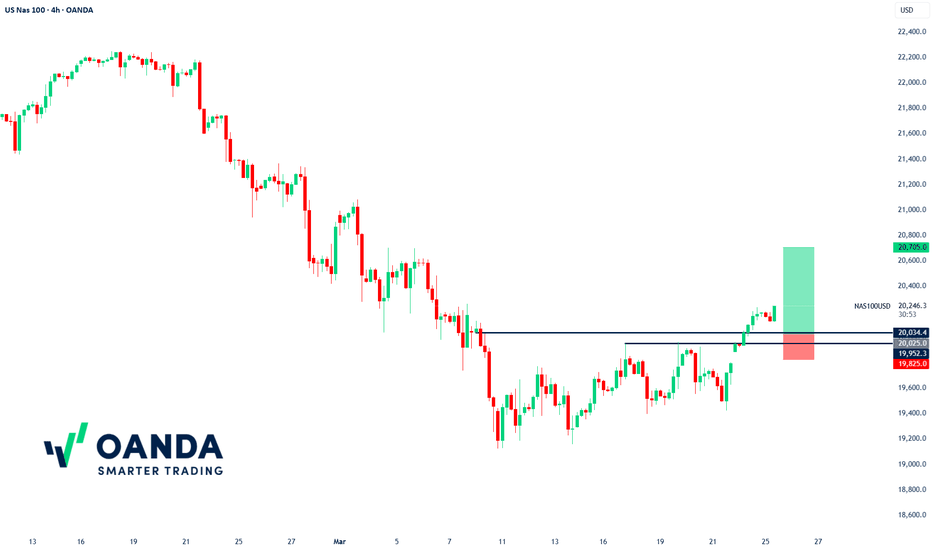

NAS100USD Buy Idea: Bullish Momentum Targets 20705🚀 OANDA:NAS100USD Buy Idea: Bullish Momentum Targets 20705 💹 - 24h expiry

OANDA:NAS100USD - We look to Buy at 20025

Stop Loss: 19825

Target 1: 20705

Target 2: 20730

Resistance: 20234, 20705, 20730

Support: 20025, 19423, 19125

Technical Setup:

📈 Continued upward momentum from 19424 resulted in the pair posting net daily gains yesterday .

⚠️ Overbought extremes indicate scope for mild selling at the open, but losses should remain limited .

🔑 Medium-term bias remains bullish .

🏁 Key resistance level at 20705 .

📰 News Sentiment

📊 Recent sessions show a bullish uptick in News Sentiment (Red Line), aligning with the price movement (Blue Line).

🌟 Positive sentiment (Red Line) is extending higher, suggesting further upside potential in the short term.

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Sentiment

USDJPY: Slight Bullish Bias This Week? (19/09/2024)As of September 19, 2024, traders are closely monitoring the USDJPY pair for potential bullish momentum. Several fundamental factors and market conditions indicate that the pair might see a slight upward bias this week. Let’s dive into the key drivers affecting the USDJPY price action.

1. Diverging Central Bank Policies

One of the primary influences on USDJPY is the monetary policy divergence between the Federal Reserve (Fed) and the Bank of Japan (BoJ).

- Federal Reserve’s Stance: As we move into the week, the market expects the Fed to maintain a hawkish stance or at least keep interest rates elevated. Although there’s some speculation about a possible pause in future rate hikes, the Fed's priority remains controlling inflation. This higher interest rate environment in the US makes the US dollar more attractive, pushing USDJPY upwards.

- Bank of Japan’s Ultra-Loose Policy: In contrast, the BoJ continues its ultra-loose monetary policy, aiming to stimulate Japan’s sluggish economy. Despite rising inflation in Japan, the BoJ has shown little inclination to raise rates aggressively. This Interest rate differential between the US and Japan tends to weaken the yen, giving a bullish outlook for USDJPY.

2. Risk Sentiment in Global Markets

Risk sentiment plays a crucial role in the movement of USDJPY. When global markets are in a risk-off mode, investors tend to flock to safe-haven assets like the Japanese yen, strengthening it. However, recent global economic data and financial news have maintained a somewhat stable risk appetite, leaning towards a risk-on environment.

