Nvidia Update New levels to the downside Longs and shortsIn this video I discuss the market structure shift in Nvidia and highlight new levels to be aware of to the downside . Potential here for longs and shorts .

Tools used Fibs, Gann Square , Speed Fan , Order blocks .

Please Like and comment if you have any questions . Have a great Day and thanks for your support

Sellsetup

continue downtrend , GOLD⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) holds steady above the key $3,000 level for the second consecutive day on Wednesday, though it struggles to reclaim the previous session’s peak. Ongoing uncertainty surrounding US President Donald Trump’s proposed reciprocal tariffs set for next week continues to bolster demand for the safe-haven metal. At the same time, the US Dollar (USD) remains under pressure following Tuesday’s weaker-than-expected macroeconomic data, providing additional support for gold’s upward momentum.

⭐️Personal comments NOVA:

Gold price continues to decrease, around 2990 - 3000

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3039 - $3041 SL $3046

TP1: $3030

TP2: $3020

TP3: $3010

🔥BUY GOLD zone: $2992 - $2990 SL $2985

TP1: $3000

TP2: $3008

TP3: $3018

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

AUD/JPY SELL IDEA (R:R=8.7)Selling AUD/JPY now. I have been waiting for this to close below the trend line. Overall direction is BEARISH according to Monthly timeframe.

Stop Loss is: 95.260

Please move SL to break even when trade is 70+ pips in profit.

1st Target: 93.500

2nd Target: 92.715

Happy Trading! :)

EUR/USD 4H | Bearish Retest Before Drop? The EUR/USD pair has broken below an ascending channel, signaling a potential bearish trend. After the breakdown, price is now retesting the previous support as new resistance, creating a sell opportunity.

🔎 Key Observations:

✅ Resistance Zone: The 1.08392 - 1.08411 level is acting as a strong resistance after the breakdown.

✅ Sell Confirmation: A rejection from this resistance level will confirm the bearish move, with 1.06773 as the next target.

✅ Bearish Expectation: If price fails to reclaim the broken trendline, further downside momentum is expected.

📌 Trading Plan:

🔻 Look for bearish price action signals (e.g., rejections, bearish engulfing candles) at the retest area.

🔻 A confirmed sell setup can target 1.06773 as the next support zone.

🚨 Risk Management Tip: Use stop-loss above 1.08500 to protect against invalidation.

💬 What are your thoughts on this setup? Are you looking for shorts or waiting for more confirmation?

GBP/USD Breakdown – Support Under Pressure, Bearish Target AheadChart Analysis:

The GBP/USD pair is currently trading around 1.29578, facing resistance near 1.30366.

A support zone has been identified around 1.29000, which the price is testing.

If this support level breaks, we could see a bearish move toward the next target near 1.26970.

Strong support is positioned lower, which may act as a key reversal point if the decline continues.

Trading Outlook:

Bearish Scenario: If the price breaks below the current support, a drop toward 1.26970 seems likely.

Bullish Scenario: If GBP/USD holds above support, we may see a retest of resistance at 1.30366.

Conclusion:

Traders should watch for a confirmed breakout or rejection at support before taking positions. A clean break below could trigger a stronger bearish move. 🚨

(XAU/USD) Sell Setup |Bearish Move Expected Towards Key SupportAnalysis:

The price has experienced a strong uptrend but is now showing signs of resistance near the 3,054.161 level.

A support level is identified around 3,000, which has been tested multiple times.

A potential sell setup is indicated after the price retested a resistance-turned-support zone around 3,027.737.

The target for the downside move is marked at 2,942.844, aligning with a previous support level.

If bearish momentum continues, a further decline toward 2,915.859 is possible.

Trading Idea:

Sell Entry: Around 3,027-3,030 after confirmation of rejection.

Stop Loss: Above 3,054 (recent resistance).

Take Profit Targets:

TP1: 2,942

TP2: 2,915

Market Sentiment:

The price is reacting to key levels, and if it breaks below 3,000, it could accelerate the bearish move.

A break above 3,054 would invalidate the short setup and could push the price higher.

GBP/USD Technical Analysis – Potential Bearish MoveThis 4-hour GBP/USD chart indicates a potential bearish setup. Price has been trading within a range, with resistance around 1.30366 and support near 1.29467.

The price recently retested the support zone, showing signs of weakness.

If the support level fails to hold, a breakdown could push the price towards the 1.27035 target.

A stronger support level is observed further below, around 1.2600, which could act as a key demand zone.

Traders should monitor the price action near the support zone. A clear rejection could signal a potential buy opportunity, while a confirmed breakdown could validate a short trade targeting lower levels.

Key Levels:

🔹 Resistance: 1.30366

🔹 Support: 1.29467

🔹 Target: 1.27035

Would you like any modifications to the analysis? 🚀

BTC/USD – Bearish Rejection, Targeting SupportChart Analysis:

BTC/USD is trading within a descending channel, showing a bearish trend.

