SMSLIFE - MAJOR UPMOVE POSSIBLE....SMSLIFE

CMP 490

STOP 400

LONG SUGGESTED ABOVE 530

TARGET OPEN

LOGIC:

WEEKLY CHART - Stock has formed a sort of reverse H&S pattern.

Fundamentally EPS has been witnessing triple digit annual growth for the last couple of quarters

Date EPS %Chg Sales(Cr) %Chg

Sep-18 14.59 +334% 89.2 +75%

Jun-18 10.16 +196% 59.9 +31%

Mar-18 6.52 -100% 54.1 -3%

Dec-17 8.19 -100% 66.5 +9%

Sep-17 3.36 -42% 51.0 +4%

Jun-17 3.43 -100% 45.8 -21%

Promoter holding 67%

D/E : 0.3

Low float share

Sensex

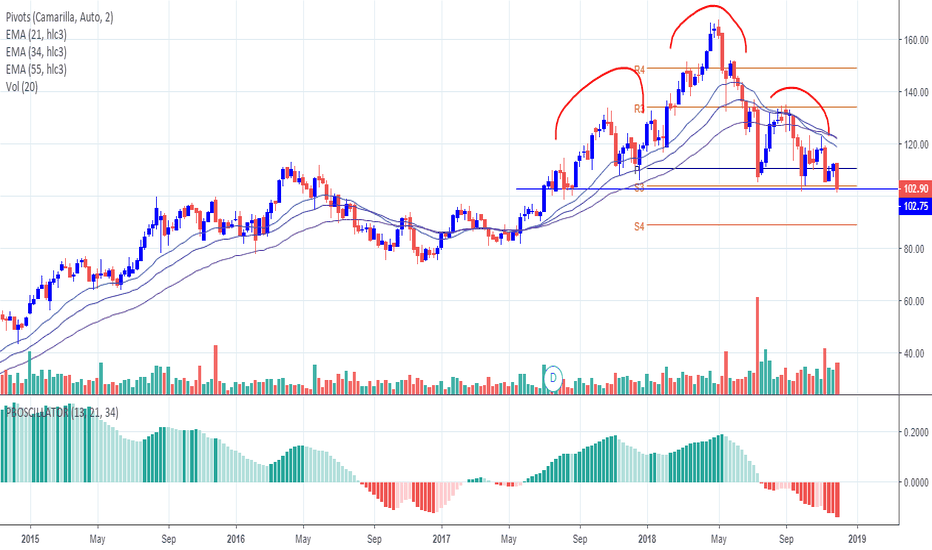

ASHOK LEYLAND - WEAK STRUCTURE#ASHOKLEYLAND

CMP 102.9

Bias - Bearish SUBJECT TO BREAKDOWN OF 100 LEVELS.

Weekly chart shows a perfect H & S pattern.

Price at the neckline region with higher probability of breakdown.

Breakdown of 100 possibly could be disaster for the stock.

Pivot based ema oscillator is at a new 2 year low.

Next major support seen in the region of 80-82. Camarilla S4 at 88.

View negated if price crosses above 112.

YES BANK - Short term pull back possible Daily charts

cmp 169.80

Long advised above 172.

High probability of Short term pull back towards mean. (195-200 )

Logic -

Strong divergence seen in price Vs pivot based oscillators.

Price forming lower lows + pivot based oscillators forming higher lows with volume supporting.

DOES NOT SIGNIFY A PERMANENT REVERSAL. ONLY A SHORT TERM TRADING OPPORTUNITY.

Stop for this would be 160. Entry should be only above 172 for a target of 195-200.

KDDL - A good one to go longCMP 484

Long suggested above 495.

Stop 420

Target Open

Logic:

Weekly chart

1) Passes MM trend template.

2) Price currently bounced from value zone and trading just above R4 cam pivots with good volumes.

3) Price has pierced the trend line resistance and has bounced back after making the first test with good volumes.

3) Fundamentally has been clocking triple digit growth in eps and sales for the last 4-5 quarters consistently.

India’s Adventures in Fiat BubblesIndia became an independent country in 1947 and had a Grand Supercycle Wave I into the 60’s. Grand Supercycle Wave II finished up the 70’s, and this chart shows the completion of Grand Supercycle Wave III.

The price action is reflective of the massive fiat credit creation in the Indian economy, hence the equity bubble. A true democracy, India is in the process of learning not to allow the politicians control of the money supply. I also don’t recommend giving control of the money supply to a criminal banking cabal either, like we have in the United States. Both are examples of letting the Fox watch over the Hen House, and will result in The People getting robbed of their money… A recent example would be the government recently robbing the lower classes of the money in circulation that they used for day to day business.

India has a proud history of buying Gold and Silver. I recommend everybody in India trade their Rupees for gold and silver coins, and tell the government to shove their fiat where the sun doesn’t shine… And, oh yeah, sell the Sensex and invest in Gold and Silver until close to the end of the 20’s and the end of Grand Supercycle Wave IV. If India is smart, they will have transitioned to a PM backed currency, independent of Politicians and Bankers, and preferably enshrined in the Indian Constitution, so 60 to 70 years from now they won’t have to repeat this whole ordeal over…

NIIT Technologies - Forming Inverted Cup & Handle patternCup & Handle Pattern being formed on daily chart of NIIT Tech, currently trading around support line, if breaks & sustain below support line of 1060 then we can expect sustained down trend for coming weeks, once it confirms of breakdown below 1060 then one can expect it to fall another 10-15% in 2-3 weeks and 30-35% over the next few months, Must trail sl at 100 Day Moving average on closing basis post breakdown.

On other side if it gives any bounce back before the breakdown then also one can go short around 1170-1190 with sl around recent high of 1240.

TATA CONSULTANCY SERVICES SHARE HOLDERS SHOULD KNOW THIS!the chart is self explanatory

i know many Indians with family and kids are holding their life savings in this stock

please read this and see the obvious bear in the room

DISCLAIMER - i don't have any TCS shares..... so hopefully this analysis is emotionally uncompromising

NIFTY in the fourth Elliott waveNIFTY appears to be moving in the fourth Elliott wave which is likely to complete around 11250. It could then move up in the fifth wave before a substantial correction to below 10000 levels, if the wave count in the above chart is correct.

This pattern will be invalidated if the the current correction drops below 10930.

PS: This analysis is just for educational purposes and is not a recommendation to buy or sell. Please do your own research and trade at your own risk.

Cheers

ND

Nifty analysis for Month of September 2018

Have marked many levels on the chart directly, keep these levels under observation, whenever price will touch these levels be alert.

Price is in complete up trend, for my trading i am keeping 2 price levels on scanner.

1. 11910

2. 11550

I personally expect market to go up till 11910 before it closes below 11550, if we dont go up till 11910 and go south then 11190 will be the target.

But currently there is no reason to expect fall in price, current price action is not suggesting any such ting. I will be watching the price actin all the time any bearish signal can push us to the second possibility of 11190. Traders keep all these levels marked on your chart and be ready for any trend reversal around 7th-10th of September . Till that time i expect we to be in green zone. All analysis is based up on history. I am not doing future telling. When we expect few things in future then be sure about one thing that its not necessary that every thing will work as you expect it to work.

I am not suggesting any investment or trade.

A potential long on Aurobindo Pharma!A long trade can be initiated around 675 levels, if Aurobindo Pharma sustains above it's resistance zone above 650, with targets close to 800 and a stop loss around 615. The Risk to reward is high, with the trade having high probabilities of success, if 675 is tested and our entry price is hit.