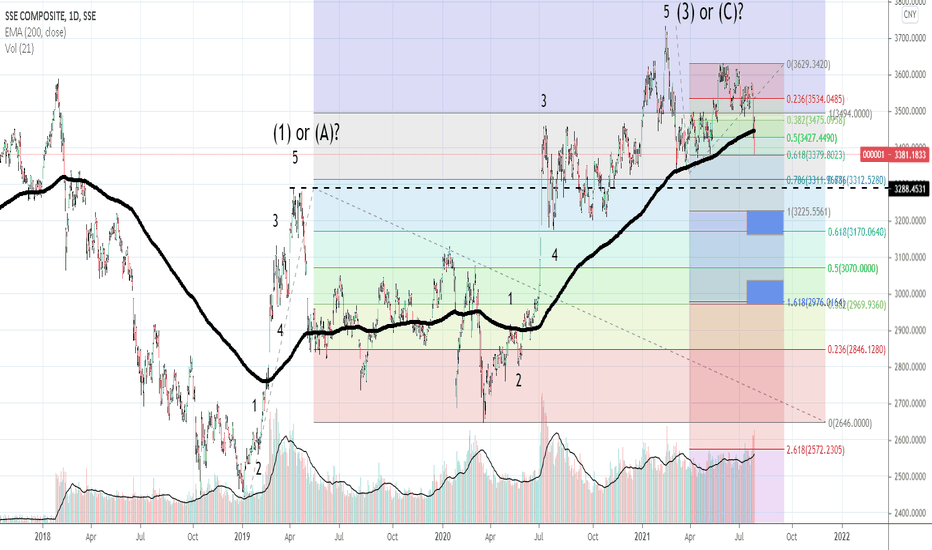

Shanghai SSE sharp bearishness and key level 3288.45Thanks for viewing.

I'm not a trader in SSE, or an investor.

General bullishness since December 2018 has recently been met with some strong resistance and selling pressure. Apart from finding myself here after reading the news today, where the commentator predicted more "risk" in the market, I don' really track this index.

I'm not a follower of the fundamentals of the market, but have some geopolitical insight. Whatever government intervention caused the sell-off, these are the technicals as I see them.

RSI: ~35 which is "oversold" but that can always go lower... or even stay at similar levels while the price grinds lower. No bullish divergence present on daily scale.

MACD: daily histogram shows below the zero line and in a steep downtrend. The moving averages have crossed over to the downside and are still diverging (converging would mean a slowing in the trend direction.

I am using Elliot Wave (which a lot of people don't really use for whatever reason) and there is a very clear support level that has to hold if your view is for continued bullishness: It is the 3288.45 level. If this level doesn't hold then the 18 month general bull-trend is over for a while. I put a couple of blue boxes as possible near-term support - even if that 3288 level is cracked, but unless you are trained to catch knives....

Either we are in a larger bullish market and this is a small (albeit very sharp correction), or there is a more extensive downwards correction underway. Personally, I wouldn't hang around to find out as the market seems to look corrective (downwards) in nature on the weekly time-frame as well.

If all the news and stories pumped out of China are true in the last 20 years... this isn't reflected in their stock market price trend. That said, the general trend - minus some massive run-ups seems to be slow and steady and there is some multi-year trend-line support at around 2800.

Let's see I guess. Best of luck and look after those funds.

Shanghai

NIO: Deliveries up YOY!!NIO

Short Term - We look to Buy at 16.34 (stop at 11.63)

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible. They reported a 11% year on year rise in deliveries which is good fundamentally. The trend of higher lows is located at 14.00. This is positive for sentiment and the uptrend has potential to return. Further upside is expected although we prefer to buy into dips close to the 16.00 level.

Our profit targets will be 27.48 and 32.00

Resistance: 24.00 / 34.00 / 45.00

Support: 16.00 / 12.00 / 5.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre

SSE COMPOSITE close to a bullish reversalThe Shanghai Stock Exchange (SSE COMPOSITE) broke and closed today above the 1D MA50 (blue trend-line) for the first time since January 12. This alone is a first major step towards restoring the long-term bullish sentiment. There are two more barriers ahead, the Lower Highs trend-line from December 13 2021 and then the 1D MA200 (orange trend-line). In our opinion, the index can methodically hit each target if a 1D candle closes above the previous barrier.

