EURAUD Potential Bearish Setup Distribution pattern with breakdown below key support suggests downside momentum.

Break above our Resistance zone will invalidate our trade setup; good idea to watch out if that happens.

- Breakdown Level: 1.77694 -1.77722

- Entry Strategy: Sell orders at BOS

- Stop Loss: Above Resistance zone

- Target Zones:

- Primary Target: Target 1 (R:R 1:2)

- Secondary Target: Target 2 (R:R 1:3)

- Extension Target: Target 3 (R:R 1:4)

Bearish/Bullish Confirmations:

🔻 Rejection candlestick patterns

🔻 Bearish Reversal patterns

🔻 Impulsive moves in line with setups directional bias

Position Management:

- Exit: Partial profits at targets

- Stop adjustment: Trail stops when target are hit

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

Setupoftheday

USDJPY Possible BEARISH setup🚀 USDJPY UPDATE: Bearish Setup

Summary:

Analysing price action from yesterday, breakout from the Daily timeframe accumulation zone has materialized with strong conviction.

TRADE SETUP Metrics:

- Entry: ✅

- Stop loss - Above Resistance Zone

- Target 1: (R:R 1:2)🎯

- Target 2: (R:R 1:3)🎯

- Target 3: (R:R 1:4)🎯

Technical Anticipations:

- Price action to show a Bearish follow-through

- Resistance zone to hold

Position Management:

- partial profits secured at Target 1

- Stop loss adjusted to breakeven upon reaching Targets

- Full Exit at Target 3

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

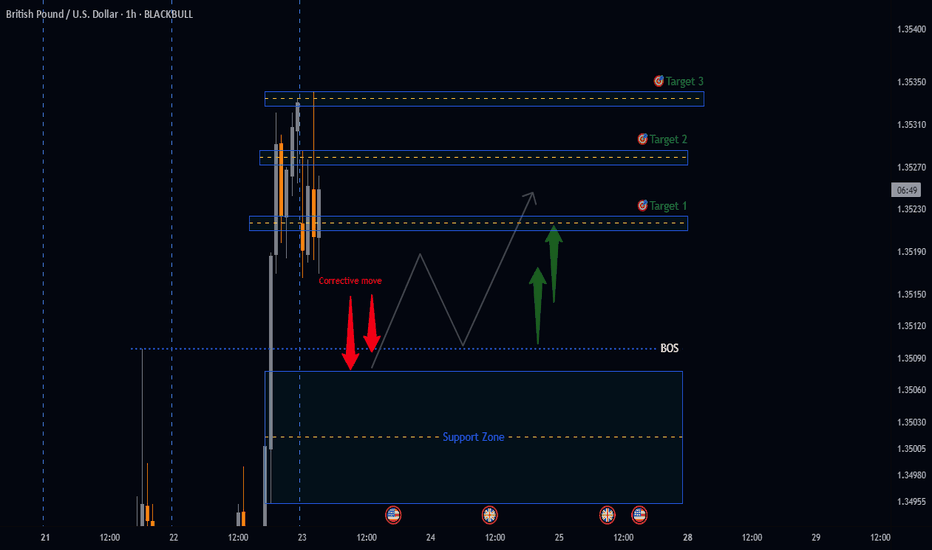

GBPUSD potential BULLISH Setup🚀 GBPUSD UPDATE: BULLISH Setup

Summary:

Analysing price action from yesterday, breakout from the Daily timeframe accumulation zone has materialized with strong conviction.

TRADE SETUP Metrics:

- Entry: ✅

- Stop loss - Below Support Zone

- Target 1: (R:R 1:2)🎯

- Target 2: (R:R 1:3)🎯

- Target 3: (R:R 1:4)🎯

Technical Anticipations:

- Price action to show a Bullish follow-through

- Support zone to hold

Position Management:

- partial profits secured at Target 1

- Stop loss adjusted to breakeven upon reaching Targets

- Final Target 3

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

GBPCHF Potential Bearish SetupDistribution pattern with breakdown below key support suggests downside momentum.

Break above our Resistance zone will invalidate our trade setup; good idea to watch out if that happens.

- Breakdown Level: 1.08149 -1.08133

- Entry Strategy: Sell orders at BOS

- Stop Loss: Above Resistance zone

- Target Zones:

- Primary Target: Target 1 (R:R 1:2)

- Secondary Target: Target 2 (R:R 1:3)

- Extension Target: Target 3 (R:R 1:4)

Bearish/Bullish Confirmations:

🔻 Rejection candlestick patterns

🔻 Bearish Reversal patterns

🔻 Impulsive moves in line with setups directional bias

Position Management:

- Exit: Partial profits at targets

- Stop adjustment: Trail stops when target are hit

Target achievedThe impulsive rise in EURUSD continues.

This morning, it reached 1,1717 — our first projected target.

This is a good level to take profits.

Now, watch for a pullback and the potential for another move up.

Most of the move should already be captured by this point.

Reduce your risk and avoid using large position sizes.

If the price moves higher again, the next target is 1,1778!

USDJPY to continue in the downward move?USDJPY - 24h expiry

The rally was sold and the dip bought resulting in mild net gains yesterday.

Selling posted in Asia.

We have a Gap open at 147.02 from 04.04 to 06.04.

The medium term bias remains bearish.

A Fibonacci confluence area is located at 143.68.

Preferred trade is to sell into rallies.

We look to Sell at 147.02 (stop at 148.02)

Our profit targets will be 143.68 and 143.10

Resistance: 147.02 / 148.09 / 150.49

Support: 144.58 / 143.68 / 143.07

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUCTION Breakout Loading – $30+ Target?$AUCTION/USDT 1D chart shows a strong bounce from the key support zone, pushing towards the major resistance zone near the descending trendline. The price is currently at $16.39, indicating bullish momentum.

If AUCTION breaks above the major resistance and the resistance trendline, it could trigger a strong rally toward $30-$35+. However, rejection from this level may lead to another retest of support.

The Stoch RSI is mid-level, suggesting more upside potential. Watch for a breakout confirmation or a possible pullback before the next move.

DYOR, NFA

Silver 4hr Timeframe Silver has risen by 3.90% in just over a day. I anticipate a reaction around the 30.7399–30.8383 zone due to multiple confluences, including a reversal point, a 4-hour order block, the 0.618 Fibonacci level, an ascending trendline from November 13th, and structural factors. This area presents a potential sell opportunity, with a target drop to the 30.2753 level.

Meanwhile, gold is approaching my area of interest, which appears to be another promising sell setup. If both gold and silver align as sell opportunities, it’s a strong indication of market synchronization, increasing the likelihood of this scenario playing out.

Dollar Index Basket

Is now reacting off my area of interest I expect double tap to then move higher

Gold 1hr

my area of interest for gold 2669.412 -2673.545

TONUSDT idea follow upHello Traders,

As we mentioned in previous idea, we will wait for a Long setup after hitting the supply zone as shown.

As we can see, it dropped to the buy zone and recover very fast, right now it looks like an accumulation for a Long setup.

If you have interest in this idea, you could monitor it closely from now.

Crypto is highly risky, please do your own research before investing.

Enjoy!

Investors, Heads Up! XAUUSD Breakout Alert!Calling all traders! XAUUSD is blazing, smashing records with finesse! Here’s the latest:

XAUUSD Overview: Engaged in a gripping duel between 2682 and 2695. Is a breakout looming?

Bearish Outlook: Be alert for potential declines if it dips below the range! Targets: 2676 and 2667.

Bullish Outlook: Anticipate buying opportunities if it breaks above! Targets: 2700 and 2705.

Join the Discussion: Share your perspectives as we journey through this golden terrain! Let’s reach new heights together!

Gold 4hr setup Gold is presently experiencing a bearish trend, characterized by a pattern of lower highs and lower lows since peaking at 2484.14. I anticipate that gold will encounter resistance at the temporary rejection level before declining further. Subsequently, I expect it to rebound and ascend to my target area, which is approximately between 2400 and 2402.02.

Confluences supporting this analysis include:

A downward trendline indicating a continuation of the bearish trend.

An upward trendline suggesting a potential reversal point.

A rejection zone between 2400 and 2402.02, which is a significant area of interest.

The round number of 2,400, often a psychological level in trading.

The 0.618 Fibonacci retracement level

Market structure.

Expectations of the US Dollar strengthening.

Gold Daily

Dollar Index

Silver

US Dollar Index Daily TF DXY

None Farm Payroll outcome from 13:30 today

U.S PRIVATE NONFARM PAYROLLS (JUL) ACTUAL: 97K VS 136K PREVIOUS; EST 148K

U.S PARTICIPATION RATE (JUL) ACTUAL: 62.7% VS 62.6% PREVIOUS

U.S MANUFACTURING PAYROLLS (JUL) ACTUAL: 1K VS -8K PREVIOUS; EST -1K

U.S AVERAGE WEEKLY HOURS (JUL) ACTUAL: 34.2 VS 34.3 PREVIOUS; EST 34.3

U.S GOVERNMENT PAYROLLS (JUL) ACTUAL: 17.0K VS 70.0K PREVIOUS

looks like it is going to close below 104.018

The DXY has dropped 100 pips following the non-farm payroll results and is expected to close below 104.024, indicating a bearish trend. Consequently, EUR/USD, GBP/USD, and GOLD are likely to swing bullish. My area of interest is around 102.959, where I anticipate a rejection due to the presence of a -0.27 Fibonacci level and an order block. This should lead to a pullback before resuming the bearish trend to create new lower lows.

Gold 4hr TF

Gold is moving higher as a result of the non-farm payroll outcome. I expect this upward trend to continue until it hits my area of interest at 2,482, where I anticipate a rejection. After this pullback, I foresee gold resuming its upward movement to achieve a new all-time high (ATH).https://www.tradingview.com/x/tuk0BSO7/

AUDUSD Daily TF Make Trading SimpleKepp Trading Simple

AUDUSD is currently pulling back after reaching the -0.27 Fibonacci target. We have multiple strong confluences around the 0.67021 - 0.66929 range. Additionally, there is a descending trend line from May and an ascending trend line from early June converging in this area. I will be looking for the price to stabilize and start to reject at this point.

US30 BEARISH IDEAWe had 2 successful prediction for this index previously.

Technical always remains bearish and could be to target more demand liquidity.

Price did reach all time high, so we could definitely be expecting a correction.

Weekly candle just broke previous low --> this could mean a long term bearish view.

And considering the fundamental facts, I believe price could target any supply zone before it keeps dropping.

This is just an idea and might be subject to change !

KEEP FOLLOWING FOR MORE UPDTADES!!

EURJPY → Day Analysis | BUY SetupHello Traders, here is the full analysis.

Price reversal going up, levels for BUY . EURJPY long

! Great BUY opportunity EURJPY

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

NZDCAD SELL | Day Trading AnalysisHello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity NZDCAD

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

AAPL - Technical Analysis SIMPLIFIED! Here's what will happenThis is as straight forward of my teachings as it gets - you can clearly see what needs to happen in order for us to attempt all time highs - and that begins with a retest and break of our teal strong selling algo, preferably lining up with a $187 break (strong liquidity levels and many bears present).

You can trade this intraday fairly easily using yellow strong continuation as your support and green tapered buying continuation as your potential resistance.

One thing is forsure - we will need Yellow strong buying continuation channel to hold price if we want to break out of teal. We've seen that in the past and we're seeing that again now.

Hope this was helpful!

Happy Trading :)

CHFJPY Short Idea Intra-day trading 4H entry TFHappy New Year Guys! Its your girl Forex Potatoe we smash the charts and here we are in 2024 ready to smash it again!.

CHF JPY has been in a prolonged uptrend and showing weakness as buyers are beginning to loose steam and momentum slowing down from buyers side. Price broke weekly and daily lows and currently bias changed to Sell on 3 TimeFrames.

What i hope to see before entering this trade is the trendline broken (which has broken a bit), i also need to see the support broken and the last low taken out before i'd be interested in taking a sell. I Predict CHFJPY sells to the TP point on the last Low.

Kindly follow me as i would be breaking down my analysis from time to time and posting videos as well mostly for beginners and intermediate traders that need to understand market structure, and how to execute trades. My goal is to simplify the charts and smash it so you can be a better traders

Tell me what you think about this idea.

EURUSD FORECAST 21/NOV/2023In this video, I did a full breakdown of eurusd, showing the important levels of structure in the market, and how I intend to trade today. I also talked about what I will expect to see before I take a trade and what I'll see that will make me not to take a trade.

If you like this kind of video, Please follow me and give me a boost.

EURJPY SELL | Day Trading AnalysisHello Traders, here is the full analysis.

Watch strong action at the current levels for SELL. GOOD LUCK! Great SELL opportunity EURJPY

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

GBPUSD short term Longs to 1.22500SCENARIO 1 - My current bias for GBPUSD is to buy roughly were current price is at (9hr demand) but could expect a bit more downside and mitigate the 7hr demand zone for the buy setup to take place. Regardless we are expecting a wyckoff accumulation to take place in this POI. Targeting 1.22500 were the 8hr supply zone is located, we will then look for price to slow down momentum and distribute for a potential sell setup to form in either the 8hr or the 10hr supply zones.

My confluences for the buys are as follows:

- Price has tapped into a 9hr demand zone that has caused a change of character to the upside.

- There's lots of imbalances left from the downwards push we had today so we are expecting that to get filled in.

- Liquidity that was lying underneath the consolidation has also been swept hence why we are starting to see higher highs and higher lows.

- Also for price to continue going down in a bearish trend overall I would be expecting for price to mitigate the 1.22500 level in order to continue going down.

- wyckoff accumulation is starting to unravel as price was slowing down whilst entering the zone (good sign, as the rejection indicates price wants to go back up.)

P.S. If price decides to push higher than our two supply zones and sweeps the liquidity at 1.23400 it will form a break of structure on the higher time frame indicating the trend will officially be bullish temporarily.