A shares are in pre-dawnLast year, I analyzed the prospect of A bull market in China's a-shares. The current view remains the same. In the next 10 years, China's stock market will be the hottest asset in the world.

Logic is as follows

1. The globalization of a-shares is accelerating, and the new foreign capital access system leads to more capital flowing into a-shares. Msci, s&p, Russell and other indexes bring hundreds of billions of dollars, which is A real fresh force for a-shares with A market value of hundreds of billions.

2. A-share has experienced A 5-year bear market, and its current valuation is close to the low point of 2014. It is absolutely attractive in the market with matching safety and maturity across the world.

3. With China's economic transformation, traditional industries are under pressure from economic downturn, and innovative industries are favored by more policies, among which financial innovation is the beneficiary.

4. During periods of stagflation, it is easier for the market to favor light assets and for real estate to be abandoned.

5. From the technical point of view, we can see a shape in line with the bottom of the head and shoulders. The right shoulder is constructed near 2733 point and will be formed after breaking through 3100 point.

To sum up, in the next 10 years, the global stock market will look at China, and the Chinese stock market will become the battlefield for institutional investors to compete with each other. The market leader in the segmentation industry with good growth will be pursued by capital. Apple will be born in China, and moutai will not be the only one with a thousand-yuan share.

But personally I have a special liking for 5 g is, for the past two years I have been bullish about 5 g plate, because he is the foundation of the Internet of things fall to the ground, only 5 g, the Internet of things application can achieve all of the scene, so it is an obvious growth, from upstream to downstream in another 3 to 5 years, gradually expand, huawei Google + in copying apple's model, so the ecosystem surrounding the huawei once begun construction, for the relevant enterprises, would be a huge opportunity.

Strategy:

Choose subdivide bibcock, long-term hold, must have tremendous gain. In the next decade, the most promising investment in China must be in stocks, and the best opportunity in stocks is the 5G Internet of things

SHCOMP

Major Correction AheadShanghai Composite Index with major correction expected by mid next year. Multiple failed formations throughout history, especially recently. The performance is rather simple to read, which is unusual for major indexes. The index is clearly "flattening out" currently, and seems to be charging for a large movement. ADXDI confirms this as well.

(lines and connections have been averaged using step-line over log for higher precision, zoom out to reveal more)

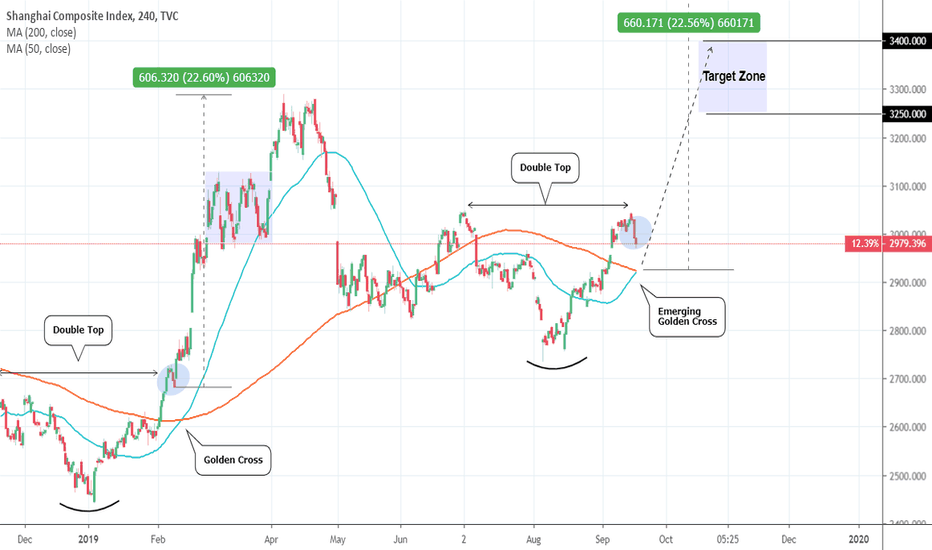

Shanghai Composite: Golden Cross. Potential for an strong rise.SHCOMP is currently pulling back off a Double Top formation near July's 3,050 Resistance. The key development here is the potential to have a Golden Cross formation on 4H.

Last time this pattern emerged was in mid February 2019, when again the price was pulling back after a Double Top. The result was an aggressive jump of +20%. Medium term investors can wait for the Golden Cross to take place, catch the low and then go long on the medium term. Target Zone: 3,250 - 3,400.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

China's stock market is on a rising pathIn A look many sound, A shares finally opened the rising mode, half day Shanghai and shenzhen stock through into nearly 6 billion, 350 billion transactions, Shanghai index 2 points of the sun line, close to the 60 average, also cut the gap, if can successfully close the above jump vacancy mouth, that long has been ready. It was just Xi & trump" a call”, but the market was so depressed that a lot of money couldn't wait for an answer at the end of the month. Of course, we also know that this answer will not be a simple result, the days ahead will be very difficult, but for a large economy, its appeal will not fade one day, and in a time of uncertainty, asset-light investment is bound to become the first choice.

strategy

Major finance, 5g is still the focus of attention, the second half of the year has 70 years of ceremony, optimistic military stocks performance.

