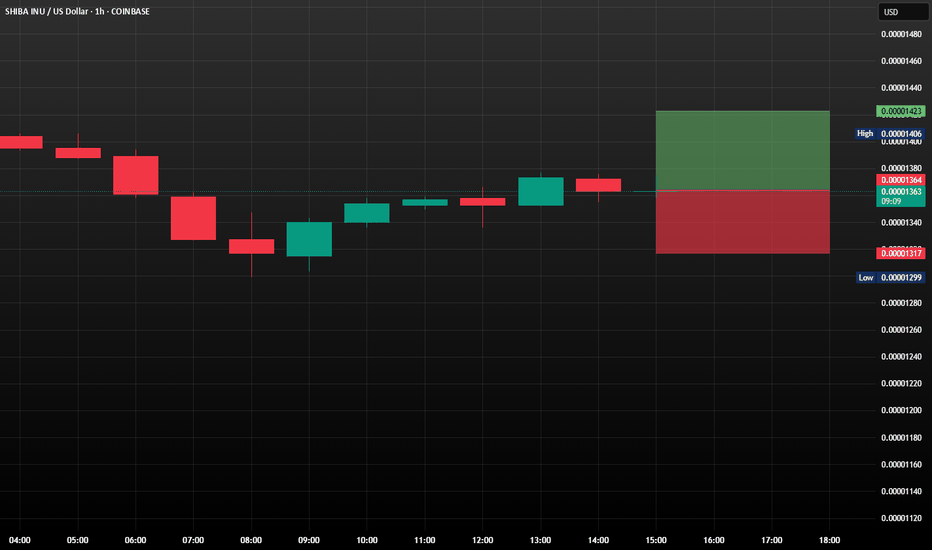

SHIB/USDT: A Fight for Recovery?SHIB/USDT is currently trading around $0.00001363, marking an approximately 11.5% drop over the past 24 hours. However, it's crucial to note that the price is successfully holding above the key support level of $0.00001373.

Recently, we've witnessed a significant increase in the activity of so-called "large holders" or "whales" concerning SHIB/USDT. Their netflow has reached a two-month high, signaling heightened interest. In the past 24 hours, addresses holding at least 0.1% of the total SHIB supply accumulated an impressive 4.66 trillion SHIB, representing an investment of a staggering $63.7 million. These major players clearly believe in the potential for a price recovery.

What's Next? Scenarios for SHIB/USDT

Bullish Scenario (Uptrend):

Should SHIB/USDT successfully bounce off the support level at $0.00001317, it would likely pave the way for further price appreciation. It could potentially reach $0.00001423. If this level solidifies as new support, it would mark a full recovery of today's losses and could initiate a new uptrend, provided that broader market conditions remain favorable. The investment by the whales would be crucial in this scenario.

Bearish Scenario (Downtrend):

However, if SHIB/USDT fails to hold above the support of $0.00001317 and falls below this level (likely due to profit-taking by other market participants), the popular "meme coin" could slip to $0.00001188. Such a development would invalidate the bullish thesis and further reduce investor confidence. The next few days will be critical for SHIB to demonstrate whether it can

maintain its current support levels.

#forex #SHIB #USDT #SwingTrade

SHIBUSDT

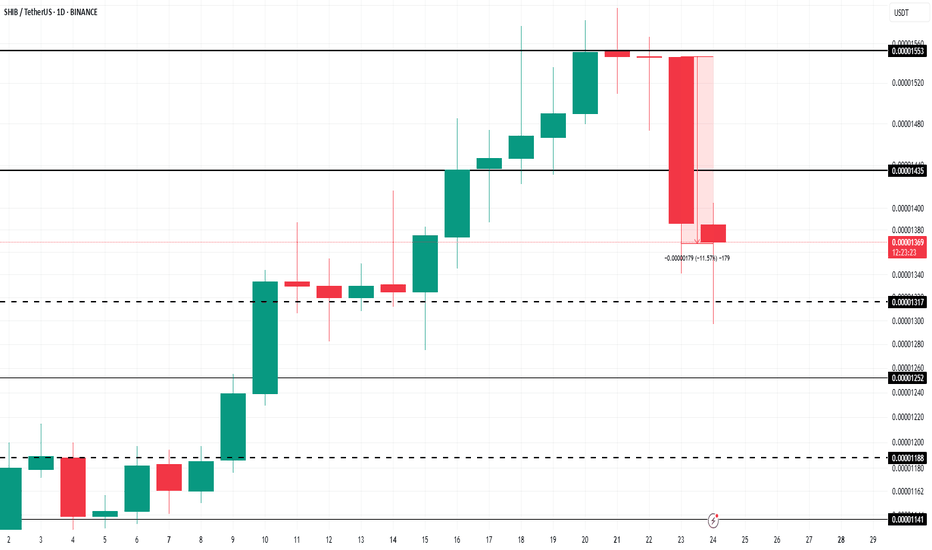

Shiba Inu Whales Amass 4.66 Trillion SHIB As Price Falls 12%BINANCE:SHIBUSDT price is currently trading at $0.00001353, down 11.5% over the past 24 hours . The altcoin is holding above the support level of $0.00001368.

