Sentimentanalysis

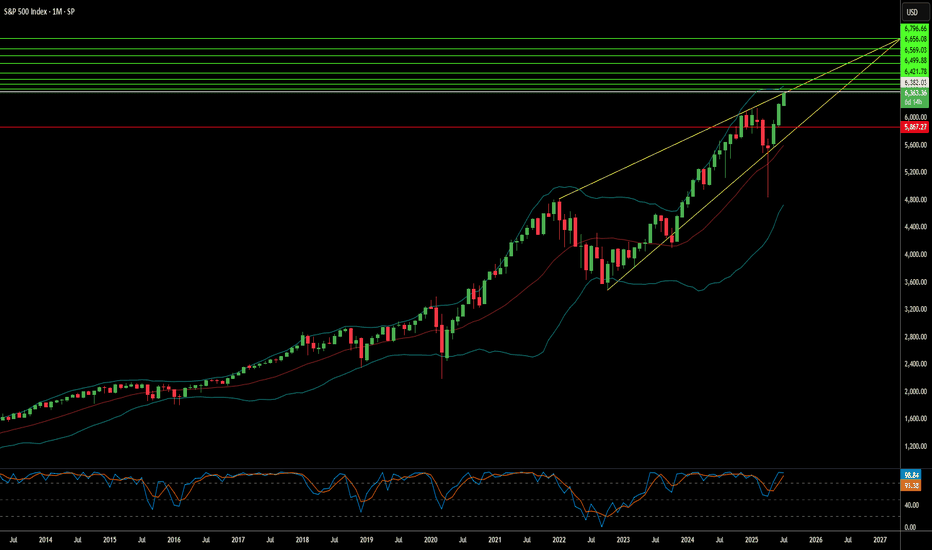

Can the S&P 500's Ascent Continue?The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in particular, demonstrated impressive growth, reinforcing investor confidence in the broader market's strength.

Geopolitical and geostrategic developments have also played a crucial role in bolstering market sentiment. Recent "massive" trade agreements, notably with Japan and a framework deal with Indonesia, have introduced greater predictability and positive economic exchanges. These deals, characterized by reciprocal tariffs and substantial investment commitments, have eased global trade tensions and fostered a more stable international economic environment, directly contributing to market optimism. Ongoing progress in trade discussions with the European Union further supports this positive trend.

Furthermore, resilient macroeconomic indicators underscore the market's upward trajectory. Despite a recent dip in existing home sales, key data points like stable interest rates, decreasing unemployment claims, and a rising manufacturing PMI collectively suggest an enduring economic strength. While technology and high-tech sectors, driven by AI advancements and strong earnings from industry leaders like Alphabet, remain primary growth engines, some segments, such as auto-related chipmakers, face challenges.

The S&P 500's climb is a testament to the powerful confluence of strong corporate performance, favorable geopolitical shifts, and a resilient economic backdrop. While the immediate rally wasn't directly driven by recent cybersecurity events, scientific breakthroughs, or patent analyses, these factors remain critical for long-term market stability and innovation. Investors continue to monitor these evolving dynamics to gauge the sustainability of the current market momentum.

CME & Deribit Insights:Smart Money Takes Profits Ahead of ExpiryCME session update.

115 000$ partially closed just closed right before the price drop — someone had a piece of their options portfolio at 115,000 strike level already squared away. Safe to say it was an experienced player who got out near the top 💡

The good news: "he" still have about 2/3 of the portfolio open at that 115K strike.

The bad news: nothing’s happened yet …

But here’s what Deribit is showing us......

👀 Observation : In the May 30 options series, the highest trading volume is concentrated between 110,000–120,000 strike levels — which makes sense given the current underlying price.

But here’s the twist: this isn’t so much new positioning as it is existing players selling off . Yep — those moves were definitely noticed. Some traders are locking in profits, even though we’re still 17 days out from expiry .

Overall, classic playbook:

Smart money lightens the load , while the not-so-smart money tries to pick up the pieces.

(Though let’s be honest — there’s way less "dumb money" in options than in spot markets 😉)

💡 Sentiment remains Bullish, but correction is prevailing at the moment!

🎯 No Valuable Data, No Edge!