- US Economic Data: Recent reports from the US, such as better-than-expected retail sales and strong labor market data, continue to support the narrative of economic resilience. This fuels demand for the dollar and supports USDJPY’s bullish momentum.

- Global Geopolitical Risks: While geopolitical tensions in regions like Europe and the Middle East may inject some volatility, there hasn’t been a major shift toward a risk-off sentiment that would heavily favor the yen. For now, dollar strength seems to dominate.

3. Japanese Economic Conditions

Japan’s economy continues to struggle with low growth despite rising inflation. The BoJ’s consistent approach to stimulus, combined with the government's push for wage growth, has not yet translated into significant yen strength. Additionally, trade deficits in Japan, exacerbated by higher import costs, have weighed on the yen’s valuation.

Without a major shift in BoJ policy or a significant improvement in Japan's economic performance, the yen will likely remain under pressure, keeping USDJPY on a slightly bullish path.

4. US Bond Yields

US Treasury yields are another major factor driving the USDJPY. Higher US bond yields, often seen in response to tighter monetary policy and strong economic data, make the dollar more attractive to foreign investors. The upward trajectory of bond yields has been a persistent theme, reinforcing dollar strength. If this trend continues through the week, we can expect additional support for USDJPY.

5. Technical Indicators

Looking at the technical analysis for USDJPY, the pair has been trading near key resistance levels in recent sessions. If the pair breaks above these resistance zones, we could see further bullish momentum.

- Key Support and Resistance Levels: The 145.00 level has been a psychological support level for USDJPY, while 148.50 serves as resistance. Should the pair break beyond this resistance, it could trigger more buying pressure, pushing USDJPY higher.

Conclusion: USDJPY’s Slight Bullish Bias

In conclusion, the USDJPY pair is expected to exhibit a slight bullish bias this week, primarily driven by:

- Monetary policy divergence between the Fed and BoJ.

- Favorable US economic data and rising Treasury yields.

- Limited economic growth in Japan, with persistent trade deficits.

- Stable global risk sentiment supporting the dollar over the yen.

Traders should keep an eye on US bond yields, Fed comments, and any sudden shifts in risk sentiment or geopolitical events, as these could influence USDJPY’s trajectory throughout the week.

---

Keywords:

- USDJPY forecast

- USDJPY bullish bias

- USDJPY analysis September 2024

- USDJPY technical analysis

- USDJPY key drivers

- USDJPY trading strategy

- USDJPY and Federal Reserve policy

- USDJPY support and resistance levels

- USDJPY risk sentiment

- USDJPY bond yields impact

Macro Monday 38 ~ The EU & German ZEW Economic Sentiment IndexMacro Monday 38

The Euro Area ZEW Economic Sentiment Index &

The German ZEW Economic Sentiment Index

(Released this Tuesday 19th Mar 2024)

ZEW is the German acronym for the Zentrum für Europäische Wirtschaftsforschung, which translates to the Centre for European Economic Research.

There are two releases from the Centre for European Economic research we will cover today both being released this coming Tuesday;

1. The Euro Area ZEW Economic Sentiment Index

(Reading of 25 for Feb 2024)

2. The German ZEW Economic Sentiment Index

(Reading of 19.9 for Feb 2024)

EURO AREA ZEW INDEX

This index is derived from 350 economists and analysts that operate from and represent the overall European Area. They include economists and analysts from different countries in the Eurozone that are using the Euro as their currency (20 countries out of the 27 members). In summary, while the EU ZEW index provides a broader perspective for the entire eurozone than the German ZEW Index discussed below, the exact methodology for distributing the surveys and their apportionment across individual countries within the eurozone is not explicitly disclosed. Historically, this index has proven very useful as a leading indicator of sentiment for the European Economy and it is closely monitoring for gauging economic sentiment in the EU by market participants.

