GOLD Breakout Done , Long Setup Valid To With Great ProfitHere is My 15 Mins Gold Chart , and here is my opinion , we finally above 3321.00 and we have a 15 Mins Candle closure above this strong res , so I'm waiting the price to go back and retest this res and new support and give me a good bullish price action to can enter a buy trade , and if we have a 4H Closure Above This res this will increase the reasons for buyers , just wait the price to back a little to retest it and then we can buy it . if we have a daily closure below it this idea will not be valid anymore .

Sellxauusd

maintain selling pressure around 3300, GOLD ⭐️GOLDEN INFORMATION:

Gold prices extended their slide for a fourth straight session, falling over 0.60%, as the U.S. and European Union reached a weekend trade agreement that halved proposed tariffs on EU goods—from 30% to 15%. XAU/USD is currently trading around $3,312, after earlier touching a high of $3,345.

The trade breakthrough lifted market sentiment, boosting risk appetite. Meanwhile, the U.S. Dollar is regaining strength, with the Dollar Index (DXY)—which measures the greenback against a basket of six major currencies—rising 0.99% to 98.64.

⭐️Personal comments NOVA:

Gold price maintains selling pressure around 3300, continuing the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3345

TP2: $3332

TP3: $3317

🔥BUY GOLD zone: $3287-$3285 SL $3280

TP1: $3295

TP2: $3307

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

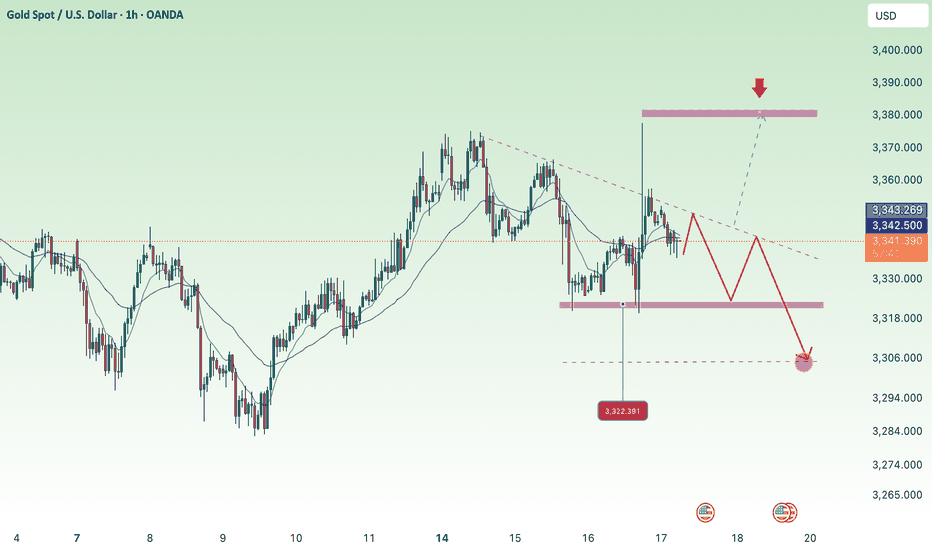

downtrend below 3300 , after ADP-NF⭐️GOLDEN INFORMATION:

The Federal Reserve’s policy statement noted that economic activity has slowed in the first half of the year, although the unemployment rate remains low and inflation is still “somewhat elevated.” The Fed reaffirmed its commitment to achieving maximum employment and returning inflation to its 2% target, while also acknowledging that “uncertainty around the economic outlook remains elevated.”

Earlier data showed that U.S. GDP grew in the second quarter, but underlying details painted a softer picture. Consumer spending cooled, and business investment declined significantly. According to Reuters, most economists now forecast full-year GDP growth at 1.5%, below the Fed’s 1.8% projection.