For example now that we got the 1D close above the 1D MA50, a buyer can target the Lower Highs trend-line. If we close above the trend-line, then target the 1D MA200. Complete long-term reversal to the bullish trend should come only above the 3500 Resistance.

Notice that the RSI on the 1W time-frame has broken above its own MA trend-line and achieved Higher Highs, which is a strong step towards the direction described above.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

SSSE - Shanghai Composite -The China Will Help Russia?This Chart Suggests That China Will Help Russia

A negative mood in China could be reaching an extreme.

Reports over the weekend are stating that Russia has asked China for military and economic assistance as its invasion of Ukraine gets bogged down. A new Sino-Russia friendship pact was formed just before Russia launched its assault, with Putin and Xi Jinping best of buddies at the Winter Olympics. With Western sanctions impacting the Russian economy, it’s abundantly clear that China is now the key in this geo-political crisis. China has a choice of whether to help Russia, by buying its oil, etc... or to put pressure on Putin to stop his imperialistic ambitions. The chart above is a clue that China will choose the former route.

The chart shows the progression of negative social mood in China since 2007, with that mood trend driving a bear market in the Shanghai Composite index. The pattern is a triangle, very similar to that seen in the Russian RTS$ index which caused to forecast that Russia would invade Ukraine.

Primary degree wave (C) of the triangle equaled 0.618 of the length of wave (A), a solid clue that the pattern is correct. The advance in wave (D) might still be operation but it’s interesting that, although not a classic triangle ratio, the proposed wave (D) ending in September 2021 equaled a Phi-related 0.382 of the length of wave (B).

So, if this wave count is correct in the Shanghai Composite index, Primary degree wave (E) is already in operation. Negative mood expressions such as widespread Covid-lockdowns could already be a manifestation of this wave, which can be expected to be the point at which negative mood reaches an extreme. (Note that regardless of whether the Shanghai Composite is already in wave E or still in the latter throes of wave (D), in either case the larger degree bear market is 15 years old and counting.)

The negative mood extreme could very probably drive China to go all-in in siding with Russia. Crisis and opportunity indeed.

512480 Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

Shanghai Composite Index failureThe SCI wiped out the four months of gains in just two days. In addition, it broke support levels and is leading towards a lower target about 3,200.

All these on the back of regulators setting new rules for the game.

Also understand that street talk tells of margin calls too.

Technicals are just turning down, so that -5% may just be a beginning.

HODL!

Needs to test 2827 levelAll time support and resistance levels and calculated projection for next movement (going South)

ridethepig | SHCOMP Market Commentary 2020.08.26📌 A quiet few weeks and enjoying the last few days of summer before things get very active in markets for the rest of the year and into 2021.

Global Equity buyers received their reward for their braveness play: overshoots are a weakness.

See diagram below.

The mysterious 2650 lows were held from the Giant Panda (PBOC), when retail threatened the attack down to make the recovery difficult the monetary side played the defence. At the same time, it also makes the inevitable far worse as the energy needed to get back to 2750/2650 is minimal. The book is very thin.

Buyers have made good use of the swing higher, ignoring Covid cases and deaths and totally looking through US/China protectionism. Sellers have played the waiting game and distributed on the test of resistance 3400/3350:

Prepare for a parry away as the ever present threat of covid approaches and puts further lockdown threats in play. The risk of a full blown monetary crisis has put Equities under permanent threat as the weakness comes from confidence. If consumers are not confident enough to return, or will question if clients are even able to meet, then it will not matter the amount of stimulus as the issue is far bigger than central banks.

A strong move here would be to push the tempo and threaten the immediate breakdown. Live portfolio flows and chart updates resuming as 'normal' from Jackson tomorrow.

As usual thanks for keeping the feedback coming 👍 or 👎

ridethepig | Chinese Equities ... The Slaughtered PigThe "hanging" candle

The problem is as follows:

If the only way to reach risk-on in and remove social distancing is either via a vaccine (most preferred option although not really in scope till 2021) or further extreme lockdown measures (as you all know extremely costly and damaging to the monetary side) to completely remove the virus from circulation. With all roads towards confidence blockaded, it's more advisable to take a contrarian stance to the equity promoters.

