China's money supply explodes.China's revision of its M1 money supply calculation in January 2025, which now encompasses individual checking accounts and assets held in non-bank financial institutions, seeks to deliver a clearer understanding of liquidity within its economy. The reported surge from $67 trillion in December 2024 to $112 trillion in January 2025 has ignited discussions, with some viewing it as a strategy to obscure underlying economic issues, such as a potential deflationary debt spiral.

The People's Bank of China has declared a "moderately loose" monetary policy for 2025, aiming to boost the money supply and lower interest rates to foster economic growth, a move that may be connected to the M1 recalibration. This shift takes place against a backdrop of broader macroeconomic adjustments, including a 5% GDP growth target and initiatives to stabilize the real estate sector, as detailed in China's 14th Five-Year Plan for 2025.

Shanghaicomposite

China's kicked off Year of the Snake: Trade War Meets AI Rally China's Markets in 2025: Trade War Meets AI Rally 🐍📊

1/9

Chinese stocks kicked off the Year of the Snake with mixed signals. Trade tensions with the U.S. are rattling markets, while AI-sector hype led by DeepSeek is lifting tech stocks. 🛑⚡ Will AI innovation outshine trade fears?

2/9

After a holiday break, mainland Chinese markets opened under pressure. The Shanghai Composite Index (SSE $000888) struggled to gain momentum, reflecting concerns over new U.S. tariffs. 📉 Trade wars continue to haunt global markets.

3/9

Meanwhile, Hong Kong-listed Chinese stocks rallied strongly despite tariff risks. Investors remain optimistic about cross-border business resilience and opportunities in tech. 🏢📈

4/9

Currency Stability: The firm fixing of the yuan signals that Beijing is stepping in to manage volatility. Stability in currency markets is crucial for maintaining investor confidence. 💴 Will this intervention calm the storm?

5/9

Trade tensions escalated with new tariffs from the Trump administration. While the measures were less severe than feared, the negative sentiment still weighed on broader market performance. ⚖️ What’s next for U.S.-China trade talks?

6/9

On the upside, the AI sector surged. Buzz around DeepSeek—a rising Chinese AI player—sparked gains in tech giants like Alibaba ( NYSE:BABA ) and Baidu ( NASDAQ:BIDU ). 🚀 AI is becoming a crucial driver of China’s economic narrative.

7/9

Technical Watch:

Shanghai Composite Index (SSE $000888): A bellwether for China's economic sentiment.

CSI300 ($000300): Captures performance across top Chinese blue chips, reflecting key market trends.

8/9

Chinese tech giants like Alibaba and Baidu are riding the AI momentum, but the backdrop of geopolitical and regulatory risks could temper gains. 📊 Can AI innovations outweigh trade turbulence in 2025?

9/9

What’s your outlook on China’s markets this year? Vote now! 🗳️

Bullish: AI-led rally continues 🐂

Neutral: Trade volatility offsets gains ⚖️

Bearish: Trade war worsens 🐻

Shanghai Composite. 'Arctic Fox' leaps on Shanghai street cornerReal estate has made China rich in recent years and decades. Now it looks more like radioactive kryptonite from the DC Comics universe - the birthplace of Superman.

Three months earlier, China's house prices fell 0.4% in a month, according to official statistics released in November 2023, the steepest drop since February 2015, according to Bloomberg data .

It was one sign that a key engine of the world's second-largest economy is still faltering despite Beijing's multiple stimulus packages.

At the same time, prices for secondary housing fell by 0.6% in October, which is the highest figure in nine years.

According to the Cato Institute data , private property accounts for 1/4 of China's total gross domestic product and nearly 70% of all household wealth.

This means that falling house prices have become a serious burden on the economy.

The situation is exacerbated by a seemingly endless debt crisis that has left the country's two largest property developers on the brink of collapse, with both Evergrande and Country Garden defaulting on bond repayments in recent years.

