Semiconductors & SOXL: A Bull ThesisWhy Semiconductors?

Virtually every single electronic device contains some form of a semiconductor unit within its components. The entire Bull theory on semiconductors as an industry could be reduced to this one sentence. The following, however, will introduce concepts contingent to the understanding of what is shaping the market for semiconductors. The weight of intra-industry, political, macroeconomic, and physical factors discerning an inconceivable upside potential for certain investments carrying maximum exposure to the sector, such as AMEX:SOXL . The last section contains my technical approach to trading SOXL.

We begin with the fundamental, and by fundamental, I refer to the simplest reasons for what is happening in the market up until now; [ Early morning Monday, 7/28 ].

Macroeconomic Context

Like essentially the rest of the market, SOXL hit its 1 year low of 7.23 USD on Monday, 4/7, following the announcement (and soon postponement) of global tariffs at levels not observed since the early 30's. This of course sparked a panic spiral in the entire market, leading to outflows from the S&P 500 of approximately 70 billion USD during the month of April. During this time we also saw a new, but familiar narrative emerge. Asset Managers, Such as J.P. Morgan set historically low price targets on the S&P 500, going as low as 5,200 USD. They reinforced their PTs with publications warning investors across the world that the risk of recession in the United States was raised to 80%, and this message was relayed across all media in parabolic fashion. While it does not seem too outward to assume an increased risk of recession due to tariffs by looking back on what we learned of the consequences from the Smoot-Hawley Tariff Act of 1930. There exists a widely overlooked, fundamental , reason as to why I can claim that the REAL risk of recession at the time that J.P. Morgan assigned an 80% risk of recession, was in actuality, 0% (I assume J.P. Morgan knew this but pushed the narrative anyways in order to acquire massive equity at a discount). If anyone has taken introductory macroeconomics in their lifetime, they may be familiar with the function for calculating GDP via the expenditure approach: GDP = C + I + G - NX. Now, why am I referencing high school/college economics basics, the answer to that lies in how we determine our rate of economic growth in the context of tariffs. The part of this formula that we must focus on is NX or Net Exports, the negative factor to GDP. Tariffs, if implemented would effectively decrease import volume, resulting in a smaller Net Exports, and ultimately a higher GDP calculation. Now, what makes this scenario unique, the tariffs having been postponed shortly after their inception, allowed US retailers to engage in front running, or the accelerated purchasing of foreign goods in advance of tariffs. During the month of April, we saw a 5.4% increase in import volume in US west coast ports. This increase in imports effectively caused the inverse impact on GDP growth that import tariffs themselves would have caused: front-running lead to import uptick, leading to a greater Net Exports, which results in lower (negative) GDP growth. Essentially, tariffs in the short-term increases GDP growth (in the long term deadweight loss, and cost structure distortion comes in to play, but that doesn't matter yet), however , tariffs that are announced but not immediately implemented will result in a lower GDP growth, coupled with uncertainty surrounding the whole situation that translated into a cut in CapEx as companies scrambled to determine if tariffs would f*ck them over or not. This argument is further supported by the trends observed in the foreign exchange market. You may have heard in the news that we are experiencing a period of "Dollar Weakness", and while, yes, you can clearly see that the USD has fared rather poorly against other currencies in most major dollar pairs over the past few months. The agent behind this isn't just that the dollar happens to be weak, it is a combination of factors that generate noise and volatility in the forex market. The two main factors highlighted by the media are 1. The obvious political policy instability, pushing bond yields higher, plus a significant debt ceiling raise as per the BBB and 2. the expectations of interest rate cuts over the next year. The other, less recognized major factor to dollar weakness is exactly what we described above: Increased imports means more dollars flowing out of the economy. When these dollars land abroad, they are converted into the native currency, driving down the demand for the dollar. Notice how none of the reasons described above, actually have anything to do with what truly drives foreign exchange markets. Over time, the strength/weakness of a currency is directly correlated to the strength/weakness of the underlying economy. To say that we can expect dollar weakness due to the aforementioned reasons outright ignores the economic growth potential that exists in our economy at this current time, subsiding the out-of-proportion tariff fears as a proponent to an economic crisis. In an all-encompassing view, what I would describe to be occurring on the macro level is a sort of "slingshot" effect: Trade imbalances and private sector response to policy unclarity results in a pullback in economic growth, one that we are now experiencing as a short-term effect. From a medium-long term perspective, assuming that tariffs aren't persistent in the long term, we would see full fledge economic boom, driven by non other than the growth of our technology sector, which at it's core, lies the almighty semiconductor.

Growth of AI as a driver of Semiconductor demand: Stable trajectory or Bubble Territory?