EURO AREA ZEW CHART - SUBJECT CHART ABOVE

How to read the chart

The index ranges from -100 (pessimism) to +100 (optimism). 0 is neutral however the historical average reading for the EU chart is 21.39 which is the point where the red area meets the green area on the chart. We show on the chart if we are above or below the average levels of optimism.

The current reading of 25 indicates current optimism among analysts for the next 6 month

The Trend

Sentiment made a recovery from -60 in Sept 2022 to +25 in Feb 2024. We have moved from deep in negative sentiment territory to just above the historical average of the chart which is 21.39.

GERMAN ZEW INDEX

The German ZEW Index data is not derived from all the countries in Europe, it is derived from the views of collection of 350 economists and analysts that operate from and represent the German economy. As Germany is the largest economy within the Euro Area, its performance significantly impacts the overall region and this this metric could be considered the economic sentiment spearhead of Europe. Germany is also the 4th largest economy in the world by nominal GDP. As of 2023, its nominal GDP stands at approximately $4.43 trillion. This index could be monitored as a measure of not only European sentiment but as an important global sentiment gauge.

GERMAN ZEW INDEX CHART

How to read the chart

The index ranges from -100 (pessimism) to +100 (optimism). 0 is neutral however the historical average reading for the German ZEW chart is 20.79 which is the point where the red area meets the green area on the chart. We show on the chart if we are above or below the average levels of optimism.

The current reading of 19.9 indicates current optimism among analysts for the next 6 months, however we are below the historical average of 20.79 thus a definitive move above this level this coming Tuesday could be a confirmation step into potential sustained optimism.

The Trend

Sentiment made a recovery from -61 in Sept 2022 to +19.9 in Feb 2024. We have moved from deep in negative sentiment territory into positive numbers but we are not above the historic average of 20.79 yet.

Lets see how both perform this coming Tuesday. The beauty of these charts is that you can review both on my Trading View at any stage, press play and it will update with the most recent release. This way you will have a full explainer of what this dataset is and can keep yourself up to date on its direction with the color coded map, the average line and the neutral line, all of which will at a glance give you a good indication of where we stand in terms of trend and sentiment. I'll keep you informed here too

Thanks for coming along

PUKA

MINA Analysis: Potential Correction, SELL or BUY Setup?!🍣📈Weekly Channel Breakout and Retest:

MINA previously broke out of its weekly channel and reached its target successfully.

The recent breakdown below the channel indicates a loss of bullish momentum and potential for a retracement.

🔍📉Corrective Phase and Resistance Levels:

If MINA undergoes a correction, it is likely to retrace upwards until reaching its weekly resistance level.

A rejection at this resistance level, coinciding with the RSI reaching the daily blue resistance line, could present a selling opportunity.

🚫Early Sell Setup and Risk Management:

A sell position could be initiated early at the current price level (below the lower channel line) using the red trigger line as confirmation.

Trailing the stop-loss to the lower support zone can help mitigate risk and maximize profit potential.

✅Important Considerations✅

The overall market trend should be taken into account before executing any trades.

Confirming the reversal with additional technical indicators and market sentiment analysis is essential.

🚫This analysis is for educational purposes only and should not be construed as financial advice. Always conduct your own research and employ sound risk management practices before trading.

🚫

Will the S&P 500 tank (or will bears be forced to capitulate?)Whilst this year's 'rally' on the S&P 500 has been mediocre at best, the increase in net-short exposure to S&P futures has been impressive. As of last Tuesday, large speculators pushed their net-short exposure to the futures contract to their most bearish level since late 2007.

Yet with prices rising whilst speculators increase bearish exposure, there is a clear mismatch between the two data sets. And one that will need correcting, one way or another.

Prices will either need to roll over to justify the short-exposure of large speculators, or bears will have to capitulate which could also trigger a short-covering rally to send prices higher.

A potential catalyst could be if (or when) the US increase their debt ceiling, with reports suggesting we are on the cusp of a 2-year raise - and that could support risk assets such as the S&P 500. But if the talks break down, the deadline is missed and the US government defaults (which would also see the US lose their 'AAA' rating), it could be a case of 'watch out below' as the market slumps to justify the aggressive positions of bears.