Evergrande serves as an example of how an industry that contributed to China's economic boom and prosperity for decades has become toxic and has become a point of weakness and decline.

The company was founded in 1996 and built huge residential complexes in the city center, helping to accelerate China's shift away from a socialist agrarian economy. The company eventually expanded beyond real estate, opening separate businesses selling bottled water and electric vehicles, and in 2010 it bought a Chinese soccer club that would go on to become the country's most successful team.

These days, the former giant is struggling for cash and facing liquidation.

China's fragile housing market is back in the spotlight at the start of 2024, following the release of a batch of fresh statistics.

China's troubled property market ended last year with the worst decline in new home prices in nearly nine years, despite government efforts to prop up a sector that was once a key driver of the second-largest economy.

New home prices in December showed their sharpest fall since February 2015, while property sales measured by area fell 23% in December from a year earlier, data from the National Bureau of Statistics (NBS) showed on Wednesday, January 17, 2024.

Of the 70 cities included in the NBS house price data, 62 reported falling prices.

Markets immediately responded with a strong decline, exacerbating the accumulated negative returns since the start of 2024.

Big China Indices Crash by Mid-January, 2024

At the same time, property developer investment in December fell year-on-year at the fastest pace since at least 2000, according to Reuters calculations based on NBS data. Overall, real estate investment fell 9.6% in 2023, roughly matching the decline in 2022.

Several Chinese developers, including China Evergrande Group HKEX:3333 and Country Garden HKEX:2007 defaulted on their offshore debts and entered into restructuring processes.

Country Garden, the country's largest private real estate developer, warned this week that it expects the real estate market to remain weak into 2024.

The technical main chart is dedicated to the Shanghai Composite Stock Index, which, judging by the current scenario, will experience far from the best year in its history, as a result of the index breaking down its narrowing multi-year range.

// Photo: “Arctic fox” leaps on Shanghai street corner .

💡 February, 2024 Notes

👉 Chinese stocks are falling for the 6th month in a row by February 2024 against the backdrop of the weakness of the Chinese economy, while SSE:000001 Shanghai Composite Stock Index fell below its 200-month SMA for the first time in its history.

👉 An extremely rare Bearish Super Combo in the Chinese financial market of 6 consecutive monthly declines is the result of disappointment with economic data and PRC government measures to support the economy.

👉 Industrial activity in China fell for the fourth month in a row in January, official data showed on Wednesday.

PMI indexes point to a bleak picture of continued contraction in manufacturing, roughly unchanged activity in the services sector and a slowdown in construction, Nomura analysts said.

👉 Weak economic recovery and limited support measures have affected investor sentiment.

The Hang Seng Tech Index of Hong Kong-listed tech giants HSI:HSTECH fell 20% in January, while Hong Kong-listed shares of mainland property developer Hang Seng index fell 19%.

Symmetrical Triangle Pattern Formed & Target.Wait for the Breakout, as it is Crucial in the Stock Market. Institutions and Professionals often Enter Trades based on PATTERNS & BREAKOUTS. After a Breakout, the Market significant BULLISH Trend.

I want to help people Make Profit all over the World throughout my entire life. Additionally, I am eager to Receive Money Worldwide because of my Potential.

Symmetrical Triangle Pattern Formed & TargetWait for the Breakout, as it is Crucial in the Stock Market. Institutions and Professionals often Enter Trades based on PATTERNS & BREAKOUTS. After a Breakout, the Market significant BULLISH Trend.

I want to help people Make Profit all over the World throughout my entire life. Additionally, I am eager to Receive Money Worldwide because of my Potential.

Shanghai Comp. (SSE) -> Please Pay AttentionMy name is Philip, I am a German swing-trader with 4+ years of trading experience and I only trade stocks , crypto , options and indices 🖥️

I only focus on the higher timeframes because this allows me to massively capitalize on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on Shanghai Composite.

The Shanghai Composite index is the leading index of China and has been trading in a long term symmetrical triangle for more than 15 years.

Considering the fact that SSE entered bullish into this triangle, I do expect a bullish breakout which could happen in the next 6-18 months and then I do expect a major move to the upside.

- - - - - - - - - - - - - - - - - - - -

I know that this is a quite simple trading approach but over the past 4 years I've realized that simplicity and consistency are much more important than any trading strategy.

Keep the long term vision🫡

Shanghai Stock Market (SSE Composite Index): A Closer LookThe Shanghai Stock Market is like a financial puzzle, and right now, it's showing us some interesting moves.

First, the rise in the 10-year yield from 3-year lows suggests that there might be changing expectations about economic growth, inflation, or monetary policy. This could be due to a variety of factors such as improved economic prospects, inflation concerns, or changes in the global interest rate environment. The central bank also did something important by closing a 5-billion yuan money deal. It's like they're keeping a watchful eye on how money is moving around. On top of that, they pumped a massive 385 billion yuan into the system, which can make things more exciting.

Now, let's talk about Ichimoku Cloud analysis. It's like a weather forecast for the stock market. Right now, it's showing that the market might be heading up, which is a positive sign. However, the cloud isn't very thick. This means we should be a bit cautious.

There's another important sign on this chart. Tenkan points up, suggesting the market might go up soon, even though it's under Kijun resistance line. It's a bit like seeing a green light at an intersection, even if the other light is still red.

So, as we decode these numbers and signals, it's clear that the Shanghai Stock Market is in a state of flux, with various factors at play. Investors will need to stay vigilant, considering both the data and the bigger economic picture to make informed decisions in the coming year.

SSE Composite Index WCA - Classic Rectangle Introduction:

Hello and thank you for taking the time to read my post. Today, we analyze the SSE Composite Index on the weekly scale, focusing on a classic price pattern called the "Rectangle Pattern." The SSE Composite Index is the most important stock index in China, excluding Hong Kong. It is a price index weighted by market capitalization and includes all public companies listed on the Shanghai Stock Exchange. The index is published by the China Securities Index Company. Analyzing an index helps enormously with top-down approaches, as it provides a broader perspective of the market and allows investors to gauge the overall sentiment before diving into individual stocks.

Rectangle Pattern:

The rectangle pattern is a chart pattern formed when the price of an asset moves between two parallel horizontal lines—representing support and resistance levels—over a period of time. In essence, it reflects a consolidation phase where the market is undecided about the direction of the trend.

Remember, this is just a brief introduction to the technical aspects of the rectangle pattern. As you delve deeper into this topic, you'll discover more nuances and practical applications that can enhance your trading strategies.

Additional Analysis:

On the SSE Composite Index chart, we can observe some fascinating insights. The general trend was downward until 25/04/2022, which changed with the formation of a hammer. Since then, the price has been bound within a range, which is depicted as a classic rectangle pattern. This pattern has been forming for 423 days, which is notable because the longer a pattern remains consistent, the higher the probability that the subsequent breakout will be volatile.

The support of the range is at 2890, while the resistance is at 3400. Currently, the price is above the 200 EMA, making a long entry more attractive. We will closely monitor the price pattern and wait for a break above 3400 while examining the sectors or stocks from the SSE Composite Index more closely. The next potential resistance after 3400 would be 3720.

Top-Down Approach Significance:

A top-down approach is a method that investors use to analyze the market, beginning with a broad overview and then narrowing down to individual stocks. This method helps investors identify the overall market sentiment and trends, allowing them to make more informed decisions when selecting stocks within specific sectors or industries. Analyzing the SSE Composite Index, as shown in this post, provides a valuable starting point for investors looking to employ a top-down approach in their decision-making process.

Conclusion:

The SSE Composite Index weekly chart showcases a classic Rectangle Pattern, reflecting a consolidation phase in the market. By closely monitoring the support and resistance levels, as well as the general trend, traders can be better prepared for any potential price action in the future. Utilizing a top-down approach enables investors to gain a broader perspective and make more informed decisions when selecting stocks. As always, it's essential to consider risk management and proper position sizing when trading based on chart patterns.

Please note that this analysis is not financial advice. Always do your own due diligence when investing or trading.

If you found this analysis helpful, please like, share, and follow for more updates. Happy trading!

Best regards,

Karim Subhieh

China: Back to the Grind (SHORT)China:

Morgan Stanley scenario:

Chinese stock indexes could plunge by another 20% from current levels over the next six to 12 months — and potentially remain lower for much longer if the hypothetical stress scenario persists.

China’s GDP could slow drastically, averaging 2% growth in 2023.

More than 11 million people could lose their jobs, likely sending the urban unemployment rate above 7%. Construction, accommodation and catering would see the most job cuts.

Chinese SSE300 Index ETF: Bearish Dragon with 1.618 TargetThis is an extension to the Bearish SSE50 setup that I posted not so long ago; I found a tradable US Listed ETF that tracks the movement of the SSE300 and the situation on this chart is pretty much the same as the one for the SSE50 where we are breaking a logarithmic trendline, the moving averages, and looking to make a minimum 61.8% retrace. However, I believe it will go much deeper and my targets will be the 88.6% retrace at $17.31 and then the 1.618 Fibonacci Extension below at $7.72

SSE (Shanghai stocks index ) probably “bottomed”. 28/Oct/22SSE ( Shanghai Stocks Exchange ) index probably now as “leading indicators” for world’s economic not US anymore..As its index “crashed / bottomed” much “earlier than US markets like its individuals stocks e.g BABA, Tencent, Xiaomi, NIO etc..

Shanghai Composite Index Macro TriangleOstensibly SSE in a macro triangle formation. In this scenario we typically find peaks at 786 relationship of one another, At times we find the last leg falls shy of the 786.

** Please not the idea conveys only a potential pattern and how it may complete, and is not intended as a projection of future price action which relies on many factors that patterns and charts cannot and often do not capture.

Chinese SSE 50 Index Bearish Dragon with 1.618 TargetThe top 50 stocks in the Shanghai Composite Index look to be collectively forming a Bearish Chinese Dragon which if it breaks down could very well send it straight down to the 1.618 Extension given that there's is only one little Support Zone Below us after the trendline is broken. Given this very great Potential Danger that is visible on the chart i will be Avoiding Investment into Chinese Assets in the foreseeable future.

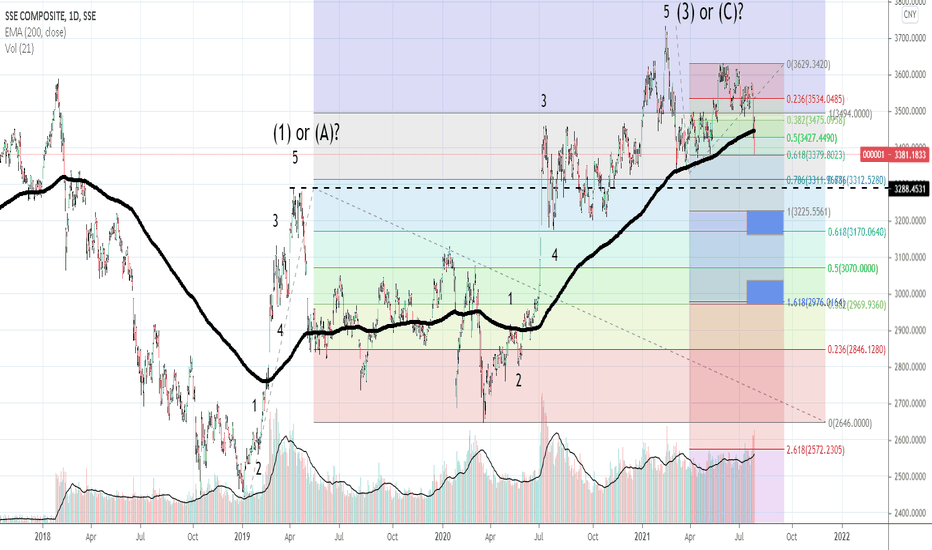

Shanghai SSE sharp bearishness and key level 3288.45Thanks for viewing.

I'm not a trader in SSE, or an investor.

General bullishness since December 2018 has recently been met with some strong resistance and selling pressure. Apart from finding myself here after reading the news today, where the commentator predicted more "risk" in the market, I don' really track this index.

I'm not a follower of the fundamentals of the market, but have some geopolitical insight. Whatever government intervention caused the sell-off, these are the technicals as I see them.

RSI: ~35 which is "oversold" but that can always go lower... or even stay at similar levels while the price grinds lower. No bullish divergence present on daily scale.

MACD: daily histogram shows below the zero line and in a steep downtrend. The moving averages have crossed over to the downside and are still diverging (converging would mean a slowing in the trend direction.

I am using Elliot Wave (which a lot of people don't really use for whatever reason) and there is a very clear support level that has to hold if your view is for continued bullishness: It is the 3288.45 level. If this level doesn't hold then the 18 month general bull-trend is over for a while. I put a couple of blue boxes as possible near-term support - even if that 3288 level is cracked, but unless you are trained to catch knives....

Either we are in a larger bullish market and this is a small (albeit very sharp correction), or there is a more extensive downwards correction underway. Personally, I wouldn't hang around to find out as the market seems to look corrective (downwards) in nature on the weekly time-frame as well.

If all the news and stories pumped out of China are true in the last 20 years... this isn't reflected in their stock market price trend. That said, the general trend - minus some massive run-ups seems to be slow and steady and there is some multi-year trend-line support at around 2800.

Let's see I guess. Best of luck and look after those funds.

SSE Shanghai Composite W1 topped w/ a diamond? W2 comingThis China index confirmed its completion of ABC when lockdown ended & their economy resumes. It has risen so much from the ABC correction low of 2888 & we may see wave 1 topping out with a diamond reversal pattern. As seen in the past 2 times shown in chart, a diamond can be either a reversal or continuation pattern so proceed with caution.

Reasons why I see this as a reversal:

1) index has already risen 500 points (2888 to 3388 completes the 5 sub-waves of wave 1) without any major retracement.

2) price was rejected exactly at wma 50 & an anchored VWAP from 3300 bottom of July 2021

3) price was rejected at the 2015 red trendline

4) price has reached the 1.272 FIB retracement of the most recent leg down (an ideal spot for abc zigzag retracements)

The 2 most probable supports (the 2 yellow zones) for the wave 2 correction are:

1) the 0.383 FIB near the 3100 to 3200 pivot zone

2) the 0.618 zone near 3100

If wave 2 is shallow, then the future wave 4 may be a deeper correction like 61.8% or 78.6%.

Not trading advice

SSE China bottomed@2863;may retest it before an abc to 3500SSE china composite index may have already bottomed at 2863.65 in April. It is now at my yellow pivot zone. It may go back down to retest the low.

2888 is a very impt FIBO level, exactly @0.786 retracement & is also coinciding with exactly 0.236 of my Fibo strategy on 2 separate retracements.

It is highly probable that SSEC may rally on early June. It may reach 3300 in early August before a long consolidation above the yellow pivot zone before another rally in early Nov2022 reaching as high as 3500

In 1Q2023. (A zigzag move)

If we see the Macro view in weekly Chart, SSEC actually finished wave 2 in 2005 at 1008.60. From there it zoomed up to 6124 ATH in Oct2007 just before the 2008 crash. From these 2 points it is actually making a very big wedge that is the big & long wave 4. The apex of this wedge has a definite destination. GUESS WHERE: exactly at 3500! It will whipsaw above & below the 3300 to 3500 zone for a while. It may reach as high as 3740 to 4000 before it finally breaks out of this BIG WEDGE to start the final wave 5.

Time to shine after zero-covid accomplishment.

Not trading advice

Double Top potential on Shanghai Composite Index? Who knows. Disclaimer: This asset is not for new traders or those who don't tolerate ULTRA HIGH risks. I don't recommend this trade (also I don't recommend any other trade). This is just my market view on the current moment. It could be TOTALLY WRONG. If my view changes in the future I am not obligated to update this idea or publish a new one.

SSSE - Shanghai Composite -The China Will Help Russia?This Chart Suggests That China Will Help Russia

A negative mood in China could be reaching an extreme.

Reports over the weekend are stating that Russia has asked China for military and economic assistance as its invasion of Ukraine gets bogged down. A new Sino-Russia friendship pact was formed just before Russia launched its assault, with Putin and Xi Jinping best of buddies at the Winter Olympics. With Western sanctions impacting the Russian economy, it’s abundantly clear that China is now the key in this geo-political crisis. China has a choice of whether to help Russia, by buying its oil, etc... or to put pressure on Putin to stop his imperialistic ambitions. The chart above is a clue that China will choose the former route.

The chart shows the progression of negative social mood in China since 2007, with that mood trend driving a bear market in the Shanghai Composite index. The pattern is a triangle, very similar to that seen in the Russian RTS$ index which caused to forecast that Russia would invade Ukraine.

Primary degree wave (C) of the triangle equaled 0.618 of the length of wave (A), a solid clue that the pattern is correct. The advance in wave (D) might still be operation but it’s interesting that, although not a classic triangle ratio, the proposed wave (D) ending in September 2021 equaled a Phi-related 0.382 of the length of wave (B).

So, if this wave count is correct in the Shanghai Composite index, Primary degree wave (E) is already in operation. Negative mood expressions such as widespread Covid-lockdowns could already be a manifestation of this wave, which can be expected to be the point at which negative mood reaches an extreme. (Note that regardless of whether the Shanghai Composite is already in wave E or still in the latter throes of wave (D), in either case the larger degree bear market is 15 years old and counting.)

The negative mood extreme could very probably drive China to go all-in in siding with Russia. Crisis and opportunity indeed.

BITCOIN and China stock market go hand in hand despite the bans!I see a lot of interest on my Bitcoin vs U.S. indices fractals and that motivated to make more seemingly 'odd' comparisons that end up to interesting findings.

One such interesting finding is the comparison of Bitcoin (orange trend-line) to the Shanghai Stock Exchange (black trend-line). Everyone in the crypto world knows how strongly the Chinese government has been battling Bitcoin mining and transactions. Last year alone (2021) we had two such events with the May one being the most severe causing a price correction of more than -50%.

Despite the bans, this chart shows the remarkable correlation of BTC with the Chinese stock market! To get a better understanding of how closely correlated they have been since late 2017, I've plotted also the S&P500 index (light grey), on very low opacity though so that it doesn't spoil the main comparison of this study. Especially their correlation throughout 2021 is astounding as both BTC and Shanghai have been trading within a wide range, while the S&P was making High after High.

So the question is obvious. Why despite all of China's hostility and legal actions against BTCUSD, it is so correlated to their stock exchange? I am very curious to read your thoughts. Let's make a heated discussion in the comments section down below!

Feel free to share your work!

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

SSE. Is it a Doom? or BOOM! BOOM! BOOM! of China's economy? SSE ( Shanghai Stock Exchange ) chart. Shown it might completed its long term "Bullish Triangle" pattern. The Western media especially U.S Media have been debating China's Doom since many decades ago to recent "comparing" U.S Lehman brother with China's Evergrande .By checking SSE and SP500 chart.. Maybe The American should be "more worry" about their own "backyard"..