Shanghai Stock Exchange (SSE) On Decision Level

SSE has reached a key pivot point.

a conjunction of a major falling trendline and horizontal structure constitute a decision level for the market.

taking into consideration current fundamental sentiment, the market will most likely go south!

our confirmation will be a bearish breakout of a rising trendline!

incase of a bearish breakout the market will reach 2750 & 2500 levels!

good luck!

please, support the idea with like and comment! thank you!

Shanghaicomposite

Shanghai Composite Index: just a narrativeHi Guys,

here the allocation of some events that impacted the Shanghai Composite Index (as well as worldwide financial markets):

1) China became a member of the World Trade Organization (WTO) on 11 December 2001; (en.wikipedia.org)

2) Financial crisis of 2007–08; (en.wikipedia.org)

3) 2015-2016 Chinese stock market turbulence; (en.wikipedia.org

TO NOTE: following 2) and 3) the Index was always supported at higher levels.

Need to take into consideration that stock market is still young and the System must be supported.

TO NOTE: impact of COVID19 in the violet circle at present.

Please share your views or comment and if you have any questions please do not hesitate to ask.

Thank you for your support and for sharing your ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. Cozzamara is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

IMHO: The point of trading is to make money. To make money you must have money. Depending on the money at your disposal, you can decide what to do and how to do it. By having stops you decide how much you are willing to lose. By having targets you decide how much you want to earn. Be disciplined with your protocol and with your strategies for trading. Sometime you win, sometime you lose. Don't be greedy. Be realistic. Be wary but not afraid. Be curious. Use your brain. As long as your working process make sense and your spirit is calm, everything will be fine. Be patient and be prepared for any circumtances.

Call your bluff - Shanghai surprise Again?

Yes, the Shanghai Composite had a massive Gap Down after a two week Chinese New Year break due to the COVID-19 (SARS-CoV-2) outbreak in Wuhan, Hubei, China. Since then, week after week it made momentous recovery up to close the gap this week. While this is seemingly bullish, and is technically starting to pull the MACD bullish, I call a bluff. Here is why...

1. The system Sell signal has not been invalidated. Invalidation requires a break out of the long term trend line, with continued momentum (in the face of bearish looking Asian markets).

2. The current range expected is very large with a widening triangle

With a slight probability advantage, I call a bluff on the Shanghai Composite, to be rejected at the trend line, and close the next week or two below 2975.

SHCOMP: Gap filledHi Guys,

the causes of the drop occurred back in May 2019 are different from today's drop due to COVID2019.

They both produced a gap down but whilst the first took two months to be filled, the latter took two weeks as it has been filled today.

For information about gaps: www.investopedia.com

What type of gap is the present one?

Please add your comments and if you have any questions please do not hesitate to ask.

Thank you for your support and for sharing your ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. Cozzamara is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

IMHO: The point of trading is to make money. To make money you must have money. Depending on the money at your disposal, you can decide what to do and how to do it. By having stops you decide how much you are willing to lose. By having targets you decide how much you want to earn. Be disciplined with your protocol and with your strategies for trading. Sometime you win, sometime you lose. Don't be greedy. Be realistic. Be wary but not afraid. Be curious. Use your brain. As long as your working process make sense and your spirit is calm, everything will be fine. Be patient and be prepared for any circumtances.

SHCOMP Gap Fill and 61.8% Fib BeatI apparently forgot the #1 rule in investing that has remained true since the financial crisis: don't bet against global central banks and their ability to maintain economic(stock) expansion. The PBOC has injected enough liquidity during this coronavirus outbreak to ease all trader fears of a market decline which has led to price filling the gap that was created around the Chinese New Year, and as of last night have now moved price back above the 61.8% fibonacci retracement level.

Both lower indicators are leaning bullish with a fresh bull cross in the PPO and an RSI that looks ready to move back into bullish territory above the 50 level.