Market Overview (May 7, 2025)📊 Key Metrics

1. Funding Rate: ~0.018% (on Binance)

— positive rate indicates long position dominance and bullish sentiment

2. Open Interest (OI): GETTEX:29B , up ~ SEED_TVCODER77_ETHBTCDATA:7B in recent days

— rising OI suggests new positions are opening, increasing volatility risk

3. ETF Inflows: +$420.9M (May 6)

— strong institutional demand, especially into BlackRock’s IBIT

4. Fear & Greed Index: 67 (Greed)

— rising greed may signal potential for a short-term correction

⸻

📈 Market Movement Probability

• Upward: 60%

(supported by ETF inflows and positive funding)

• Downward: 40%

(high greed and rising OI could trigger a correction)

⸻

Disclaimer: This is not financial advice. Always do your own research.

Market Overview (May 5, 2025)

📊 Key Metrics

1. Funding Rate: -0.0024% (on Binance)

— traders are paying to hold short positions, signaling bearish pressure

2. Open Interest (OI): $27.5B, down –3.13% in 24h

— positions are closing, possibly due to liquidations or profit-taking

3. ETF Inflows: +$674.9M (on May 2)

— strong institutional demand, especially into BlackRock’s IBIT

4. Fear & Greed Index: 52 (Neutral)

— sentiment has stabilized after a period of greed

⸻

📈 Market Movement Probability

• Upward: 55%

(potential short squeeze fueled by ETF inflows)

• Downward: 45%

(OI is dropping, market losing momentum)

⸻

Disclaimer: This information is not financial advice and should not be used as the sole basis for investment decisions.

Bears Knocked Out: Market Sentiment Shifts as Bulls Cut ProfitGuys, don't get me wrong, but it's like they knock out the bears before going down. The sentiment indicators we're looking at agree with that.

In particular, yesterday, with the rise in quotes, some participants are actively draining call options in-the-money with about 15 trading days ahead. In other words, they just cut the profits and didn't wait.

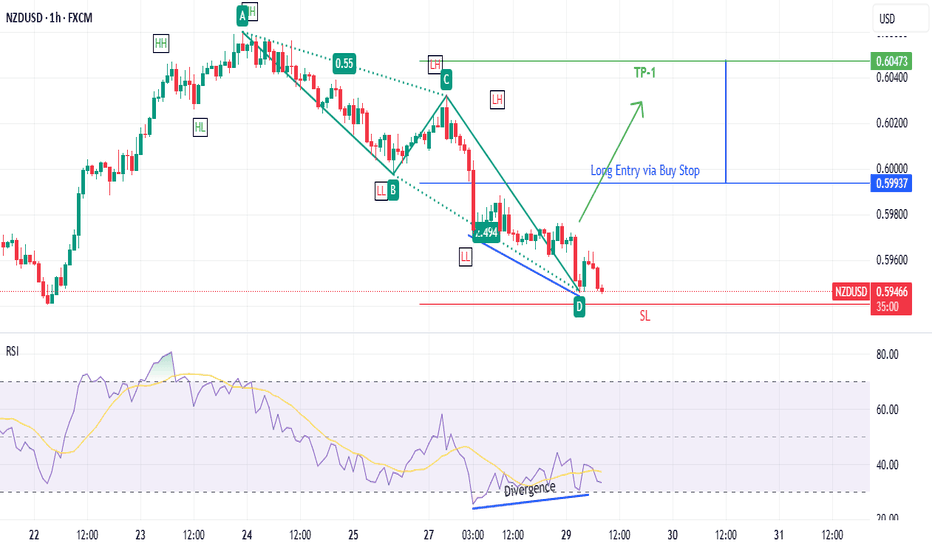

Take a look at this chart

It shows the balance of bullish and bearish open positions among retail traders, and how it change over time. Two things are clear: 1) there's a correlation between how prices move and the number of traders who are long vs. short, and 2) there are certain levels where the balance tips and the trend reverses (basically, it's like a oscillator indicator).

The red line shows your current position. You'll have to make your own decisions and observations.

Use retail sentiment in your trades - it's a great tool that can help strengthen your strategy and make your trading more efficient.

Decoding Market Mood: The Sentimental Drivers of Gold FuturesIntroduction

In an era where information is as precious as gold itself, understanding the underlying currents that drive market sentiment has become crucial for traders and investors alike. Gold Futures, a standard in hedging against economic uncertainty and inflation, serve as a beacon for those navigating the volatile seas of the financial markets. This article embarks on an explorative journey into the realm of sentiment analysis, uncovering how shifts in global mood translate into movements in Gold Futures prices. Through a blend of case studies and theoretical insights, we will decode the signals broadcasted by market participants, hopefully offering a compass for those seeking to align their strategies with the underlying emotional and psychological state of the market.

