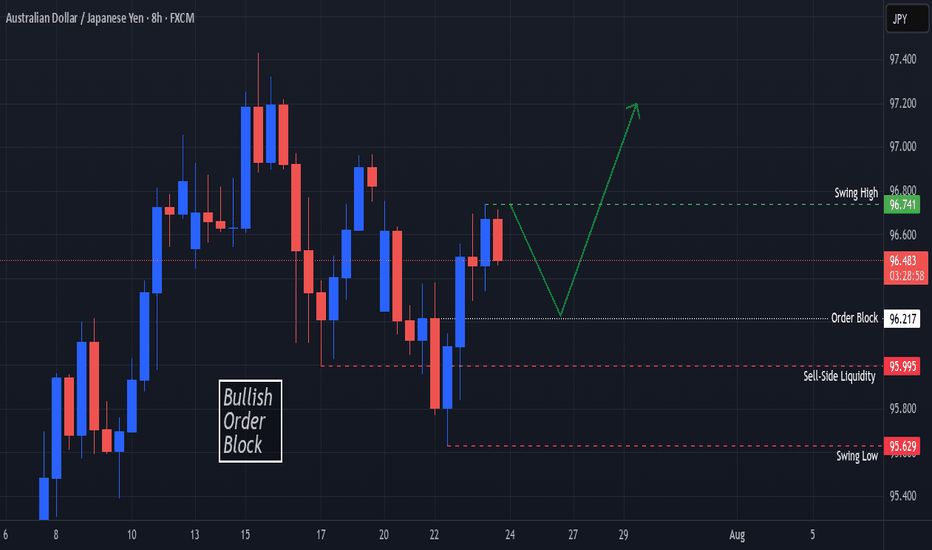

AUDJPY Bullish Order Block In SightOANDA:AUDJPY Price finds Support at the Swing Low @ 95.629 and creates a Swing High @ 96.741!

Based on the ICT Method, the Swing Low broke Sell-Side Liquidity @ 95.995 and opened up a Bullish Order Block Opportunity @ 96.217!

Price is currently working down from 96.49 at the time of publishing but once Price visits the Order Block, this could deliver Long Opportunities!!

Sellsideliquidity

BTCUSD Rejection Setup – Order Block Hit, Weak Lows in Sight!📉 BTCUSD is setting up a textbook bearish reversal — Smart Money style.

This 1H chart shows Bitcoin tapping into a high-timeframe Order Block at ~$104,190–104,560, with a clear rejection from the premium zone and confluence with the upper trendline.

📊 Technical Breakdown:

✅ Order Block tapped at $104,190–104,560

✅ Strong rejection candle near the trendline resistance

✅ Price failed to break above the Strong High — a sign of Smart Money distribution

✅ Targeting Sell-Side Liquidity at $101,420

✅ Final target? Weak Low and liquidity pool around $99,189

🔍 Smart Money Confluence:

Price has moved into a premium selling zone, aligning with the upper bounds of market structure

Order Block rejection suggests institutional selling interest

Weak lows below $100K are prime targets for liquidity grabs

Retail longs are likely trapped — ideal conditions for a downward sweep

🧠 Institutional Logic:

Smart Money doesn’t chase price — it delivers it. This move likely represents a "Mitigation and Distribution" phase before a deeper selloff:

📌 Mitigation of previous long positions inside the OB

📌 Distribution at the highs before targeting the next liquidity pool

📉 Trade Idea:

Short Entry Zone: $104,200–104,500

Targets:

TP1: $101,420 (Sell-side Liquidity)

TP2: $100,000 (Psych level / Weak Low)

TP3: $99,189 (Liquidity Magnet)

Invalidation: Clean break and close above $104,800 (above the OB and Strong High)

🧠 Tip for Traders:

Wait for a confirmation bearish structure shift or lower high on the LTF (15m/5m) before entering full size. Smart Money leaves clues — not impulses.

💬 Comment "BTC Setup" if you’re trading this drop

🔁 Save this analysis — this is how Smart Money dominates crypto markets.

