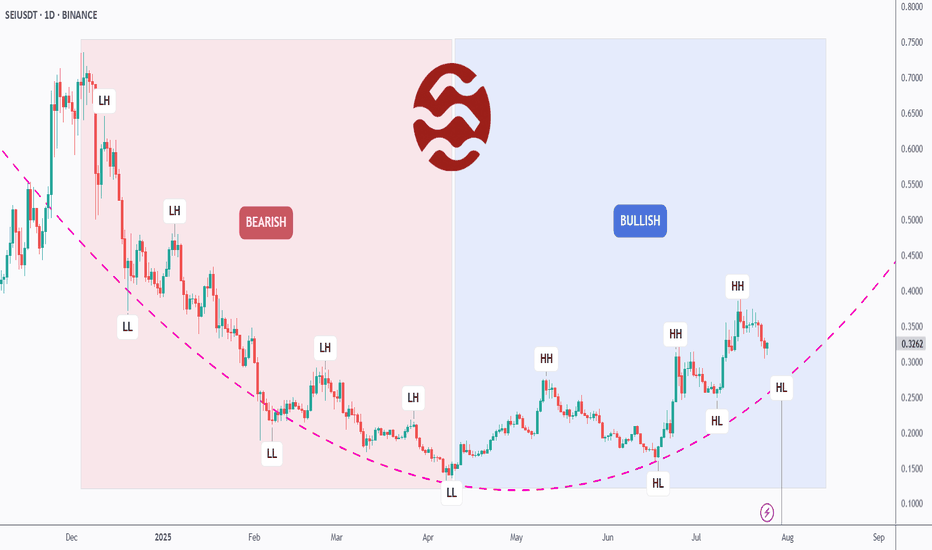

[Deep Dive] SEI – Edition 2: From Pain to Power: A Bull Cycle?SEIUSDT may have just flipped the script.

After months of consistent lower highs and lower lows, SEI has officially broken its bearish structure and is now printing clear higher highs (HH) and higher lows (HL) — a textbook sign of a trend reversal.

📉 Left Side: Bearish Breakdown

From late 2023 to Q2 2025, SEI was stuck in a painful macro downtrend. The structure was brutally clean: LH → LL → LH → LL. Each bounce was weaker than the last, reflecting exhausted buyers and relentless supply.

But something changed in late Q2…

📈 Right Side: Bullish Rebuild

Since its final low around April, SEI began to carve a new path. What started as a subtle accumulation quickly morphed into a solid structure of higher highs and higher lows.

The arc-shaped pink trendline tracks this momentum shift — and we’re now watching a potential continuation of the bullish cycle.

The most recent HL is forming exactly on that curve — a critical moment where bulls may step in for the next impulsive move.

🔥 What’s Fueling the Shift?

SEI is gaining traction as a high-performance Layer 1 designed for trading apps, with native parallelization and a focus on speed and throughput.

Its recent ecosystem growth — including projects in DeFi, gaming, and infrastructure — has started to attract both retail and VC attention.

On-chain metrics are showing increased activity, and whispers of upcoming protocol incentives could be the spark that pushes SEI toward the $0.45–$0.50 range.

🧠 What We’re Watching

- The current HL zone — will bulls defend this level?

- If SEI can break above the previous HH, the bullish structure strengthens.

- A failure to hold this HL would suggest a range or even deeper correction — so risk management is key.

Let’s recap:

- Structure has flipped bullish ✅

- SEI is riding a fresh higher low ✅

- Fundamental momentum is building behind the scenes ✅

It’s now up to the market to decide if this was just a bounce — or the beginning of a much bigger move.

💬 What do YOU think: Is SEI building steam for a breakout, or just teasing us with a fakeout?

