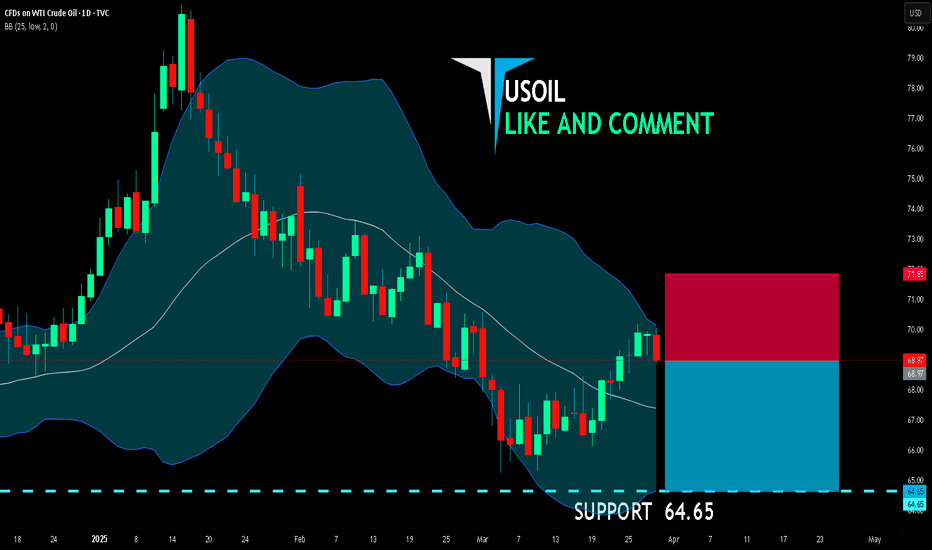

USOIL BEARS WILL DOMINATE THE MARKET|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 68.97

Target Level: 64.65

Stop Loss: 71.85

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

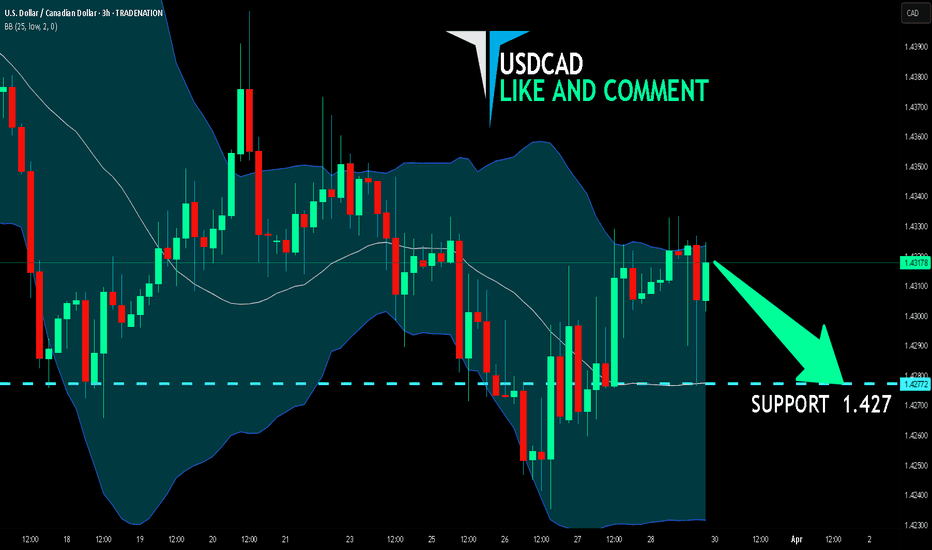

USD/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

The BB upper band is nearby so USD/CAD is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 1.427.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