ETHUSD Bearish Trap Unfolding: FVG Fill Targets Sell-Side Liq!🚨 ETHUSD – Smart Money Bearish Setup (30-Min Timeframe)

Ethereum just gave us a beautiful SMC reversal setup after a short-term range liquidity sweep. Let’s break this down so you don’t miss the next leg. 👇

🔍 1. Structural Liquidity Sweep

A clean grab above internal highs pushed price into a well-defined premium zone where both Order Block (OB) and Fair Value Gap (FVG) reside. It’s not a bullish breakout – it's a liquidity trap.

The strong high at ~$2,566 hasn’t been breached, meaning structure still leans bearish.

🟪 2. Order Block Reaction Zone

Price is tapping directly into a bearish Order Block zone (~$2,559–2,566), showing hesitation and rejection candles.

💥 OB rejection confirmed with wicks and short-body closes

🔻 Follow-through expected down to clean up inefficiencies below

This is where Smart Money quietly enters short – right before the crowd realizes it wasn’t a real breakout.

🟦 3. Fair Value Gap (FVG) Below Price

A large FVG zone (~$2,553–2,503) is waiting to be filled. This is textbook Smart Money behavior – price rallies into premium, rejects OB, and aggressively seeks to rebalance inefficiency below.

📉 4. Weak Low & Sell-Side Liquidity

Below $2,530 lies a Weak Low, likely to be swept as price seeks out Sell-Side Liquidity. Final target sits at ~$2,487, right before the broader demand re-enters.

This is a liquidity vacuum move:

Price is engineered to sweep internal liquidity → break structure → mitigate deeper imbalance.

🎯 5. Trade Setup Breakdown

📍 Short Entry Zone: $2,555–2,566 (OB + trendline + FVG rejection)

🔐 Stop Loss: Above $2,570 (structure break level)

🎯 Take Profit Zones:

TP1: $2,530 (Weak Low sweep)

TP2: $2,503 (FVG base)

TP3: $2,487 (Sell-Side Liquidity)

⚖️ Risk:Reward Ratio – 1:3 or better

💡 Bonus: Add trailing stop after TP1 for locked-in gains

🧠 Market Psychology Lesson:

Retail sees a breakout of range = FOMO buys

Smart Money sees trapped longs = entry fuel for bearish move

Weak lows = targets

Your job = be the hunter, not the hunted. 🎯

✅ Summary:

ETHUSD is setting up for a classic bearish SMC reversal. Price tapped the OB, respected structure, and is showing a roadmap toward Sell-Side Liquidity below $2,500.

Don’t fade the confluence:

Premium OB + FVG

Rejection wick confirmations

Weak low + clean internal liquidity targets

⚠️ Keep emotions out, follow the setup, manage risk like a sniper.

💬 Type “ETH ON LOCK” if you’re tracking this beast with precision. Tag your trading squad!

POLKADOT - Strategic Patience for the Next MovePolkadot: Strategic Patience for the Next Move

I've been holding Polkadot since $5.82 and still have my trade open. While I haven’t taken profits yet, this time I plan to secure gains once it approaches $10 again, as I anticipate a correction around December 18th. This pullback could last until December 23rd, where I aim to significantly increase my position.

📈 Scalping Opportunities:

For now, patience is key. However, scalpers will find plenty of opportunities leading up to December 17–18. Be vigilant during those dates, as volatility may spike.

💡 Swing Trading Insight:

Any swing trades entered on December 23rd or the early hours of the 24th could offer exceptional returns.

⚠️ Key Advice:

Always stick to your plan.

Don’t let greed cloud your judgment—secure partial profits to maintain liquidity.

From January onward, the market's psychological and analytical demands will increase. Be prepared and don’t get distracted by noise.

🔑 Closing Thoughts:

This market rewards discipline and foresight. Stay sharp, stay humble, and remember: the best opportunities often come to those who are patient and prepared.

May your trades be fruitful.

God bless you.

—Jay

Bitcoin Wait for a good longThe bullish case is strong, but proper risk management is essential if you're looking to go long. The current market is heavily overleveraged with long positions, causing sharp wicks and rejections, typical of a bull run.