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

Series

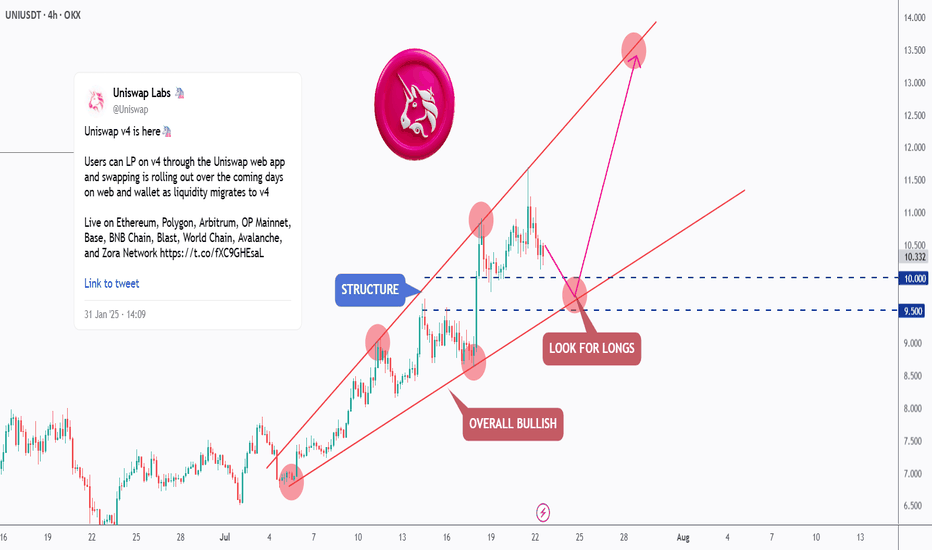

[Deep Dive] UNI – Edition 1: Retest. Reload. Rally?Uniswap (UNI) has been trading within a well-respected rising channel, showing consistent bullish structure across the 4H timeframe.

After a strong rally from the $7.50 region, price is now undergoing a healthy correction — retesting the lower boundary of the channel, which intersects with the $9.50–$10.00 demand zone.

📐 Technical Outlook

The market has printed a series of higher highs and higher lows, confirming the bullish momentum. The recent correction is testing a key support structure — previously a resistance zone — and this confluence aligns perfectly with the channel’s lower bound.

As long as this zone holds, UNI is well-positioned for a continuation toward the $13–$14 region, in line with the pink projected path.

🔥 Fundamental Boost

Uniswap has recently launched its V4 upgrade, introducing "hooks" — customizable smart contracts that allow developers to build more complex DeFi logic directly within liquidity pools. This upgrade not only enhances flexibility and capital efficiency, but also reduces gas costs — making Uniswap an even more dominant player in the DEX ecosystem.

Additionally, with Ethereum L2 adoption growing and Uniswap expanding across multiple chains (Arbitrum, Base, and Optimism), protocol usage and fees are on the rise again.

The UNI token may soon benefit from the proposed fee switch, which would redirect a portion of protocol fees to token holders — potentially adding new value accrual mechanics.

🟢 Conclusion

The technicals and fundamentals are aligning. UNI is in a bullish structure, trading at a key area of interest, and the latest upgrades may unlock new growth for the ecosystem.

Traders and investors alike should keep a close eye on this zone for long opportunities, as the next impulse could be just around the corner.

💬 What do you think — is UNI ready to break toward new highs, or will the demand zone fail? Let me know in the comments 👇

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

3 Altcoins to watch this weekend...BINANCE:RAREUSDT

After a 50% surge, RARE is currently in a sharp correction phase.

As it approaches the black structure, I will be looking for trend-following longs.

BINANCE:MASKUSDT

Just like RARE, MASK surged by over 60% forming a massive demand zone marked in blue.

As it retests the demand zone, it would be an attractive zone to look for longs at a discount.

BINANCE:ALPHAUSDT

This one is the strongest among today's list, as it surged by almost 50% 2 weeks ago.

ALPHA has been in a correction mode and seems the bears are loosing momentum.

The more it approaches the gray demand zone, the more potential the bulls will have to kick in.

Which altcoins would you like me to cover next?

All Strategies Are Good; If Managed Properly!

~Rich

JIO FIN SERVICES LTDJIO FIN SERVICES LTD

The series of 1-2 1-2 is good sign of a stock to give the multifold returns.

Our stock JIO FIN SERVICES LTD is also making a series of 1-2 1-2 on daily chart and 4hourly chart. If you have the stock in your portfolio it is to keep it for multifold returns.

I am not aware of any news on the stock but feeling it will go up even in this tense situation.

Regards.

Understanding the Differences Between Stock Market and Crypto P2Thank you very much for your support, as I told when we will get 20+ likes on Part 1, than I will make Part 2. Here you get the summary of each, with the other points:

10. Market Infrastructure: The infrastructure supporting traditional stock markets, including trading platforms, clearing systems, and market data providers, is well-established and interconnected, whereas the infrastructure for the crypto market is still evolving and fragmented, with multiple competing platforms and protocols.