The large holders' netflow for BINANCE:SHIBUSDT has recently spiked, reaching a two-month high. In the last 24 hours, 4.66 trillion SHIB were accumulated by addresses holding at least 0.1% of the circulating supply. These whales, who have collectively invested $63.7 million , are betting on a price rebound.

A successful bounce off $0.00001317 would likely pave the way for further price appreciation, potentially pushing BINANCE:SHIBUSDT to $0.00001553 . Securing this level as support could mark a recovery of today’s losses and initiate a new uptrend, provided the broader market conditions remain favorable.

On the other hand, if BINANCE:SHIBUSDT falls below the support of $0.00001317 due to profit-taking, the meme coin could slip to $0.00001188 . This would invalidate the bullish thesis and further reduce investor confidence. The next few days will be crucial in determining if SHIB can maintain its current support levels .

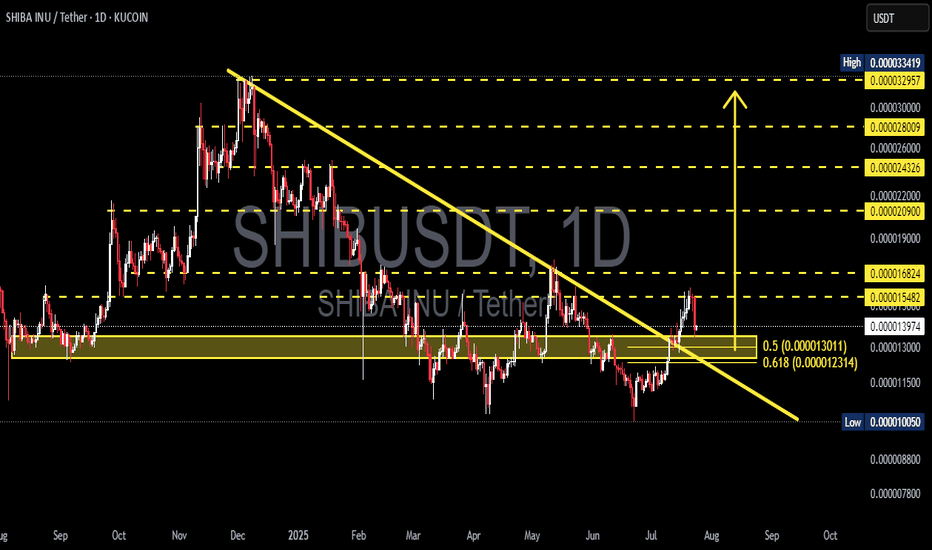

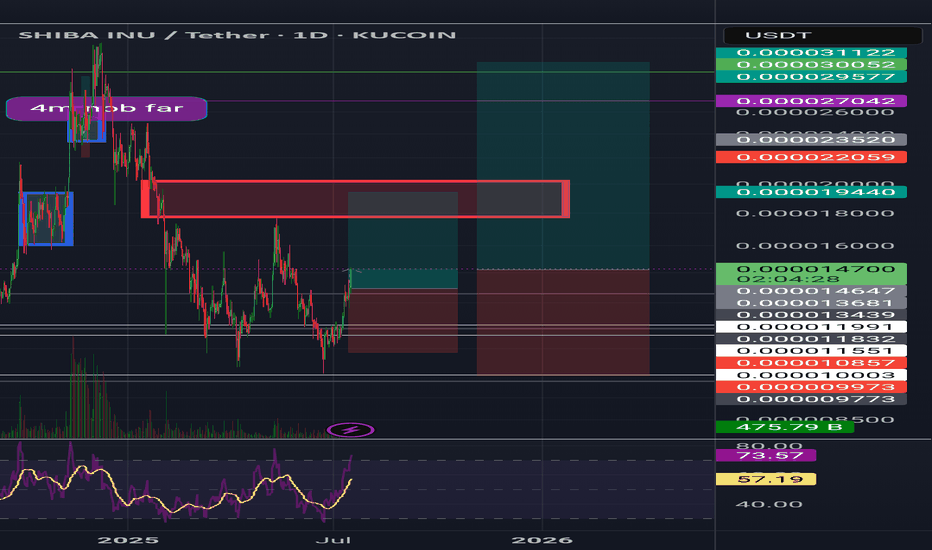

SHIBUSDT | Explosive Breakout from Long-Term Downtrend!📊 Overview:

After months of being trapped in a major downtrend, SHIBA INU (SHIBUSDT) has finally broken out of a multi-month descending trendline that has been capping price action since late 2024. But this isn’t just a minor breakout — this could mark a macro trend reversal, with bullish momentum building up fast.

---

📐 Technical Breakdown (Daily Chart – KuCoin):

🟡 Chart Pattern:

A clear Falling Wedge pattern has been forming since December 2024.

The breakout occurred mid-July 2025 with strong price action and early confirmation from volume.

Falling wedge is typically a bullish reversal pattern — and this breakout confirms that narrative.

🟨 Breakout Zone:

Price decisively broke above the descending trendline and is now consolidating just above it.

A successful retest of the breakout level strengthens the bullish case.

