SHORT ON NZD/USDNZD/USD Is currently at a major resistance level/zone and has created a double top or equal highs.

Price has started to fall a bit, but I do believe price will rise to take out the equal highs in a "Liquidity hunt"

Overall I am taking a market execution sell on NZD/USD to the next demand level looking to catch over 300+ pips.

Sellsetup

SHORT ON NZD/USDPrice is in a overall uptrend but has started its pullback phase from the high.

Got a choc (change of character) to the downside as well as equal highs/ double top forming.

Dollar news just came out positive and there is a good chance this pair could fall 200-300 pips by the end of the week.

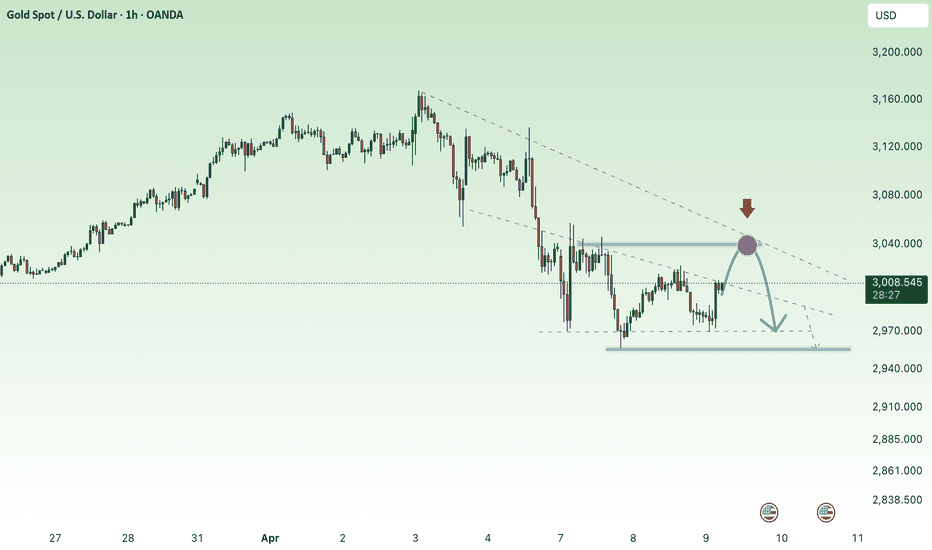

Gold sell setup Why We Would Sell (Short) XAUUSD in This Setup:

Strong Resistance Zone:

Price is approaching a clear resistance level around 3,250, marked by multiple rejections in the past.

This zone acted as a ceiling for the bulls — each time price reached this level, it got pushed back down, showing strong selling pressure.

Double Top Formation (Potential Reversal Pattern):

The price formed a potential double top near 3,250.

This pattern often signals a shift from bullish to bearish momentum.

Bearish Rejection Wicks:

Candlesticks near the resistance show long upper wicks, indicating that buyers are getting weak and sellers are stepping in.

Lower High Forming:

After the second peak, price failed to make a new high, suggesting buying momentum is weakening.

The current price action is forming a lower high, which is a bearish signal.

Bearish Price Projection (Arrow Path):

The blue arrow suggests a retest of the resistance zone followed by a strong drop down to the support zone at 3,187.

This offers a good risk-to-reward ratio for a short trade setup.

Trade Parameters:

Stop Loss above resistance (around 3,250).

Take Profit around 3,187 (previous support).

This setup offers a clear invalidation point if the price breaks above resistance.