This is not an easy one to add too. It depends on the circumstances next week, namely on the virus front as Europe looks set to follow the US and lose control. This is something I would like you all to anticipate: it is all too easy as for the Robinhood pawns who tend to be weak when tested.

The flows are as follows:

1️⃣ the flows themselves in US equities are open to attack

2️⃣ the final nail in the coffin comes from long bonds which are too much pressure to maintain: this means that the necessary complacency forces retail to buy all the junk while those smart enough unload and exert Puts / shorts.

Here the notion of parking capital in China in the short-term turns out to be deceptive and soft. Once more the reason can be found in the previous SHCOMP swings: in diagrams attached below you will see excellent examples of PBOC blockaders and failures.

Ride the PBOC, Feb 3rd 2020

The attempt to ride the CB flows, the hanging lows were relatively obvious and panic creates weakness which can be bought with confidence like passing clouds.

SHCOMP Market Commentary, Feb 24th 2020

The pullback was a result of the PBOC and sharp hands. Many moons ago I would've been convinced by this market...not today.

This leads to the long run choppy conditions and unfavourable outcome of soft hands who placed their stops too blatently. The sell side is still there on the move, ride weakness is the strategy and balance out at key support levels.

Thanks for keeping the feedback coming 👍 or 👎

China plummets as data shows patched recoveryAfter a 24% rally in their stock market from the start of July, the Shanghai Composite index saw a sharp reversal down 17% as data shows a patched recovery in China.

Bloomberg reporting industrial output was lower by 1.3% while retail sales plummeted 11.4%, showing strong weakness in the consumer, which use to be the backbone of many economies. Michelle Lam, China economist at Societe General SA in Hong Kong, stated that the recovery was “driven by credit stimulus as evident in the strong infrastructure and property investment, while the recovery in sales in retail sales and private investment has continued to lag.”

It is interesting to note that the strong infrastructure and property investment gains are on the back of the PBOC’s wary of cutting rates earlier in the year when the Coronavirus hits. In favour of a more direct approach, China issued bonds, facilitated direct lending and lowered the reserve ratio required for banks to provide liquidity into the money markets. These measures injected more than 1.7 Trillion Yuan ($220 Billion) of liquidity into the money markets. This is a stark contrast to how 38 other central banks around the world tackled the Coronavirus early this year by slashing interest rates. Michelle continues, stating that “Policymakers will probably save bullets and hold back broad-back easing and find the current growth trajectory acceptable.” This sentiment is backed by Ma Jun, a PBOC adviser, stating that “the PBOC doesn’t use all its bullets at once. China has plenty of room in monetary policy.”

China has been giving investors something to cling on to

The recent bull run has given many Chinese retail traders great euphoria. Bloomberg documented Min Hang, who opened her trading account, stating that “There is no way I can lose” and that “ feels invincible.” The rally added $1 Trillion of value in the span of 8 days, topping China’s equity market valuation to 10 trillion – the top of the bubble in 2015. However, being known as the world’s manufacturer, China continues upward hinges on the global economy to recover. Ding Shuang, chief economist for China and North Asia at Standard Chartered, stated that Coronavirus around the world continues to affect businesses around the world, which “may weaken demand for China’s goods and services and is the main risk facing China’s economy.”

This highlights a significant problem with Globalization: Dependency with all the other markets. Amid a trade war between China and the United States, Globalization faces an imminent threat akin to mutually assured destruction. With both countries’ interests in the forefront of their foreign policy, they are blinded to the fact that in this day in age their rely on each other more than they give each other credit for.

Are you riding China’s bull market?

Shanghai: Still some upside before profit taking kicks in.SHCOMP has formed a Golden Cross on the 1D chart turning vastly overbought (RSI = 89.841, MACD = 105.710, ADX = 52.201). Last time that took place within the long-term Channel Up that started in January 2019, the market consolidated for a few days and delivered a last peak in a month. The MACD has entered into this red Resistance Zone of the 2019 consolidation, so there are high probabilities that investors won't close massively positions and let profits run a little higher towards the 3,580 2 year Resistance (January 2018 Top).

** If you like our free content follow our profile to get more daily ideas. **

Comments and likes are greatly appreciated.