𝗡𝗲𝘄 𝗖𝗵𝗮𝗿𝘁: $SSEC Daily (or $SHCOMP). Hitting resistanceConfluence of resistance here. Worth watching to see if straight-line DCB continues and #PBOC liquidity pumps remain effective

ridethepig | SHCOMP Market Commentary 2020.01.31As usual thanks for keeping your support coming with likes, comments and etc... Lets get started with a round of important chart updates coming today (which btw is extraordinarily late after a week ban). I would like you to note the position arising here looks as though its "business as usual" for the dip buyer crowd, whereas sellers are seeking salvation in a momentum breakdown against the support.

The 2793.xx has now been exposed and the base is open for a typical attack. The macro cycle swing down started here when we traded the highs in April year:

As we know, the philosophy of a swing which we have dealt with can wield sound reason for the evaluation of any possible scenarios where flows are involved. But as this example will show, the theory of swings we have widely mentioned in previous charts can also be useful to highlight the notion that battlefields exist.

So we are talking here about an area which is needed to break in order to form the breakdown as a first premise. I would recommend that you try to technically understand the two different sides in play, notably should we fail to breakdown then the swing to the extreme topside with a rebound through the red line as the other scenario (this will come via coronavirus fading). It is possible to remain indifferent to direction without great difficult in the game.

German Equities are now forming a high and already appear to be coming off:

To secure the breakdown we will need Europe and NY to keep the pressure on today, SHCOMP is closed till Monday so gaps expected! Good luck!

SHCOMP bounced from support, potential for a further rise!

SHCOMP bounced off 2937.698 where it could potentially rise further to 3130.627.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.

Shanghai IndexStill monitoring if minor 2 is in as the chart labeled. Currently looking for the yellow lines as necessary range. If it breaks up, minor 2 is in. Otherwise, who knows.

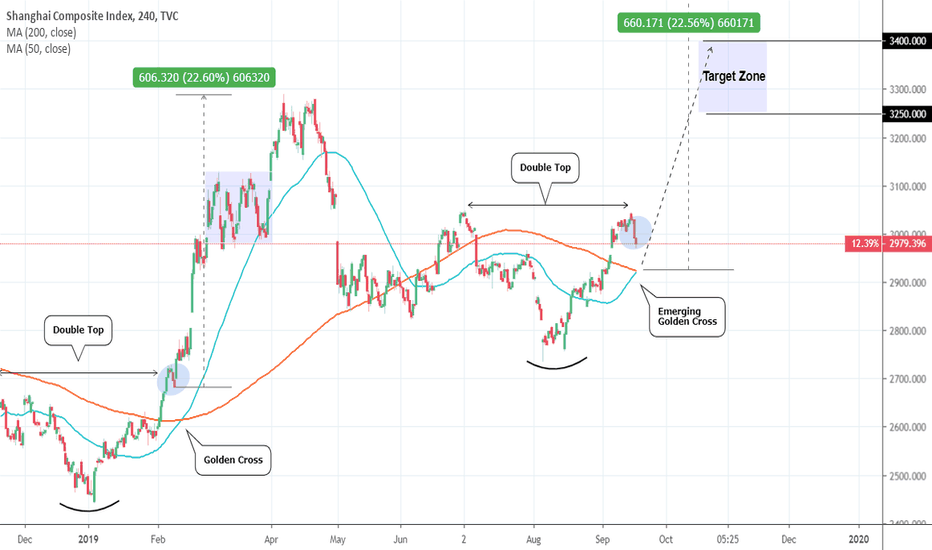

Shanghai Composite: Golden Cross. Potential for an strong rise.SHCOMP is currently pulling back off a Double Top formation near July's 3,050 Resistance. The key development here is the potential to have a Golden Cross formation on 4H.

Last time this pattern emerged was in mid February 2019, when again the price was pulling back after a Double Top. The result was an aggressive jump of +20%. Medium term investors can wait for the Golden Cross to take place, catch the low and then go long on the medium term. Target Zone: 3,250 - 3,400.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

When Trump Made America Great Again - SPXSP:SPX

TVC:SHCOMP AMEX:VEU

TVC:SX5E

AMEX:VEU

1, Vertical lines: Thin Orange is Trump wins election. Thick Orange is start of Trump presidency

2. Chart Lines:

White is USA stock market, S&P500

Blue is the European “Dow Jones”, Euro Stoxx 50

Orange is the market cap weighted index of the entire planet’s stock markets (the 44 countries with capital markets), except the S&P 500. “All World minus USA” ETF.