🟦 Key Fibonacci Support – “Golden Pocket”:

The zone between 0.000013011 (Fib 0.5) and 0.000012314 (Fib 0.618) is now acting as strong support.

Known as the “Golden Pocket”, this zone is often where high-probability reversals occur.

---

🚀 Bullish Scenario (High Probability):

As long as price stays above the Fibonacci golden pocket, SHIB is well-positioned for a continued rally. Key upside targets include:

1. 📍 Target 1: 0.000016824 → Previous key resistance

2. 📍 Target 2: 0.000022000 → February supply zone

3. 📍 Target 3: 0.000029000 → Major historical resistance

4. 🏁 Target 4 (Full Extension): 0.000033419 → Potential top of the breakout range

If momentum and market sentiment align, SHIB may be entering a new bullish cycle.

---

🔻 Bearish Scenario (Low Probability, but Manage Risk):

If price fails to hold above the golden pocket:

🔽 Support 1: 0.000011500 → Previous consolidation base

🔽 Support 2: 0.000010050 → Historical demand zone

A breakdown below 0.000010050 would invalidate the bullish structure and shift SHIB back into a prolonged accumulation phase.

---

🔍 Conclusion & Market Sentiment:

✅ The trend has flipped! This is one of the most anticipated breakouts for SHIB holders. As long as the structure holds above the golden pocket zone, the bullish outlook remains very strong.

⚠️ However, beware of potential fakeouts if volume drops or Bitcoin triggers broad market weakness.

---

📢 Trading Setup (Not Financial Advice):

For Bulls: Look for entries around 0.00001350–0.00001300

Stop-loss: Below 0.00001220

Take-profits: 0.0000168 → 0.000022 → 0.000029

For Bears: Wait for breakdown below 0.00001200 to consider short positions

---

🧠 Final Notes:

> SHIB remains a high-volatility microcap token. It's a prime pick for swing traders and momentum hunters — but risk management is key. Keep an eye on BTC for confirmation or invalidation.

#SHIBUSDT #SHIBA #SHIBBreakout #AltcoinSeason #BullishSetup #GoldenPocket #FallingWedge #CryptoSignals #TechnicalAnalysis #BreakoutPlay

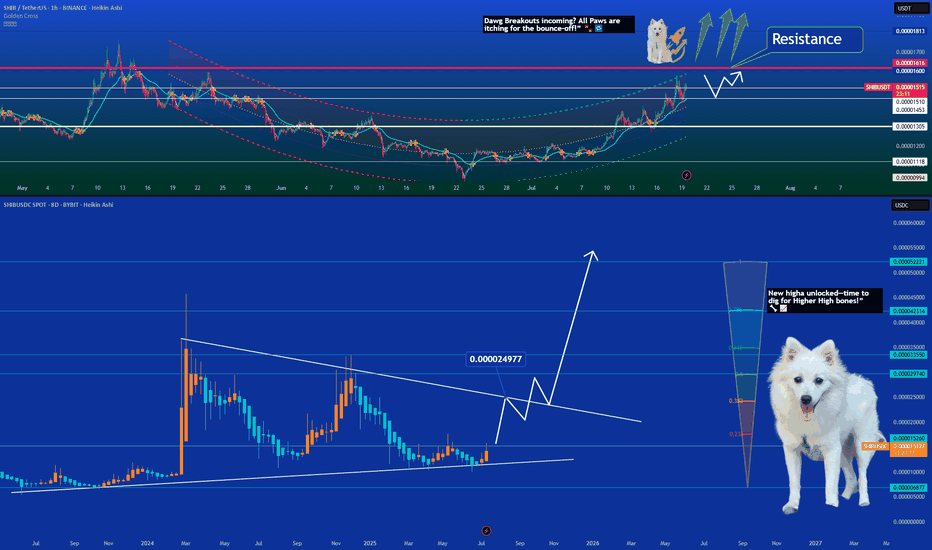

SHIB — Starting a Bullish Climb?📈 SHIB Breaks Downtrend — Starting a Bullish Climb 🔥🐾

Shiba Inu just pierced its descending resistance line on the 8‑day chart—signaling a trend reversal🔥

On the 1‑hour chart:

SHIB has climbed above a key resistance zone (~0.00001510–0.00001550 USDT)

Now forming a potential retest → bounce setup

Close support lies near 0.00001400, with resistance at ~0.00001600–0.00001620

If the retest holds, SHIB could climb toward 0.00002497 (projected breakout-high), and potentially push further into the 0.00003–0.00005 range if broader momentum kicks in.

📰 Recent SHIB Highlights

AI & Burn Surge: SHIB recently spiked ~3%, hitting a 7‑week high as burn rates and AI whitepaper buzz fueled optimism

Technical breakout: Surpassed a 26‑day EMA resistance (~0.00001280) with +93% volume increase, RSI/MACD showing room to grow toward 0.000015

c

Price outlook: Analysts predict SHIB to reach ~0.000016 by July 23—about +9% upside in the next few days

Ecosystem strength: With Shibarium L2, NFT and metaverse initiatives, and strong community support, SHIB is seen as one of the top meme‑ecosystem plays

Market cap stands near $8.9B, same as Uniswap – highlighting SHIB’s heavyweight presence despite price lag.

