Sgd

Aussie - Sing Dollar continues to channel lowerThe Australian dollar continues to fall against the Singapore dollar as we have developed a reasonably reliable downtrend channel. This makes a lot of sense, because the Singapore dollar is quite often used as a bit of a safety currency in Asia, while the Australian dollar is so highly levered to the Chinese mainland.

At this point, you can see that the 50 day EMA is just above recent trading, and we are testing the 61.8% Fibonacci retracement level. Ultimately, we are at roughly the middle of the down trending channel, so therefore it looks as if the channel will continue to hold going forward. With that in mind it’s very likely that we are probably going to reach towards the 0.9350 level, before bouncing again to find even more sellers.

It’s very likely that this pair will continue to drift lower until we get some type of resolution or at least serious progress to the US/China trade relations, or perhaps even signs of global growth. At this point it doesn’t seem like we are getting that anytime soon, at least not anything that you can hang your hat on. Because of this, we can simply extrapolate that every time this market rallies, you should be looking for signs of exhaustion to start selling.

The 0.95 level which coincides perfectly with the 50 day EMA will more than likely continue to offer resistance, just as a break down below the lows from last week opens the door to the previously mentioned 0.9350 level. All things being equal though, you should remember that this pair doesn’t necessarily move quickly, but rather steadily. That makes it a great longer-term trade as you can see. It is not until we break above the 0.9550 level that I would be concerned about the downtrend, and even then we would need to see a significant close above that level on the daily chart. As things stand, downward channel trading continues to work.

There is a trading opportunity to buy in NZDSGDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.9030). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. NZDSGD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 77.

Take Profits:

TP1= @ 0.9090

TP2= @ 0.9160

TP3= @ 0.9340

SL= @ 0.8940

There is a trading opportunity to buy in NZDSGDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (0.9030). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. NZDSGD is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 77.

Take Profits:

TP1= @ 0.9090

TP2= @ 0.9160

TP3= @ 0.9340

SL= @ 0.8940

USDSGD: Sell opportunity on 1W.The pair has been strongly rejected on the 1.3800 - 1.38735 1W Resistance Zone and is declining towards the 1.3500 - 1.34450 1W Support Zone. With neutral (RSI = 52.884, STOCHRSI = 45.209, Williams = -45.866) we have an optimal medium term sell signal and our TP is 1.35000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

daily usdsgdAs long as the price stay below 1.3820 resistance level, it will test the white trend line. If the price will cross the trend line downward, next target will be next support line which is around 1.3610 level.

We can also expect that the price can touch the main trend line (yellow) for long term expectations. White trend line is getting more important for this idea.

USDSGD: Buy opportunity on 1D.The pair is trading inside a 1D Channel Up (RSI = 65.836, MACD = 0.002, Highs/Lows = 0.0038). After breaking through the 1.36150 Resistance, which is now essentially its support, it should aim for the next sell accumulation point a 1.37450. We are long to that point.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDSGD: Medium term opportunity. Sell and Buy zones.The pair has been trading sideways in 2019 within the 1.36140 Resistance and 1.34450 Support. With 1D neutral (RSI = 51.626, Williams = -49.207, CCI = -45.7804, Highs/Lows = 0.0000), the price is expected to continue consolidating on the medium term within those levels. We are using 1.35750 - 1.36140 as a Sell Zone and 1.34450 - 1.34900 as a Buy Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

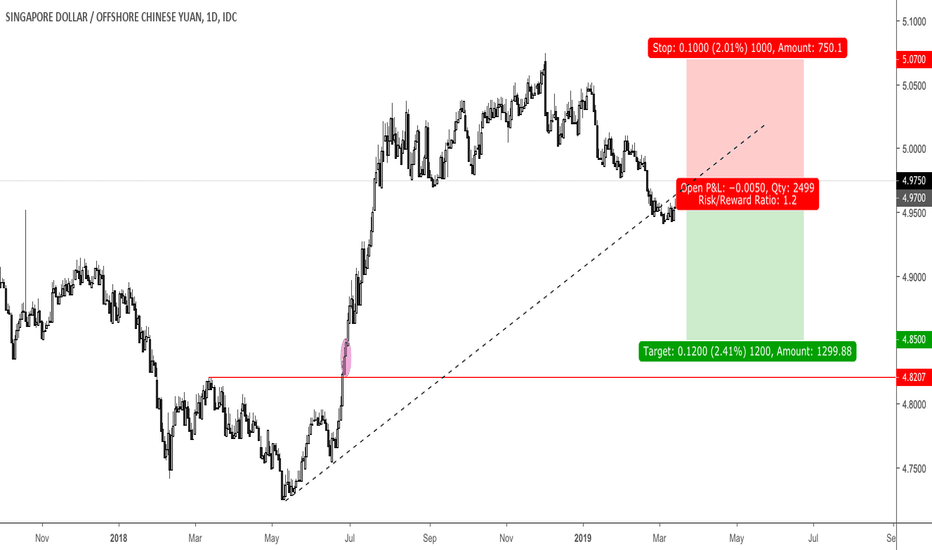

Year of the Bull? Not according to the fundamentals...With large account deficits, disinflation and widening interest rate differentials there are many reasons to not be bullish China.

Whilst on the political side there is a desperate need to keep CNY stable and stronger because China needs to attract capital inflows for the second half of 2019.

Why?

Because they are trying to facilitate the process of inclusion in equity and bond indexes to make China more attractive for FDI.

Risks to this trade are for deterioration in Chinese macro data and if equity markets sell-off.

Best of luck all and thanks for keeping the support coming with likes, comments, follows and etc.

SGDUSD Continues Moves Within a RangeWhile USDSGD began the past week of trading with a downward moves, these were quickly reversed by the end of the week and the price ended up where it started: Clearly, traders can see over the past few months that USDSGD prefers to trade within its range of horizontal resistance at around 1.3612 and of support between around 1.3442 and 1.3473. Bull bear indicator signals oversold while RSI is less convinced of a move in either direction. Meanwhile, a whole host of exponential moving averages suggests that the trend is further down. Overall, the in general picture for USDSGD remains what it was last week and the week prior which is to short.

For more analysis and charts please go to www.anthonylaurence.wordpress.com

USDSGD: Bearish sequence on 1D.The pair is trading on a 1W Channel Down (RSI = 42.533, Highs/Lows = -0.0041, B/BP = -0.0178, MACD = -0.002) which is close to pricing a top based on a recurring bearish pattern inside the channel. A new Lower Low should follow so we are going short, TP = 1.3400.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

NZD/SGDJust showing you that NZD/SGD's pattern seems to be incomplete. So I would expect break of the last high. That is a contracted flat though which always means it can turn into a regular flat. But if you get a flag like Aud/Chf did, look to buy to break the high would probably be the safest type setup from here....