11. Market History: Traditional stock markets have a long history dating back centuries, with well-documented market cycles and economic trends, whereas the crypto market has a relatively short history, with significant price movements driven by technological developments and market speculation.

12. Regulation of Investment Products: Traditional stock markets offer a wide range of investment products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs), all subject to regulatory oversight, whereas the crypto market primarily offers cryptocurrencies and tokenized assets with varying degrees of regulatory clarity.

13. Market Correlation: Stocks and traditional financial assets often exhibit correlations with broader economic indicators such as GDP growth and interest rates, whereas the crypto market may demonstrate correlations with factors such as Bitcoin dominance, market sentiment, and technological developments.

14. Market Participants: Traditional stock markets attract a diverse range of participants, including retail investors, institutional investors, hedge funds, and pension funds, whereas the crypto market has a more diverse participant base, including retail traders, technology enthusiasts, speculators, and early adopters of blockchain technology.

15. Market Fragmentation: The stock market operates as a unified marketplace with standardized trading rules and regulations, whereas the crypto market is fragmented across multiple exchanges, each with its own trading protocols, liquidity pools, and pricing mechanisms.

16. Market Impact of News Events: News events such as corporate earnings releases, economic data reports, and geopolitical developments have a significant impact on stock market movements, whereas the crypto market may react more strongly to news related to regulatory developments, technological advancements, and adoption trends.

17. Market Efficiency: The efficiency of traditional stock markets is supported by established trading mechanisms, liquidity providers, and market makers, leading to relatively stable price discovery and reduced arbitrage opportunities, whereas the crypto market may experience inefficiencies due to lower liquidity, market manipulation, and regulatory uncertainties.

Stock Market:

Pros:

Stability: Stock markets have a long history and are generally stable investment options.

Regulation: They are heavily regulated, providing a level of security for investors.

Diversification: Investors can choose from a wide range of stocks across various sectors and industries.

Dividends: Many stocks offer dividends, providing a source of passive income.

Access to Information: There is a wealth of financial information available for analysis and research.

Cons:

Limited Trading Hours: Stock markets operate during specific hours on weekdays, limiting trading opportunities.

High Entry Barriers: Some stocks may require a significant investment, making it inaccessible for small investors.

Market Volatility: While generally stable, stock markets can still experience significant volatility during economic downturns or market crises.

Slow Settlement: Settlement times for stock transactions can take several days, delaying access to funds.

Limited Accessibility: Access to certain stocks may be restricted based on geographical location or regulatory requirements.

Crypto Market:

Pros:

24/7 Trading: Cryptocurrency markets operate 24/7, allowing for round-the-clock trading.

Accessibility: Anyone with internet access can participate in the crypto market, promoting inclusivity.

Potential for High Returns: The crypto market has seen explosive growth, offering the potential for high returns on investment.

Decentralization: Cryptocurrencies operate on decentralized networks, reducing dependency on centralized authorities.

Technological Innovation: The crypto market is at the forefront of technological innovation, with developments in blockchain and decentralized finance (DeFi).

Cons:

Volatility: Cryptocurrencies are highly volatile and can experience rapid price fluctuations.

Lack of Regulation: Regulatory uncertainty in the crypto market can lead to investment risks and market manipulation.

Security Risks: Cryptocurrency exchanges and wallets are susceptible to hacking and cyberattacks.

Limited Adoption: Despite growth, cryptocurrencies still face challenges in widespread adoption as a mainstream form of payment.

Complexity: Understanding cryptocurrencies and blockchain technology can be challenging for newcomers, leading to potential investment mistakes.

Summary:

Both the stock market and the crypto market offer unique opportunities and challenges for investors. The stock market provides stability, regulation, and a wide range of investment options, while the crypto market offers accessibility, potential for high returns, and technological innovation. Deciding which market is better depends on individual preferences, risk tolerance, and investment goals. Diversification across both markets may provide a balanced approach to building an investment portfolio.

Understanding the Differences Between Stock Market and Forex P2Because of your strong support on the Part 1, I decided to make Part 2 (as I already told in the last Part). Today lets see the other 17 differences between Stock market & Forex market. You must know them before investing/trading.

1. Market Size: The stock market represents ownership in companies, whereas the forex (foreign exchange) market deals with trading currencies. The stock market is typically larger in terms of market capitalization, as it encompasses a wide range of companies with varying sizes, while the forex market is the largest financial market in the world in terms of daily trading volume.