CoinCodex

🎯 Trade Setup & Targets

Level Zone (USDT) Importance

Support 0.00001400–0.00001450 Ideal retest zone

Short Target 0.00001600–0.00001620 Near-term bounce objective

Mid Target 0.00002497 Measured breakout target

Sky’s Limit 0.000030–0.000045 If momentum aligns with narrative

Stop-loss can be placed just below 0.00001350 to protect against false breaks.

🐶 Punchlines for Chart Overlay

Top Chart (1‑hr):

“Bounce incoming? Shib's paws are itching for the bounce-off!” 🐾🔁

Bottom Chart (8‑day):

“8‑week high unlocked—time to dig for next bones!” 🦴📈

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Can Shiba Inu rally 20 percent to hit 0.000015?Hello✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Shiba Inu📈.

BINANCE:SHIBUSDT has decisively broken above its descending channel and key daily resistance, supported by fresh, solid volume 📈. This breakout signals strong momentum, with a projected upside of at least 20% targeting 0.000015 🚀.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

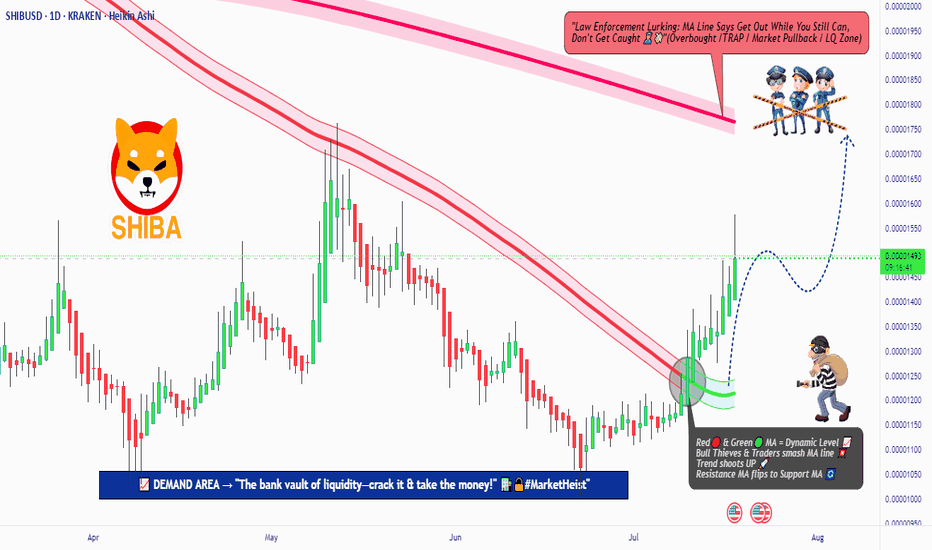

SHIBA INU Heist Plan: Rob the Market, Ride the Bull!💎🚨 "SHIBA INU Crypto Heist Plan: Rob the Market or Get Robbed!" 🚨💎

Thief Trading Style | SHIBA/USD | Bullish Analysis | DCA Heist Strategy | Swing & Scalping Masterplan

🌍 Hey World! 👋 Hola, Ola, Bonjour, Hallo, Marhaba! 🌟

To all the Market Robbers, Bulls in Disguise, and Silent Money Movers — welcome to Thief Trading’s Heist Blueprint 💼🔫 for SHIBA INU vs. USD!

📊 Chart Analysis Breakdown:

Based on my Thief Trading™ Style – a fusion of technical setups, fundamentals, and macro crime-scene evaluations – we’re executing a bold LONG setup targeting a bullish breakout. 🕵️♂️💥

This heist involves breaking past the Police Resistance Checkpoint (moving average red zone), where bearish forces and retail roadblocks stack up.

💹 Heist Entry Strategy:

📍Entry Idea: “The vault's cracked open!”

Longs can be triggered at market price – but wise robbers use precision:

⏱ Place Buy Limit Orders near 15min or 30min swing low pullbacks.

💼 DCA / Layered Entry Method is advised – the more stealthy the approach, the bigger the bag.

🛑 Risk Management:

📌Stop Loss (SL):

Set near recent swing highs/lows on the 1D candle wick zone.

🔒 Example SL: 0.00001300

Remember, SL should scale with your risk appetite, lot size, and number of entries.

🎯 Thief Target:

📍 Target: 0.00001770 or jump off early if the cops (market sellers) start closing in.

You don’t need to wait for the vault to be empty — grab what you can and exit clean.

🔍 Scalper's Shortcut:

Only long-side scalps are valid here.

💰 Big pockets = Fast Entry

💼 Small pockets = Join the Swing Gang

Use Trailing SL to guard your loot and stay agile in the escape.

🧠 Why This Heist? (Fundamentals Insight):

SHIBA/USD is heating up 🔥 due to:

Bullish sentiment in crypto

On-chain activity uptick

Retail momentum shifts

Intermarket cues lining up

📚 Dive deeper into:

📰 News Impact

📊 COT Reports

🔗 On-chain metrics

🧭 Sentiment & Intermarket Guidance

⚠️ Risk Zone Alert:

🚨 News events = Market Chaos

➡️ Avoid fresh entries near news drops

➡️ Use Trailing SLs to lock profits & manage active positions wisely

🙌 Support the Heist Movement:

🔥 Hit the BOOST button if you vibe with the Thief Trading style!