Understanding Sentiment Analysis

The Essence of Sentiment Analysis:

At its core, sentiment analysis in the financial markets involves the qualitative assessment of the collective mood or opinion of investors towards a specific asset or the market as a whole. It transcends traditional analysis by incorporating psychological and emotional factors, aiming to assess market movements based on the prevailing sentiment. This approach acknowledges that market prices are not solely driven by fundamental indicators but are also heavily influenced by human emotions and perceptions.

Application in Financial Markets:

In the realm of Gold Futures, sentiment analysis serves as a powerful tool to gauge investor confidence, fear, and overall market outlook. It encompasses the examination of various sources, including news articles, social media chatter, economic reports, and geopolitical events, to construct a sentiment score or index. This score reflects the general optimism or pessimism surrounding gold as an investment, influencing traders' decisions to buy or sell Gold Futures contracts.

The Impact of Sentiment on Gold Prices:

Gold's allure as a safe-haven asset makes it particularly sensitive to changes in market sentiment. During times of economic uncertainty or geopolitical tensions, a surge in pessimism can lead to increased demand for gold, pushing prices upward. Conversely, in periods of market optimism, where riskier assets become more appealing, gold may see reduced demand, leading to a decline in prices. Understanding these sentiment-driven dynamics is essential for anyone trading Gold Futures, as it allows for more informed decision-making, aligning trades with the broader market mood.

Factors Influencing Gold Market Sentiment

The sentiment toward gold is shaped by a myriad of factors, ranging from macroeconomic indicators to geopolitical events. Understanding these influences is paramount for traders aiming to navigate the Gold Futures market effectively. This section delves into these factors, reinforced by case studies that highlight their impact on gold prices.

Economic Indicators and Central Bank Policies:

Gold is often viewed as a hedge against inflation and currency devaluation. Economic indicators such as inflation rates, GDP growth, and unemployment figures significantly influence investor sentiment toward gold. Central bank policies, including interest rate decisions and quantitative easing measures, also play a crucial role. For instance, a decision by a major central bank to lower interest rates can lead to a weaker currency, prompting investors to turn to gold as a store of value.

Case Study 1: Gold finishes October on a high

In October 2023, amidst heightened geopolitical tensions and central bank activities, gold rallied, marking its highest monthly close by the LBMA PM price. This movement was influenced by a combination of factors, including COMEX futures' net short positions and substantial ETF inflows. The case underscores how geopolitical uncertainties and central bank maneuvers can drive investor sentiment, steering the direction of Gold Futures prices.

Geopolitical Tensions

Geopolitical events and uncertainties can lead to increased volatility in the financial markets, with gold often benefiting as a perceived safe haven. Conflicts, elections, and trade negotiations can sway investor sentiment, leading to spikes in gold demand.

Case Study 2: Geopolitical and economic uncertainty boost gold demand and prices

The World Gold Council's report indicated a slight dip in annual gold demand for 2023 but highlighted that demand from OTC markets and central banks kept the average annual gold price at historic highs. Despite ETF outflows, sectors like bar and coin investment and the global jewelry market showcased resilience, illustrating how geopolitical and economic uncertainties can bolster gold's appeal.

Social and Environmental Considerations

The growing emphasis on responsible sourcing and environmental sustainability is influencing investor sentiment toward gold. Initiatives aimed at ethical mining practices and combating illicit gold trade affect the market's perception and, subsequently, gold prices.

Case Study 3: Collaboration underway to develop consolidated standard for responsible mining

Efforts to establish a global standard for responsible mining, involving major industry players, highlight the market's shift toward sustainability. This collaboration aims to create a unified framework that reassures investors about the ethical provenance of their gold investments, potentially impacting demand.

Case Study 4: World Gold Council and DMCC Collaborate to Combat Illicit Hand-Carried Gold Trade

This strategic initiative to strengthen international regulations around gold sourcing and trade showcases the industry's commitment to ethical practices. Such measures not only enhance gold's reputation as a responsible investment but also influence market sentiment by ensuring a more transparent and reliable supply chain.

Central Bank Activities

Central banks are significant players in the gold market, with their buying and selling activities offering insights into their confidence in the global economy. Their actions can serve as a barometer for gold's future trajectory.

Case Study 5: Central banks maintain historic buying pace in Q3

The Q3 2023 Gold Demand Trends report highlighted continued robust demand for gold, with central bank purchases significantly contributing to quarterly demand. This activity underscores central banks' role in bolstering gold market sentiment and illustrates their confidence (or lack thereof) in the current economic landscape.

