Sentiment

USDCAD SHORT on Order Flow - Follow the smart money! Strong Bearish Signal:

The price tested the support level, but could not break it down, however, the pair resumed falling after a smooth upward correction. Moreover, the recent sharp sink supported by the huge volume implies that the smart money pushed the price downwards.

Volume Zones:

We need to point out the level of support 1.2775 - 1.2787, which contains the large volume and has already been tested by the price. The pair is currently testing this mark.

Sentiment:

This indicator shows that 82% retails traders are in long positions, which is a good additional signal for us (trading against the "crowd").

b.radikal.ru

Consider Short Positions:

Given all these factors, we should consider exceptionally short positions. We may enter the market after a keen breakdown of the support level. The drop must be keen and supported by the large volume, which will be a more precise signal for entering the market. A stop loss may be placed above the breakdown volume bar.

Profit Potential:

More than 100 points.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -

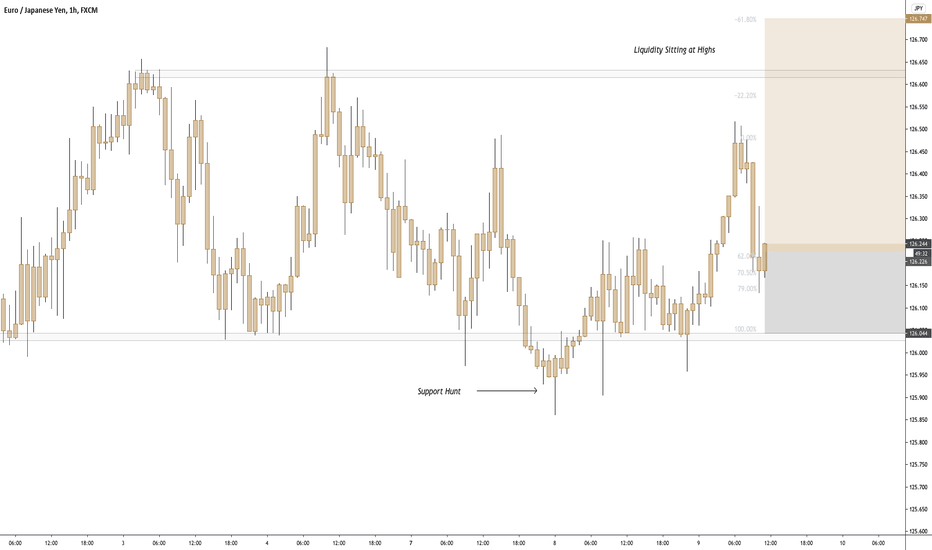

The euro saw lacklustre trade ahead of the aforementioned...The euro saw lacklustre trade ahead of the aforementioned key risk events and traded either side of 1.21. On the flip side JPY was flat, hovering around 104 on the index. XAU continued its move higher with real yields falling again today, gold reached highs of 1875/oz, silver was also firmer. Overall as painted on the chart I am now looking for a third drive into this key range marked in the box before we see some bullish activity come into play into the later part of this week.

RGR price hints at what traders think about the electionNYSE:RGR tends to perform well in the presence of social unrest and in the face of regulatory restrictions on firearms (reflect upon the Obama years etc). The mainstream narrative of a landslide Biden victory with no election fraud seems to contradict the story playing out in the price action of $RGR. If confidence exists in a Biden victory, traders simply aren't seeing it that way. What do you think?

EURUSD - Great EntryMe and the team got involved in a buy from a limit order placed just below the support region of the range. We have been trading this in hopes of more upside potential but the volume this week has been flat. I will continue to hold this position and let you know what the outcome is.

XAUUSD LONG on Order Flow - Follow the smart money! Strong Bullish Signal:

The pair showed a sharp growth and broke out the previous level of resistance. The move was on the increased volume and large positive delta, so that we may assume that the smart money pushed the price up. It increases the possibility of the further surge.

Volume Zones:

It is necessary to point out the new support level 1860.20 - 1863.20, which contains the large volume.

Sentiment:

This indicator shows that 55% retails traders are in short positions, which is a good additional signal for us (trading against the "crowd").

c.radikal.ru

Consider Long Positions:

Given all these factors, should prefer a scenario of opening purchases. We may enter the market after a smooth downward correction, in order to get a better entry point. A stop loss should be placed below the new support level with a little margin.