I plan to wait and open a position at $60,750, keeping in mind that the price could drop further to $57,700, where I also plan to enter. However, don’t sleep on that level—it might be the last opportunity to open a long at a good price!

BINANCE:BTCUSD

WTI USOUSD Short day tradingBearish Arguments

VANTAGE:USOUSD

Previous Month Low (PML) is holding strong.

Previous Week Low (PWL) remains unbroken.

Previous Day Low (PDL) is respected.

Daily Bearish Fair Value Gap (FVG) is acting as resistance.

Monthly Bearish FVG is also being respected.

4H Bearish FVG is holding.

4H Swing High is capping price action.

4H Swing Low is holding as a short-term support, but may break down soon.

Trade Management

Risk-Reward Ratio (RR): 2

Stop-Loss (SL): Placed near the 4H FVG to protect against upward moves.

Take-Profit (TP): Targeting the swing low (SSL). Although price could extend lower, securing profits in this zone ensures gains in case of a rebound.

Risk: 3%

XRP Wait for the HUGE opportunity🔻 Tough week for $XRP. The price has been a rollercoaster 🎢, leaving investors exhausted.

💡 Opportunity: The next time the market picks up momentum, we could see a major breakout. I'm looking to go long in the marked zone.

⚠️ Advice: Don't rush in expecting a bounce. Save liquidity and stay patient until the right opportunity comes. Patience pays 💰.

BINANCE:XRPUSDT

ARB/USDT 15m / D BB & FVG / ELLIOT / LIQUIDATIONS / FIBOAccording to higher timeframes, the market sentiment is bullish. We are moving within an ascending channel with the potential to rise to 0.7416. To increase the probability of this outcome, the price needs to establish itself above the ascending channel.

Locally, within the range of the daily breaker block (D BB) and the daily imbalance (D FVG), three potential entry points are visible:

1. Liquidity grab (Sellside liquidity)

2. 0.5 Fibo

3. 0.618 Fibo / bottom of the ascending channel

4. The target is the local high, which is at the midline of the channel.

Locally, based on the EFIATR oscillator, volume, and liquidation levels, there is a likelihood of growth. According to Elliott Wave theory, a 5-wave pattern and an ABC correction in the 4th wave are visible, which further increases the probability of upward movement.

BTCUSD: The Rally Is Just Beginning, Probability Confirms6M: BITSTAMP:BTCUSD

3M: BITSTAMP:BTCUSD

1M: BITSTAMP:BTCUSD

2W: BITSTAMP:BTCUSD

1W: BITSTAMP:BTCUSD

3D: BITSTAMP:BTCUSD

1D: BITSTAMP:BTCUSD

If you have any questions, need further clarification, or would like to share your own insights, feel free to leave a comment below!

The information provided is for educational purposes only and should not be considered financial advice. Trading involves risk, and you may lose some or all of your investment. Always conduct your own research and consult a licensed financial advisor before making any trading decisions.

58.55% Probability of USOIL Bullish Continuation This Week!Based on a mechanical top-down structural analysis from higher to lower timeframes, there's a strong probability (58.55%) of a bullish continuation in USOIL this week.

This analysis, combined with hourly timeframe probabilities , suggests a favorable outlook for price movement.

Follow me with the detailed top-down analyses linked below to see the key factors contributing to this bullish projection on FX:USOIL

12M:

6M:

3M:

1M:

2W:

1H:

2H - Entry:

Take a look at these analyses to see the details behind this trade idea.

If you have any questions or want to discuss further, feel free to ask.

Let's make this a great trading week!

TSLA: Short-term Probability Analysis | 57.35% Reversal!Short-term analysis of NASDAQ:TSLA indicates that the price is most likely to head to trade above +$200 in the coming days/weeks.

Breaking down the reason behind the current setup and why we should be expecting new mid-term highs:

Feel free to share your thoughts or any feedback you have on the analysis.

Also, if you're interested in analyzing the probabilities directly on your charts make sure to check out the Free Public Indicator that I've published recently!

