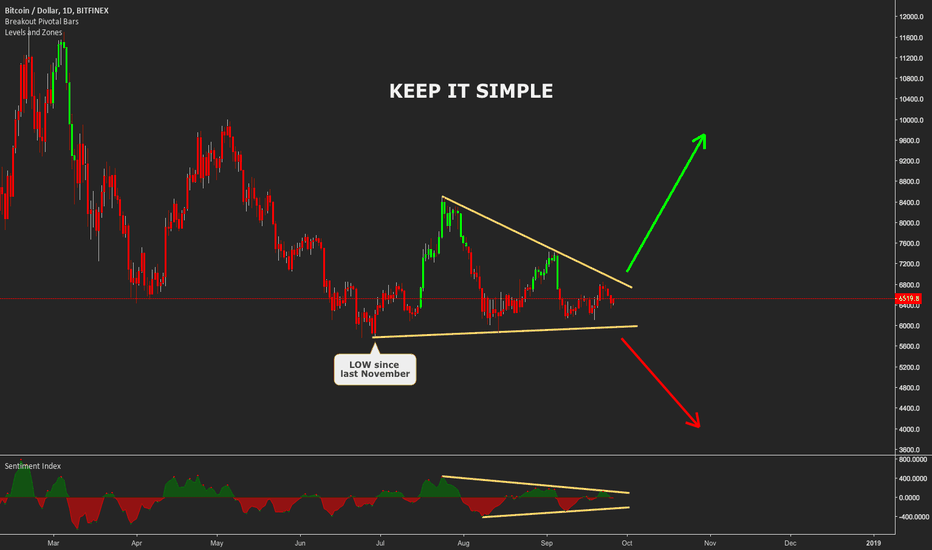

BIG MOVE COMING ON BTCUSDThe BTCUSD is due to a major move soon. The pair has been consolidating to the downside for several months now and it has been significantly squeezing until now.

During the last few months, the pair formed Lower Highs and Higher Lows, hence forming a nice pattern that is about to be broken.

The Sentiment Index is squeezing which is a great indication that something big is about to happen.

The Breakout Pivotal Bars is negative (red candles) so a breakdown seems more likely but we need to wait and see the color of the breakout candle.

Either way the price will break, we are prepared and ready to profit from the move.

Sentimentindex

Breakout opportunity on AUDUSDA breakout opportunity is forming on the AUDUSD. The pair is in a downtrend from a few weeks and has already given three very great sell opportunities. The setup was identical for all the three:

• breakdown of price

• breakdown of Sentiment Index

• opportunities below resistance

Right now the breakout could be either to the upside or to the downside so let's just wait and see when the breakout comes.

Last but not least, always check confirmation from the indicators!

LONG BITCOIN TO BOTTOM AT $5K? History reveals hidden "There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again" -Jesse Livermore. Despite claims that millennials are the most purpose driven generation, history shows they have failed to overcome the traps of speculation and investment. From the Tulip bubble(1634) to the Gold bubble(1980), we saw the psychology of fear and greed in market prices. Just when it seemed investors and traders have learned, then came the dot com bubble(1996) which was followed by the Real estate bubble(2008). In the middle of the financial crisis in 2008, A new technology was born, with a promise to end all financial crisis and restore trust to the financial system. Despite its disruptive and use case, we have found ourselves once again in a bubble which raises the question, "Have we ever learned from history?"

I will argue that yes we have. The fact is, regardless of the disruptive nature of any invention, markets eventually run ahead of reality, greed kicks in and then comes the dip. Bubble are arguably healthy for the ecosystem as it eliminate the "dump money" looking to get rich quick. They also create Technical entry points for long term investor. But how do we know when a market has bottom?

History has shown that most market crashes are likely to bottom at 75% dip on just below. Stock market traders use market sentiment charts to measure this. For stock trading, when the market sentiment index scale(0-100) reaches or drops below 25, it indicates a buy signal. Looking at the BTCUSD chart, price fall from all time high to $5000 or slightly below indicate a dip of 75% which shows we are left with 25%. Cryptocurrencies are a highly volatile asset class and thus, its very difficult to pin point the exact momentum to which the price will reverse. This for what it is, will serve as a technical point for a major reversal together with fundamentals at the given time.

HOW TO RIDE TRENDSThis educational idea refers to the last trading idea I published (linked below) and to many more I traded in the past.

The chart above shows the BTCUSD going from about 6'500 at the beginning of April up to around 10'000 in early May and all the way back down to about 6'500 in mid-June.

This idea shows how it was possible to ride the trend all the way up (4 buy opportunities) and all the way down (4 sell opportunities) with three indicators: the Breakout Pivotal Bars , the Sentiment Index and the Levels and Zones .

Here's how they work to identify setups:

Breakout Pivotal Bars

• For break-ups the candle must be coloured in green.

• For break-downs the candle must be coloured in red.

• Blue candles mean indecision so either trend continuation or imminent trend reversal. Depending on your strategy it is possible to trade them or not.

Sentiment Index

Possible situations are:

• Breakout (e.g. Bullish Sentiment in case 1 or Bearish Sentiment in case 8)

• Divergence with the price (Bullish Sentiment in case 8)

Levels and Zones

Gives a reference in real-time to where the most significant levels and their corresponding long/short zones are.

Let's see the 8 trading opportunities:

1. Break-up of consolidation (blue candle) + Break-up of Bullish Sentiment + Above Support -> GOOD OPPORTUNITY

2. Break-up of consolidation (green candle) + Break-up of Bullish Sentiment + Above Support -> GOOD OPPORTUNITY

3. Break-up of consolidation (blue candle) + Break-up of Bullish Sentiment + No Support nearby -> VALID OPPORTUNITY but pay attention

4. Break-up of consolidation (green candle) + Break-up of Bullish Sentiment + Resistance Above -> VALID OPPORTUNITY but pay attention

5. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment (divergence in Bullish Sentiment) + Below Resistance -> GOOD OPPORTUNITY

6. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is pretty far! -> GOOD OPPORTUNITY

7. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is pretty far! -> GOOD OPPORTUNITY

8. Break-down of consolidation (red candle) + Break-down of Bearish Sentiment + Support is still pretty far! -> GOOD OPPORTUNITY

ANTICIPATING THE MARKETThis idea shows how the Sentiment Index indicator clearly anticipates big shifts in the Market.

The first situation shows the EURUSD consolidating between late 2016 and spring 2017 – the consolidation was characterized by a consistent decline in the Bearish Sentiment which ultimately led to a strong uptrend until early 2018 (1500+ pips movement).

The second situation shows the EURUSD in an opposite setup – a sligthly shorter consolidation charaterized by a decline in the Bullish Sentiment and a consequent breakdown of the pair.

Predicting market moves with JUST ONE INDICATORThis idea shows how easy it was to identify a massive opportunity on BTCUSD with the Levels and Zones indicator.

Basically, after days of sideways movement, the pressure started to build up and ultimately a massive explosion took place!

First, the Resistance Level moved significantly down (hence pushing price lower), then the Support Level made its move up (hence pushing price higher). Give it a few more time for the pressure to increase further (price is forced to move into a tight channel) and then the explosion takes place.

You can find a similar setup before most of the major impulsive movements across any asset and timeframe. First, pressure builds up then, the explosion takes place!