Profit Potential:

More than 300 points.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -

A choppy day for the Buck with the earlier Sterling...A choppy day for the Buck with the earlier Sterling-influenced impetus waning heading into the US cash open with State-side players eyeing events at Capitol Hill as expectations mount for Congress to pass an interim stopgap bill and kick the can down one week to Dec 18th, whilst the bipartisan group continues to haggle over COVID relief with liability overhaul a sticking point. Nonetheless, the Buck was propelled in early European hours from its 90.686 overnight base to a peak at 91.241 but has since the Index has lost traction to stabilise below the round figure heading into the European close. Meanwhile, tomorrow’s State-side docket remains light with Fed officials also observing the blackout period, but with focus likely to remain on Capitol Hill developments.

GBP/USD: 1.3650 Target.

Gold: 1930 Target.

DXY: 90 Target.

EUR/JPY: 129.00 Target.

Stay tuned for more posts to come this week! It will be a good week ahead!

Weekly Market recap 10: Here we go!What's happening

Last week marked the beginning of the continuation of the long-term downtrend in safe-havens. The market already offered short-term momentum opportunities at the initial move after DXY broke down the last support at 91.75.

Currently, we're experiencing the first stop or apparently a minor pullback in the global risk assets, as each major asset tests its respective resistance level (support in case of safe-havens). DXY is mildly rebounding from the support around 90.50.

Traders should be ready for decisive actions this week as the trend in risk assets (or a downtrend in DXY) may resume in any moment.

Action plan

There are two major price action scenarios I'd be interested in trading:

a)Breakout of the current resistance level and the trend continuation. In the case of Indices, it pertains only to those, that are not overextended, such as DAX, S&P500 & NASDAQ100. If you look at Nikkei 225, it's been one of the strongest Asian markets since the beginning of November, so it'd be natural if it corrects before the trend continuation.

b)Reversal of the short-term uptrend of the safe-havens in the context of selling the pullback of the long-term downtrend. For example, if DXY approaches 91.75, look for short-sell setups in USD and JPY pairs.

December 6 Market Update | Technical, Fundamental, NewsDescription:

An analysis for the week ahead.

Points of Interest:

Projections near $3,710.00, the micro-composite HVNode at $3,690.75 and $3,667.75, as well as the $3,682.00 and $3,640.00 balance boundary.

Technical:

During much of the week, participants lacked the conviction to break through to new highs.

However, conditions markedly improved after Thursday’s long liquidation on Pfizer Inc (NYSE: PFE) news flushed out weak-handed participants, and responsive buyers surfaced. The quick recovery of the balance-area high suggested the news was immaterial.

During Friday regular trading, initiative buyers extended range — through the $3,682.00 balance-area high — separating and accepting value above the week-long balance-area.

Therefore, given the acceptance of higher prices, participants must monitor whether S&P 500 spends time trading above the $3,682.00 balance boundary. An initiative drive below that figure would portend a potential response at the $3,667.75 high-volume node. Auctioning further below that area would denote a clear change in conviction. The line in the sand is the $3,640 balance-area boundary. Auctioning below that figure puts the rally on hold.

All in all, though sentiment and positioning imply limited potential for upside, the S&P 500 remains in an uptrend after confirming a multi-month balance-break.

Fundamental:

In a commentary, Nasdaq’s Phil Mackintosh discussed new proposed actions from the SEC.

The U.S. is moving away from an equal, actionable, accessible market. It will become more similar to Europe, where segmentation and latency are so prevalent that, even though public data is available, each investor’s view of what they can access is different, making it hard to agree on what quotes and trades should be used to benchmark their executions.

Simply put, Mackintosh suggests proposals like NMS II, which is intended to modernize market data infrastructure, will likely lead to more market fragmentation, segmentation, and quote deterioration.

Key Events:

Monday: Consumer Credit Change.

Wednesday: MBA Mortgage Applications, Wholesale Inventories, EIA Cushing Crude Oil Stocks Change, EIA Distillate Stocks Change.

Thursday: Core Inflation Rate MoM and YoY, Inflation Rate MoM and YoY, Initial and Continuing Jobless Claims, Jobless Claims 4-Week Average, Monthly Budget Statement.

Friday: PPI MoM, Michigan Consumer Sentiment Preliminary, Michigan 5-Year Inflation Expectations Preliminary, Michigan Inflation Expectations Preliminary, Fed Quarles Speech.