Every boost helps power the team to deliver more precision setups, market heists, and easy-to-follow strategies daily. 💸💎💪

📌 Important Disclaimers:

This is a general market outlook and not financial advice. Always analyze based on your own system and risk tolerance. Markets shift fast — stay updated and adapt.

💬 Comment below if you're on the crew. Let's rob the market together — one chart at a time.

🚀 See you in the next heist, Money Makers! Stay silent, move smart, and steal success! 🤑🐱👤🏆

SHIBUSDT🕯 The key resistance level, identified as the best resistance for a break and pump, stands at 0.0000135, with a potential price increase to 0.00001567 if breached, serving as the next target (Pullback level). On the support side, the main level is observed at 0.0000115, and should the price fall below this, it may decline further to the lower Major Level of 0.0000100.

🔽 Resistances:

Main resistance level: 0.0000135 (potential break for pump)

Next target (Pullback level): 0.00001567

🔼 Supports:

Main support level: 0.0000115

Lower level (Major Level): 0.0000100

⚠️Contorl Risk management for trades.

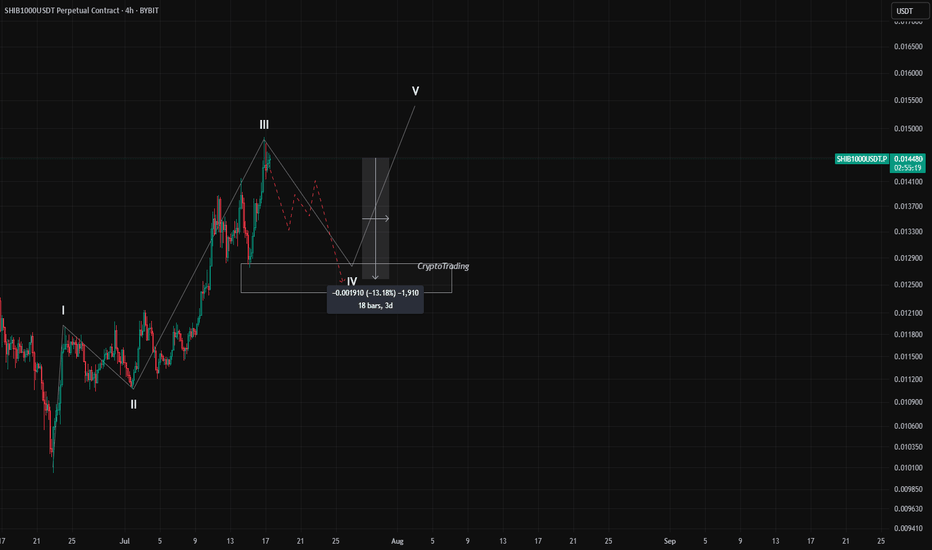

SHIBUSDT 4H Potential 10% Drop – Wave 4 Incoming? Hey traders,

On the 4H timeframe, SHIBUSDT seems to be completing Wave III of a classic 5-wave impulse structure. We can clearly identify:

- Wave I and II behind us

- Wave III topped out recently with a strong push upward

- Now expecting a Wave IV correction to unfold

What supports this setup:

- Wave II was an irregular correction (note how Wave B pushed above Wave A).

- According to Elliott Wave alternation rules, if Wave II is complex/irregular, Wave IV is likely to be a simple ZigZag (ABC) correction.

- Zigzags are typically sharp and quick, which fits the momentum of the current market structure.

🕵️♂️ What’s next?

- The potential correction target lies in the marked rectangle zone (around -10% to -13% drop

from the recent top).

- On lower timeframes (like 7min or 10min), we’ll be watching for a support break to confirm

the start of Wave IV.

- If the support is broken with confirmation, that may offer an opportunity to enter a short

position — as long as it fits within the personal risk parameters.

📌 Disclaimer: This is not financial advice. Trading is risky — always manage your risk, do your

own research, confirm your setups, and never blindly follow others. Stay safe and smart.

🧠 Are you planning to catch this correction? Or waiting for the final Wave V? Let me know in the comments 👇