Applying Sentiment Analysis to Gold Futures Trading

Incorporating sentiment analysis into trading strategies for Gold Futures involves a nuanced understanding of market mood and its implications for future price movements. This section discusses the current sentiment influenced by geopolitical and economic uncertainty and how it sets the stage for trading decisions in 2024.

Current Market Sentiment and Gold Futures

As we edge into 2024, the geopolitical and economic landscape continues to shape investor sentiment toward gold. The World Gold Council's Gold Demand Trends report for 2023 highlighted a nuanced market. Despite a slight decline in annual demand, the total demand reached a new record, propelled by central bank buying and OTC investments. This paradoxical situation—where demand dips but overall interest remains high—underscores the complex interplay of factors influencing gold prices.

The Future of Gold Futures and Sentiment Analysis

As sentiment analysis becomes increasingly sophisticated, its application in trading Gold Futures is expected to evolve. The development of AI and machine learning tools will enhance our ability to gauge market mood, providing traders with deeper insights and more accurate predictions. The integration of sentiment analysis into trading strategies will likely become more mainstream, offering a competitive edge to those who can interpret and act on market sentiment effectively.

Trade Plan for Gold Futures

Given the current sentiment and market conditions, there's a compelling case for a bullish outlook on gold. As such, we present a trade plan to go long on Gold Futures, with specific attention to risk management and catering to traders with varying risk appetites.

Point Values and Contract Options

Standard Gold Futures (GC): Each contract represents 100 troy ounces of gold, and the point value is $100 per troy ounce. This means a $1 move in the gold price equates to a $100 change per contract.

Micro Gold Futures (MGC): For traders with a lower risk tolerance, Micro Gold Futures offer a smaller-scale opportunity. Each MGC contract represents 10 troy ounces of gold, with a point value of $10 per troy ounce, providing a more accessible entry point into gold trading.

Trade Plan Details

Entry Price: 2045.2

Stop Loss Price: 2001.7

Target Price: 2156

Rationale: The entry is predicated on current sentiment indicators and technical analysis, suggesting an upward momentum. The stop loss is strategically placed below key support levels to mitigate risk, while the target price is set at a level that previous sentiment-driven rallies have reached.

Micro Gold Futures for Lower Risk Appetite

For traders looking to engage with the gold market at a reduced risk level, Micro Gold Futures (MGC) provide an excellent alternative. Utilizing the same trade plan but with MGC contracts allows traders to manage their exposure more precisely, tailoring their investment to their comfort with risk while still capitalizing on gold's potential upside.

Risk Management and Consideration

Effective risk management is the cornerstone of successful trading, especially in the volatile realm of Gold Futures. Trading based on sentiment analysis introduces unique challenges and opportunities, making it imperative for traders to employ robust risk management strategies. This section emphasizes the significance of managing risk to preserve capital and sustain profitability over the long term.

Understanding Risk in Sentiment-Based Trading

Trading on sentiment involves interpreting market moods that can swiftly change due to unforeseen events or shifts in investor perception. Such volatility requires traders to be vigilant and adaptive, employing strategies that protect against sudden market movements.

Key Risk Management Strategies

Setting Stop Loss Orders: A well-placed stop loss can prevent significant losses by automatically closing a position if the market moves against your prediction. For the trade plan outlined (going long on Gold Futures), the stop loss at 2001.7 is critical for limiting potential downside.

Position Sizing: Adjusting the size of your trade according to your risk tolerance and account size can mitigate risk. For traders utilizing Micro Gold Futures (MGC), this means leveraging the smaller contract size to maintain control over exposure.

Diversification: While our focus is on Gold Futures, diversifying your portfolio across different assets can reduce risk. This strategy ensures that adverse movements in gold prices do not disproportionately impact your overall trading performance.

Regular Monitoring and Adjustment: Sentiment can shift rapidly; regular monitoring of sentiment indicators and readiness to adjust your positions accordingly is essential. This includes potentially moving stop loss levels or taking profits early if the sentiment begins to change.

Utilizing Hedging Techniques: Options and other derivative products can be used to hedge against your Gold Futures positions, offering protection against adverse price movements.

Incorporating Micro Gold Futures for Risk-Averse Traders

Micro Gold Futures contracts provide a nuanced way to engage with the gold market while managing risk exposure. For those cautious about sentiment-driven volatility, trading MGC allows for participation in potential upside movements without the larger capital exposure associated with standard Gold Futures contracts.