Recent News:

The U.S. labor market looks to be losing its steam as the COVID-19 pandemic rages. reut.rs

Boeing Co (NYSE: BA) is reducing its 787 widebody production to five jets per month. reut.rs

For now, despite rising economic risks, the Fed will probably not ramp its bond-buying. reut.rs

S&P Global Inc (NYSE: SPGI), IHS Markit Ltd (NYSE: INFO) merger credit positive. bit.ly

Economic recovery will likely be uneven across Latin American countries and sectors. bit.ly

The business environment has improved, but will remain unsettled over the next year. bit.ly

These are the startups that are still expected to go public before the end of December. bit.ly

AstraZeneca PLC’s (NASDAQ: AZN) COVID-19 data has positive social implications. bit.ly

The rapid recovery in profits could be signaling a brisk recovery by business activities. bit.ly

U.S. retail operating profit will grow in 2021 with growth pronounced in hard hit sectors. bit.ly

Britain and the EU make a last-ditch attempt to strike a post-Brexit trade deal this week. reut.rs

Trump and McConnell expected to back a pandemic relief bill before the end of the year. bloom.bg

Travel and tourism demand will take several years to recover to pre-COVID-19 levels. bit.ly

Goldman Sachs Group Inc (NYSE: GS) could move a key division to new Florida hub. bloom.bg

Mystery surrounds a $7 billion outflow from one large Vanguard exchange-traded fund. bloom.bg

Key Metrics:

Sentiment: 49.1% Bullish, 28.3% Neutral, 22.7% Bearish as of 12/02/2020. bit.ly

Gamma Exposure: (Trending Neutral) 4,429,232,865 as of 12/04/2020. bit.ly

Dark Pool Index: (Trending Lower) 40.4% as of 12/04/2020. bit.ly

Disclaimer:

This is a page where I look to share knowledge and keep track of trades. If questions, concerns, or suggestions, feel free to comment. I think everyone can improve, especially me.

In no way should this post be construed as investment advice.

EURUSD LONG on Order Flow - Follow the smart money! Strong Bullish Signal:

The price tested the resistance, but could not break it out and corrected downwards. However, given the presence of the strong uptrend which was supported by the large volume, we still should consider that the smart money are pushing the price up.

Volume Zones:

We need to point out the resistance level 1.2155 - 1.2170, which contains the large volume. The price is still trading nigh this mark.

Sentiment:

This indicator shows that 84% retails traders are in short positions, which is a good additional signal for us (trading against the "crowd").

b.radikal.ru

Consider Long Positions:

Given all these factors, we may regard a scenario of the breakout of the resistance, which will be a great bullish signal. The rise must be keen and supported by the large volume, which will be a more secure signal for entering the market. A stop loss may be placed below the breakout volume bar.

Profit Potential:

More than 100 pips.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -

GBPUSD - Its Not OverPersonally, I think buying will continue, we may get the typical sell lure but for the most part I think we will test the prior highs again. As illustrated we may have a manipulated head and shoulders pattern before shooting back to the upside. This is not my favourite setup but I will work with it next week.

GBPJPY - Trend ContinuationIn my view the trend is still bullish until we manage to crossover the ascending trend line. I would like to think that price has pulled back to the 4hr resistance level in order to stop loss hunt buyers from the resistance break. We may now see the continuation to the upside.

EURUSD - The Trend Never EndsDon't try and create an ending point in your head for when you think a trend will finish, this will only cause you more pain. It is very unlikely price will leave the station without grabbing liquidity/orders from its highs, expect a push up into prior highs before a huge sell-off, if there is one. I will be looking for short intra-day buys next week and will keep you updated on the progress.

Retail is selling this pair hard at 71%, banks love to mess around with retail, don't get caught in the traps.

EURUSD LONG on Order Flow - Follow the smart money! Strong Bullish Signal:

The pair showed a sharp growth and tested the level of resistance. The price did not break it out, but is still testing it. The move was on the large volume, so that we may assume that the smart money pushed the price up. It increases the possibility of the further surge.

Volume Zones:

We need to point out the new resistance level 1.2155 - 1.2170, which contains the large volume and is being tested now.

Sentiment:

This indicator shows that 85% retails traders are in short positions, which is a good additional signal for us (trading against the "crowd").

d.radikal.ru

Consider Long Positions:

Given all these factors, we may regard a scenario of the breakout of the resistance, which will be a great bullish signal. The growth must be sharp and supported by the large volume, which will be a more reliable signal for entering the market. A stop loss may be placed below the breakout volume bar.