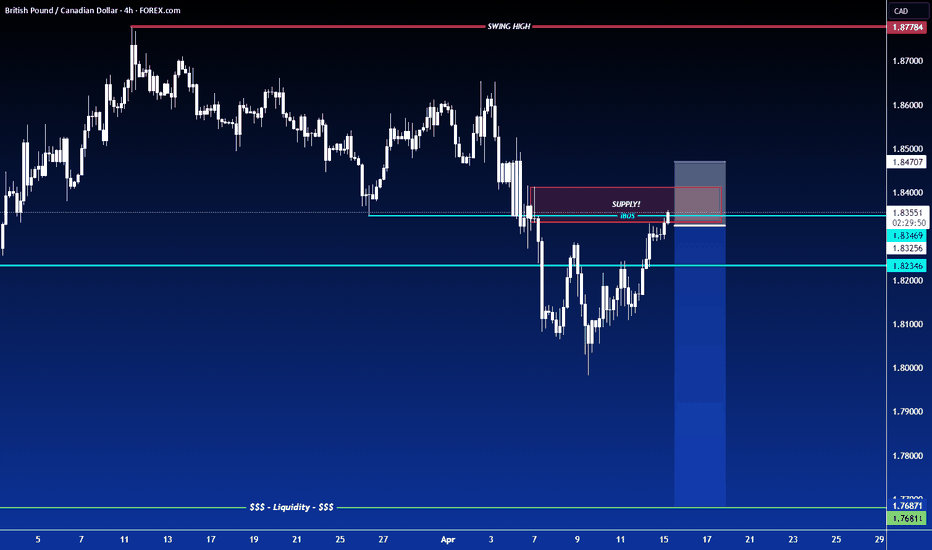

UsdChf Sell bias Price cleared Fridays High 0.82565 with a nice rejection. My initial point of interest was the H4 open and close level.

Hence the target is the previous day low 0.80983

But scaling down lower timeframe like 20m shows engulfing with inducement that's a confirmation for short. Ride with me

Kindly boost if you find this insightful 🫴

SHORT ON GOLD (XAU/USD)Gold has found a ceiling and has given a bit of a double top with a change of market structure from up to down.

Its currently retesting the supply area that provided the choc (change of character)

I will be selling gold to the next support level looking to make a $50 move which is 500 pips.

Gold price accumulates below 3038, waiting for FOMC information⭐️GOLDEN INFORMATION:

Gold prices break a three-day losing streak but remain capped below the key $3,000 level, as rising US Treasury yields dampen the appeal of the non-interest-bearing metal. Despite optimism surrounding potential trade agreements among global partners, lingering tensions in the ongoing US–China trade conflict continue to keep investors on edge. At the time of writing, XAU/USD is trading flat around $2,980 per troy ounce.

⭐️Personal comments NOVA:

Gold price moves with large amplitude, in a downward correction phase. Continues to trade below 3040 waiting for the FED's move on interest rates and agreements on tariff levels of countries around the world.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3038 - 3040 SL 3045

TP1: $3028

TP2: $3015

TP3: $3000

🔥BUY GOLD zone: $2958 - $2960 SL $2953

TP1: $2975

TP2: $2990

TP3: $3010

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GBP/USD possible bear set up/sell offAscending wedge channel 70% of bear breakout. We have 3 HHs printed with a possible 4th. We are currently in a strong bear trend. So trading with the trend here. Biggest target is a daily target. If a certain support level breaks on the daily I will target the wedge channel fill from the daily.

Gold begins to stabilize, trading around 2990⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) finds renewed upward momentum during Tuesday’s Asian session, appearing to end a three-day losing streak after dipping to a nearly four-week low around the $2,957–2,956 region on Monday. Investor sentiment remains fragile amid lingering concerns over a potential global trade war, triggered by US President Donald Trump’s sweeping reciprocal tariffs announced last week. Fears of a recession and heightened uncertainty continue to fuel safe-haven demand, helping bullion stabilize after its sharp pullback from last Thursday’s all-time high.

⭐️Personal comments NOVA:

Gold price is in a correction downtrend, will continue sideways around 2950 - 3040

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3036 - 3038 SL 3043

TP1: $3020

TP2: $3005

TP3: $2990

🔥BUY GOLD zone: $2962 - $2964 SL $2957

TP1: $2975

TP2: $2990

TP3: $3010

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices start to cool down - back to 3000✍️ NOVA hello everyone, Let's comment on gold price next week from 04/07/2025 - 04/11/2025

🔥 World situation:

Gold (XAU) prices deepened their decline on Friday, sliding to a seven-day low of $3,015 before rebounding slightly, after remarks from Federal Reserve (Fed) Chair Jerome Powell suggested that inflation may accelerate again due to the impact of tariffs. At the time of writing, XAU/USD is trading at $3,029, representing a 2.70% drop.