China's stock market is waiting for the boots to dropWe have seen that originally optimistic negotiations, the storm changes, the market will also bear a huge impact. This topic is too sensitive to discuss. But here are a few logical questions to explore.

1. The market responds according to the worst expectation, and the strategy of the institution will not be adjusted at any time. In other words, the trend of the market in recent days is a response to next Monday. But there are several possibilities, the worst of which is that if the talks collapse, the market will return to square one. If it's possible to beat this result, the market will have a short-term rebound, because the technical oversold situation will not last.

2, look from the current trend, here belong to 2 waves, but strength and amplitude are more than expected, if fundamental changes, I think there should be a retaliatory rebound may be here, a lot of mark down, actually not because the deleveraging, big probability is already feeling the back of the management problems, so the release of the risk in this way. And the current trend of oversold, that risk released, and overcorrection, so there is demand for a rebound in the market, regardless of the outcome, the rebound will come.

3. Although the overall environment has not been clearly improved, China needs to develop and develop a more stable financial market. This idea will not change, so there will be policies to support the market, which should be included in the so-called preparation by the authorities.

Strategy: focus on the weekly line ma18 support

SHCOMP: The 0.618RETThe SHCOMP dove rapidly because of the tense trade dispute. But I still hold a positive attitude toward the war.

Where will the market stop dropping?

From the chart, we can see the 0.618RET of previous rally is at 2764 level.

Meanwhile, a very good demand zone locates at 2737-2759 zone.

So it is the final target and it is good to buy at this zone as well.

ENTRY: 2737-2764

SL: 2682

TP1: 3200

TP2: 3600 and further

Future and Indices Watch 20190423 by 9 Seasons Rainbow IndicatorAssets being monitored: Gold, Crude Oil, Silver, SHCOMP, SPX500, NDX

Time Frame:

2H - 4D

XAUUSD: Bearish (Red) on almost all Time Frames

XAGUSD: Crazy Sold (Fuchsia) on 16H, 23H, indicates breakdown support, Bearish (Red) on most Time Frames

USOIL: Bullish (Green) on almost all Time Frames

SHCOMP: Bearish Divergence, Resistance / Overbought on 2H - 8H, a pull back is expected.

SPX500: Crazy Bought (Lime) on both small and big Time Frames, is breaking out, super Bullish

NDX: SAME AS SPX500

DISCLAIMER

This is only a personal opinion and does NOT serve as investing advice NOR trading advice.

Please make their own decisions, carefully assess risks and be responsible for your own investing and trading activities.

Shanghai Composite / S&P 500 ratio & The USDHKD PegUnsurprisingly, similar to the currency, the outperformance of the Chinese stock market vs. the S&P 500 falters when the Chinese currency can't be sustained. Not quite as direct of a relationship, but this clearly affects emerging markets, which are highly indebted to the dollar.

This is visible if you go back further as well - the broad rolling emerging market problems all occurred starting when the USDHKD peg was hit in April 2018. April 18th, 2018 was a pivotal day in that regard. Also, it's no surprise that EM currency problems are starting to suddenly become problematic once again....

Long Term Trend for SHCOMP on Weekly ChartSELL When:

- RSI reaches 90

- Touches the RED Line with RSI reaches 80

- Bearish RSI Divergence occurs

BUY When:

- Touches the GREEN Line with RSI reaches 35

- Bullish RSI Divergence occurs

Shanghai Composite: Long on pullbacksShanghai Composite Index has broken into the weekly Ichimoku clouds and continue to trade well. With policymakers determined to channel credit to the right sector and promote growth, the bears are now in retreat. Time to look for opportunities to get long on any reasonable pullbacks!

Shanghai Index: Buy the pull back.The Shanghai Composite Index has seen a considerable rise since the start of the year, which we predicted in December ( ). The parabolic rise on 1D has reached past the overbought zone (RSI hitting 80.000) and as it got close to the 0.500 Fibonacci retracement level (3,015), we should start see it consolidating. The strongest candidate for a pull back however is the 0.618 level (3,150). We are willing to buy any such pull back and target the 0.786 level at 3,340.

See below how we predicted this +22% rise in December:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

SHCOMP How long is the divergence willing to last?The Shanghai Composite reflects the real situation that we are facing up. The S&P 500 completely out of mind in that perspective. Are we approaching a reversal movement in both indexes? Indeed, one of them has a lot of chances rather than the other. Which one is willing to turn over first?

Learn how to beat the market as Professional Trader with an ex-insider!

Be part of an elite trading group. Last course of the year on November 2nd, 2018.

Have a Nice Trading Week!

Cream Live Trading, Best Regards!

SHCOMP fors a GIGANTIC wedge!Left without comment.

If I have been helpful, please like my work and follow me, it helps us both.

SHCOMP could drop furtherThe lackluster demand for Asian dollar bonds (ADB) is likely to recover as investors who shunned weaker quality notes during the turbulent final quarter of 2018 now see them as too cheap to ignore. This indicates investors will take money out of SCI and invest into ADB junk bonds