Having laid the economic framework for picking the general direction our market is heading in, we can now begin to talk about the internal combustion occurring within the world of technology, and the two letter term associated with just about every cool thing in the business world, that is of course AI. Now just to clarify, AI is not new, its been around for at least 20 years and has a well established role in the world prior to the existence of ChatGPT. What changed so drastically in recent years is the breakthrough into a new form of artificial intelligence, known as "Artificial General Intelligence" or AGI. Long story short: AGI's primary difference in the business context is the colossal amount of electrical infrastructure and computing power that is demanded by the development of these mega language models. As a result of the high barrier for entry to this new industry, only 5 AGI companies have arisen to the global stage: OpenAI, Google DeepMind, Anthropic, Microsoft, and DeepSeek. Increasing competition in this space through more players entering the market is unlikely at this time as the cost to create a standalone AGI model is so astronomical. This is a particularly good thing because it tells us that AGI as an industry can result in natural monopolies. The ultra-intensive RnD costs and Data Center infrastructure demands make it more sensical to have a greater number of resources dedicated to producing 1 AGI model, instead of dividing resources to develop multiple less optimized models (similar to how a water company holds a natural monopoly as competition in that industry would result in no foreseeable benefit to it's customers). A further effect from this dynamic lies in how businesses in this industry scale to expand, and its pretty straightforward: the more megawatt computing power a model can access, the more parameters a model can account for, and the more vast the dataset that model can train on, with enhancing speed and efficiency (GPT 4o takes into account >500B parameters in a given query). We see the concept of natural monopoly playing out as the concentration of market capitalization is becoming more extreme where firms like Google, Microsoft, and NVIDIA are absorbing larger share of the market, while trading at ever increasing Price/Earnings multiples. To many, this reflects a trend we saw during the dot com bubble, however what makes the AGI industry different is the nature of the good or service provided. During the dot com boom, companies saw speculative value based on only the fact that their business existed on the .com domain. We know that each of these businesses are unique, providing a good or service across whatever industry they were part of, the only thing having in common was that dot com. The major oversight that took place during the turn of the dot com era was that the success of these businesses wasn't in truth due to them ending in .com, but whether the idea, and execution behind the underlying business is strong or not. Like how Amazon and Facebook saw unparalleled success not just because they were .coms, but because they were pioneering business models that would attract global demand to the services they were providing. The business of AGI has a sort of homogenous property. All AGI companies produce a service that is extremely similar in nature, the only ways they can compete with one another is through Capital Expenditure towards harnessing more computing power. This is the main reason capital is concentrating in a handful of companies trading at high multiples. To me, this is not an indication of a tech bubble but rather a product of how the AGI industry is poised to grow within our economy.

AGI as a Factor of Production

To get even more philosophical, we can think about how AGI itself enhances economic growth. We already see AGI tools applied in various ways, but the most widespread application pertains to the enhancement of human capital. While it is possible to make AGI models complete ongoing tasks completely on their own with zero human input, its far more common to see AGI tools be used, well, as tools. What I mean is that firms are not looking to replace human workers with AI ones (certain exceptions may include the manufacturing industry), instead they want to integrate AGI tools into their workforce as a means of optimizing regular processes, allowing them to access and process information with tremendous efficiency. The most observable economic outcome of this is firms being able to cut costs in human capital requirements, allowing them to achieve the same level of workflow with a smaller number of employees, or outsourcing solutions to business processes by way of automation utilizing AGI. The possibilities are endless and the economic impact of AGI appears to write itself new economic theory to explain how business growth is accelerating in unprecedented ways.

Semiconductor Physical Limitations: Blessing or Burden?

In 1965, Gordon Moore articulated his observation which would come to be known as Moore's Law. He observed that the number of transistors in an integrated circuit doubles approximately every 2 years. Based not so much on law of physics, Moore's law describes an empirical relationship between time and the number of transistors per chip, suggesting that the rate of production advancements would allow for such doubling to occur on a biannual basis. And to Gordon's own surprise, he was right. Transistor count for a given chip roughly doubled every 2 years for the following 50 years. However, Gordon also predicted that Moore's Law would come to an end in 2025, where transistor sizes would reach the physical limit of 2 nanometers (10-15 silicon atoms in width). While it may appear as a bottleneck to the semiconductor and AI industry, not being able to fit anymore transistors on one chip, but in reality, this limitation pressures companies to pursue innovations such as semiconductor packaging, which is NVIDIA's bread and butter. This technique allows for the stacking and integrating of many different chips to perform together as one. This technology has already proven wildly successful and is the backbone to virtually all of NVIDIA's GPU products. Google has invented their own method to getting around the physical limitation of silicon chips, producing AI-specialized integrated circuits known as Tensor Processing Units (TPUs). Catering these innovative solutions to expanding the frontier of AGI is almost a given.