2. Market Participants: In the stock market, participants include individual investors, institutional investors, hedge funds, mutual funds, and pension funds. On the other hand, the forex market primarily involves central banks, commercial banks, institutional investors, corporations, and retail traders.

3. Market Influence: Stock markets are influenced by company-specific factors such as earnings reports, mergers, acquisitions, and corporate governance issues. In contrast, forex markets are influenced by macroeconomic factors such as interest rates, inflation, geopolitical events, and central bank policies.

4. Market Transparency: Stock markets are relatively more transparent due to regulatory requirements for companies to disclose financial information regularly. Conversely, the forex market operates over-the-counter (OTC), which can lead to less transparency and information asymmetry.

5. Market Structure: The stock market operates through exchanges where buyers and sellers are matched electronically or physically, whereas the forex market is decentralized and operates 24 hours a day through a global network of banks and financial institutions.

6. Market Access: Access to the stock market often requires a brokerage account, and trading is conducted through regulated exchanges. In contrast, the forex market is accessible directly through banks or online brokers, offering greater ease of entry for retail traders.

7. Market Liquidity: While both markets are liquid, the forex market generally offers higher liquidity due to its immense size and constant trading activity. This liquidity allows for rapid execution of trades without significant price slippage.

8. Market Correlation: Stocks tend to have positive correlations with economic growth and corporate performance, whereas currency pairs may exhibit different correlations based on factors such as interest rate differentials, trade balances, and geopolitical events.

9. Market Risk: Stock market investments are subject to company-specific risks such as management decisions, industry trends, and competitive pressures. In forex trading, risks include currency fluctuations, geopolitical instability, and central bank interventions.

10. Market Analysis: Fundamental analysis is essential in both markets, but the focus differs. In the stock market, analysts evaluate company financials, management quality, and industry dynamics. In the forex market, analysts assess macroeconomic indicators, interest rate differentials, and geopolitical developments.

11. Market Trends: Trends in the stock market can be influenced by investor sentiment, economic cycles, and industry trends. Forex trends are influenced by macroeconomic factors and shifts in global capital flows.

12. Market Participants' Goals: Stock market investors typically seek long-term capital appreciation and income through dividends, while forex traders may aim for short-term profit opportunities by speculating on currency price movements.

13. Market Entry and Exit Strategies: Stock market investors often employ buy-and-hold strategies or use technical analysis to identify entry and exit points. Forex traders frequently utilize leverage and short-term trading strategies such as scalping or swing trading.

14. Market Regulation Impact: While both markets are subject to regulation, regulatory changes may have different effects. Stock market regulations primarily focus on investor protection, market integrity, and disclosure requirements, while forex market regulations often target leverage limits, margin requirements, and risk management.

15. Market Sentiment Indicator: In the stock market, sentiment indicators include measures of investor confidence, such as the VIX (Volatility Index) and surveys of investor sentiment. In the forex market, sentiment indicators may involve positioning data from futures contracts, surveys, or sentiment indexes specific to currencies.

16. Market Impact of Economic Data Releases: Economic indicators such as GDP growth, employment reports, and inflation data can significantly impact both markets but may have different effects depending on the asset class and prevailing market sentiment.

17. Market Accessibility: The stock market is often perceived as more accessible to the general public, with familiar companies and brands driving investor interest. In contrast, the forex market may seem more esoteric to some due to its focus on currency pairs and macroeconomic factors.

Now as I told lets discuss about what is better. And the Pro & Cons of each market summarized:

(before we continue like, Follow, Share it to your trader buddies......

Determining which market is "better" depends entirely on an individual's investment objectives, risk tolerance, and trading style. Both the stock market and the forex market offer unique opportunities and challenges, catering to different types of investors and traders.

Stock Market:

Pros:

Ownership in companies: Investing in stocks allows you to become a partial owner of companies, offering potential for capital appreciation and dividends.

Transparency: Stock markets are regulated and require companies to disclose financial information regularly, providing transparency for investors.

Long-term growth: Historically, the stock market has generated substantial long-term returns, making it suitable for investors with a buy-and-hold strategy.

Diversification: With thousands of stocks across various sectors and industries, investors can build diversified portfolios to manage risk.