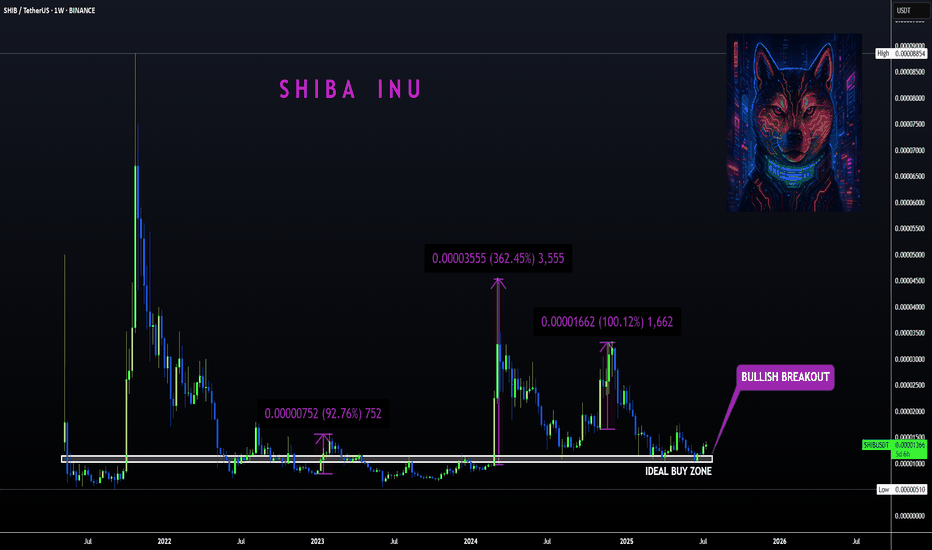

SHIBA | Bullish Breakout ABOVE Ideal Buy ZoneBINANCE:SHIBUSDT

Shiba is know to make big increases in short periods of time... that's why we love it!

The tricky thing about SHIBA is that the pumps can be unpredictable so the best way to ensure a position is to buy as low as possible to the ideal buy zone.

In the weekly timeframe, the technical indicators are not quite bullish yet. The moving averages is still above the price, meaning the bulls have yet to take full control of the price in lower timeframes.

The same can be said for the daily, although we are seeing progress as the 200d moving averages have been reclaimed:

SHIBA INU Heist Plan | Layered Buy Limits + SL Strategy🏴☠️💸**SHIBA INU Heist Blueprint: Rob the Bulls, Outsmart the Bears | Thief Trading Style Strategy (Swing/Scalp)**💸🏴☠️

🌍Hola! Hello! Marhaba! Bonjour! Ola! Hallo!🌍

💰Calling All Market Pirates, Profit Seekers, and Silent Thieves... the vault is open!💰

This is a special market mission for SHIB/USD (SHIBA INU), based on the notorious "Thief Trading Style" — a method designed to sneak in, grab profits, and vanish with style. 💼✨

🧠Backed by a spicy combo of technical, fundamental, on-chain, and sentiment analysis, this strategy is crafted for both swing and day traders ready to infiltrate volatile zones and escape with gains.

🎯The Robbery Plan:

We're targeting a high-risk, high-reward breakout with our eyes on the ATR police trap zone, where market makers often lure and trap traders. Our focus? The sweet spot where consolidation ends, fakeouts begin, and true reversals take off. ⚠️🐍

📥ENTRY (The Break-in):

"The Vault is Unlocked!"

Sneak in using buy limit orders at swing lows or support zones—opt for the 15m or 30m chart to catch pullbacks.

We're stacking orders like a professional thief using DCA (Layering Method) to reduce entry risk. 📊💼

🔎 Entry Zone: Market or limit entries near structure lows—be precise, not greedy.

🛑STOP LOSS (Escape Hatch):

Use the 2H swing low around 0.00001150 as your escape signal.

Risk management is your armor: adjust SL based on your lot size, order count, and trade exposure.

🔒Thief Tip: Never trade without your getaway plan!

📈TARGET (The Safe Zone):

🎯 Primary Target: 0.00001290

Optional: Use trailing SL and scale out profits as the robbery gets hotter.

Scalpers—only join the long side of the heist! If you're packing a big bag of capital, jump in earlier; if not, ride with the swing team. 🚁💸

📊THIEF FUNDAMENTAL FUEL:

SHIB bullish momentum is rising due to macro sentiment shifts, market rotation, whale accumulation, and on-chain volume flow.

Check related macro reports, intermarket insights, and crypto futures data before loading your bags. 🧠📈🔗

🛎️HEIST WARNINGS – Stay Safe!:

🚨 During major news releases, volatility can explode. Don’t get caught!

❌ Avoid fresh entries during news

✅ Use trailing stops to lock gains on existing positions

💖LOVE THIS PLAN? SUPPORT THE CREW:

💥Smash that Boost button💥 to keep the Thief Trading Crew alive and plotting!

We drop fresh heist plans regularly—help us spread the love, grow the crew, and keep stealing profits from the noise. 🚀

📌Disclaimer: This analysis is for educational purposes only—not financial advice. Always DYOR and adjust based on your personal risk profile.

📌Stay tuned for more heist missions. Let’s outwit the markets—one trade at a time.

🤑🐱👤💎 #ThiefTradingStyle #SHIBHeist #CryptoStrategy #MarketRobbery #SmartMoneyMoves

SHIB Long Entry Heist Plan – Bullish Setup in Trap Zone🦹♂️💸 SHIB INU Market: The Silent Heist Plan Is Live! 🚨💰

Thief Trading Style | Swing & Scalping Blueprint | High-Risk Zone Masterplan

🌍 Hello Global Robbers & Market Raiders! 🤑💥

Welcome to another secret mission straight from the vault of Thief Trading Style. We're eyeing the SHIB INU Crypto Market, and the time has come for a stealthy bullish strike!