Profit Potential:

More than 100 pips.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -

EURUSD LONG on Order Flow - Follow the smart money! Strong Bullish Signal:

The price corrected downwards, but then resumed rising. The movement was keen and supported by the large volume, which shows that there is a significant imbalance of long positions.

Volume Zones:

We need to allocate the new volume level of support 1.2038 - 1.2049, which has been already tested.

Sentiment:

This indicator shows that 86% retails traders are in short positions, which is a good additional signal for us (trading against the "crowd").

b.radikal.ru

Consider Long Positions:

Given all these factors, we may cogitate purchases after a smooth and slight downward correction of the price, in order to get a better entry point. A stop loss may be placed below the support level.

Profit Potential:

More than 100 pips.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -

EURUSD LONG on Order Flow - Follow the smart money! Strong Bullish Signal:

The price demonstrated an abrupt and keen growth supported by the large volume. The pair broke out the previous resistance level/local maximum, so now there are no obstacles for a further rise of the price. Moreover, the large positive delta implies that there is a huge long positions imbalance.

Volume Zones:

We need to point out the new support level 1.2009 - 1.2019, which contains the large volume.

Sentiment:

This indicator shows that 86% retails traders are in short positions, which is a good additional signal for us (trading against the "crowd").

c.radikal.ru

Consider Long Positions:

Given all these factors, we should prefer a scenario of opening long positions. We may enter the market after a smooth downward correction, in order to get a better entry point. A stop loss should be placed below the new support level with a little margin.

Profit Potential:

More than 120 pips.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -

Market EXTREMELY complacent right now; long VIX "Be fearful when others are greedy" - Warren Buffet.

More applicable now than ever !

I've looked at the put/ call ratio as well as VIX which reflect extreme greed and a broken market. This type of euphoria that "stocks can never go down" is only a belief of dumb money and a strong indication of a top.

November 29 Market Update | Technical, Fundamental, NewsDescription:

An analysis for the week ahead.

Points of Interest:

$3,631 High-Volume Area, $3,655 and $3,668.75 Rally Highs, $3,620 and $3,610 Nodes.

Technical:

After an initiative drive alongside news that provided clarity on the election transition, participants recovered the $3,580 balance-area boundary, invalidating the prior week’s selling activity. Afterwards, conviction disappeared and the market remained range-bound, as evidenced by a non-participatory delta (i.e., the non-presence of committed buying) and mechanical trade (i.e., low-excess at the edges of developing balance).

Given that initiative buyers remain in control, participants come into Monday’s session knowing recent activity has been dominated by short-term, momentum-driven buying, sentiment is stretched, and cash levels are low.

Therefore, if participants manage to spend time and build value above the $3,631 micro-composite high-volume node, then the S&P 500 may confirm a multi-month balance-break. Otherwise, an initiative drive below the high-volume node would put the rally on hold.

Image of potential $SPX Balance-Break:

Fundamental:

In a commentary, BlackRock upgraded its outlook on U.S. equities. bit.ly

We upgrade U.S. equities to overweight, with a preference for quality large caps riding structural growth trends – as well as smaller companies geared to a potential cyclical upswing. We prefer to look through any near-term market volatility as Covid cases surge. Positive vaccine news reinforces our outlook for an accelerated restart during 2021, reducing risks of permanent economic scarring.

Simply put, BlackRock suggests an accelerated restart on structural growth trends and a cyclical upswing, as a result of positive COVID-19 coronavirus vaccine developments, could benefit the market during 2021.

Key Events:

Monday: Pending Home Sales YoY.

Tuesday: Markit Manufacturing PMI Final, ISM Manufacturing PMI, Construction Spending MoM, Fed Chair Powell Testimony, ISM Manufacturing Prices, Fed Brainard Speech, Fed Daly Speech, Fed Evans Speech.

Wednesday: MBA Mortgage Applications, ADP Employment Change, Fed Quarles Speech, Fed Williams Speech, Fed Chair Powell Testimony, Fed Harker Speech, EIA Cushing Crude Oil Stocks Change, EIA Distillate Stocks Change, Fed Williams Speech, Fed Beige Book.

Thursday: Continuing Jobless Claims, Initial Jobless Claims, Jobless Claims 4-Week Average, ISM Non-Manufacturing Business Activity, Non-Manufacturing Employment, Non-Manufacturing New Orders, Non-Manufacturing PMI, Non-Manufacturing Prices.