Cons:

Volatility: Stock prices can be highly volatile, influenced by factors such as economic conditions, industry trends, and company-specific news.

Company-specific risks: Investing in individual stocks carries the risk of company-specific events such as poor earnings, management issues, or regulatory changes.

Market cycles: Stock markets are subject to economic cycles, including periods of recession and market downturns, which can affect investment returns.

Forex Market:

Pros:

Liquidity: The forex market is the largest financial market in the world, offering high liquidity and tight spreads, allowing for swift execution of trades.

Accessibility: Forex trading is accessible 24 hours a day, five days a week, providing flexibility for traders to participate in global currency markets.

Leverage: Forex trading offers high leverage, allowing traders to control large positions with a relatively small amount of capital, potentially magnifying profits (but also losses).

Diverse opportunities: With a wide range of currency pairs and trading strategies, forex markets offer diverse opportunities for traders to profit in various market conditions.

Cons:

..........& Comment your Opinion)

High volatility: Currency markets can be highly volatile, influenced by geopolitical events, central bank policies, and economic indicators, leading to rapid price fluctuations.

Risk of leverage: While leverage can amplify gains, it also increases the risk of significant losses, especially for inexperienced traders who may overleverage their positions.

Lack of transparency: The forex market operates over-the-counter, which can lead to less transparency compared to regulated exchanges, potentially exposing traders to counterparty risk and manipulation.

Summary:

In summary, there is no definitive answer to which market is "better" as both the stock market and the forex market have their advantages and disadvantages. The choice between them depends on individual preferences, investment goals, risk tolerance, and trading style. Investors seeking long-term growth and ownership in companies may prefer the stock market, while traders looking for short-term profit opportunities and high liquidity may favor the forex market. Ultimately, it's essential for investors and traders to conduct thorough research, understand the risks involved, and align their investments with their financial objectives.

Understanding the Differences Between Stock Market and Crypto P1Hey there, welcome to 'Stock Market VS Crypto Market'! Our goal? To break down the complexities and highlight the fascinating differences between traditional stocks and the exciting world of cryptocurrencies, making it easier for traders and investors to navigate both landscapes. This is Part 1: (In Part-2 I will tell where to invest and how much)

1. Market Maturity: Traditional stock markets have been established for centuries, with robust infrastructures and historical data available for analysis, whereas the crypto market is relatively young, experiencing rapid growth and evolving regulatory frameworks.

2. Market Size: The global stock market has a significantly larger market capitalization compared to the crypto market, reflecting the extensive presence of publicly traded companies and institutional investors.

3. Volatility: While both markets experience volatility, the crypto market tends to exhibit higher levels of volatility due to its speculative nature and rapid price fluctuations.

4. Transparency: Stock markets typically provide greater transparency in terms of financial reporting, corporate governance, and regulatory disclosures compared to the crypto market, where transparency can vary widely among different projects and exchanges.

5. Counterparty Risk: In the stock market, counterparty risk is mitigated through centralized clearinghouses and regulatory oversight, whereas the decentralized nature of the crypto market may expose investors to higher counterparty risk, such as hacking incidents or smart contract vulnerabilities.

6. Market Manipulation: Instances of market manipulation, such as pump and dump schemes, are regulated and monitored more closely in traditional stock markets compared to the crypto market, where regulatory enforcement may be less stringent.

7. Market Psychology: The psychology of investors in the stock market is influenced by traditional financial metrics and investor sentiment, whereas the crypto market often exhibits a unique blend of technological optimism, speculative frenzy, and fear of missing out (FOMO).

8. Custody Solutions: Custody of traditional stock assets is typically managed by regulated financial institutions, whereas custody solutions for cryptocurrencies range from self-custody through private wallets to third-party custodians and institutional-grade solutions.

9. Accessibility to Information: Stock market participants have access to a wealth of financial information through established platforms such as Bloomberg and Reuters, while information in the crypto market is often decentralized and distributed across various forums, social media platforms, and blockchain explorers.

If we get 20+ likes, I´ll make Part-2 (including the summary, where to invest and which is better).

So like (boost), follow, comment and share it for increasing the knowledge of your friends!

Understanding the Differences Between Stock Market and Forex P1Get ready for an exhilarating adventure as we unveil the intriguing disparities between two titans of the financial world: the Stock Market and the Forex Market. These dynamic arenas captivate the attention of traders and investors alike, each offering a unique tapestry of opportunities and challenges. Join us on an exhilarating exploration of 27 key differences between these powerhouse markets, igniting your curiosity and empowering you to master your investment journey with flair. Let's dive in and discover the secrets that set these markets apart!