ETHUSD: Bouncing back to ATH | 66.67% Probability!COINBASE:ETHUSD has been getting a lot of attention in the crypto world lately.

It recently went through a big drop in price (-25%) , but now it's showing signs that it might be bouncing back and heading bullish again.

Here's what you need to know:

ETH's price dropped a lot over the past 2-3 months, and it's been consolidating since then. According to my Free Probability Indicator , there's a good chance that ETH's price could hit a new high. Around 66% chance on the 3D chart and 62% on the daily chart which is a pretty high number!

This drop in price could actually be a good thing because it's created a big opportunity to buy ETH at a lower price. Right now, it's about 38% cheaper than its highest price ever.

If you're thinking about trading ETH, here's what you should consider:

Entry:

Wait for clear signs that the price is going up again, like breaking through certain price levels or seeing strong positive movements on the daily chart.

Once you're confident the trend is changing, you could think about buying ETH.

I'm currently looking at 4H Equilibrium to get position

Exit:

To protect yourself from losses, you might want to set a "trailing stop-loss." This means if the price starts dropping again after you buy, your sell order will automatically trigger to limit secure your running profits.

Risk Management:

Make sure you're not risking more money than you can afford to lose.

Only invest what you're comfortable with, and consider how much you're willing to lose if things don't go as planned.

This isn't any financial advice. It's just some insights to help you make informed decisions.

Always do your own research before investing in anything.

SOLUSD: Snapping Back to $210 | 70.70% Probability!BINANCE:SOLUSD has been drawing a lot of attention in the crypto space in the past few days due to its integration with NASDAQ:PYPL

Let's have a technical analysis breakdown:

BINANCE:SOLUSD According to my Free Probability Indicator , There's a 70.00% chance it could climb back over $210 and beyond, which is pretty much encouraging!

If you're thinking about trading LINK, here's what you should consider:

Entry:

Wait for clear signs that the price is going up again.

Once you're confident the trend is changing, consider buying LINK.

I'm currently looking at the 8H Equilibrium to get positioned.

Exit:

To protect yourself from drawdowns, consider setting a "trailing stop-loss." This will automatically trigger a sell order if the price starts dropping again after you buy, securing your running profits.

Risk Management:

Ensure you're not risking more money than you can afford to lose.

Only invest what you're comfortable with and consider how much you're willing to lose if things don't go as planned.

This isn't financial advice, just some insights to help you make informed decisions. Always do your own research before investing in anything.

LINKUSD: Rallying Back to $20 | 72.73% Confidence!COINBASE:LINKUSD has been drawing a lot of attention in the crypto space in the past few days. It experienced a significant drop in price (-47%), but now it's starting to show signs of a potential rebound and might be heading bullish again.

Here's the breakdown:

COINBASE:LINKUSD price took a major hit over the past 2-3 months and has been consolidating since. According to my Free Probability Indicator , There's a 72.73% chance it could climb back over $20, which is pretty much encouraging!

This price drop might actually be beneficial as it presents a great opportunity to buy LINK at a lower price.

If you're thinking about trading LINK, here's what you should consider:

Entry:

Wait for clear signs that the price is going up again, like huge up-move candle showing strong positive movements on the daily chart.

Once you're confident the trend is changing, consider buying LINK.

I'm currently looking at the 4H Equilibrium to get positioned.

Exit:

To protect yourself from drawdowns, consider setting a "trailing stop-loss." This will automatically trigger a sell order if the price starts dropping again after you buy, securing your running profits.

Risk Management:

Ensure you're not risking more money than you can afford to lose.

Only invest what you're comfortable with and consider how much you're willing to lose if things don't go as planned.

This isn't financial advice, just some insights to help you make informed decisions. Always do your own research before investing in anything.

BTCUSD: The Game of Probabilities | New ATH? 65.28% Chance!Medium-term analysis of COINBASE:BTCUSD indicates that the price is poised to surge towards new all-time highs, with a probability of 65.28%!

Let's get into the underlying reasons for this:

1. The current status on the "1D" timeframe is "Active," indicating that the price has already reached and touched the 50% equilibrium level on the current timeframe.