Conclusion: The Sentimental Journey of Gold Futures

The intricate dance between market sentiment and Gold Futures prices underscores the dynamic nature of financial markets. By decoding the mood of the market, traders can align their strategies with the prevailing winds, navigating through periods of uncertainty with informed confidence. This article has journeyed through the application of sentiment analysis, from understanding its foundations to applying it in trading strategies, and underscored the paramount importance of risk management.

As we look ahead, the role of sentiment analysis in trading Gold Futures is poised to grow, propelled by advancements in technology and a deeper understanding of market psychology. The traders who succeed will be those who not only master the art of sentiment analysis but also adhere to disciplined risk management practices, ensuring their trading journey is both profitable and sustainable.

In the ever-changing landscape of the gold market, the wisdom lies not just in predicting the future but in preparing for it with a well-rounded strategy that embraces sentiment analysis as a powerful tool in the trader's toolkit.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Short oil @ 90.60 with a stop on close above 92.4Commercials are max short and both Large & Small speculators are long. Today looks like a reversal day. Everyone is expecting $100+

www.bloomberg.com

"Oil surged to a 10-month high — extending a powerful rally that may rekindle inflation — as supply cuts from OPEC+ tightened the market, with Saudi Arabia’s energy minister shying away from any change in course.

Global benchmark Brent topped $95 a barrel for the first time since November, advancing for a fourth day after Saudi Arabia and Russia curtailed production. The tighter market has ignited a flurry of predictions that $100 oil could soon return in a roster than runs from industry heavyweights such as Chevron Corp. Chief Executive Officer Mike Wirth to traditional bears at Citigroup Inc.

12/29/22 Intraday PlanningHi all and welcome back! Today's market seems like it wants to keep opening traders in suspense with intraday long targets quickly being achieved right from the opening bell. That being said, here are my two main scenarios with a third outlier scenario (this seems to be a handy format!):

Scenario 1 - Opening highs are broken, blocking short targets: In this scenario, the market breaks highs set around the open confirming long momentum. Expect longs towards the weekly open. Intraday targets have been achieved for longs so either a slow grind or unexpected sharp move is possible.

Scenario 2 - Opening highs are not broken and/or opening lows are broken: In this scenario, the market does not breaks highs set around the open. Intraday short targets will then be in play and shorts back into today's opening range can be expected. This scenario gains a higher chance of occurring if opening lows are broken though potential profit will be reduced. Breaking today's low is very unlikely so assess risk accordingly.

Scenario 3 - Opening highs and lows are broken - leaning short: In this VERY UNLIKELY scenario, the market breaks highs and lows set around the open. In this case, expect to lean short into today's range the same as scenario 2. Unexpected late day moves are also possible.

Apologies on the lateness today, I've been super busy! See you all tomorrow and good luck!

Billy_FX_

12/28 NQ Intraday PlanningHi all, back at it for the second day =). We've seen a lot of ranging action this morning which has already taken many targets out of play according to my plan. As a result, I have three scenarios with a long bias until opening lows are breached.

Scenario 1: Sellers have been absorbed and bullish zones remain true, expect pullbacks to around the equity open or lower but within today's lows. Extra confirmation if price continues to rise after opening action has ended.

Scenario 2: Opening highs are not broken and price breaks opening lows. The plan will be to hone into (my) prepared technical setups and timing for potential short trades. Be wary of a slow grind (chop) or unexpected moves since intraday targets will be harder to define.

Scenario 3: This scenario has a VERY LOW chance of happening and is not drawn but is still worth mentioning. Both the opening highs and lows will be spiked in this scenario in which case the expectation is to lean long with a focus on prepared technical setups and timing to execute. If yesterday's high to open are already broken by this point, then there will be no intraday bias except one based on technical setups and timing.

As usual I will be eyeing all the indices and sitting tight, good luck all!

12/27/22 NQ Intraday PlanningHi all, felt like sharing my intraday planning for NQ today. I have two scenarios based on the opening range especially since we have taken out local lows (high probability short targets) during the open. Please note that the idea is shown on a 15-minute chart but I will often use lower timeframes (5 minute) to plan and execute.

If the low set during the opening range is not revisited some time after the open, I expect there to be a higher probability of going long, with further long confirmation as the market climbs. It is unlikely that new highs will be set today (possibly even a late day selloff), but it is possible to set new highs if the market climbs with some hourly momentum. Also it is possible that longs can be faked out into the next scenario below so size accordingly.

If the low set during the opening range is breached some time after the open, I would expect a higher probability of a slow crawl down or an unexpected spike short since all high probability short targets have been achieved. It is also likely in this scenario that the market can pullback within the opening range and chop at least until late in the day.

