Major Correction AheadShanghai Composite Index with major correction expected by mid next year. Multiple failed formations throughout history, especially recently. The performance is rather simple to read, which is unusual for major indexes. The index is clearly "flattening out" currently, and seems to be charging for a large movement. ADXDI confirms this as well.

(lines and connections have been averaged using step-line over log for higher precision, zoom out to reveal more)

Shanghai

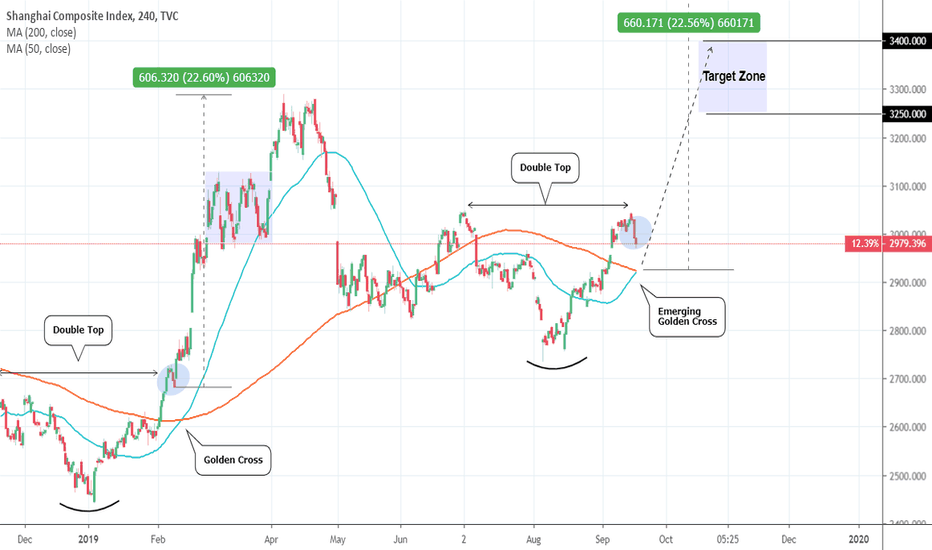

Shanghai Composite: Golden Cross. Potential for an strong rise.SHCOMP is currently pulling back off a Double Top formation near July's 3,050 Resistance. The key development here is the potential to have a Golden Cross formation on 4H.

Last time this pattern emerged was in mid February 2019, when again the price was pulling back after a Double Top. The result was an aggressive jump of +20%. Medium term investors can wait for the Golden Cross to take place, catch the low and then go long on the medium term. Target Zone: 3,250 - 3,400.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Shanghai A composite, in the key resistance levelHello, Dear friends

China Shanghai A composite index just break the key level ~ 3000, but huge resistance in above, and 4H&1D RSI running in over bought region.

my strategy is retest the below key support level ~ 2830, to see if a reverse H&S could be formed or not.

HSBC Bullish For Stock Market ReboundHSBC is trading this month in congruence with the current global stock market pullback by offering a time-relative discount in share prices.

HSBC target $43 for a 5.4% difference from the current quote of $40.78. The S&P 500 is off 7.5% from doubly tested but not yet broken all time highs which renders this parallel HSBC trade idea as conservative and defensive. The duration for this trade is 1-3 months.

China H&S target reached and now a bullish wedgeLooks like an almost perfect bullish wedge here. The H&S had a target arond 12.600, which has been reached, so it could be a (temp) turning point. With this bullish wedge at the low, it seems to be a perfect setup. Ideally we see one more drop to test the low again. When seeing it turn a bit at that low, might get a chance to catch the exact low. But in theory, with a wedge we want to see 3 touches of the support line, which we already have here, so it could already have set the low.

This wedge would also perfectly fit the picture of a normal correction of the big drop we had the past days. Making like a right shoulder as we can see on the left.

Chinese Growth Rebound? The chattering class is clearly leaning towards the sentiment that Chinese growth is stabilizing as GDP growth was strong (compared to its 6.0 to 6.5 percent range) in conjunction with strong PMI numbers and, as can be seen by the Shanghai Composite, strong capital markets.

While Europe is unsure what to do with the euro from the prospect of Brexit still on the table and the United States obsessed with the Mueller Report being released today, China is considerably devoid of these types of political risks that are mostly distraction. The market is much more focused on fundamentals and while the political risk in Europe or the US is not likely to significantly shift markets today per se, the Chinese are technocratically attempting to solve their financial problems.

