Shares

Ralph Lauren updateAs part of SP500, company has a market cap of $6.8B. Price target for banks and investment funds ranges from $98 to $150. Year on year stock lost. 34.52%.

4 hour chart shows it could be forming double bottom at the weekly support buy zone (see in the comments). Could be good for a long here with great risk-reward.

Today US session opens after bank holiday and first time in autumn, expecting high volatility today.

Good Luck!

Facebook updateSupport buy zone broken during Friday's sell off and the uptrend lone broken as well now. This opens lower levels and potential to short this stock. Despite today's announcement from Trump that talks with China resume, market's bounce up did not retrace all the loses from Friday at the time of writing.

One of the biggest funds in the world, UBS, announced for the first time since last crisis, that they are going bearish on the stock market to protect capital from trade war tensions. While faith is maintained in the avoidance of 2020 recession, this could put further down pressure on stocks. Good Luck!

McDonald's updateMcDonald's has been having a great run, with price rarely selling off even during economic cycles and turmoil. Now in a channel with confirmed levels. Over the past year price made it 35.57% up with all time high at $222. Creates great options to trade when the price tests the low side of the channel. Long trade with a good risk-reward or wait for the potential break to sell. Majority of banks and investment funds see this stock as 'overweight'. Watch for the next test of the channel lows. Good Luck!

Domino's updatePatience paid off. Line tested and rejected in a great spinning top candle. Good Luck!

Ferrari update Big banks and investment funds have a divided opinion of this stock, between 'hold' and 'buy'. Their target price ranges below the current one.

Technically, the price made a 3rd touch on the trend line, so it confirmed now. A support zone at 150 is close. If the break happens wait for the support zone to break as well. Currently can look for longs for better risk-reward.

Ferrari seems one of the resilient stocks to global turmoils and recently continues to impress investors with improved financial performance. Good Luck!

Possible LIN ASX Long Position!!SMP TRADING

SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Chart time frame - H4

Timeframe - 1 - 3 weeks

Actions on -

A – Activating Event

Market will find support in zone @ Current Levels - .... and move to the 0.022 . In order to enter, the pair MUST be in line with my Entry Procedure....

B – Beliefs

Market will move towards the first Target 1 level @ 0.022

ASX:LIN

Trade Management

Entered @ .....

Stop Loss @ .....

Target 1 @ 0.022

Target 2 @ ....

Risk/Reward @ 2.1

Happy trading :)

Follow your Trading plan, remain disciplined and keep learning !!

Please Follow, Like,Comment & Follow

This information is not a recommendation to buy or sell. It is to be used for educational purposes only!

Possible ARM ASX Long Position!! SMP TRADING

SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Chart time frame - H4

Timeframe - 1 - 3 weeks

Actions on -

A – Activating Event

Market will find support in zone @ Current Levels - .... and move to the 0.025 . In order to enter, the pair MUST be in line with my Entry Procedure....

B – Beliefs

Market will move towards the first Target 1 level @ 0.025

ASX:ARM

Trade Management

Entered @ .....

Stop Loss @ .....

Target 1 @ 0.025

Target 2 @ ....

Risk/Reward @ 2.1

Happy trading :)

Follow your Trading plan, remain disciplined and keep learning !!

Please Follow, Like,Comment & Follow

This information is not a recommendation to buy or sell. It is to be used for educational purposes only!