⭐️Personal comments NOVA:

Gold prices reacted negatively as the FED kept interest rates unchanged and Chairman POWELL's hawkish stance. Selling pressure below 3300 is being maintained.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3360- 3362 SL 3367

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3249-$3247 SL $3242

TP1: $3258

TP2: $3270

TP3: $3285

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

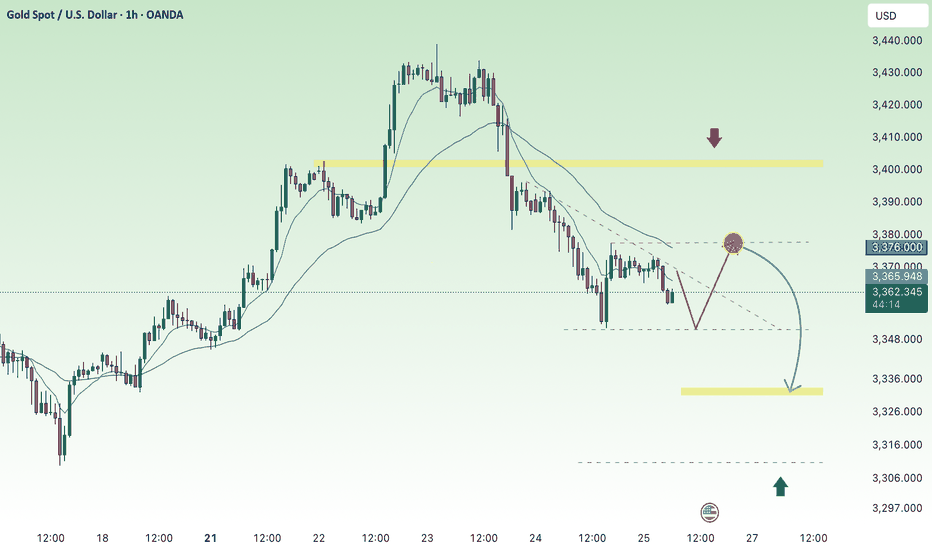

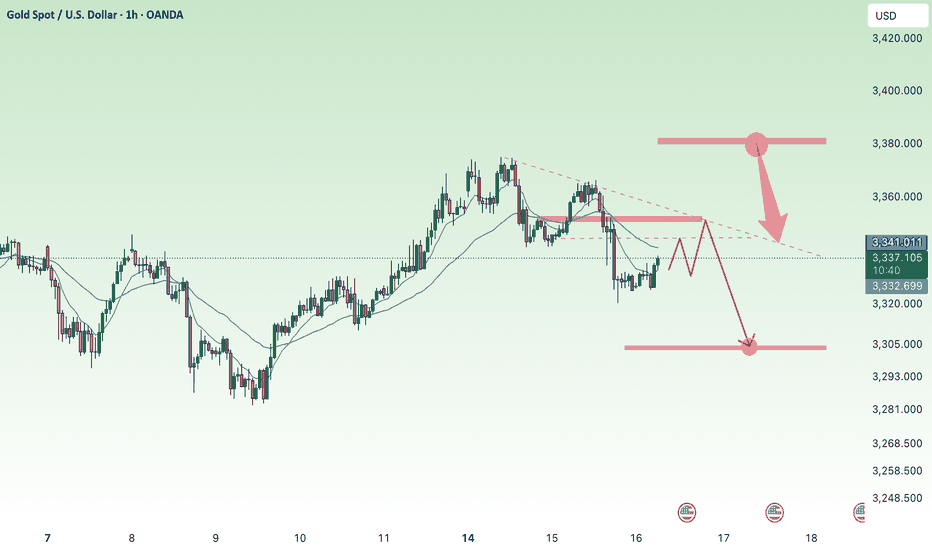

Get liquidity at the beginning of the week, continue to decrease⭐️GOLDEN INFORMATION:

Gold (XAU/USD) continues to lose ground, slipping to around $3,335 in early Asian trading on Monday. The metal is on its fourth straight day of declines as easing geopolitical tensions and trade progress weaken safe-haven demand. Investors are now turning their focus to the upcoming FOMC policy decision on Wednesday.

Market sentiment has improved following a breakthrough in US–EU trade talks, with both sides agreeing to a uniform 15% tariff on traded goods, effectively ending months of stalemate. The new tariffs will come into effect on August 1. Meanwhile, the US and China are reportedly planning to extend their tariff truce for another three months, according to the South China Morning Post. The renewed risk appetite continues to pressure gold, traditionally favored in times of uncertainty.