Good News This Morning on Shanghai CompositeExports data coming out of China is positive this morning, moreover the US will not keep on putting pressure on China politically according to Bloomberg. Also, data suggests the trade surplus increases while credit growth beats estimates. Could see 3 to 6 percent increase in Shanghai on Monday if all else is equal.

Stochastic Flashes Sell, But Has Changed BeforeWhile moving averages at the weekly level only half bullish, the stochastic is now consistently flashing to sell while RSI heads in that direction. While this has been reversed in the past such as 2017, conditions are different. Recently, Trump indicated a trade war detente may not come until June if it comes at all as he threatens to keep tariffs on against the Chinese if they don't clean up their act, summing up his sentiment not my own. Overall, trade wars are for now here to stay and could put on downward pressure on this index as had been the case for mostly of 2018.

If you would like to look at more of my work with more charts, check out www.anthonylaurence.wordpress.com

Trade War Alleviation Gives Much Evidence for UpsideVolatility is decreasing as the trend upwards slows down. I think there is large potential to the upside as the US-China trade war comes to a detente. However, many resistance levels remain in the way before that can happen. On the other hand, the index quite easily blew past previous levels of resistance with no problems. Want to see more talk towards trade war resolution before I'll be bullish. More words on the matter here: anthonylaurence.wordpress.com

Shanghai Composite Trades on Trade War HeadlinesQuite a run since February. One of the most volatile world indies though with a volatility percentage of 1.91 percent while the most volatile index is Iceland's 2.54 percent and the global average of .96. Trade deal headlines really influence Chinese equities. Inspires me to stay away.

Fibonacci Retracements on the Shanghai Composite 3117 and 3136 remains short-term support over the next week while 2794 and 2829 could be support. Fib retracements could also be pivot points as they have been in the past.

Shanghai CompositeTime to short China/Chinese stocks.. The $SHCOMP monthly log chart is running up into some critical resistance.

GL!

Shanghai Index: Buy the pull back.The Shanghai Composite Index has seen a considerable rise since the start of the year, which we predicted in December ( ). The parabolic rise on 1D has reached past the overbought zone (RSI hitting 80.000) and as it got close to the 0.500 Fibonacci retracement level (3,015), we should start see it consolidating. The strongest candidate for a pull back however is the 0.618 level (3,150). We are willing to buy any such pull back and target the 0.786 level at 3,340.

See below how we predicted this +22% rise in December:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Expecting a last leg down from near 28000HSI has dropped down significantly since my idea published in June predicting price drop to 24000 (see below). It is now likely to drop in a last leg down. Note that it may move up to 28000 before moving down.

PS: This analysis is just for educational purposes and is not a recommendation to buy or sell. Please do your own research and trade at your own risk.

Idea published in June

time to load up on china? Shanghai composite breaking out of its 12 months downtrend channel with a bullish divergence.

SHCOMP How long is the divergence willing to last?The Shanghai Composite reflects the real situation that we are facing up. The S&P 500 completely out of mind in that perspective. Are we approaching a reversal movement in both indexes? Indeed, one of them has a lot of chances rather than the other. Which one is willing to turn over first?

Learn how to beat the market as Professional Trader with an ex-insider!

Be part of an elite trading group. Last course of the year on November 2nd, 2018.

Have a Nice Trading Week!

Cream Live Trading, Best Regards!

Is this the right time to start buying Chinese stocks?Since the all time highs in 2007 the Shanghai Composite has not recovered those levels failing on successive Lower Highs. This has created a Triangle pattern on the Monthly chart with Higher Lows. We can't be sure which trend line has to be followed to mark the new Higher Low as both have valid grounds. In any case, the index is approaching its long term technical low, which was either on October's 2,449.20 or will be near 2,100. 2,500 is currently the MA200 period on the monthly chart, so there are more chances to see the recovery starting now. Our early estimates place the long target at 4,380.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Chinese stocks under severe pressure from global risk => Market turmoil is creating its own negative feedback loops for China driving further tightening financial conditions that will last and have further effects on the economic growth in the region.

=> It seems unlikely to open the floodgates to a recession so far however further trade tensions between the US and China will add to fragility.

=> Targets in Chinese stocks remain at 2400 after the technical break of the 76.4% retracement.

=> Good luck all

China Long, near termSHCOMP broke out of falling wedge and is bouncing of severe support. Will expect it to go back up to test long term pennant resistance.