Price recently tested the resistance zone but faced rejection.

A strong sell signal is indicated, suggesting a move towards the support level around $79,877.

If price breaks below support, further downside is possible.

Trading Plan:

Sell below resistance with a target at support.

Watch for confirmation signals before entering a position.

If price breaks above resistance, a trend reversal could be possible.

Gold declines, accumulate and wait for April news⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) continues its pullback, slipping toward $3,025 in early Asian trading on Monday. The metal retreats from Thursday’s record high, driven by renewed optimism over a potential Ukraine peace deal. However, expectations of Federal Reserve (Fed) rate cuts and lingering economic uncertainties could provide support, limiting further downside for the yellow metal.

⭐️Personal comments NOVA:

Gold is under pressure to sell and take profits in the short term. There is still a lot of liquidity in the 3000 price zone. The price will continue to accumulate around $3000.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3031 - $3033 SL $3038

TP1: $3020

TP2: $3010

TP3: $3000

🔥BUY GOLD zone: $2991 - $2993 SL $2986

TP1: $3000

TP2: $3008

TP3: $3017

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price start to adjust yet?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) face renewed selling pressure during the Asian session on Friday, retreating toward the $3,030 level in recent trading, inching closer to the previous session’s low. The US Dollar (USD) maintains its upward trajectory for the third consecutive day, prompting some profit-taking on the precious metal ahead of the weekend. However, a confluence of supportive factors is likely to keep bullion resilient, positioning it for a third consecutive week of gains.

⭐️Personal comments NOVA:

Breaking the trend, has gold price really been in the weekend price adjustment rhythm? According to NOVA, it has started. Before the tax policies in early April, the market needs a little balance in terms of liquidity on the selling side.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3040 - $3042 SL $3047

TP1: $3030

TP2: $3020

TP3: $3010

🔥BUY GOLD zone: $3019 - $3017 SL $3014 scalping

TP1: $3023

TP2: $3030

TP3: $3040

🔥BUY GOLD zone: $3000 - $3002 SL $2995

TP1: $3010

TP2: $3020

TP3: $3030

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold (XAU/USD) Bearish Reversal – Potential Sell SetupAnalysis Overview

The 4-hour chart of Gold (XAU/USD) shows a possible head formation, indicating a potential trend reversal. The price has faced resistance near the 3,053 level, leading to a rejection. The current price action suggests a bearish movement, with a possible downside target at the support zones marked in the chart.

Key Levels:

📍 Resistance: 3,053

📍 Current Price: 3,030

📍 Target Levels: 2,978 / 2,962 / 2,931

📍 Major Support: 2,881

Trading Plan

🔴 Sell Entry: Below 3,030

🎯 Target: 2,978 / 2,962 (Short-Term), 2,931 / 2,881 (Extended)

🛑 Stop Loss: Above 3,053

Technical Outlook

The market structure suggests a potential breakdown.

Confirmation will be needed through further bearish momentum.

Traders should watch for rejection candles or breakdown from key levels.

📊 What’s Your Take on Gold? Will it hit the lower support levels? Let me know in the comments! 👇

Gold (XAU/EUR) – Bearish Setup at Key Resistance LevelChart Overview:

This 4-hour chart of Gold (XAU) against the Euro (EUR) suggests a potential bearish setup as the price has reached a key resistance zone.

Key Observations:

Resistance Zone: The price has broken above a descending channel and is testing a significant resistance level around 2,790 - 2,800 EUR.

Sell Signal: A rejection from this resistance level has prompted a potential short entry.

Bearish Target: The projected price decline could reach the 2,727 EUR support zone, aligning with previous demand areas.

Risk-to-Reward: The expected decline represents a -2.08% move, indicating a strong risk-reward setup for sellers.

Trading Idea:

Sell Entry: Near 2,790 EUR (if rejection confirms).

Target: 2,727 EUR (support zone).

Invalidation: A breakout above resistance could signal further bullish continuation.

This setup suggests a short opportunity, but traders should watch price action for further confirmation before entering trades. 📉🔥

EURGBP Bearish Continuation Setup Potential Drop to Key Support📌 Overview:

The EUR/GBP pair is showing signs of bearish continuation after failing to break above key resistance levels. Price action indicates a potential downward move towards a major support zone, aligning with the overall market structure.

🔎 Technical Analysis:

The pair has formed a lower high, indicating weakness in bullish momentum.

A breakdown from the recent consolidation zone suggests sellers are in control.

Price has breached a key support level, turning it into a resistance zone.

The market structure indicates a potential drop towards 0.82773, which aligns with a previous support area.

📊 Key Price Levels:

✔ Resistance: 0.84000 - 0.84200 (previous support turned resistance)

✔ Current Price: 0.83876

✔ Target: 0.82773 (major support and liquidity zone)

✔ Stop Loss: Above 0.84000, invalidating the bearish setup

📉 Trade Plan & Execution:

🔹 Entry Strategy:

Traders can look for a retest of broken support (now resistance) near 0.84000 to confirm selling pressure.