⭐️Personal comments NOVA:

Short-term recovery in Asian session, gold price takes liquidity and continues to accumulate below 3369

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3369- 3371 SL 3376

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3305-$3303 SL $3298

TP1: $3314

TP2: $3330

TP3: $3342

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

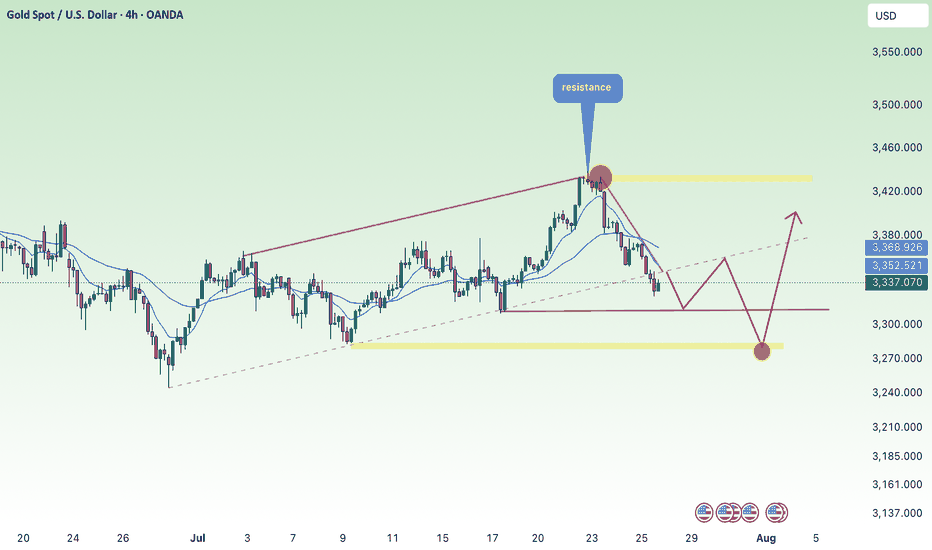

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

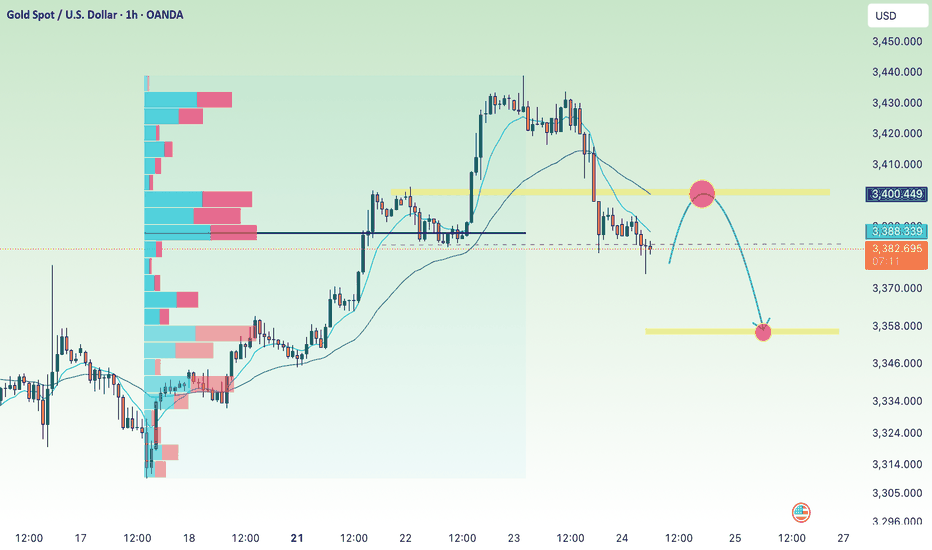

Gold prices under selling pressure from tariff policy⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) stays under pressure during Thursday's Asian session, extending the sharp pullback from its highest level since June 16 seen the previous day. Optimism surrounding global trade continues to build, fueled by reports that the United States and the European Union (EU) are nearing a tariff agreement, following progress in the US-Japan trade deal. This upbeat sentiment has dampened safe-haven demand and is a major factor weighing on gold prices.