Market volatility persisted as tensions escalated in the ongoing trade conflict between the United States (US) and China. In addition, Powell dampened hopes for imminent Fed rate cuts, stating that tariffs are expected to affect the US economy by slowing growth and pushing inflation higher.

According to a Financial Times (FT) report, hedge funds faced their largest margin calls since the Covid-19 pandemic, triggered by President Trump’s Liberation Day announcement.

🔥 Identify:

The FOMO increase in gold prices is starting to show signs of stopping due to concerns about economic recession. Gold prices will continue to decline back to the price range below 3000, stabilizing the market again.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3054, $3076, $3105, $3135

Support : $2998, $2953

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

SHORT ON EUR/USDEUR/USD has finally given a change of character to the downside and is currently pulling back into a supply area.

The dollar is gaining strength due to Tariffs and looks like it will rise.

I will be selling EUR/USD with a sell limit order looking to catch over 200-300 pips over the next few days.

Gold prices cool after tariff announcement⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) surged to a new all-time high during the Asian session on Thursday as investors flocked to safe-haven assets amid heightened risk aversion. Market sentiment took a sharp downturn after US President Donald Trump unveiled sweeping reciprocal tariffs on Wednesday evening, igniting fears of a global economic slowdown and a potential US recession.

The announcement triggered a broad sell-off in equity markets, reinforcing the risk-off mood and further fueling demand for gold as a traditional store of value.

⭐️Personal comments NOVA:

Gold hits 3167 peak, buying pressure gradually decreases. Adjustment waiting for new moves from other countries on Trump's tariff policy

⭐️SET UP GOLD PRICE:

🔥 SELL 3165 - 3168 SL 3172

TP1: $3160

TP2: $3150

TP3: $3140

🔥BUY GOLD zone: $3108 - $3110 SL $3103

TP1: $3115

TP2: $3130

TP3: $3140

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

SHORT ON AUD/NZDAUD/NZD has given a perfect setup for a sell.

I has bearish divergence as well as a rising channel/wedge into a Major Supply Area from the Higher TF.

We have also change structure from Up to Down on the Lower Timeframe.

I will be selling AUD/NZD to the pervious swing low / demand area for about 100 pips. OANDA:AUDNZD

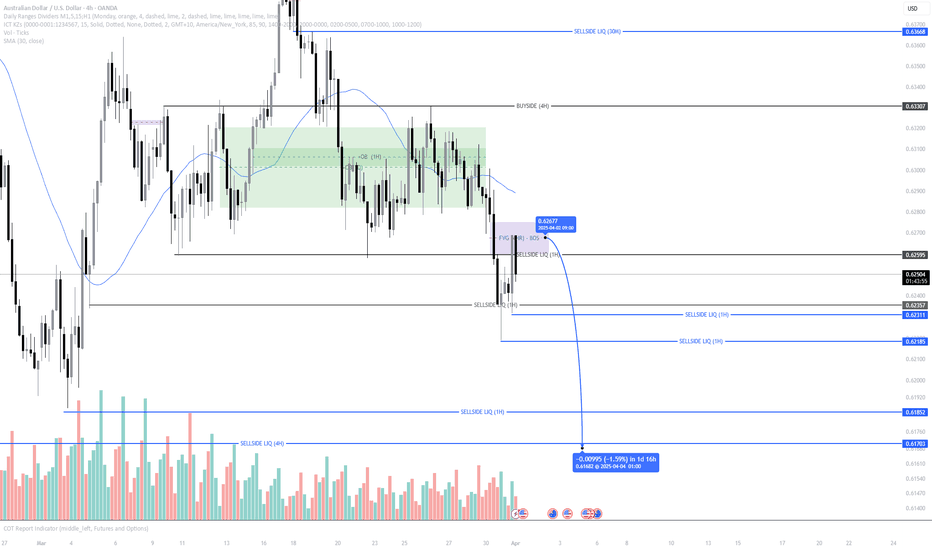

No Rate Hike, No Mercy – AUD/USD Selling in Style!Riding the wave of bearish structure, AUD/USD continues to follow the macro trend with laser precision. After the RBA held rates steady, we’re seeing the typical post-news dump play out—fueled by the market’s disappointment and reduced sentiment.