Major Highs Cooking for Chinese Equities!📍 In this position, after clearing the knee-jerk reaction from covid flows we are starting to enter into chapter II, heavy protection. The flows have shown strength in drastic fashion; the apparently bottomless wallet of keynsian economics - suddenly showing a surprising amount of animation! You can see the impact of PBOC on Chinese Equities here:

...and now buyers had a simple win by testing the 2983 highs. The retrace idea was as follows; overprotecting a strategically important structure. The reward was to open up a retest of the support which was an all embracing struggle for the PBOC:

In the long run, the positional struggle from CB's will come down to a struggle between healthcare on one hand and restraining capitalism on the other. It is extremely important to strive for re-openings in sensible fashion since the virus is still in circulation and lusts to expand. Health crisis cannot be solved with throwing money at it... not enough time has elapsed so the Stan Erck pump and dump we are watching with Novavax is set to flop and sadly put the final nail in the coffin for Global Equities.

As usual thanks for keeping the feedback coming 👍 or 👎

Shanghai Composite - Something is BrewingShanghai Composite had very strong performances in the past few trading days. The monthly RSI is above 60 and the highest since 2015. It is about to break ABOVE 2019 high which is very significant.

Is China telling us something about the capital inflow?

Very intriguing. Everytime China is heading into bull market, never ever neglect this information. As we can see in 2007 and 2015. Are we heading into a bull market that will top in 2022? Who knows.

But charts never lie. If one thing you can rely on, its the chart.

China equity bull market will be bullish globally as we can see in 2007 and 2015. But at the same time, when it is overdue, its time to be cautious and to exit the market.

It seems like the overall bullishness in Nasdaq has spilled over to Emerging Market. I don't expect to see any major top soon, but we will have it, and when all the indicators are there, its time to exit and pull the trigger.

Until then, enjoy the ride.

Regards.

Don't reach out to me. Don't messages and comments. I don' read them. So, stop wasting your time.

SSE Composite Index Probabilities Retracement HigherChina commerce ministry says production of auto, auto parts have fully resumed. China continues the narrative that they are back up and running. It should lift off some pain from the market and we probably have some retracement upward if market players are optimistic.

ridethepig | SHCOMP Market Commentary 2020.02.24A bloodbath across most of Asia with SHCOMP managing to hold via PBOC intervention. Actively sold the Tokyo close as red alerts have been triggered across Global EQ Index.

Those familiar with the current technical flows we are tracking will remember the PBOC dip; it was a classic example of CB intervention in attempt to stop the bleeding. The issue is that markets want to test the limits, CV is showing no signs of abating and the impact is still yet to be seen in earning and growth figures.

We have retraced back to the last breakdown point and selling has begun as if a new crisis is here...

Good luck all those on the sell-side in equities, a major move in the making if things do not get under control within days on the virus front. Thanks for keeping the support coming with likes, comments and etc!!

𝗡𝗲𝘄 𝗖𝗵𝗮𝗿𝘁: $SSEC Daily (or $SHCOMP). Hitting resistanceConfluence of resistance here. Worth watching to see if straight-line DCB continues and #PBOC liquidity pumps remain effective

ridethepig | SHCOMP Market Commentary 2020.01.31As usual thanks for keeping your support coming with likes, comments and etc... Lets get started with a round of important chart updates coming today (which btw is extraordinarily late after a week ban). I would like you to note the position arising here looks as though its "business as usual" for the dip buyer crowd, whereas sellers are seeking salvation in a momentum breakdown against the support.

The 2793.xx has now been exposed and the base is open for a typical attack. The macro cycle swing down started here when we traded the highs in April year:

As we know, the philosophy of a swing which we have dealt with can wield sound reason for the evaluation of any possible scenarios where flows are involved. But as this example will show, the theory of swings we have widely mentioned in previous charts can also be useful to highlight the notion that battlefields exist.

So we are talking here about an area which is needed to break in order to form the breakdown as a first premise. I would recommend that you try to technically understand the two different sides in play, notably should we fail to breakdown then the swing to the extreme topside with a rebound through the red line as the other scenario (this will come via coronavirus fading). It is possible to remain indifferent to direction without great difficult in the game.

German Equities are now forming a high and already appear to be coming off:

To secure the breakdown we will need Europe and NY to keep the pressure on today, SHCOMP is closed till Monday so gaps expected! Good luck!

SHCOMP bounced from support, potential for a further rise!

SHCOMP bounced off 2937.698 where it could potentially rise further to 3130.627.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.