🧠 The Blueprint – Operation SHIB-INU Break-In

We’re executing a bullish move towards the Yellow MA Zone, a high-risk territory filled with consolidations, trap setups, and a potential reversal. The battlefield is tight, but the rewards are sweet for those who play it smart. 🎯💸

🔑 ENTRY STRATEGY – “Vault Access Granted” 🚪📈

💥 Entry Type: Buy/swing

💡 Zone: Pullback entries near swing lows (within 15–30m timeframes)

🕵️♂️ Stealth Entry – Wait for candle signals or limit orders near key liquidity zones.

🛡️ STOP LOSS – “Secure the Exit” 🛑🔐

📌 Placed just below recent swing low at 0.00001050 (30m TF)

🎯 SL adapts to your lot size, trade size, and number of entries.

🏴☠️ TARGET – “Escape Before Alarms Go Off” 🎯💨

💰 Target: 0.00001350

⏳ Optional: Trail your SL and exit on signs of exhaustion.

💼 Scalpers’ Side Mission – “Quick Loot Runs” 🧲⚡

Scalp only on the Long side; use trailing SLs and follow the robbers’ path.

Big wallets? Enter now. Small bags? Wait and follow the swing wave. 🕶️🚀

🧠 Strategic View

Market sentiment remains bullish, but the zone is volatile.

Use macro analysis, COT data, on-chain insights, and sentimental clues for confirmation. 🧠📊

⚠️ Important Notice – Market Hazards Ahead 📉📰

🔔 Watch out for major news releases!

✔️ Avoid new trades during high-impact events.

✔️ Use trailing SLs to guard profits.

✔️ Monitor market developments regularly – stay one step ahead.

💖 Support the Mission

If you love this robbery blueprint, 💥Hit the Boost Button💥 and join the Thief Trading crew for more profitable adventures! Every click fuels our next plan. 🏆💪❤️

📢 See You in the Next Raid!

Stay tuned for more high-stakes missions and daily loot setups!

📲 Follow for the next crypto break-in.

🐱👤🚨 Thief Traders never sleep... we scan, we strike, we secure the bag.

Shiba Inu Still Early Massive Wave yet Bullish —1,558% PPThe blue pattern on the chart is an analog of the purple pattern but bigger.

It is still early for Shiba Inu (SHIBUSDT) because the action is happening below MA200. The long-term bullish bias is only confirmed once the action moves and closes above this level.

This shouldn't be considered bearish because we have a clear higher low based on the two different consolidation patterns. The purple one produced the main low and the blue one the higher low. Multiple higher lows.

Lows—support confirmed—in August 2024, April & June this year. And that's it. This weekly candle is now full green and everything is about to turn positive crazy. Shiba Inu has been bearish since March 2024.

There was some bullish action in November 2024 but it ended as a lower high, what a bummer. All this time with no new highs, no major growth. This cycle is coming to an end. The null cycle, the boring cycle, the little-to-no-profits cycle is over... That's awesome. What does Shiba Inu has in store for us?

A new all-time high to start. Maximum growth. Euphoria, higher prices; growth. It will be awesome.

I am giving you all of the targets for Shiba Inu (SHIBUSDT). The highest one is 0.000220491. Total profits potential reach 1,558% from current price.

There are two resistance levels of interest below the previous ATH: 0.000067612 & 0.000057511.

Minimum new 2025 all-time high we will go for 0.000103188 for 676%.

You can find more numbers and targets by doing a close-up on the chart.

I hope you find this information useful.

Your support is appreciated.

Namaste.

SHIBUSDT Bounces Strongly from Wedge SupportSHIBUSDT is forming a bullish falling wedge on the weekly chart, showing signs of reversal after bouncing from key support at 0.00001000. A breakout above the wedge resistance could trigger strong upside momentum in the coming weeks.

Entry at current price

Stop Loss: .00000890 (Below the Wedge Support)

TP1: 0.00001700

TP2: 0.00003100

TP3: 0.00007000

$1000SHIBUSDT CRYPTOCAP:SHIB

You all Panic and Sell While Whales Buy Ever sold at the exact bottom, just before the bounce?

Mass fear always becomes the perfect entry for whales, while regular traders are running away.

In this post, I’ll break down how their mindset beats ours, and how to flip the script on your own fear.

Hello✌

Spend 3 minutes ⏰ reading this educational material.

🎯 Analytical Insight on PEPEcoin:

BINANCE:PEPEUSDT has broken above the descending channel resistance as well as a significant daily resistance level, supported by a solid increase in trading volume 📈. This confirms genuine buying interest and momentum in the market. Based on this breakout, I expect at least a 22% upside, with a target near 0.0000135 🚀.

Now , let's dive into the educational section,

🧠 Emotions Lie. The Chart Doesn’t.

In crypto markets, our first reaction is rarely logical. When prices dump, fear kicks in, not analysis.

That’s exactly when the big players step in. They know retail won’t buy the bottom; they chase green candles, not red opportunities.

🐋 What Whales Think That Retail Doesn’t

Whales wait for emotional exhaustion, full-on fear or full-on greed.

They don't enter with the crowd. They enter when the crowd wants out. That’s not coincidence. It’s a setup.

🧨 Self-Sabotage: The Retail Playbook

Retail traders usually:

Sell in panic on the dump

Buy in FOMO on the pump

Quit after liquidation

Whales don’t react to price, they react to opportunity.

