NEAR is here to stay!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

After breaking above the falling wedge pattern, CBOE:NEAR has been overall bullish, trading within a rising broadening wedge 🔼 marked in blue and red.

📉 As it approaches the lower bound of the wedge — which perfectly intersects with the green support zone — we’ll be watching for short-term long opportunities 🎯.

From a long-term perspective, for the bulls to fully take control, a break above the $3.6 resistance is needed to confirm the next bullish wave 🚀.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Shift

BTC - Bullish Control, Confirmed!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

🚀 As per my last two setups (highlighted on the chart), BTC rejected the $72,000 support and pushed higher with strength.

📈 This week, BTC broke above the $90,000 structure, confirming a shift in momentum from bearish to bullish.

🟢 For the bulls to stay in control, a break above the $95,200 resistance is still needed.

📊 In the meantime, as BTC retests the $89,000–$90,000 zone, we’ll be looking for medium-term trend-following longs to catch the next impulsive move.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

LTO - Shift in Momentun in Action!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 LTO is a perfect practical example of a momentum shift in action.

It’s clear that the bears are losing steam — the impulse moves marked in red are becoming flatter and smaller, forming a wedge pattern.

Moreover, LTO just tapped into a key weekly support zone near the $0.03 round number, making it a prime area to look for potential long setups.📈

🚀For the bulls to confirm this momentum shift in their favor and aim for the $0.05 round number as the first target 🎯, a break above the last major high marked in green at $0.0345 is essential ✅.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

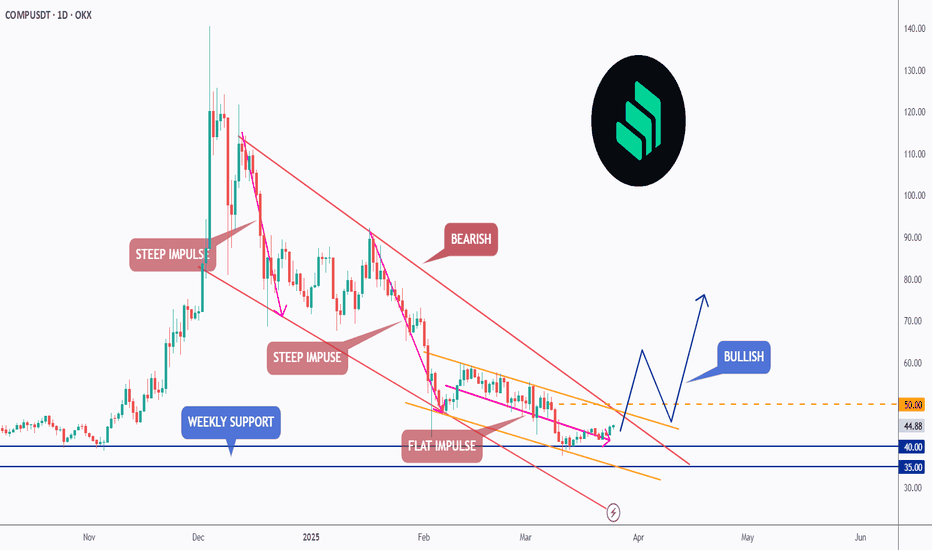

COMP - Shift in Momentum in Action!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

🔹 COMP has been overall bearish trading within the falling channel in red.

However , it is currently rejecting a strong weekly support at $35 - $40.

Moreover, it is clear that the bears are exhausted as the bearish impulse phases are getting more flat.

📈 For the bulls to take over, and shift the momentum in their favor, a break above both trendlines and $50 round number is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

AltSeason Begins If/When...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

🔹 Let’s keep it simple and straightforward:

📈 Altseason begins if/when ETH breaks above its falling channel (in red) 📉 and the $2,000 round number.

⚠️ Meanwhile, further downside is expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

TSLA on the go...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 After rejecting the $200 round number zone and breaking above the red channel, TSLA's momentum shifted from bearish to bullish.

Currently, TSLA is in a correction phase and approaching the green demand zone and round number $300.