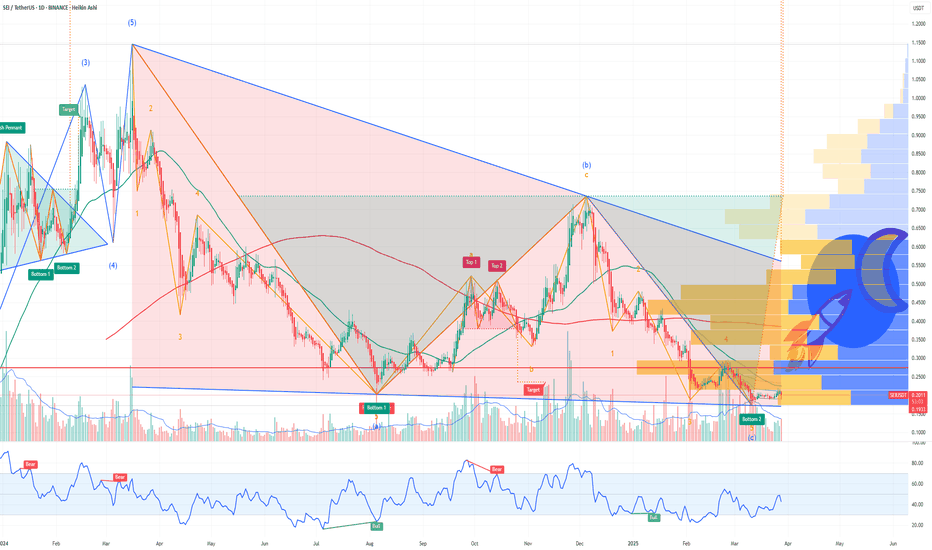

SEI Poised for a Breakout After Bold 23andMe Acquisition Bid !Sei (SEI), the innovative layer-1 blockchain designed for high-speed trading and decentralized finance (DeFi), is flashing strong bullish signals both fundamentally and technically. The recent news that the Sei Foundation is exploring the acquisition of 23andMe, the leading personal genomics company, has sparked excitement in the market. If successful, this strategic move could position Sei at the forefront of the multi-billion-dollar genomic data industry — combining blockchain’s security and transparency with the rapidly growing demand for data privacy.

Why This Is Huge

23andMe recently filed for Chapter 11 bankruptcy protection, opening the door for a potential buyout. The Sei Foundation’s plan to migrate genetic data onto the blockchain would give individuals direct control over their data, allowing them to decide how it’s used and even monetize it. This taps into a massive and underserved market where data security and privacy are becoming critical issues.

Bullish Chart Setup

From a technical perspective, Sei’s chart is showing signs of a major breakout:

✅ Double Bottom: SEI has recently formed a clear double bottom pattern, signaling a strong reversal from recent lows. This is a classic bullish pattern that suggests the selling pressure has been exhausted and buyers are stepping in.

✅ Falling Wedge: SEI is also breaking out of a falling wedge, a high-probability bullish formation. Falling wedges typically lead to strong upside moves as downward momentum fades and buying pressure builds up.

✅ Volume Increasing: Recent spikes in volume confirm that smart money could be accumulating in anticipation of a breakout.

Perfect Storm for a Rally

With a bullish technical setup aligning with a game-changing fundamental catalyst, Sei could be on the verge of a major breakout. A successful acquisition of 23andMe would not only give Sei real-world utility in the health data sector but also drive increased adoption and network activity. If SEI clears key resistance levels, this combination of technical strength and strategic growth could send the token to new highs.

Sei isn’t just another DeFi project — it's positioning itself to be a leader at the intersection of blockchain, health data, and privacy.

This could be the beginning of a powerful new trend for SEI. 🚀

USDJPY Will Go Lower! Short!

Take a look at our analysis for USDJPY.

Time Frame: 3h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 150.395.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 149.580 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

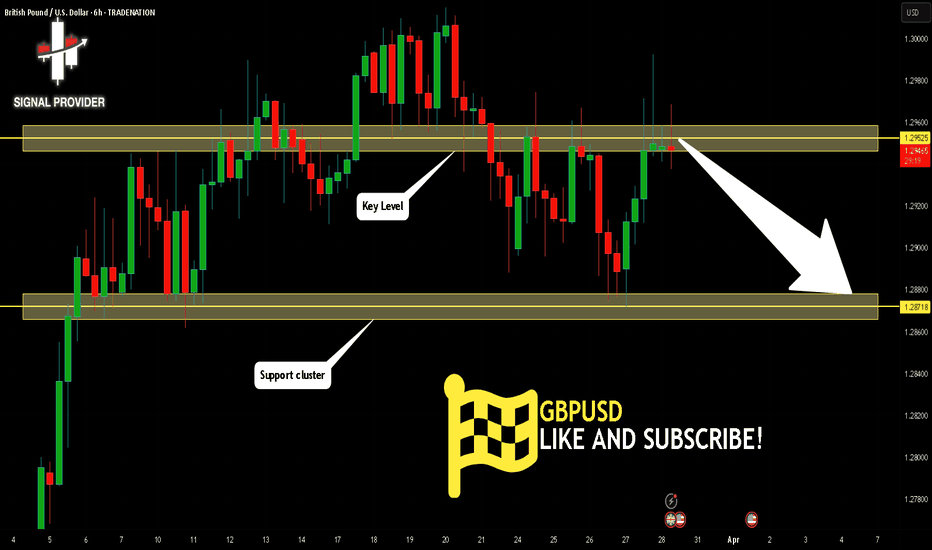

GBPUSD Will Go Down! Sell!

Please, check our technical outlook for GBPUSD.

Time Frame: 6h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.295.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.287 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPNZD Will Move Lower! Short!

Here is our detailed technical review for GBPNZD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 2.263.

The above observations make me that the market will inevitably achieve 2.229 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!