Either way, this is one to watch as the week's progress.

VOO VANGUARD S&P500 ETF- IS IT GOOD FOR A LONG TERM HOLD? VOO AMEX:VOO is showing promise. Markets have very slowly begun to correct since the Russian Invasion into Ukraine Feb 24th, 2022. Since then, you see some recover on this chart. While things are still uncertain with the overall health of the economy and markets the S&P is gaining some slow momentum. However is VOO a good long term hold ? Well, I'm gonna be opening a position with VOO for my portfolio and increase with dollar cost average new positions to protect me from any volatility.

Hope you enjoy this TA and don't forget to like and subscribe and show your support.

Disclaimer

I’m not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA, an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this TA,(Technical Analysis) are for informational and educational purposes only and do not constitute financial, investment, trading, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using or reading this technical analysis or site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this analysis, or post. AMEX:VOO

Daily Checklist Before The Market Opens | Feb 4 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 8 out of 6.66

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 89.72-86.20

3️⃣Options IV: 42.15%

🚀Daily Expected Move: ±2.43

🚀Weekly Expected Move: ±5.36

🚀Monthly Expected Move: ±11.16

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 7 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1781.3-1753.0

3️⃣Options IV: 16.01%

🚀Daily Expected Move: ±18.30

🚀Weekly Expected Move: ±40.29

🚀Monthly Expected Move: ±83.86

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 3 out of 5.44

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 97.440-97.050

🛸Buy UFOs: 94.645-93.865

3️⃣Options IV: 6.96%

🚀Daily Expected Move: ±0.42

🚀Weekly Expected Move: ±0.92

🚀Monthly Expected Move: ±1.91

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 2 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 82.65%

🚀Daily Expected Move: ±1975.98

🚀Weekly Expected Move: ±4349.92

🚀Monthly Expected Move: ±9055.09

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice

Daily Checklist Before The Market Opens | Feb 3 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 7 out of 6.64

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 80.47-77.83

3️⃣Options IV: 41.86%

🚀Daily Expected Move: ±2.29

🚀Weekly Expected Move: ±5.05

🚀Monthly Expected Move: ±10.50

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 6 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1809.7-1781.3

3️⃣Options IV: 15.66%

🚀Daily Expected Move: ±17.79

🚀Weekly Expected Move: ±39.17

🚀Monthly Expected Move: ±81.54

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 2 out of 5.44

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 97.440-97.050

🛸Buy UFOs: 95.335-95.030

3️⃣Options IV: 6.25%

🚀Daily Expected Move: ±0.38

🚀Weekly Expected Move: ±0.83

🚀Monthly Expected Move: ±1.74

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 1 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 80.79%

🚀Daily Expected Move: ±1871.46

🚀Weekly Expected Move: ±4119.83

🚀Monthly Expected Move: ±8576.11

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice

Daily Checklist Before The Market Opens | Feb 2 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 6 out of 6.64

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 80.47-77.83

3️⃣Options IV: 41.31%

🚀Daily Expected Move: ±2.30

🚀Weekly Expected Move: ±5.05

🚀Monthly Expected Move: ±10.52

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 5 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1781.3-1753.0

3️⃣Options IV: 16.50%

🚀Daily Expected Move: ±18.74

🚀Weekly Expected Move: ±41.26

🚀Monthly Expected Move: ±85.88

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 1 out of 5.44

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 97.440-97.050

🛸Buy UFOs: 96.260-95.405

3️⃣Options IV: 6.58%

🚀Daily Expected Move: ±0.40

🚀Weekly Expected Move: ±0.88

🚀Monthly Expected Move: ±1.82

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: NO

🎯Stats: 2 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 76.77%

🚀Daily Expected Move: ±1865.51

🚀Weekly Expected Move: ±4106.73

🚀Monthly Expected Move: ±8548.83

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice

Daily Checklist Before The Market Opens | Feb 1 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 5 out of 6.63