With both scenarios there is a clear element of unpredictability (where a quality scenario will usually provide a clear directional bias in terms of which targets are likely/unlikely). It would be wise to control size and maximum loss today with a focus on taking clean technical setups. I have a clear reproducible setup I use to execute these scenarios, so I take no responsibility for whatever setup you choose to take ;)

Good luck all,

Billy_FX_

VIX Diamond reversal may reach 27/25 for a 4Q election rally?VIX reach the major resistance at 35. There is a great chance this diamond pattern may bring down VIX

back to 27 support or the ideal 25 just in time for a historical 4Q midterm election rally into December.

Watch next few days to see if price bounces up from diamond base or continues down.

Not trading advice

BTC (Weekend Outlook)Honestly, this "bottom" is pretty weak. There are signs of incredible resiliency, but there's a breaking point for traders, and the market FUD/suppression/over-selling in order to orchestrate whales buying the dip to $30k-$35k might have been too aggressive. Bitcoin should/could claw back to $40k this weekend, which wouldn't be terrible, but it likely won't push through to $42,500 yet. Longs at today's earlier "dip" that are being currently retested should result in a bounce (maybe), but without influx of new cash, USDT outflow, or BTC.D increase from alt-sell off, $40k touch to a lower-low will be likely.

Here's hoping some random hedge fund buys 100,000BTC like magic tomorrow afternoon, and we all buy lambos on Monday.

Bullish Behavior - MaybeBitcoin has been operating sub 0sigma since the Elon fiasco kicked the market into high downward gear, however - this latest Trend Map (sentiment trend forecasts mapped to provide levels similar to Fib Retracement levels) looks like BTC might (maybe) try to stabilize and rise above the trend-median price (0sigma) which puts $53,500 to $58,000 (high target) on the radar. Finger's crossed for those of us that enjoy going long on BTC.

BTC USD (Sentiment Forecast)Sentiment data is marginally different than traditional technical analysis.

Median Trend Price, aka 0sig = Orange Line

Resistance, aka 1sig = Yellow, upper

Support, aka -1sig = Yellow, lower

Extended Resistance/Support (2/-2sig) = gray, respectively

Green is the 3sig (extended target)

Red is the -3sig (retracement level)

Ranging between the -1 and 1 sig provides a level of price strength. Continued action above the -1sig will keep the upper 3sig target on the table, I'm terms of how the trend is leaning. I don't see $60k just yet with BTC, but high $59k prior to retrace range sub -2sig is likely.

#USDCADThe pair is still in a downtrend and will probably decline to the bottom of the channel due to the oil price rally and crossing the short-term range. After that, if Dollar strengthens, buyers expect the price to reach to the upper edge of the channel. Meanwhile, the 4-hours trend line will show not much strong resistance.

GBP STILL BULLISHlooking at the chart we have marked out key levels with active Options strike prices supported with high volume and open interest. We plan to observe how price reacts at 1.3300 and 1.2500 levels prior the the expiration of these contracts. In terms of price action , Cable still maintains an upward trajectory in line with non-commercial sentiments and seasonal outlook. UK bond price maybe trending downwards in line with its inverse relationship with the GBPUSD. However, the Brexit fears may invalidate this move if the trend line is broken and prices fall below 1.2500

Risky short on USDCHFLong term we have a downtrend on USDCHF. Retail sentiment is also 70% long so looking for shorts here. However, recently price has started ranging and there is a slight uptrend in the last few days.

Either take a risky short now or wait until price breaks out of its current range.

BTC- Slow correction or the second phase of bull trend?Now, the effect of the major short squeeze has worn off. Where will BTC go now?

5 months of downward price movement with low volume and volatility is worrisome, but the recent breakout of the downward trend would remain a lone silver lining of this distribution period if BTC can fend off the 8k retest.

BTCUSD realized volatility_10 day is 1/3 of what it was back in June & July

The Bitmex fund rate and OI are very low relative to the April-June period

Institutional buyers are not helping either. Bakkt's BTC OI indicates a lukewarm sentiment and COT-CME's institutional buying has been slowly increasing its shorts as do the 4 biggest shorts.

I think BTC ETF, ETH 2.0, and ETH future contracts on the U.S regulated exchange are some of the fundamental and catalytic changes that will get more retail money to flow into the crypto space

More liquidity, custody and ironically, regulation will probably inject the much-needed institutional money into the crypto market

Until then, patience and discipline will serve you well in this stagnant and low-volatility market condition