Friday: Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings MoM, Average Hourly Earnings Mom and YoY, Average Weekly Hours, Balance of Trade, Nonfarm Payrolls Private, Participation Rate, Fed Evans Speech, Factory Orders MoM, Fed Bowman Speech.

Recent News:

Yellen would push expansive economic policy amid hawkish fiscal tone. bloom.bg

Hedge fund Citadel doubled down, and more, on shale in third quarter. bit.ly

JPMorgan Chase and Co (NYSE: JPM) says the economy will shrink. bit.ly

OPEC+ faces seismic demand split as cartel, ministers plot next move. bloom.bg

Tesla Inc’s (NASDAQ: TSLA) S&P debut will put $100 billion in motion. on.wsj.com

The International Energy Agency releases 2020 World Energy Outlook. bit.ly

Biden presidency to create ‘big momentum’ on tackling climate change. bit.ly

Tesla Inc’s plan to turn Berlin plant into ‘world’s largest EV battery plant’. bit.ly

Interim Report: NYMEX WTI Crude Contract Trading around April 2020. bit.ly

Regulator rescinds Boeing Co (NYSE: BA) 737 order, a credit positive. bit.ly

Coca-Cola Co (NYSE: KO) to not benefit from U.S. Tax Court opinions. bit.ly

Alphabet Inc’s (NASDAQ: GOOGL) growth into banking bad for banks. bit.ly

Nasdaq Inc’s (NASDAQ: NDAQ) acquisition of Verafin a credit negative. bit.ly

Could a COVID-19 vaccine mean a rebound for travel startups in 2020? bit.ly

Ten COVID-19 vaccines seen by mid-year says head of a pharma group. reut.rs

Facebook Inc (NASDAQ: FB) crypto Libra to launch as early as January. reut.rs

Key Metrics:

Sentiment: 47.3% Bullish, 25.3% Neutral, 27.5% Bearish as of 11/25/2020. bit.ly

Gamma Exposure: (Trending Neutral) 3,668,362,084 as of 11/27/2020. bit.ly

Dark Pool Index: (Trending Lower) 41.5% as of 11/27/2020. bit.ly

Disclaimer:

This is a page where I look to share knowledge and keep track of trades. If questions, concerns, or suggestions, feel free to comment. I think everyone can improve, especially me.

In no way should this post be construed as investment advice.

VIX Cycle: “Shock-Reversal-1-2-3-4” Repeat“Shock-Reversal-1-2-3-4” is a model or cycle that occurred on VIX a few times since 2018. What is important is to recognize in which stage of that cycle the VIX is currently positioned. We see fear dropping as stocks are recovering since March as investors are less concerned about the potential risk-off because of QE and vaccine solution to coronavirus. But we know that markets are moving from pessimism to optimism due to different global events which are the main reasons for change in investors mood. Now we see optimism increasing, which is the first but important evidence for next important upcoming cycle. When reading the current model of VIX cycle then we shall be aware that there can be slightly more upside left on stocks, but then maybe in 2021, cycle may change with a jump in fear especially if VIX goes even lower. We think that “shock” is the next leg, and that increase in volatility may cause a new turn on stocks. However, this may not be the case just yet, maybe sometime in 2021, but we think that even if stocks will continue straight to the upside it’s much safer to join the ride after higher degree retracement.

Breakout opportunity on AUDUSDA breakout opportunity is forming on the AUDUSD.

The pair is currently consolidating after a recent uptrend that offered two nice buying opportunities. Price movements are increasingly compressed and will eventually break. As of now, the breakout could be either to the upside (trend continuation) or to the downside (retest of the previous major support) so let's just wait and see when the breakout comes.

Last but not least, always check confirmation from the indicators!

GBPUSD LONG on Order Flow - Follow the smart money! Strong Bullish Signal:

The pair showed a sharp growth and broke out the previous level of resistance. Now there is now obstacle for further growth of the price. Moreover, the increased positive delta shows that buyers are prevailing the market at the moment.

Volume Zones:

The move was on the average volume, hence, we cannot allocate any new volume or zone.

Sentiment:

This indicator shows that 73% retails traders are in short positions, which is a good additional signal for us (trading against the "crowd").

a.radikal.ru

Consider Long Positions:

Given all these factors, we should prefer long positions. We may enter the market after a smooth downward correction, in order to get a better entry point. A stop loss should be placed below the beginning of the sharp rise.

Profit Potential:

More than 150 points.

To learn more about order flow based volume trading, sentiment analysis and trading against the retail crowd see the educational article below -