Technically, price respected the 4H Fair Value Gap (FVG) and showed strong displacement to the downside, confirming continuation.

Key Targets:

🔻 0.62311 – Minor liquidity

🔻 0.62185 – 1H Sell-side liquidity

🔻 0.61703 – Ultimate short-term sell-side target

Expecting the market to bleed lower unless major fundamentals flip the bias. Until then... the trend is your bestie.

DYOR 🧠📉

"Gold (XAU/USD) Approaching 3,110 – Sell Setup in Play?"The price is in an uptrend, making higher highs and higher lows.

A potential reversal zone is identified around $3,110, marked as a possible sell entry.

The chart suggests that after reaching $3,110, the price may decline towards the support zone at $3,010 - $2,999.

Confirmation of the sell trade can be considered if price action forms a bearish structure around resistance.

Key support levels are at $3,010, $2,999, and $2,981, which could act as potential take profit targets for short positions.

Trading Strategy:

Sell Entry: Around $3,110, if resistance holds.

Target: $3,010 - $2,999 zone.

Stop Loss: Above $3,120 to manage risk.

This idea follows technical price action, making it crucial to watch for confirmation signals before executing a trade. 🚀📉

CADJPY analysis for a Sell!!!!Here’s a sell-side analysis for CAD/JPY on the 2H chart based on your updated screenshot:

⸻

Pair: CAD/JPY

Timeframe: 2H

Current Price: ~104.656

Market Bias: Short-term bearish shift from previous bullish trend

⸻

Sell Analysis Overview:

1. Bearish Structure Forming Below 105.300–105.600

• Price recently broke below a major support zone (~105.300–105.600), which is now turning into a resistance zone.

• This rejection aligns with the concept of structure flipping — previous support now acting as resistance.

• The marked “Sell Structure Forming Below” zone highlights this key area for short positions on pullbacks.

2. Multiple Rejections at 105.866

• There are clear lower highs forming, with repeated rejections around 105.866 (circled).

• Each attempt to push higher has failed, showing strong bearish pressure and exhaustion from buyers.

3. Breakdown of Key Moving Averages

• Price has closed below both the 50 EMA and 100 EMA, which are beginning to curl downward — a common signal of a trend reversal.

• Momentum has shifted, and sellers are currently in control.

4. Liquidity Grab + Breakdown

• After a false breakout to the upside, price grabbed liquidity around 105.866 and quickly reversed.

• This aligns with smart money behavior: sweeping highs before dropping — a classic bearish trap.

5. Short-Term Target Zone

• The current bearish move has a clear downside target in the 103.600–103.800 zone, which is marked as an “Area of Liquidity”.

• If this zone breaks cleanly, extended targets sit around 101.800–101.400, where fresh demand and buy structure are likely to form.

⸻

Sell Plan & Risk Management:

• Entry Idea: Wait for a pullback into the 105.300–105.600 zone to look for bearish confirmation (e.g., bearish engulfing, rejection wick).

• Stop Loss: Above 105.866 (invalidates structure)

• Take Profit Levels:

• TP1: 103.600 (liquidity zone)

• TP2: 101.800 (demand zone)

• TP3: 101.400 (long-term structure support)

⸻

Final Thoughts:

CAD/JPY is now showing early signs of a bearish trend reversal after a clean breakdown of structure and liquidity sweep at highs. As long as the price remains below 105.600, the bias remains bearish. A bounce from 104.500 could temporarily delay the drop, but deeper downside is likely if that level gives way.

Nvidia Update New levels to the downside Longs and shortsIn this video I discuss the market structure shift in Nvidia and highlight new levels to be aware of to the downside . Potential here for longs and shorts .

Tools used Fibs, Gann Square , Speed Fan , Order blocks .

Please Like and comment if you have any questions . Have a great Day and thanks for your support