How to play this market: A Technical Approach

If you have made it this far, I commend you. The following describes my approach to analyzing price activity in SOXL:

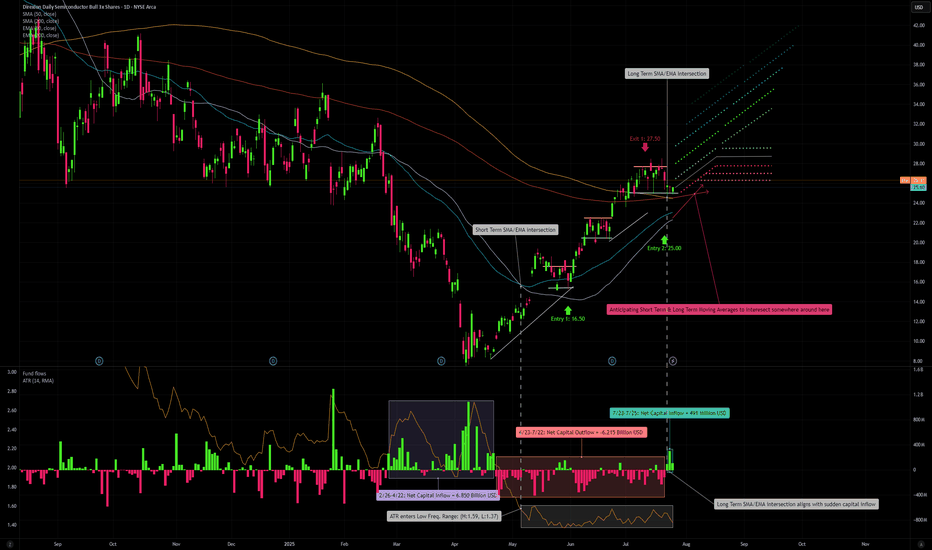

My First entry into SOXL took place on 5/30 with a unit cost of 16.50 USD. Two things can be noted prior to this entry. 1: Fund flows during late February, into March, and through April were extremely high, net inflow of 6.85 Billion USD, however price movement did not reflect the huge inflow until late April/early May where we began to see upward price direction. The beginning of June marked the start of the market bull rally which consolidated into our current price range of 25-28 USD, following contingent earnings releases of NASDAQ:ASML , NYSE:TSM , NASDAQ:NXPI and NASDAQ:INTC . The most recent pullback was a combination of a slightly concerning outlook from ASML, stating that tariffs on the EU would negatively affect projected sales growth for the 2026 fiscal year. As for TSM, there is not one concerning thing that could be said regarding the state of its business growth other than the New Taiwan Dollar gaining considerable strength over the USD amid trade relations between the US and Taiwan, affecting TSM's gross margin by an estimated 6%. NXPI released a sub par earnings and revenue growth outlook, but in my opinion this is not to be too heavily objectified as NXPI produces chips primarily for the Automotive sector, thus making it's sales heavily contingent on supply chain issues being faced by automotive manufacturers in leu of tariffs. NXPI carries a 3.5% market share in semiconductors whereas TSM carries a 68% market share. Lastly, INTC, earnings release I am almost embarrassed to talk about. If it were up to me I'd say they sell their plants in Ohio to TSM and look into opening a fruit stand instead. The most important earnings releases have yet to come though. NASDAQ:MSFT is just around the corner on 7/30, and NASDAQ:NVDA announces on 8/27. These two earnings reports will carry major weight in hinting the overall direction, momentum the market sees in AI demand growth, and the technology sector as a whole. Speculating, I have high expectations that both MSFT and NVDA will top all estimates, pushing the bar higher for 2025 into 2026.

If we look at our short-term 50-day SMA/EMA, you will notice a crossover occur on 5/6, a minor indication of a short term positive trend. Alone this is insignificant, but if we look at our 14-day Average True Range, we can see that this crossover aligns with a fall in ATR that would persist between the values of 1.37 and 1.59. This low ATR value signals that trailing volatility is actually quite low for semiconductors, considering the currently mixed market sentiment. Further along we see that price has crossed above both our long-term, 200-day SMA/EMA and a crossover occurred between the two on 7/23, serving as a small indication of a positive long term trend. Once again, not super significant on its own, but you will notice that the convergence aligns perfectly with a sharp increase in fund inflows, netting 491 Million USD in a matter of 3 trading days. If we see a continuation of net inflows over the several days, we can expect a near future extension of our bull rally, a semi-cyclical wave of inflows that concentrate during consolidation periods (which we have seen take place in the current price range between 25-28 USD following my first exit at 27.50 USD). If we extrapolate both our short-term and long-term SMA/EMA, we can anticipate a crossover to occur in the coming days to weeks. If this occurred, that would further reinforce our expectation for a positive long term trend. I have already locked in my entry 2 with a limit order executed at 25 USD. If all of the above conditions are met, I would confidently predict that we may see SOXL trade at around 42 USD in the coming months.

One more thing I would like to note, if we zoom out to our 5 year historical price progression, we can identify the previous high of 70.08 USD occurring on 7/11/2024. We know that the bull rally which took place in July of last year can be attributed to the first realization of AI as a driver for semiconductor demand, combined with renewed interest in GPU technology for applications in crypto. If we compare AI-related Capital Expenditure in fiscal year 2024 to AI-related Capital Expenditure of the first half of 2025 fiscal year: 246 Billion USD made up AI-related CapEx for all of 2024, vs first 6 months of 2025, adding up to 320 Billion USD. That is a 30% increase in capex, and we still have another 5-6 months to go. Just some food for thought.

Do you believe all of the above has been priced into SOXL, leave your thoughts in the comments!