2. Since the price has reached the equilibrium level of the daily timeframe, our focus now shifts to determining which liquidity side presents higher probabilities compared to the other.

3. In this scenario, the 1D/BSL (Buyside liquidity) indicates a 65.28% probability of the price reaching the 73835.57 level again.

More details:

Feel free to share your thoughts or any feedback you have on the analysis.

Also, if you're interested in analyzing the probabilities directly on your charts make sure to check out the Free Public Indicator that I've published recently!

TRADING FOUNDATION: WHY DOES PRICE MOVE (PART 1 - LIQUIDITY)WHY DOES PRICE MOVE IN THE FOREX MARKET?

A simple answer to this question is... price moves for 2 major reasons

To take liquidity

To fill imbalances or price inefficiencies

I will break this into two parts and discuss Liquidity first.

What is Liquidity in Forex Trading?

Liquidity is the presence of orders at specific prices in the market, ensuring that transactions can take place without disruptions. When traders talk about liquidity, they are usually referring to the resting orders in the market. These orders can be absorbed or targeted by banks and financial institutions (BFIs) to influence the patterns of price movement. Liquidity can be found throughout the market, although certain areas may have higher levels than others. The good news is that it is indeed possible to learn how to identify and recognize liquidity patterns.

Liquidity comprises a variety of orders that gather in the market, including limit orders, stop loss orders, and stop limit orders. These orders come into play when prices reach specific levels of supply or demand in the market. Understanding liquidity is essential in comprehending how prices move.

Why do you need to understand Liquidity?

Liquidity is crucial for predicting price movements. Analyzing liquidity, along with market structure, supply and demand, and order flow, provides insights into potential price directions. It's important to consider liquidity alongside trend analysis and supply and demand to understand market conditions effectively. Highly liquid markets can be manipulated by large banks or institutions, leading to liquidity shortages, price slippage, and poor trade execution. Recognizing liquidity pools during slow sideways price movements is key.

What are the main types of Liquidity in Forex trading?

1. Buy-side liquidity (see chart for example)

Buy-side liquidity refers to the accumulation of orders above a range or high, including buy-stop limits and stop losses placed by sellers and breakout traders. Banks and financial institutions (BFIs) may target these orders to fuel temporary or sustained bullish price movements.

Buy-side liquidity can be divided into 3

a. Relatively equal highs liquidity

b. Previous high liquidity

c. Trendline liquidity

a. Relatively equal highs: This is when the price fails to break a level within a minimum of two tries. When this happens, there is a high tendency that orders will be above that level i.e. stop-losses or buy-stop orders. Due to this, large institutions will target that level to liquidate their orders or fill new orders. see the example below.

b. Previous high: A previous high is the top of a level or range from which a retracement in price started. Every high in the market holds liquidity. Usually not as appealing at the relatively equal highs. see the example below.

c. Trendline: This liquidity setup is usually as appealing as the relatively equal highs as it provides enough liquidity in the market to liquidate orders of large funds or fill in more orders. Anytime you notice a buy-side trendline liquidity building up, expect that price will move radically fast towards it. see example below

2. Sell-side liquidity (see chart for example)

Sell-side liquidity refers to the collection of orders situated below a range or low, including sell-stop limits and stop losses placed by buyers and breakout traders. Banks and financial institutions (BFIs) can target these orders to generate temporary or sustained bearish price movements. Similar to buy-side liquidity, sell-side liquidity serves a crucial role in the market dynamics.

Sell-side liquidity can be divided into 3

a. Relatively equal lows liquidity

b. Previous low liquidity

c. Trendline liquidity

a. Relatively equal lows: This is when the price fails to break a level within a minimum of two tries. When this happens, there is a high tendency that orders will be below that level i.e. stop-losses or sell-stop orders. Due to this, large institutions will target that level to liquidate their orders or fill new orders. see the example below.

b. Previous low: A previous low is simply put at the top of a level or range from which a retracement in price started. Every low in the market holds liquidity. Usually not as appealing at the relatively equal lows. see the example below.

c. Trendline: This liquidity setup is usually as appealing as the relatively equal lows as it provides enough liquidity in the market to liquidate orders of large funds or fill in more orders. Anytime you notice a sell-side trendline liquidity building up, expect that price will move radically fast towards it. see example below

Note : This does not mean you should just trade based on where you see liquidity, you should also do a proper multi-timeframe analysis, and if your narrative aligns with where liquidity is resting, there is a higher chance for it to go there.