📉 Why Real Bottoms Never Feel Safe

When a real bottom forms, it feels terrible. News is negative. Social media screams "SELL."

No one trusts the recovery. That’s why most miss it. Comfort does not equal opportunity.

⏳ Silence and Patience: Whale Superpowers

In sideways markets, retail gets bored and walks away.

Whales? They accumulate silently. They don’t seek confirmation. They seek positioning.

📊 TradingView Tools That Reveal Whale Moves

TradingView isn't just a charting site, it’s a weapon if you know what to look for:

Volume Profile shows zones where the most trading occurred. If price drops but volume remains dense, that’s hidden buying.

OBV (On-Balance Volume) tracks if smart money is loading while price moves slowly.

Combine RSI + MA to spot where sentiment diverges from logic.

Set up your own TradingView layout with these indicators. Use the data, not your gut.

🧲 Is This Crash A Hidden Invitation?

Every major dip asks one quiet question: “Do you still know the game?”

The smart money listens while the rest scream. The market has rhythm, if you hear it, you win.

🛡 Recap

Next time the market’s bleeding red and everyone’s afraid, zoom out.

Don’t listen to your fear, listen to the chart. Let TradingView’s tools be your edge, not just your screen.

✅ Final Thought:

Whales feed on our fear. So next time you're scared, don’t run, observe.

That fear might be your best entry, not your worst exit.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

SHIB – One Last Chance for a MoveGiving CRYPTOCAP:SHIB one last shot to do something big.

It’s sitting at a strong pivotal level with some clean weekly SFPs forming.

A 2x looks doable, especially considering how well it’s been holding—though it may take time.

CRYPTOCAP:PEPE and CRYPTOCAP:DOGE are showing strength too, so SHIB isn’t alone here.

The key? CRYPTOCAP:BTC needs to cool off and give alts some breathing room over the next two months. Otherwise, BINANCE:SHIBUSDT could drop another 50%.

SHIBA +100%?? | BEST Buy OPPORTUNITYSHIBA has been in a downtrend for many weeks.

From here, upside is likely - especially if we look at the consecutive amount of "red" weekly candles (blue on this chart).

A 40% bounce zone is easily possible from this zone. Even at modest, 20% would be ideal:

____________

BYBIT:SHIBUSDT

SHIBUSDT: Price Weakness & Your Next Short OpportunityMy focus is on SHIBUSDT, and the picture is clear: price is weak. This isn't a market where buyers are proving their strength; in fact, the opposite is true.

Most traders are confused by volatility. But you need to see the real opportunity. My analysis points to this: both red boxes I've marked on the chart are prime zones for short opportunities. They represent powerful selling regions.

Here's why, and your plan for action:

Red Box Power: These zones are where sellers are truly in control. I'm actively looking for price to engage with these areas.

Green Box Uncertainty: As for the green box, its strength is questionable. I'm not confident it will hold as reliable support for a bullish move, reinforcing my overall bearish view.

Confirm the Downside: Your decisive move comes with confirmation:

Volume Footprint: I'll be scrutinizing the volume footprint to see clear distribution from sellers.

CDV (Cumulative Delta Volume): Look for CDV to turn deeply negative, affirming seller dominance.

LTF Breakdowns: On the low timeframes (LTF), demand concrete breakdowns. Price must fail, retest the red boxes as resistance, and then continue lower. This is your undeniable signal.

My general bias remains bearish. I only trade assets showing a sudden increase in volume, and while this is a short setup, the volume dynamics confirming weakness are what I'm seeking.

Keep a sharp eye on those red boxes. If these confirmations line up, you'll uncover precise, high-probability short entries. This is where smart, confirmed decisions are made.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Shiba Inu Crypto: A Useless Coin That Can Still Make You RichHey everyone, welcome back to a new supply and demand crypto analysis. Today, I will analyse one of the most unexpected — but potentially lucrative — investment opportunities in the crypto space right now: Shiba Inu Metaverse crypto.

Yeah, I know what you’re thinking… “Isn’t Shiba Inu just another meme coin?”

And yes, fundamentally, it’s not trying to solve world hunger or revolutionise finance. But guess what? You don’t need a coin to be helpful to make money from it.

All you need is to understand price action and supply and demand. That’s it.

What is Shiba Inu?

So let’s break it down. Shiba Inu started as a meme — a direct competitor to Dogecoin. It’s an ERC-20 token on the Ethereum network with a massive circulating supply and a huge following. Over time, it has evolved and launched its own ecosystem — including Shibarium, SHIB: The Metaverse, and other utilities.

But let’s be real: Shiba Inu is not about real-world utility. It’s about speculation, community hype, and timing the market right based on simple but powerful trading concepts.

Daily Timeframe is Trending UP

Right now, things are shifting in our favour on the daily timeframe. We’ve just entered an uptrend — a key change in market structure — and more importantly, we’ve got a new imbalance forming around $0.00001320. This is the next key level where we’re waiting to re-enter the market.

Why wait? Because smart investors don’t chase candles. They wait for the price to return, where demand will likely kick in again. That level is $0.00001320. Once price returns there and confirms demand, we buy — and we ride the next wave.