Disclaimer

You must obviously keep in mind, SOXL is a 3x leveraged ETF, you can expect volatility with such type of investment. However, in capturing a bullish market, a 3x leveraged investment may produce greater than 3x the returns as the underlying (non leveraged) assets, due to the effect of compounding growth of returns over time. However, the same is true for sideways, or bearish markets, losses may be amplified to greater than 3x. If this is an uncertainty you do not wish to be exposed to, I would opt for the non-leveraged Semiconductor ETF ( NASDAQ:SOXX ), or divide your allocation across the top 5-10 equity holdings of SOXL. Please remember to employ your OWN due diligence before making any investment decision, as none of what I am saying shall serve as financial advise to you, the reader.

Semiconductor

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia), but that company is getting all the attention. And, to me, this means opportunity for the future. The cashflow is likely to grow tremendously for

NASDAQ:AMD into 2027 and beyond, which may inevitably reward investors with dividends.

From a technical analysis perspective, NASDAQ:AMD just entered my historical simple moving average zone. This area (currently $108-$126) is where I will be gathering shares. Something tremendous would have to change regarding the fundamentals of this company (like a scandal) for the overall thesis to change. There may be some near-term price pains as NVidia gets all the focus, but to meet demand in the semiconductor and AI space, NASDAQ:AMD is poised to fulfill that roll in the future.

Target #1 = $158.00

Target #2 = $175.00

Target #3 = $188.00

Target #4 = $205.00

Applied Materials | AMAT | Long at $169.75Republican Ashley Moody recently dropped $200k-$500k on Applied Materials $NASDAQ:AMAT. The semiconductor boom may not be over...

Price-to-earnings: 21.68x (great in comparison to others...)

Debt-to-equity: 0.34x (low)

Cash flow: $10.4 billion (FY2024)

Insiders awarded options recently

Unless NASDAQ:NVDA brings the market down, NASDAQ:AMAT is in a personal buy zone at $169.75. While the price may dip in the near-term to the $140s, bullish until the semi boom dies...

Targets:

$195.00

$215.00

$240.00

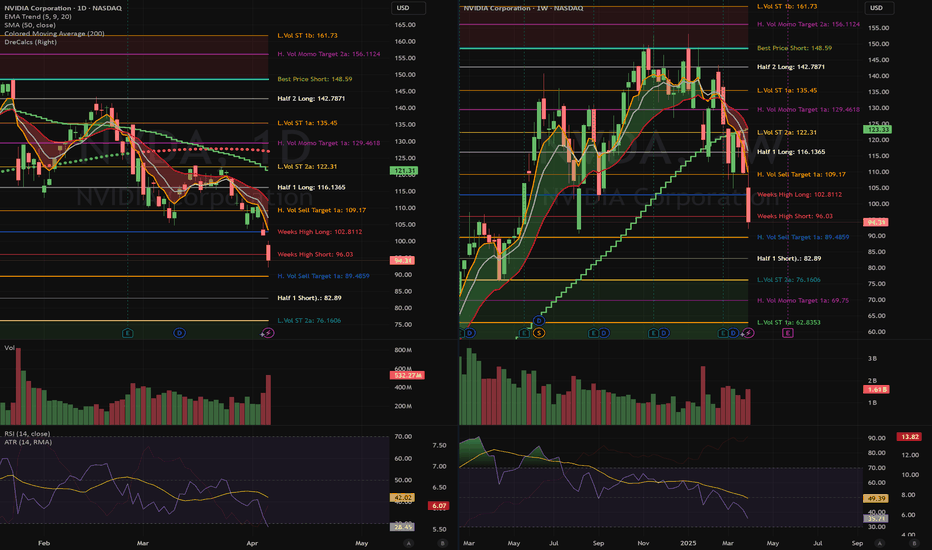

NVIDIA (NVDA): Oversold or Start of a Larger Correction?Overview & Market Context

NVIDIA just saw a major sell-off, dropping around 7% in a single session and slicing below key support levels. This abrupt move has raised questions: Is NVDA oversold enough for a bounce, or are we at the onset of a broader bearish trend? High trading volume suggests significant institutional distribution, so caution is warranted for both bulls and bears.

1. Price Action & Volume

* NVDA closed near the $94.31 mark after the sharp decline.

* Volume spiked (~532M), confirming that large players have been active—often a sign of heightened volatility and potential trend changes.

2. Moving Averages

* The 200-day SMA sits near $127.07, which NVDA fell below decisively. Historically, losing the 200-day often signals a medium-term bearish bias, making it a key level to watch on any rebound attempts.

3. RSI & Momentum

* The RSI on the daily timeframe is hovering around the high-20s, indicating oversold conditions. While this can lead to a short-term bounce, oversold can remain oversold if negative momentum persists.

Key Levels to Watch

Immediate Resistance:

* $96–$100 Range: Minor overhead supply; if price rallies here, watch to see if it rolls over again.

* $105–$110: This region aligns with prior support-turned-resistance. A strong push above $110 would challenge the bearish thesis.