A bearish rejection candle (such as a shooting star, bearish engulfing, or pin bar) could confirm the continuation of the downward trend.

🔹 Profit Target:

The primary target is 0.82773, which acts as a strong demand zone from previous price action.

🔹 Risk Management:

A stop loss should be placed above 0.84000, as a break above this level would invalidate the bearish setup.

Maintaining a favorable risk-to-reward ratio (1:2 or better) is advisable for optimal trade execution.

📢 Market Outlook & Considerations:

✅ Bearish Confirmation: Sustained rejection from resistance and lower highs strengthen the bearish outlook towards 0.82773.

🚨 Bullish Reversal Risk: A break above 0.84000 could invalidate the setup, signaling a potential return to bullish momentum.

📊 Fundamental Factors: Keep an eye on GBP and EUR-related economic data, central bank policies, and risk sentiment, which could impact price movements.

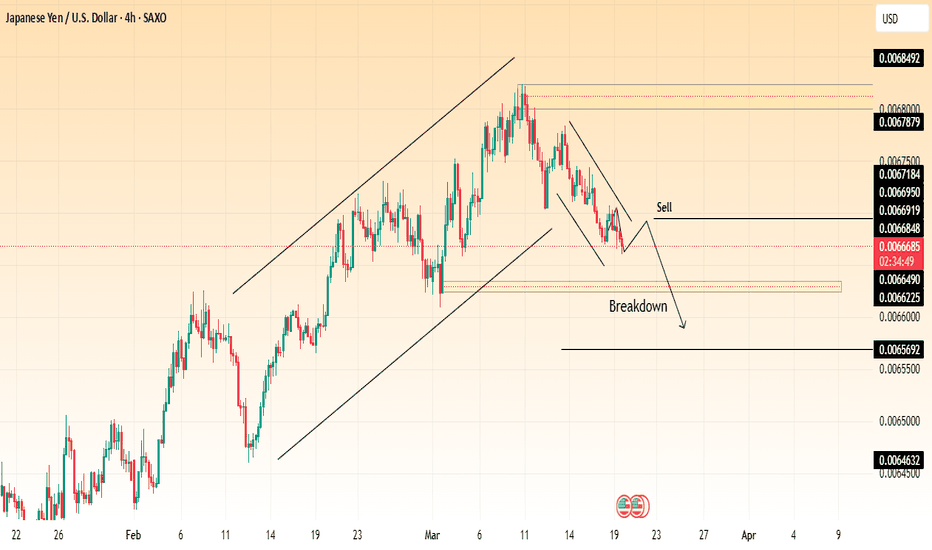

USD/JPY Bearish Continuation📉 Trend Analysis:

The chart shows a breakdown from an ascending channel, indicating a potential bearish reversal after an extended uptrend.

Price has formed a descending channel, reinforcing the short-term bearish structure.

🔍 Key Levels:

Sell Zone: Around 0.0066848 - 0.0066919, acting as resistance.

First Target: Around 0.006490, a strong support area.

Second Target: Around 0.0065692, marking a deeper level of bearish continuation.

Final Target: Around 0.0064632, a critical demand zone.

📌 Trade Plan:

Look for sell entries on a possible pullback to the resistance zone.

Confirmation through rejection candles or continuation patterns could strengthen the bearish case.

⚠ Risk Management:

Stop loss above the previous resistance around 0.0067184.

Take profits gradually at key support zones.

Gold (XAU/USD) on a 4-hour timeframe, showing a potential short Chart Analysis:

Current Price: $3,039.93

Resistance Level: $3,055.47 (marked as a key level where a sell opportunity is identified).

Target Level: $3,000.73 (suggested as the take-profit area).

Support Zone: Highlighted around $2,900.

Trading Idea:

The price is in an uptrend, but a potential reversal is expected at the $3,055.47 resistance level.

If the price fails to break above this resistance, a short position could be considered.

Entry Strategy: Sell near $3,055.47 upon confirmation of rejection.

Target: A drop towards $3,000.73.

Stop Loss: Above the resistance zone to manage risk.

Conclusion:

This is a counter-trend short setup, aiming for a pullback within the broader bullish trend. Traders should monitor price action near resistance before entering a trade.

GOLD ROAD MAP 3000 TO WATERFALL ALERT!🔥 Attention Traders! 🔥

XAUUSD is on fire! 🔥 Here's the latest update:

🔻 Bearish Outlook: Watch out for a potential drop if price falls below 2979. Targets: 2940 & 2960.

🔺 Bullish Outlook: A breakout above 2989 could lead to buying opportunities! Watch for targets: 3000 & 3020.

📈 Stay Tuned: Share your thoughts and strategies as we navigate this golden market! Let's hit new highs! 💰🚀