SH

SPY: I favor a another wave down soonFrom the daily chart you can see we are still in an intermediate down trend with the current price very near the down trend line. Also there was a recent gap down starting at 399.4. Price action seems to love to close gaps. I guess it is just fun to do. And we are just a 1 point from closing the gap. There are currently potential negative reversals in the daily and hourly RSI's ( dashed lines.) Put together this suggests to me another wave down is just ahead.

Remember all such analysis is imperfect so wait for price action to support this idea. You then can use the most recent high as your stop is price then reverses.

Ifffff this count is correct the wave down would be a 3rd wave or a C wave both of which can at times be fast and furious.

Hope this is helpful. Have a great week. Finally thank God for Martin Luther King for all his courage to improve the USA.

A very very first time for this Newbabie - SMC+LiquidityAfter scanning quite a lot of videos and articles and discussions with buddies, and started to mark the key area on the chart. Not all the trade were taken, but i did backtest and paper trading most of them.

What confusing me is the TF that where i am truly in! have to workout on this

Slice, dice in any way you like itPlease read this carefully before trading with SH

As you can see from the line chart, the SPX500 has broken down from the bullish trend line. Instead of shorting it, you can also buy the SH ETF if you believe SPX500 price will continue to fall.

It says it is meant for 1 day trading which means the timing of short entry becomes crucial. If you do not have a clear trading strategy to do that, it is better to avoid using such instrument.

You would realise the market is full of products, much like the Casino to increase your stay in this virtual market. From a trading perspective, the Market hopes to win you at the end of the day even if you won a few round at the black jack table (eg. forex). You might become overconfident and think you are over the top that you go on to lose all you have later at the futures or commodities table.

Those who had been to the casino will be able to relate to what I am saying.

In summary, know what you are in for. If you come in with 1000 chips and are prepared to lose all of it, make sure you stick to the game and NOT be tempted to go and exchange for more chips (similar to adding more funds to the account).

When Lady Luck is with you or God of Fortune likes you, when you make profits, know your limit and take it ,get out of the casino, go out and celebrate. Don't even think of double down what you had won (show hand). The casino works on the law of probability, over time, more people lose than the few who won. Those who won knows they cannot stay all day in the casino and knows when to quit.

SH Hedge portfolio? *UPDATE* Hedge Future PlanAMEX:SH This investment, while in conjunction with positive beta investments, is very useful. With this strategy, if it touches the RED line I buy more, if it touches the GREEN line I sell. If this drops, the market is Bullish and positive beta investments increase. If it increases, the market is bearish and providing insurance for the portfolio.

Trading the "Trump collar"The S&P500 is trapped in a fairly tight range, between 2830 and 2960, we are currently mid range.

Short-term traders can trade the range, while more longer term investors can wait for the break ….

Look to buy the SPY ETF near the 2930 bottom of the channel, or use the inverse ProShares Short S&P500 ETF (SH) to get short at the top of the channel (2950)

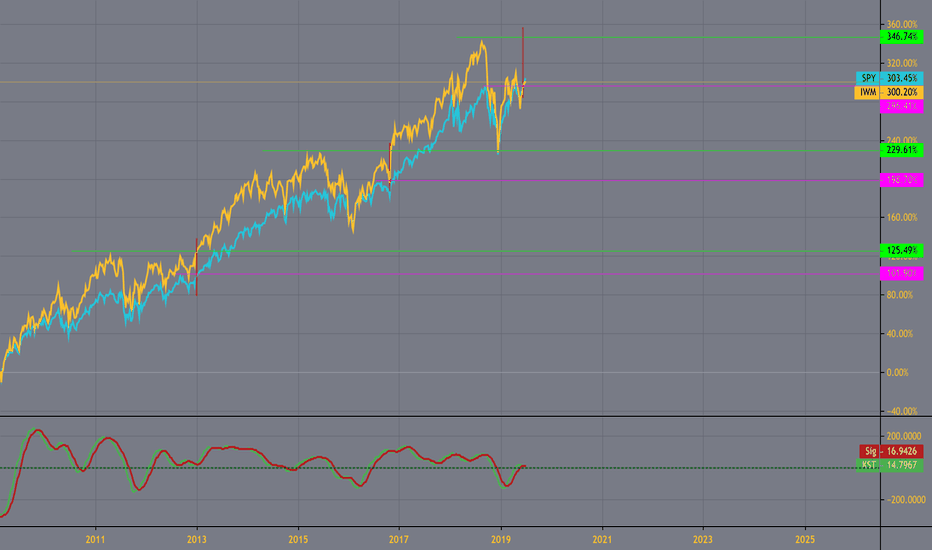

Houston- we have a problem.... iwm vs spyIWM has been the spy's faithful partner up chart since 2009. This run is different. I think we may be destined for failure.. until iwm can muster the strength to breaks its trend.

Suppose there's 2 possibilities here. either spy's gonna retreat, or iwm needs to make up some ground.. has a large distance to make a new high. Given circumstances i think retreat makes most sense.

Caution is warranted given conditions and charts history....

GOOD LUCK THIS WEEK!

xlf in a popular retreat zone. may be good hedge, or shortHeres some interesting spots on chart. xlf been lagging. similar to iwm.. which looked to be backing out of similar resistance zones.

May pickup some puts to add to my rally for nothing hedge.. Keep waiting to hear why we're back up here. fed rate that never changed? trump deals that never get made? earnings revisions everywhere.. so much debt.. etc

Seems this or iwm reacts stronger to downside, vs spy or vti.. Some may consider this a warning that there is downside risk mounting.. others on the trump train just see more money to harvest. Not sure where i stand. I guess id say im not convinced. But eager to see what happens.

investors gonna fall for it? nothing new since december.. ATH?Market loves it when trump claims a victory.. but how many times will we fall for same news? Last time the tweet news did not make sustainable rally. seems like nothing new here. Why would we break highs and continue up?

Maybe..

There's some lines showing possible lack of confidence. We'll see how the cpu's play it. Trying to keep stance balanced. But im leaning more towards a decline in July than big rally. I know, I know July is the best month, the greatest month.... we'll see.

spx channel, trade problems, expansion problems, debt problems..Heres a trend that may continue? Not sure I see a reason to break out to upside? Not sure what china will do as retaliation, but I imagine market wont think of it as a reason to rally back to highs.. but who knows, been wrong many times before.

Why this forecast will ultimately prove to be incorrect:

Im around 90% that monday, if market starts falling, we'll be seeing some trade talks going well, beautiful conversation stuff popping up in the news.. which will surely inspire our cpu palls to push price up into the 2900's.