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 80.47-77.83

3️⃣Options IV: 42.35%

🚀Daily Expected Move: ±2.35

🚀Weekly Expected Move: ±5.18

🚀Monthly Expected Move: ±10.78

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 4 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1781.3-1753.0

3️⃣Options IV: 16.70%

🚀Daily Expected Move: ±19.03

🚀Weekly Expected Move: ±41.88

🚀Monthly Expected Move: ±87.19

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 10 out of 4.89

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 97.440-97.050

🛸Buy UFOs: 96.260-95.405

3️⃣Options IV: 6.69%

🚀Daily Expected Move: ±0.41

🚀Weekly Expected Move: ±0.89

🚀Monthly Expected Move: ±1.86

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: NO

🎯Stats: 1 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 74.50%

🚀Daily Expected Move: ±1797.68

🚀Weekly Expected Move: ±3957.40

🚀Monthly Expected Move: ±8237.99

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice

USDCAD Bearish Bias to 1.267 price point on the 4HR ChartLooking for USDCAD to respect 127.5 Price Point on the Daily

Anticpating a pullback to 1.26700 on the 4hr

Really good risk to reward short during High volume

time (London Session Close) We''ll see what happens

This is a day trade, don't plan on holding it into asian

unless we are in a fair amount of profit

Daily Checklist Before The Market Opens | Jan 31 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 4 out of 6.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 80.47-77.83

3️⃣Options IV: 47.74%

🚀Daily Expected Move: ±2.63

🚀Weekly Expected Move: ±5.80

🚀Monthly Expected Move: ±12.07

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 3 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1781.3-1753.0

3️⃣Options IV: 17.12%

🚀Daily Expected Move: ±19.33

🚀Weekly Expected Move: ±42.55

🚀Monthly Expected Move: ±88.57

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 9 out of 4.91

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 98.550-97.935

🛸Buy UFOs: 96.260-95.405

3️⃣Options IV: 6.48%

🚀Daily Expected Move: ±0.40

🚀Weekly Expected Move: ±0.87

🚀Monthly Expected Move: ±1.82

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 24 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 73.70%

🚀Daily Expected Move: ±1725.91

🚀Weekly Expected Move: ±3799.42

🚀Monthly Expected Move: ±7909.11

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice

Risk Model for Swing Traders (US)Our risk model for SWING-TRADERS (US Stock Market) is still showing a high risk environment.

Swing-Traders should still be very careful and keep risk to a minimum. A very few indicators in our risk model suggest that we may have reached the bottom of the current market correction.

Best way to manage the current situation is to start off with a very few and small pilot positions. If those work and your own portfolio is getting traction, market exposure can be increased.

Some details:

1. Market-Indices (Distribution Days Avg)

The distribution day count according to IBD's model is still showing a market in correction. That means that the price/volume action of the major indices are characterized by institutional selling. Not a good environment for swing-trading.

2. New 52w Highs / Lows

This indicator is still way below 1 indicating that more stockas are making new 52w Lows versus Highs. In a good evironment, you will see this indicator reading higher than 1.

3. Stocks above/below 200d MA

Only 30% of stocks are trading above their own 200d MA. Readings >> 50% indicate a broad market breadth which we currently do not have.

4. Up / Down Volume

Still below 1 indicating that the current market environment is more characterized by heavy selling.

5. Advance-Decline Line

Still in a downward trend. in a good environemtn, this indicator is in an upward trend or at least trending sideways.

6. Volatility Index VIX

Improved versus last week. Now reading < 30% and still falling. Might be a good early indicator that we may have reached a market bottom.

7. Bulls vs Bears

This is a contrarian indicator. Market sentiment is now less bullish which is good.

8. Margin-Debt

Now reading at 17% and still falling. Also a good contrarian indicator suggesting that we may have reached the bottom of the current correction.