I will make a post on the Part 2 - Imbalances.

Ensure to follow so you see what it is and how to make good use of it.

Cheers,

Jabari

LINK/USDT Long Trade Setup ⬆️Hello Everyone 🙋🏽♂️

RSI +Demand zone + Sellside liquidity

🟠 EP 14.225

🔴 SL 13.806

🟢 TP1 14.679⚠️( Close 33% of the trade and Set the SL on EP )⚠️

🟢 TP2 15.071⚠️ ( Close 33% of the trade )⚠️

🟢 TP3 15.516🔥 ( Final result)🔥

We are not responsible of any losses for anyone, our trades are profitable more for long terms and we take losses as everyone,

manage your lot size as well and your SL and TP and my opinion is 0.01 lot for each 500 $.

Don't forget to hit the like bottom and write a comment to support us.

Follow us for more 🙋🏻♂️

Best Regard / EMA Trading .

Disclaimer:

----------------

It's not a financial advise, As everyone we take losses sometime but for long term trading we are profitable traders, so manage your account well with SL and TP and your lot size to keep your account safe and stay in the market

XAU Weekly - BearishThis Week we Say OANDA:XAUUSD was Super Bullish, But is It?

gold has Engineered Liquidity up and Down, I believe its going up to Hit Retail Stop loss and then Revert to go Down .

I have noted Levels that I am interested in Chart

Another Confirmation : If you Check #Gold Seasonality, Normally OANDA:XAUUSD is Bearish in October and November !

Disclaimer : this is Just Technical Analysis, You Should never use this information for real Trading, Do your own Research.

Sincerely,

Sobhan JTN

FET Sell-Side Liquidty PUMPS UP🤖💹Fetch.ai (FET) is navigating the complex world of cryptocurrency with an intriguing strategy that involves tapping into hidden liquidity, setting the stage for potential growth. 🤖💹

Understanding Buy Side and Sell Side Liquidity

In the world of trading, understanding the dynamics of liquidity is paramount. Two crucial components in this ecosystem are "buy side liquidity" and "sell side liquidity." Let's delve into these concepts:

Buy Side Liquidity: This refers to the willingness of traders and investors to buy a particular asset at a specified price. It represents the demand for the asset.

Sell Side Liquidity: On the other hand, sell side liquidity represents the supply of an asset that market participants are willing to sell at a certain price.

Fetch.ai's Unique Approach

Fetch.ai (FET) has adopted a distinctive approach to utilizing liquidity. It focuses on "sell side liquidity," which means it strategically leverages the supply side of the market to drive its price upwards. This method often involves executing a "sweep of the low."

Sweeping the Low: A Bullish Strategy

When Fetch.ai "sweeps the low," it means that the project is actively targeting available sell side liquidity by making purchases at opportune moments when the price is at lower levels. This strategy creates an upward push, which can lead to increased demand and a subsequent price surge.

Trading Strategy: Capitalizing on Fetch.ai's Tactics

For traders and investors, understanding Fetch.ai's unique liquidity strategy is essential. Keeping an eye on its activity around "sell side liquidity" can provide valuable insights for potential trading opportunities.

Conclusion: Fetch.ai's Unconventional Path to Success

By strategically embracing sell side liquidity, Fetch.ai is rewriting the playbook on how cryptocurrencies can harness market dynamics to their advantage. With its unconventional approach and potential for growth, FET is one to watch closely in the dynamic world of crypto.

🤖 Innovative Strategies | 📊 Liquidity Dynamics | 🚀 Cryptocurrency Trading | 💡 Market Insights

❗See related ideas below❗

Feel free to share your thoughts and insights. 💚🚀💚