Year of the Bull? Not according to the fundamentals...With large account deficits, disinflation and widening interest rate differentials there are many reasons to not be bullish China.

Whilst on the political side there is a desperate need to keep CNY stable and stronger because China needs to attract capital inflows for the second half of 2019.

Why?

Because they are trying to facilitate the process of inclusion in equity and bond indexes to make China more attractive for FDI.

Risks to this trade are for deterioration in Chinese macro data and if equity markets sell-off.

Best of luck all and thanks for keeping the support coming with likes, comments, follows and etc.

SGDCNH

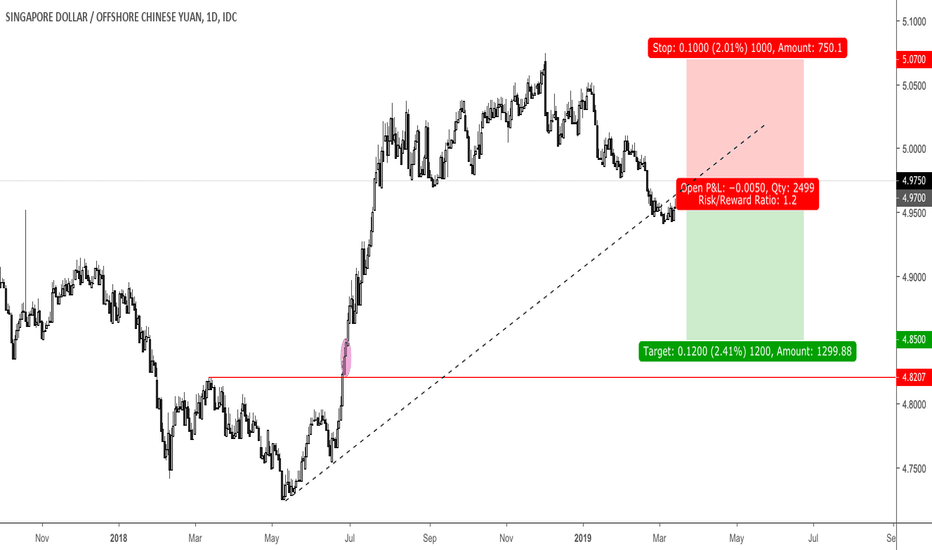

SGDCNH - 5-0 pattern setting upThis is a currency pair that I hold close to my heart.

As someone who travels to Shenzhen china almost monthly, I am pretty interested to put what I learn into good use to gain an advantage in life.

I change SGD to CNH every single month.

Keeping this post short, I am expecting SGDCNH to go down to 4.7 before rebounding.

For those of you who are planning to visit China in the next few months, I will suggest either changing more CNH this month or wait until it rebounds from 4.7,completing a 5-0 harmonic pattern before it charges towards $5. Do not change your sgd to cnh when it is around 4.7, either change it early or wait to change after it rebounds.

I cannot predict how long it will take but my conclusion is I will see the SGD weakening against the CNH over the next few months.