1. Trading Hours:

The stock market adheres to specific opening and closing times, such as the US stock market's operational hours from 9:30 AM to 4:00 PM Eastern Time. Conversely, the forex market operates round the clock, 24 hours a day, five days a week, providing unparalleled accessibility and flexibility. Thus, in terms of availability, the forex market takes the lead.

2. Days in the Week:

While both markets are open for trading five days a week, the stock market observes government holidays, leading to occasional closures. In contrast, the forex market remains operational throughout the year without interruption, offering continuous trading opportunities. Hence, the forex market excels in terms of consistency and accessibility.

3. Instruments Traded:

The stock market boasts a diverse range of instruments, including shares, derivatives, bonds, and more. In contrast, the forex market primarily deals with currency pairs, such as EUR/USD or USD/INR, offering a narrower scope of trading options. Therefore, the stock market holds an advantage in terms of instrument variety.

4. Trade Volume per Day:

The forex market stands as the largest financial market globally, with an impressive daily trading volume exceeding trillions of dollars. In comparison, the stock market's trade volume pales in comparison, highlighting the immense liquidity and opportunity present in forex trading.

5. Market Volatility:

While both markets exhibit liquidity, the forex market boasts even greater liquidity, making it highly conducive to swift and efficient trading. With increased liquidity comes enhanced market stability and reduced slippage, positioning the forex market as the preferred choice for many traders.

Before we delve deeper into the distinctions, let's familiarize ourselves with the fundamentals of forex trading:

1) Base Currency: The base currency is the first currency listed in a currency pair. It is the currency against which the exchange rate is quoted. For example, in the currency pair EUR/USD, the euro (EUR) is the base currency.

2) Quote Currency: The quote currency is the second currency listed in a currency pair. It is the currency in which the exchange rate is quoted in relation to the base currency. Using the same example, in the currency pair EUR/USD, the US dollar (USD) is the quote currency.

So, in summary, the base currency is the currency being bought or sold, while the quote currency is the currency used to express the value of the base currency. In forex trading, the exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Let continue:

6. Manipulation:

In the stock market, instances of manipulation may occur at a smaller scale, potentially impacting individual stocks or sectors. Conversely, manipulation in the forex market tends to be more macroscopic and infrequent, providing traders with a more transparent and fair trading environment.

7. Leverage:

Forex trading offers significantly higher leverage compared to the stock market, allowing traders to amplify their positions with relatively small capital outlays. While leverage can magnify profits, it also heightens risk, necessitating prudent risk management strategies.

8. Capital Required:

Unlike the stock market, which often demands substantial capital investments to yield significant returns, the forex market offers the flexibility of trading with smaller initial capital. This accessibility is further augmented by the availability of leverage, albeit with associated risks.

9. Stocks/Pairs:

The stock market boasts a vast array of individual stocks available for trading, providing investors with diverse investment opportunities. In contrast, the forex market primarily revolves around trading currency pairs, limiting the variety of assets available for trading.

10. Regulatory Body:

Regulatory oversight plays a crucial role in maintaining market integrity and protecting investors' interests. In the stock market, entities like SEBI oversee regulatory compliance, whereas The forex market is largely decentralized, but it's still subject to regulation in many countries. Regulatory bodies such as the Commodity Futures Trading Commission (CFTC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom oversee forex brokers and ensure fair trading practices.

Write down in the comments what type of content you want, so we can focus on your Demand!

Like & Follow

BTC Detailed Top-Down Analysis - Day 140Hello TradingView Family / Fellow Traders. This is Richard Nasr, also known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 139Hello TradingView Family / Fellow Traders. This is Richard Nasr, also known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 137Hello TradingView Family / Fellow Traders. This is Richard Nasr, also known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 136Hello TradingView Family / Fellow Traders. This is Richard Nasr, also known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 133Hello TradingView Family / Fellow Traders. This is Richard Nasr, also known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 128Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 123Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

123 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 122Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

122 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 120Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

120 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 119Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

119 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 118Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

118 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 113Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

113 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 112Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

112 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC & ETH Video Top-Down Analysis!Hello TradingView Family / Fellow Traders. This is Richard Nasr, as known as theSignalyst.

111 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich