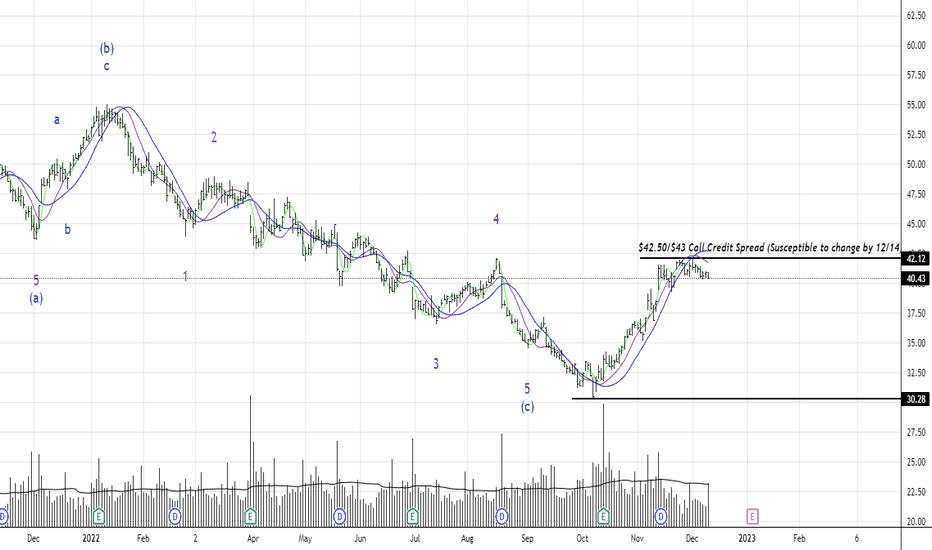

KHC (Range Trade)Price closed Friday under $40.50 after almost reaching that same price this week but stalling out near $40.44. This stock tends to move slower than others. $41.50 to me is a safe price range with zeroing out at $42 worst case before we lose money. Daily bar Friday closed under the most recent candle before that as well to note. Wave 3 may lowkey be a wave 5 but not sure. Might wait til the fed decision and cpi reports pass next week to get a second look.

Setups

PFE (Range Trade)Since the recent news relative to the authorization this past week, price has been making higher highs and lower lows. Only 6 times this year price played around in the $54 -$56 area. I'm banking on price exhaustion from the recent "good" news this past week. Daily is overbought as well. Maybe we can get a bar close or two this week lower than previous to give us some time. If price reaches this resistance area, we will reassess Might wait til the fed decision and cpi reports pass next week to get a second look.

WBA (Range Trade)The last two times price touched $42 was in August ($42.10) and December ($42.03). Price hovered near $42 highs in November but didn't hold. Could also be a start of new impulsive wave to the downside. Might wait til the fed decision and cpi reports pass next week to get a second look.

GM (Range Trade)$41.48 to $42.36 were two recent noteable highs since September. Price rejected the $41.50 area twice in November. Daily is oversold so we still need to be a bit careful here for the type of range trade we are looking for. Might wait til the fed decision and cpi reports pass next week to get a second look.

DXYPatterns look familiar?

If price tests the 103.60's, could we see a repeat?

Higher PPI report came out today.

Interest Rate Decision next week.

What could CPI read next week?

So many factors to consider.

Fed said they will slow the amount of hikes but may get more serious about the level of hikes if data doesn't show good indicators relative to inflation.

Price broke first trend line. Will it touch the second or not before the next market fall ?

I personally believe we may be in the midst of a new impulsive wave to the upside.

WHEN PRICE WANTS TO GO HIGHERWhen we are BULLISH and price wants to go higher it will create a TRIANGLE. After the TRIANGLE is Complete at a Macro PP price will consolidate and accumulate buy & sell orders aka MONEY aka LIQUIDITY.

Once this accumulation is complete price will then head north and take out the previous high. Once this high is taken out it will reach for more liquidity aka buy stops above previous structure areas. Once

these levels are reached price will then begin to stall and show signs of reversal (wicks, doji candles, consolidation) This is when we begin to look for the M set up and the DROP.

Never over leverage.

Trust your analysis.

Have fun!

GBPNZDI really like this setup here. I started a leg a few moments ago. Price could go a bit lower but the narrative stays the same. Price did not break lower than the start of wave 1 yet. It usually retraces 61% from what I've seen. If price doesn't break the recent low, we could be headed for a wave 3 extension. Not sure if the full impulse wave will play out. However, the rules are fitting thus far. What do you think?