⭐️Personal comments NOVA:

Gold price adjusted down, broke support, faced selling pressure again, accumulated below 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3356-$3354 SL $3349

TP1: $3365

TP2: $3373

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price moves sideways above 3320⭐️GOLDEN INFORMATION:

Gold prices advanced during the North American session, gaining 0.78%, supported by headlines suggesting US President Donald Trump had discussed firing Federal Reserve (Fed) Chair Jerome Powell. Although Trump later denied the reports, calling it “highly unlikely” unless fraud was involved, the speculation lifted demand for the precious metal. At the time of writing, XAU/USD is trading around $3,348, after briefly reaching a daily high of $3,377 following Trump-related headlines.

According to Bloomberg, Trump floated the idea during a meeting with GOP lawmakers focused on cryptocurrency regulation, noting that most attendees reportedly supported Powell’s removal.

Beyond political drama, softer US economic data and ongoing geopolitical tensions also underpinned gold’s gains. The latest US Producer Price Index (PPI) came in below expectations but remained above the Fed’s 2% inflation target. Meanwhile, Israeli airstrikes in Syria helped limit downside pressure on bullion, though Gold’s upside remained capped below the $3,400 level following the recent US consumer inflation report.

⭐️Personal comments NOVA:

Gold price moves sideways in the price range of 3306 - 3380, accumulating and waiting for information on US tariffs and interest rates

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3379 SL 3386

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3318

TP2: $3330

TP3: $3343

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

downtrend, back to 3300 gold price⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) inch higher in early Asian trading on Wednesday, recovering part of Tuesday’s sharp decline to multi-day lows, though follow-through buying remains limited. Lingering uncertainty surrounding US President Donald Trump’s trade tariffs, combined with expectations that the Federal Reserve (Fed) will maintain elevated interest rates, continues to dampen risk appetite. This weaker market mood is providing modest support to the safe-haven metal.

Meanwhile, the US Dollar (USD) eases slightly after Tuesday’s surge to its highest level since late June, which is helping gold stabilize. However, persistent speculation that the Fed may delay rate cuts, following a slight uptick in US inflation, continues to bolster the greenback and could cap further gains in gold. Traders remain cautious and await today’s US Producer Price Index (PPI) release for clearer direction.

⭐️Personal comments NOVA:

Selling pressure, break 3340 downtrend line continues. Economic news is helping DXY recover

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3383 SL 3388

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3318

TP2: $3330

TP3: $3343

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold Loses Its Shine – Short-Term Sentiment Turns BearishHello everyone, great to see you again for today’s market chat!

The factors that once made gold appealing — inflation fears, economic uncertainty, and the flight to safety — are gradually fading. As confidence grows that the Fed will maintain high interest rates for an extended period, capital is steadily moving away from gold and into more stable, yield-generating assets.

Across the financial community, there’s growing consensus: gold is no longer a top investment priority. The U.S. dollar is gaining strength, Treasury yields are rising, and gold’s support structure is weakening. While investors await the Fed’s next move, many are staying on the sidelines — or even leaning toward a bearish outlook. Notably, the rebound in the DXY is also playing a key role in adding pressure.

Gold is currently lacking momentum, lacking support, and most of all — lacking conviction. At this stage, the trend is no longer a debate, but a widely accepted short-term reality.

What about you — where do you think gold is headed next?

downtrend, gold price below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) remain under pressure during Wednesday’s Asian session, slipping below the $3,300 level and hitting their lowest point in over a week. The decline comes amid growing consensus that the Federal Reserve (Fed) will maintain interest rates at elevated levels for an extended period, especially as expectations rise that aggressive US tariffs could fuel inflation in the months ahead.

This outlook has driven US Treasury yields higher and kept the US Dollar (USD) anchored near a two-week high reached on Tuesday — a key headwind for the non-yielding precious metal, which continues to face downward pressure as a result.

⭐️Personal comments NOVA:

Gold price breaks support, DOW H1 formation, gold downtrend below 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3344- 3446 SL 3351

TP1: $3335

TP2: $3320

TP3: $3302

🔥BUY GOLD zone: $3256-$3254 SL $3249

TP1: $3268

TP2: $3280

TP3: $3298

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears pressure early week below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) face renewed selling pressure, dipping toward the $3,320 level during the early Asian session on Monday. The pullback comes as June’s stronger-than-expected US Nonfarm Payrolls (NFP) report has reshaped market expectations around the Federal Reserve’s (Fed) policy path. Investors now turn their attention to the upcoming release of the FOMC Minutes on Wednesday for further guidance.

The US economy added 147,000 jobs in June, beating expectations and slightly up from May’s revised figure of 144,000. Meanwhile, the Unemployment Rate held steady at 4.1%. These figures reinforced the view that the labor market remains resilient, thereby lowering the odds of an imminent Fed rate cut. As a result, the US Dollar has strengthened, weighing on non-yielding assets such as Gold.

⭐️Personal comments NOVA:

Downtrend at the beginning of the week, gold price returns to accumulate below 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3337- 3339 SL 3344

TP1: $3328

TP2: $3312

TP3: $3300

🔥BUY GOLD zone: $3297-$3295 SL $3290

TP1: $3308

TP2: $3320

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

stable tariffs, gold price impact reduction✍️ NOVA hello everyone, Let's comment on gold price next week from 06/30/2025 - 07/04/2025

⭐️GOLDEN INFORMATION:

Gold prices plunged over 1.5% on Friday as risk appetite strengthened, fueled by a combination of positive geopolitical and economic developments. Easing tensions between Israel and Iran, the formal trade agreement between the United States and China, and continued efforts by Washington to strike new commercial deals with global partners lifted market sentiment—dampening demand for safe-haven assets like bullion.

At the time of writing, XAU/USD is trading at $3,274, having pulled back from an earlier high of $3,328. On Thursday, the White House confirmed the signing of a long-awaited trade pact with China, marking an official end to the protracted trade war. US Commerce Secretary Howard Lutnick also indicated that additional agreements may be finalized ahead of the July 9 deadline

⭐️Personal comments NOVA:

Information on tariff negotiations is gradually becoming stable and favorable. Information on inflation showing signs of increasing, dxy increase is also a temporary pressure causing gold price to return to the 3200 mark.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3307, $3348, $3390

Support: $3248, $3202

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Strong weekend selling pressure, below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) came under renewed selling pressure during the Asian session on Friday, retreating below the $3,300 level after a lackluster performance the previous day. The precious metal is edging closer to the two-week low seen on Tuesday, as investors await the release of the US Personal Consumption Expenditures (PCE) Price Index. This key inflation gauge is expected to offer fresh insight into the Federal Reserve’s policy outlook and could significantly influence US Dollar (USD) movements—ultimately shaping the near-term trajectory of the non-yielding yellow metal.

⭐️Personal comments NOVA:

Selling pressure at the end of the week caused gold prices to fall below 3300, maintaining selling pressure and falling today

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3326- 3328 SL 3333

TP1: $3315

TP2: $3302

TP3: $3290

🔥BUY GOLD zone: $3248-$3250 SL $3243

TP1: $3260

TP2: $3270

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears under strong pressure, gold price adjusted⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) saw a modest rebound during Thursday’s Asian session, recovering part of the prior day’s decline and stabilizing around the $3,362–$3,363 zone, marking the weekly low. Lingering trade uncertainties and escalating geopolitical tensions in the Middle East continue to weigh on global risk sentiment, supporting demand for the safe-haven metal.

Meanwhile, the U.S. Federal Reserve concluded its two-day policy meeting on Wednesday by holding interest rates steady, while signaling a more cautious approach to future rate cuts. This shift, driven in part by concerns that President Donald Trump’s tariff policies could fuel inflation, boosted the U.S. Dollar to its highest level in over a week. The resulting Dollar strength is capping gold’s upside momentum, keeping the metal below the $3,400 threshold and prompting investors to remain cautious.

⭐️Personal comments NOVA:

Bears continue to put selling pressure on gold prices. Accumulating below 3400.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3414- 3416 SL 3421

TP1: $3402

TP2: $3390

TP3: $3376

🔥BUY GOLD zone: $3347-$3345 SL $3340

TP1: $3355

TP2: $3368

TP3: $3380

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Adjusted down 3385 at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) climbed toward $3,445 during the early Asian session on Monday, marking their highest level in over a month as mounting tensions in the Middle East and growing expectations of a Federal Reserve rate cut bolstered demand for safe-haven assets.

Despite stronger-than-expected US economic data on Friday, investors remained focused on geopolitical risks. The University of Michigan’s Consumer Sentiment Index for June jumped to 60.5, well above the consensus forecast of 53.5 and May’s reading of 52.2. However, markets largely shrugged off the data.

Instead, attention turned to the escalating conflict in the Middle East, where Israel’s recent strike on Iran has intensified fears of broader regional instability. In response, Iranian authorities warned they would “respond firmly to any adventurism,” reinforcing gold’s appeal amid global uncertainty.

⭐️Personal comments NOVA:

At the beginning of the week, gold prices adjusted slightly down, returning to the liquidity zone of 3385, before continuing the uptrend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3462- 3464 SL 3469

TP1: $3450

TP2: $3440

TP3: $3430

🔥BUY GOLD zone: $3390-$3388 SL $3383

TP1: $3400

TP2: $3410

TP3: $3422

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

CPI, US inflation, gold price waiting to decrease⭐️GOLDEN INFORMATION:

Gold (XAU/USD) drew fresh bids in Wednesday’s Asian trading, reclaiming the $3,340 level and edging back toward this week’s high. A U.S. federal appeals court decision allowing President Donald Trump’s broad tariffs to remain in force—for now—added a fresh layer of trade uncertainty and stoked safe-haven demand. Heightened geopolitical tensions and growing expectations that the Federal Reserve will cut rates in September further bolstered the non-yielding metal. Even so, optimism surrounding ongoing U.S.–China talks has lifted broader risk sentiment, while a mildly stronger U.S. Dollar is helping keep gold’s upside in check.

⭐️Personal comments NOVA:

Gold price recovered, buying power increased gradually in Asian session, approaching resistance zone 3348

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3373- 3375 SL 3380

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3278- $3280 SL $3273

TP1: $3290

TP2: $3300

TP3: $3314

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure, bears active⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) edge higher toward $3,325 during the early Asian session on Tuesday, supported by a softer US Dollar as markets turn cautious ahead of key developments in US-China trade negotiations.

Delegations from the United States and China are set to continue discussions for a second consecutive day in London. President Donald Trump expressed optimism, stating the talks “should go very well.” According to US officials, discussions may lead to Washington lifting certain tech export restrictions in exchange for Beijing easing controls on rare earth exports — materials vital to sectors ranging from energy and defense to advanced technology. The outcome of these negotiations could provide fresh direction for the precious metal.

⭐️Personal comments NOVA:

The market is mainly sideways and accumulating, under selling pressure below 3300 due to the US-China trade negotiations taking place today.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3350- 3352 SL 3357

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3276- $3274 SL $3269

TP1: $3285

TP2: $3300

TP3: $3312

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Breaking the big frame, gold price returns to accumulation✍️ NOVA hello everyone, Let's comment on gold price next week from 06/09/2025 - 06/13/2025

🔥 World situation:

Gold prices declined for a second straight session on Friday, yet remain on track to close the week with a gain of over 1.30%, as traders recalibrate expectations for Federal Reserve policy easing following a stronger-than-expected U.S. Nonfarm Payrolls report. At the time of writing, XAU/USD is trading at $3,322, marking a 0.84% daily decline.

The U.S. Bureau of Labor Statistics (BLS) reported that the labor market continues to show resilience, with the unemployment rate holding steady from April. Meanwhile, Wall Street staged a modest rebound from Thursday’s losses, despite political tensions flaring between President Donald Trump and Tesla CEO Elon Musk, following the House's approval of a bill to raise the U.S. debt ceiling.

🔥 Identify:

Gold prices reacted lower after the release of good May employment data. Breaking the H4 uptrend line, gold prices continued to accumulate.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3348, $3400

Support: $3251, $3202

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold back below 3200 today?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) edged lower to around $3,230 during early Asian trading on Tuesday, weighed slightly by a modest rebound in the US Dollar (USD). However, lingering concerns over the health of the US economy—especially in the wake of Moody’s recent credit rating downgrade—may help limit further downside for the precious metal.

The Greenback’s recovery is curbing upside momentum for USD-denominated assets like gold. Still, heightened economic uncertainty continues to underpin safe-haven demand. Moody’s downgraded the US sovereign rating from "Aaa" to "Aa1" on Friday, citing escalating debt levels and interest obligations that now exceed those of other similarly rated nations. These developments are keeping risk sentiment fragile and lending underlying support to gold prices.

⭐️Personal comments NOVA:

Accumulate along the upper and lower trend lines, gold price will break and take more liquidity than the downtrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3224- 3226 SL 3230 scalping

TP1: $3215

TP2: $3208

TP3: $3200

🔥SELL GOLD zone : 3276- 3278 SL 3283 scalping

TP1: $3260

TP2: $3250

TP3: $3240

🔥BUY GOLD zone: $3152 - $3150 SL $3145

TP1: $3165

TP2: $3180

TP3: $3195

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

16 hours ago

Interest rates, will gold prices fall sharply today?⭐️GOLDEN INFORMATION:

However, US Dollar bulls appear cautious, holding back from making bold moves as they await clearer signals regarding the Federal Reserve’s (Fed) future rate-cut trajectory. This wait-and-see stance, combined with ongoing geopolitical tensions—particularly the prolonged Russia-Ukraine conflict and unrest in the Middle East—continues to bolster demand for safe-haven assets like gold. As such, investors are likely to remain on the sidelines until the conclusion of the closely watched two-day FOMC policy meeting on Wednesday.

⭐️Personal comments NOVA:

Gold price awaits today's interest rate result, there was a good recovery above 3400 but then fell immediately after, showing that the market is not ready for the first interest rate cut if any, gold price may face strong selling pressure today

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3438- 3440 SL 3445

TP1: $3425

TP2: $3410

TP3: $3395

🔥SELL GOLD zone : 3396- 3398 SL 3402 scalping

TP1: $3390

TP2: $3380

TP3: $3365

🔥BUY GOLD zone: $3308 - $3306 SL $3301

TP1: $3315

TP2: $3330

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

What is gold waiting for? Stuck in the 3300 area⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) fails to build on Monday’s rebound from the key $3,265–$3,260 support zone, encountering renewed selling pressure during the Asian session on Tuesday. Although signals from the US and China remain mixed, investor sentiment remains buoyed by hopes of a potential easing in trade tensions between the world’s two largest economies. Additionally, signs of advancement in tariff negotiations have further bolstered optimism, dampening the appeal of the safe-haven metal.

⭐️Personal comments NOVA:

Gold price needs to be boosted by economic news to break out of the sideways price range around 3300, continue to wait today around 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3366- 3368 SL 3373

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3267 - $3265 SL $3260

TP1: $3280

TP2: $3300

TP3: $3318

🔥BUY GOLD zone: $3301 - $3299 SL $3296 scalping

TP1: $3305

TP2: $3310

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price decreased at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) edged lower toward $3,310 during the early Asian session on Monday, retreating from last week's record highs amid growing signs of easing global trade tensions.

US Agriculture Secretary Brooke Rollins revealed on Sunday that the Trump administration is engaged in daily discussions with China regarding tariffs, according to Reuters. Rollins also emphasized that agreements with several other countries were “very close” to being finalized.

"Headlines hinting at possible partial exemptions from retaliatory tariffs further lifted market sentiment and contributed to gold slipping below the $3,300 mark," noted Yuxuan Tang, strategist at JPMorgan Private Bank.

⭐️Personal comments NOVA:

At the beginning of the week, gold prices were mainly sideways, without much news impact, trading around 3300 and gradually decreasing.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3368- 3370 SL 3375

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3212 - $3214 SL $3207

TP1: $3225

TP2: $3240

TP3: $3255

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account