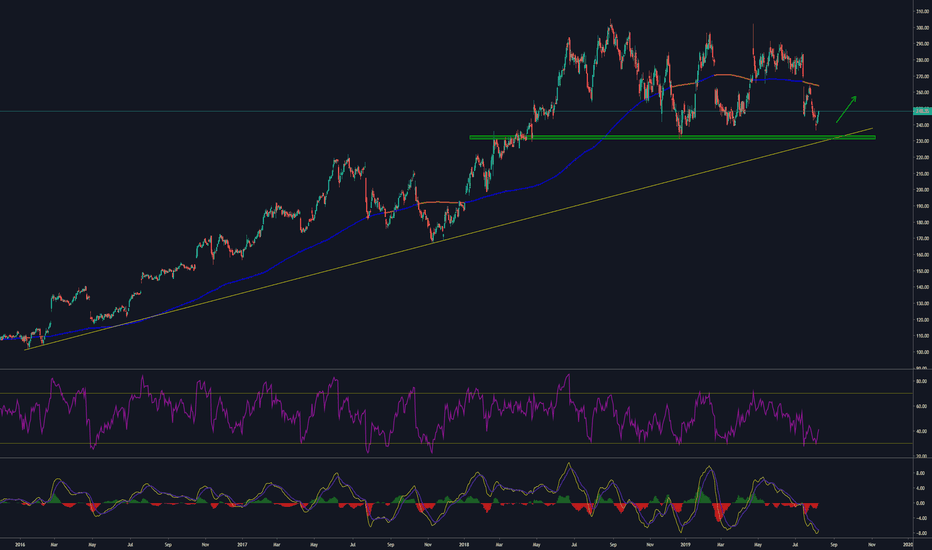

Domino's pizza updateDomino's pizza stock approached the support buy zone, near a big daily trend line. Major banks like JP Morgan have a $270 price target at the moment, labelling the stock as 'overweight'. Investment funds like Maxim Group targets at $300 back to the highs of this stock. Overall banks and investment funds believe the stock is considered under priced.

Technically, stock almost hit support at oversold on indicators. Would be best to see if the stock hits the support zone first before buying in. Good Luck!

Occidental Petroleum updateLast time price was this low was in February 2009. With global growth worries as banks across the globe started to cut rates this summer, oil prices took another blow and stock of Occidental followed. A major level is at $40 where a great risk-reward buying opportunity, if the level holds.

On the technical side, stock is oversold on indicators and waiting for the reversal pattern on smaller time frames.

Major banks downgraded Occidental stocks 'from Buy to Neutral' in the first quarter of 2019 with price target ranging $55-$70. As the price hits support and global growth picks up would be a great opportunity to ride the wave here. Good Luck!

Facebook updateCurrently at 4 hour 200SMA, resistance formed at the gap, a break through that could trigger a long trade to close the gap at least. Ideally we would see the retest of the uptrend line at 38.2%, but still decent recent risk-reward. Good Luck!

FedEx updatePrice currently at the uptrend line, which was confirmed. Also 50% retracement level. With recent earnings disappointing and news came out today that there will be no renewal deal with Amazon at the end of this month.

While it is a good level for a buying opportunity, the stock seems to be more on the sell side for now. Major banks like Morgan Stanley and JP Morgan gave it a 'hold' rating and a price target of $143 and $173 respectively.

So far, higher probability is that this stock will go lower, so maybe best to wait for the next support if this one breaks and buy then. Or short the break of the current 150 support level. Good Luck!

Possible SIS ASX Long Position!!SMP TRADING

SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Chart time frame - H4

Timeframe - 1 - 3 weeks

Actions on -

A – Activating Event

Market will find support in zone @ Current Levels - .... and move to the 0.110 . In order to enter, the pair MUST be in line with my Entry Procedure....

B – Beliefs

Market will move towards the first Target 1 level @ 0.110

ASX:SIS

Trade Management

Entered @ .....

Stop Loss @ .....

Target 1 @ 0.110

Target 2 @ ....

Risk/Reward @ 2.1

Happy trading :)

Follow your Trading plan, remain disciplined and keep learning !!

Please Follow, Like,Comment & Follow

This information is not a recommendation to buy or sell. It is to be used for educational purposes only!

Snapchat updateAfter disappointing IPO, Snapchat fell to $5, practically crossing to penny stocks territory. Investors kicked in to buy cheap stocks and the price rallied. That seems like the end of wave C and now the new wave count started up. Wave 3 seems like over, now waiting for the wave 4 to complete before buying in again to catch the 5th. After very good Q2 earnings and new users added, projections for Snapchat look much better and price is expected to rally further. Good Luck!

Astom Martin updateAston Martin had a bad run from the start as the open price of 1915 plummeted to, currently, 460 area. Recent word from Merrill Lynch changed the forecast from 'buy' to 'hold' as Aston issued profit warnings and earnings forecasts were cut by 40%. This is where investors are waiting for the stock to become cheap enough to buy, but it seem like it could still go lower before the big institutions commit to the this stock. Potential short term trade on the long side as we retrace a little here. Good Luck!

Amazon updateLast week saw a slump in Amazon share as $2.9b worth of stocks were sold, some by Bezos himself to fund his rocket company 'Blue Origin'. Also, trade war caused a panic in the markets. Now at 200SMA daily and 78.2% retracement. Good opportunity to buy with great risk reward, if this level holds.