Primary Support Targets

* $90 (Psychological Marker): Could be the first zone for a pause or bounce.

* $82.89 (“Half 1 Short” from algorithmic levels): A logical next stop if the sell-off continues.

* $76 Area: Deep support from earlier consolidation zones; if selling intensifies, the stock may reach these levels.

Potential Trade Setups

1. Bearish Continuation (Short)

Entry:

* On a weak bounce into the $96–$100 zone, or

* A breakdown below $94 on strong volume.

Stop Loss:

* Conservative approach: Above $105–$110, where a bullish reversal could invalidate the short setup.

Profit Targets:

* $90 (near-term psychological level),

* $82.89 (algorithmic short target),

* $76 (longer-term support).

2. Contrarian Bounce (Long)

* Entry: Around $90 or upon a clear intraday reversal signal (e.g., a bullish engulfing candle on strong volume).

* Stop Loss: Below $88 to reduce risk of a deeper flush.

* Profit Targets:

* $96–$100 (short-term push),

* Extended target near $105–$110 if momentum sharply reverses.

Thought Process & Strategy

* The extreme volume and steep decline reflect a high-conviction move. Usually, when you see volume spikes on a breakdown, it suggests institutional selling, meaning rallies may be met with further supply.

* However, the oversold reading (RSI in the high-20s) hints that a bounce might come soon—though it could be short-lived unless macro or fundamental conditions shift.

* Clearly defining both bullish and bearish scenarios—along with exact stop-loss levels—removes emotion and helps avoid “decision paralysis.” Trading is about probabilities, not certainties.

Final Notes

* Risk Management: Always size positions so that a single trade does not jeopardize your account.

* Emotional Control: These levels are algorithmically defined, aiming to reduce subjective bias. Watch how price reacts at each support/resistance zone.

* Stay Vigilant: With elevated volatility, rapid intraday swings are possible. Monitor real-time price action for confirmation.

Disclaimer: This is not financial advice. Perform your own due diligence, and trade responsibly.

Monolithic Power | MPWR | Long at $580.00Monolithic Power $NASDAQ:MPWR. If the semiconductor market continues to get attention in connection with AI, there may be a bounce here near $580.00 as NASDAQ:MPWR enters my historical simple moving average area. However, a further dip into the high $400s wouldn't surprise me (tax harvesting season is in session) and doesn't change the thesis as long as the overall trend continues to stay positive. While NASDAQ:MPWR is a strong company with growth predictions on the horizon, it has a 65x P/E, 46x price-to-cash flow, lots of insider selling, and some near-term concern if the economy shows weakness. From a technical analysis perspective, though, it's in an area of opportunity as long as semis stay a "hot" investment. Thus, at $580.00, NASDAQ:MPWR is in a personal buy zone.

Target #1 = $690.00

Target #2 = $745.00

Target #3 = $825.00

Target #4 = $908.00

NVIDIA's Technical Outlook After the Market CrashYesterday, the market experienced a sell-off that pushed most stocks into the red. One of the key stocks in the spotlight was NVIDIA (NVDA).

From a technical perspective, NVDA had been drifting between the $130 and $150 range for the past three months without establishing a clear direction. During this time, the stock made several attempts to break above the $150 level, but all efforts failed – investors simply weren’t ready to pay such a high price.

Yesterday, the stock finally found a direction: not above $150, but instead below $130. Slightly lower price levels have now taken over.

Current Technical Outlook

At the moment, the stock is once again trapped between two levels – $130 as resistance and $100 as support. Currently, the price sits in what I’d describe as "no-man’s land," and for me, the optimal buy zone would be in the range of $90–$107.5. If the price doesn’t reach this area (pre-market is already up 5%) and instead rebounds back above $130, we can react there, in what I’d consider a safer zone. For now, it’s best to let things settle.

Opening positions at this stage might be risky; ultimately, it’s about balancing risks with your strategy. Personally, I always aim for the best possible prices or the safest scenario. For me, the lower zone between $90 and $107.5 offers the best potential value.

Second Scenario

Another approach is to wait for the price to break back above the current resistance level of $130 and secure a strong weekly close above it. This would signal that the price has moved into a potentially safer zone, suggesting that market panic may have ended well for NVDA holders. This scenario also allows us to take advantage of further potential growth.

Sector Stocks of Interest

Here are a few stocks from this sector that caught my attention and might also be of interest to you:

Broadcom (AVGO)

ASML Holding (ASML)

Marvell Technology (MRVL)

Strongest levels below the current price.

All the best,

Vaido

Hobo is Deepseek exposure: could run hard!The market has woken up to bad news from China with Deepseek. Not going into detail but its generally bad for semiconductors, especially NVDA - which is quite high priced (understatement).

Been looking for opportunities on the other side of this trade and found HOLO. They will be using DeepSeek R1 as the model for their holographic AI engine. Thing is: Deepseek is the hype (just like AI and Quantum was before) and HOLO is probably one of the few stocks that offers exposure AND its only sitting at a 33 million market cap. Jokes, much higher! First target: $7, if rally can sustain for multiple weeks: $18.

I literally just bought, i honestly dont care if it pumped 50% pre-market - its a sign of strength. Let's see, obviously a risky play but also makes a lot of sense. Chart looks good after a retest of previous resistance.

SMH | SHORTNASDAQ:SMH

VanEck Semiconductor ETF (SMH) Weekly Analysis:

Current Price Action:

SMH is trading at $218.43, down 9.10% for the week.

Price has breached the upward trendline support, indicating potential further downside.

Key Levels:

Bearish Line: $214.18

Target Price 1: $199.15

Target Price 2: $172.35

Target Price 3: $155.65

Target Price 4: $136.10

Support Zones:

Immediate support is expected around $199.15.

Further support levels are $172.35, $155.65, and $136.10.

Resistance Levels:

Resistance is at the broken trendline near $240, followed by the recent high around $300.

Relative Strength Index (RSI):

RSI is at 53.98, trending downwards, suggesting weakening momentum.

Volume:

Volume is significant at 75.462M, indicating strong selling pressure.

Conclusion:

SMH's breakdown below key support levels and significant bearish momentum suggest further downside potential. Watch for reactions around $199.15 and $172.35 for potential entry points or further declines.

ASML Holding | ASML | Long at $680.00NASDAQ:ASML Holding, a developer and servicer of advanced semiconductor equipment systems for chipmakers, dipped backed into my overall, long-term selected simple moving average (SMA). From here, stocks typically bounce or drop, but given the AI boom is far from "over", I anticipate another bounce to eventually close the gap near $1,060. It may show some minor weakness to close the gap in the low $600s and get the bears excited. But, unless the economy further shows major weakness in the semiconductor space, NASDAQ:ASML is in my personal "buy zone" at $680.

Target #1 = $730.00

Target #2 = $915.00

Target #3 = $1,060.00

ASML range bound in from 620 to 670. ASML has biggest volume at range 645 to 665. I posit that until ASML can break 675 we won't see the next level. Given the news that Biden won't levy strict tarrifs on TSMC, this is positive for ASML as well and I think in December we will see ASMl go above 700. Let's wait for the reversal confirmation though.

$AMD DOUBLE BOTTOM EASY $175 BY NEXT EARNINGA double bottom pattern is a traditional technical analysis chart formation that signifies a significant trend reversal and a shift in momentum from a previous downward movement in market trading. It depicts a security or index experiencing an initial decline, followed by a rebound, then another decline to a level similar to the initial drop, and finally a subsequent rebound that may lead to a new uptrend.

- PlayStation 6 Processor Contract : NASDAQ:AMD has secured the contract to supply processors for the upcoming PlayStation 6, surpassing Intel. This agreement ensures the sale of millions of custom chips and generates billions in revenue, solidifying AMD's position in the gaming console market.

- Strong Financial Performance: NASDAQ:AMD reported remarkable revenue growth, with a 17.57% increase in the third quarter of 2024. This performance underscores AMD's robust market position and profitability.

-AI and Semiconductor Supercycle: The semiconductor industry, including NASDAQ:AMD , is poised to benefit from the rising demand for AI-related products and services. This trend is expected to drive further growth and profitability for AMD.

Positive Analyst Ratings: Numerous analysts have given NASDAQ:AMD a "Strong Buy" rating, with price targets ranging from $155 to $250. This optimistic outlook suggests significant potential gains in AMD's stock value.

AS OF 12/16/2024

RSI (14) 33.31

52W Low 3.99%

Swig trade on MicronMicron looks to be setting up for a nice swing trade. The chart also shows a double bottom and price potentially goes back to 106 lvl. This is one of the few semi stocks that has great fundamentals but has not really given stock gains. Hence a good pick. A good swing trade but also a good long term hold. In summary this is an undervalued stock and from technicals perspective setting up for a bounce.

Amd - Retest, Reversal And A +100% Rally!Amd ( NASDAQ:AMD ) will soon retest massive previous support:

Click chart above to see the detailed analysis👆🏻

After Amd perfectly retested the upper channel resistance about half a year ago, we saw a beautiful rejection and already a retest of the crucial horizontal support. Now, Amd is once again coming back to retest this support and another bullish reversal is extremely likely.

Levels to watch: $130, $260

Keep your long term vision,

Philip (BasicTrading)

Can a Tech Giant Rewrite Its Future While Racing Against Time?In a remarkable display of corporate resilience, Super Micro Computer stands at the intersection of crisis and opportunity, navigating regulatory challenges while simultaneously revolutionizing the AI infrastructure landscape. As the company addresses its Nasdaq compliance requirements through comprehensive reforms, including the strategic appointment of BDO USA as its new independent auditor, it hasn't missed a beat in its technological innovation trajectory - a feat that has left critics and supporters watching intently.

The numbers tell a compelling story of growth amidst adversity: a staggering 110% revenue surge to $15 billion in FY2024, coupled with a nearly 90% increase in adjusted earnings. But, perhaps more impressive is Supermicro's technical leadership, maintaining an 18-24 month advantage over competitors in liquid-cooled AI rack technology and demonstrating the capability to deploy 100,000-GPU liquid-cooled AI data centers. This technical prowess, combined with strategic partnerships with industry giants like NVIDIA, positions Supermicro at the forefront of the AI infrastructure revolution.

Looking ahead, Supermicro's journey represents more than just a corporate turnaround story - it's a masterclass in organizational agility and strategic focus. While many companies might have faltered under the weight of regulatory scrutiny, Supermicro has instead used this moment as a catalyst for transformation, strengthening its corporate governance while accelerating its innovation pipeline. With analyst projections indicating 40%+ earnings growth for FY2025 and revenue expected to surge over 70%, the company's trajectory suggests that sometimes, the most significant opportunities for growth emerge from the crucible of challenge.

ASML KEY S/R ZONE ON THE WEEKLY! MOAT COMPANY! 55% UPSIDE! NASDAQ:ASML just did a Wykoff under it's key Support/ Resistance zone over the last 5 years on the weekly chart! If we hold here and start to bounce upward on the chart, MACD, Stochastic, and RSI we could be in for a major upward move back to All time highs! I don't believe the sell off has been way over done for such a solid MOAT company!

TSM: Entry, Volume, Target, StopEntry: above 175.45

Volume: above average

Target: 197.89 area (this is an area, no guarantees, you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 175.46, 167.96 gets you 2/1 Reward to Risk Ratio.

This LONG swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not enter a trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

Can the Tech Titan Weather the Storm?Nvidia, a leading force in artificial intelligence and semiconductor innovation, is now facing a critical juncture. The company has recently experienced a sharp decline in its stock price, compounded by an escalating antitrust investigation from the U.S. Department of Justice (DOJ). These challenges have sparked widespread concern about Nvidia's future and the broader implications for the tech industry.

The DOJ's probe centers on Nvidia's dominance in the AI chip market, with allegations of anti-competitive practices that may limit customer choices. The potential outcomes of this investigation could reshape Nvidia's business and influence the entire semiconductor landscape.

As Nvidia navigates these turbulent waters, its response will determine not only its own trajectory but also the future of AI-driven technologies. The company must address regulatory concerns, diversify its revenue streams, and continue to innovate if it hopes to maintain its leadership in the tech world.

In this time of uncertainty, Nvidia's ability to adapt and evolve will be crucial in determining whether it can emerge stronger or be eclipsed by emerging competitors.

Intel | INTC | Long at $20This is going to be purely about technical analysis since Intel NASDAQ:INTC has a 90x P/E and has not proven themselves to be a viable challenger in the semiconductor market (yet...). Bad news could continue to destroy this ticker, but without that news, there could be some recovery in the near term.

The NASDAQ:INTC chart is in an overall downward trend. However, based on a few of my selected simply moving averages (SMAs), there is some predictability around support/resistance areas. Some of my favorite setups are a nice bounce on the lowest (green) selected SMA, occurring in October 2022 for a "rip then dip" to the second lowest (blue) - which it hit now. Often, but not always (I can't stress this enough), this green to blue SMA bounce represents a very strong support area during a downward trend. The other move is a further dip to retest the green SMA, but I suspect that would come with tremendously bad news for Intel... let's hope not, though.

Currently, NASDAQ:INTC is in a personal buy zone at $20.00 based on technical analysis only. A stop has been set if it drops below the blue SMA (which is may further test).

Target #1 = $28.00

Target #2 = $32.00

Target #3 = $60.00+ (very long-term, but high-risk unless fundamentals change)

The Chips Act's Biggest Beneficiary may be...Intel!The Biden administration is nearing completion of allocating $39 billion in grants under the CHIPS and Science Act, aimed at revitalizing the U.S. semiconductor industry. However, the real challenges lie ahead.

1.The CHIPS Act, passed two years ago, is a bold attempt to bring advanced chip production back to the U.S., betting on Intel, Micron, TSMC, and Samsung. The goal is to produce 20% of the world's most advanced processors by 2030, up from nearly zero today.

2.Key to this effort is Mike Schmidt, who leads the CHIPS Program Office (CPO) at the U.S. Department of Commerce. His team, composed of experts from Washington, Wall Street, and Silicon Valley, aims to reduce reliance on Asia, particularly Taiwan, as chips are essential for everything from microwaves to missiles.

3.The CHIPS Act outlines specific goals and capacity expectations, as shown in the chart. According to BCG forecasts, by 2032, the U.S. is expected to produce about 14% of the world's wafers, up from the current 10%. Without the Act's support, this figure would drop to 8% by 2032.

The immediate priority is to establish at least two major clusters for advanced logic chip manufacturing (the brains of devices). Officials also aim to build large-scale advanced packaging facilities, which are crucial for connecting chips to other hardware. Additionally, they seek to boost the production of traditional chips, as the U.S. is concerned about China's growing capacity in this area. Advanced DRAM memory, essential for AI development, is also a focus.