Red is China stock market.

Summary:

Between January 29th and May 24th, 2018, The U.S. went from lagging the World’s stock market to clearly leading the Earth’s stock. I propose this is a direct result of the announcement and implementation of Tariffs. 1st with $50B of tariffs on China on March 22nd, 2018.

- I had initially thought this was due to Brexit (Britain exiting the European Union), However, the Brexit vote happened in June 2017, and actually seems to have boosted their markets.

- For symmetry, and to compare apples 2 apples, this chart is in log percentage format.

Chinese Growth Rebound? The chattering class is clearly leaning towards the sentiment that Chinese growth is stabilizing as GDP growth was strong (compared to its 6.0 to 6.5 percent range) in conjunction with strong PMI numbers and, as can be seen by the Shanghai Composite, strong capital markets.

While Europe is unsure what to do with the euro from the prospect of Brexit still on the table and the United States obsessed with the Mueller Report being released today, China is considerably devoid of these types of political risks that are mostly distraction. The market is much more focused on fundamentals and while the political risk in Europe or the US is not likely to significantly shift markets today per se, the Chinese are technocratically attempting to solve their financial problems.

China's Large Cap: Ready to test the 10 year Highs?With the U.S. - China trade deal developments ongoing and reportedly staying on positive grounds, the stock markets are globally on the rise in 2019. This is a good time to examine how the heavy Chinese companies are performing.

FXI is the index that tracks China's stocks with the largest capitalization. On the monthly (1M) chart we see that since the 2009 crash, it has been recovering on Higher Highs and Higher Lows, effectively constructing a Channel Up on 1M (RSI = 56.535, MACD = 0.600, Highs/Lows = 0.3822). These indicators show that it recently hit a low point and is on the early stages of a new bullish leg. On the chart this is evident by the January 2019 bounce on the inner lower Higher Low trend line (indicated in dash). What is also evident are the 1M Support Zone (28.20 - 28.70) and 1M Resistance Zone (52.90 - 54.00). The 1M Resistance Zone is our immediate target although the 10 year Channel Up suggests that it may break it and peak as high as 61.00.

In our opinion it is definitely a time to start looking at China's Large Cap more favorably.

We have already warned of this upcoming bullish leg on the Shanghai Composite Index on December 2018:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Stochastic Flashes Sell, But Has Changed BeforeWhile moving averages at the weekly level only half bullish, the stochastic is now consistently flashing to sell while RSI heads in that direction. While this has been reversed in the past such as 2017, conditions are different. Recently, Trump indicated a trade war detente may not come until June if it comes at all as he threatens to keep tariffs on against the Chinese if they don't clean up their act, summing up his sentiment not my own. Overall, trade wars are for now here to stay and could put on downward pressure on this index as had been the case for mostly of 2018.

If you would like to look at more of my work with more charts, check out www.anthonylaurence.wordpress.com

Trade War Alleviation Gives Much Evidence for UpsideVolatility is decreasing as the trend upwards slows down. I think there is large potential to the upside as the US-China trade war comes to a detente. However, many resistance levels remain in the way before that can happen. On the other hand, the index quite easily blew past previous levels of resistance with no problems. Want to see more talk towards trade war resolution before I'll be bullish. More words on the matter here: anthonylaurence.wordpress.com

Shanghai Composite Trades on Trade War HeadlinesQuite a run since February. One of the most volatile world indies though with a volatility percentage of 1.91 percent while the most volatile index is Iceland's 2.54 percent and the global average of .96. Trade deal headlines really influence Chinese equities. Inspires me to stay away.

Fibonacci Retracements on the Shanghai Composite 3117 and 3136 remains short-term support over the next week while 2794 and 2829 could be support. Fib retracements could also be pivot points as they have been in the past.