Daily Checklist Before The Market Opens | Jan 28 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 3 out of 6.61

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 80.47-77.83

3️⃣Options IV: 46.90%

🚀Daily Expected Move: ±2.57

🚀Weekly Expected Move: ±5.67

🚀Monthly Expected Move: ±11.80

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 2 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1781.3-1753.0

3️⃣Options IV: 17.15%

🚀Daily Expected Move: ±19.26

🚀Weekly Expected Move: ±42.40

🚀Monthly Expected Move: ±88.27

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 8 out of 4.93

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 98.550-97.935

🛸Buy UFOs: 96.260-95.405

3️⃣Options IV: 6.29%

🚀Daily Expected Move: ±0.39

🚀Weekly Expected Move: ±0.85

🚀Monthly Expected Move: ±1.77

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 23 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 74.63%

🚀Daily Expected Move: ±1709.26

🚀Weekly Expected Move: ±3762.75

🚀Monthly Expected Move: ±7832.80

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice

USDCAD 4Hr AnalysisWe have created a HH on the 4Hr Chart

However the way that the candles are printing has me concerned

for the bulls. Additionally, the Daily TF has a large top wick

. This wick was created during London Open as price came flying down

liquidating fomo buyers. Im looking for a correction down to 1.263.

Our Daily Resistance at 1.26850 appears to be holding fairly well

GBPJPY 4Hr Analysis, week 4 2022 We may come up to 155 on the Daily

We may Respect 154.500 Since we just closed below that

price point during the Pre-NY 4hr Candle.

I don't like it a whole lot, Staying out for the Time being

I had just taken a 5:1 RR position that got stopped out,

Trading in Line with my bias, Bearish , Due to the Daily/Weekly TF's

I'm still looking for a retest of lows, at 153.8 and 153.5

Daily Checklist Before The Market Opens | Jan 27 2021Hello and thank you if you are a regular reader 🖖 Welcome if you are new to my daily publication... 👍

Publishing this post on a daily basis helps me avoid distractions and sets my focus to be fully in line with the now in the marketplace.

Knowing you read me keeps me accountable and forces me to be objective in my analysis which helps with my own trading emotions and temptations 😉

This selfish moment may also serve you well 😁 as my findings may guide you into understanding the markets better, or may simply act as a second opinion after you have performed your own analysis 👏

The rationale of my analysis is detailed on the chart itself so you don't need to look up and down.

Below you will simply find the results of my process applied to other four relevant markets I always check before I trade.

Trade well!

OIL: NYMEX:CL1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 2 out of 6.6

2️⃣Buy and Sell UFOs

🛸Sell UFOs: -

🛸Buy UFOs: 80.47-77.83

3️⃣Options IV: 45.67%

🚀Daily Expected Move: ±2.52

🚀Weekly Expected Move: ±5.55

🚀Monthly Expected Move: ±11.56

GOLD: COMEX:GC1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 1 out of 5.62

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 1854.2-1829.3

🛸Buy UFOs: 1802.0-1652.8

3️⃣Options IV: 16.42%

🚀Daily Expected Move: ±18.77

🚀Weekly Expected Move: ±41.33

🚀Monthly Expected Move: ±86.03

DOLLAR: ICEUS:DX1!

1️⃣Market CLIMATE

🎯Current: UP

🎯Confirmed: YES

🎯Stats: 7 out of 4.93

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 97.810-96.790

🛸Buy UFOs: 96.260-95.405

3️⃣Options IV: 6.07%

🚀Daily Expected Move: ±0.37

🚀Weekly Expected Move: ±0.82

🚀Monthly Expected Move: ±1.70

BITCOIN: ICEUS:BTM1!

1️⃣Market CLIMATE

🎯Current: DOWN

🎯Confirmed: YES

🎯Stats: 22 out of -

2️⃣Buy and Sell UFOs

🛸Sell UFOs: 43590.0-41362.5

🛸Buy UFOs: 32820.0-31615.0

3️⃣Options IV: 76.81%

🚀Daily Expected Move: ±1772.01

🚀Weekly Expected Move: ±3900.89

🚀Monthly Expected Move: ±8120.36

I believe now you know why UFO and 3D are part of my name…

Feel free to private-message me and share more about your trading style if you are too attracted by those UFOs 💪

*This daily post is not intended to be used as financial advice