4.Intel is a major beneficiary of the CHIPS Act, receiving $8.5 billion in direct assistance and $11 billion in support loans from the U.S. Department of Commerce to support its over $100 billion chip investment plan. Intel also stands alone as the sole recipient of a $3.5 billion plan to produce advanced electronics for the military, despite controversy in Washington.

5.Other chip manufacturers face challenges. TSMC, Intel, and Samsung have committed to investing $400 billion in U.S. factories, but most have missed their targets due to various issues. For instance, TSMC has been reluctant to move its production lines and packaging capabilities from Taiwan, as chip packaging is seen as Taiwan's "trump card" in ensuring U.S. protection.

6.The broader challenge remains workforce shortages. McKinsey estimates that the U.S. semiconductor industry will face a shortage of 59,000 to 77,000 engineers in the next five years. Without immigration reform and a cultural shift toward hardware innovation, the U.S. may struggle to maintain its lead even if it builds new factories.

For individuals, pursuing a two-year technical degree at a community college could be a smart career move, as over 80 semiconductor-related courses have been introduced or expanded since the CHIPS Act was passed.

ARM Long Position TradeHello sorry my camera did not pick up this time but next time I should get the camera working. Here is a different strategy for today that I haven't shared with anybody on TradingView where I simply put on a large position and ride the market up in a high performing stock or sector. I use my VIX Rank Percentile histogram indicator "that you'll see in this video you can download from my profile " which tells me that the VIX is calm or not calm green bean safe time to hold the position and red being a riskier time to hold the position. I will hold this long position whenever my histogram is green, and I will take the trade off whenever I feel like it's a good time to take it off or maybe partially take it off if the market's getting a little shaky.

Mind the gap! What next for Broadcom?Broadcom (AVGO) has been a major beneficiary of the AI boom, with its stock soaring 53% since the beginning of 2024 and more than doubling year-to-date. While not reaching the astronomical heights of NVIDIA (NVDA), Broadcom's performance remains remarkable.

The company's Q2 revenue report was a resounding success, showing a 43% year-over-year increase, while EBITDA grew 31% year-over-year. This strong performance prompted Broadcom to announce a 10:1 stock split on July 15th, a move that will make the stock more accessible to smaller retail investors.

The sustainability of this growth in the rapidly evolving AI landscape remains a key question for any AI-related company. However, Broadcom's forward P/E ratio of 35 appears relatively modest compared to its AI peers like NVIDIA (50), CrowdStrike (95), and AMD (46). This suggests that Broadcom may still have room for further valuation expansion.

Following the impressive earnings report, the stock surged 12% on June 13th and continued to trade higher in after-/pre-market activity. The technical picture is also positive, with the price comfortably above its short, mid, and long-term moving averages, indicating strong momentum. The recent surge in volume, reflected in the Volume Oscillator, further underscores the heightened interest in the stock.

While the Relative Strength Index (RSI) is currently in overbought territory at 79.23, this is not unusual following a major earnings announcement. Importantly, the RSI's moving average has been trending upwards since early May, suggesting that the bullish momentum behind AVGO may not be exhausted yet.

Furthermore, the overall market sentiment towards AI remains positive, which could continue to support Broadcom's growth trajectory. Yet it remains important to monitor Broadcom's competitive position in the Semiconductor Solutions & Infrastructure Software market, as the landscape is constantly evolving.

Risk Management: Despite the positive outlook, investors should be mindful of potential risks, such as a slowdown in AI adoption or increased competition, and employ appropriate risk management strategies.

SKYT Potential Reversal Coming to the Upside Good morning everyone,

Looking at SKYT earnings report, results look worse than what they actually are. If you have not listened to their conference call I highly suggest you do so and educate yourself. Overall, I think this is a company that will do very well in the near future especially when you see a company like them being backed by the Department of Defense.

We currently have a small breakout to the downside on the weekly timeframe, meaning another small move down could be incoming and pivot shortly after. I'm predicting a reversal very soon and could potentially be the last time you see SKYT at these low levels.

Well that's it for SKYT, don't forget to like and follow! If you would a specific company for me to analyze don't forget to leave the ticker on the comments below.

Be Blessed and Happy Trading!

🚀 TSM: Semiconductor Growth Potential 🖥️💰📈 Market Analysis:

Industry Trends: TSM is positioned for growth amid rebounding global semiconductor sales, driven by increasing demand.

Technological Advancements: Investment in state-of-the-art 2-nanometer chips in Arizona underscores TSM's commitment to innovation and staying ahead in the industry.

Partnerships and Innovation: TSM's involvement in the AI revolution and strong partnerships with tech firms bolster its competitive edge and growth prospects.

💡 Investment Strategy:

Bullish Outlook: A positive stance is recommended for TSM, particularly above the $122.00-$123.00 level, signaling potential upward momentum.

Upside Target: An optimistic target of $200.00-$210.00 is set, reflecting the anticipated growth trajectory of TSM.

Market Monitoring: Continuously monitor market dynamics and TSM's performance to evaluate target realization and adjust strategies accordingly.