📚 As per my trading style:

As #TESLA approaches the $300 zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

EURAUD - Wait For The Bulls ↗️Hello TradingView Family / Fellow Traders,

On Daily: Left Chart

EURAUD has been hovering within a big range between our blue support and red resistance.

Currently, EURAUD is approaching the lower bound of the range, so we will be looking for buy setups on lower timeframes.

On 1H: Right Chart

📈 For the bulls to take over, we need a momentum candle close below above the last major high highlighted in gray.

📉 Meanwhile, EURAUD would be bearish short-term and can still trade lower inside the daily support.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

PTON - Shift In Momentum In Action ↗️Hello TradingView Family / Fellow Traders,

📈 NASDAQ:PTON has been overall bearish trading within the falling channel in red.

PTON is currently retesting the upper bound of the channel and a strong resistance zone highlighted in green.

🏹 For the bulls to assume control and shift the momentum from bearish to bullish, we need a daily candle close above the 7.5 resistance.

Meanwhile, PTON would be bearish and can still trade lower.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Short-term Bearish! Until The Halving.Bitcoin has surpassed the Future Halving Price before the end of Crypto Spring. As we stated in our previous video, if this happens we will be short-term bearish on Bitcoin. Historically when this happens, the likelihood of a Mini-Bear Market or prolonged downwards price trend is very high! What are your thoughts? Let me know in the comments and thanks for watching!

Déjà Vu of 2021's Bearish Shift? 📉📉📉The Eerie Resemblance:

If you've been in the crypto game for a while, you might be experiencing déjà vu. In 2021, Bitcoin was riding high before it underwent a profound transformation from a bullish to a bearish trend. What followed was a period of intense volatility and uncertainty. 🐻

The Bearish Divergence:

One of the key signals of concern is the emergence of a notable bearish divergence. This phenomenon occurs when an asset's price makes higher highs while an oscillator, like the Relative Strength Index (RSI), forms lower highs. It suggests weakening buying momentum and is often a precursor to a trend reversal. 📊

What Lies Ahead:

While history doesn't always repeat itself, it can offer valuable lessons. The current market sentiment, combined with the bearish divergence, is a reminder of the importance of caution in crypto investing. 🚦

Trading Strategy:

Risk Management: Protect your capital by setting stop-loss orders and defining clear risk tolerance levels.

Diversification: Consider diversifying your portfolio to spread risk across different assets.

Stay Informed: Keep a close watch on market news and developments that could influence Bitcoin's price.

Conclusion:

The crypto market is inherently volatile, and it can shift rapidly. While the current situation may appear similar to 2021, it's essential to approach it with an open mind and a well-thought-out strategy.

Remember, trading and investing in cryptocurrencies carry risks, but they also offer opportunities. Stay vigilant, stay informed, and adapt to the evolving market conditions. 🌟

The future remains uncertain, but it's our ability to navigate the unknown that sets us apart as crypto enthusiasts.

❗️Get my 3 crypto trading indicators for FREE❗️ Link below🔑

BTC - Decision Zone Ahead ❗️Greetings, TradingView Family! This is Richard, also known as theSignalyst.

Based on my last analysis, BTC rejected the red supply zone and traded lower.

Currently, BTC is trading inside a falling wedge pattern and approaching the lower red trendline and 26,000 support.

📈 For the bulls take over again short-term, it's crucial for BTC to surpass the last high in gray and upper red trendline.

📉 Meanwhile, BTC would be bearish, and if it breaks below 26,000 we will expect further bearish movement till the 25,000 support and demand zone.

Which scenario do you think is more likely to happen? and why?

📚 Always remember to follow your trading plan when it comes to entry, risk management, and trade management.

Good luck!

Remember, all strategies are good if managed properly!

~Rich

BTR - Strong Again 💪Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

on Weekly: Left Chart

BTR has been trading within a wide range, and it is currently consolidating near a robust support zone. Consequently, we will be searching for buying opportunities on lower timeframes.

on H4: Right Chart

BTR is forming a potential inverse head and shoulders pattern but it is not ready to go yet.

For the bulls to take over, we need a momentum candle close above the gray neckline.

In this case, we will expect a shift in momentum from bearish to bullish.

Meanwhile, until the buy is activated, BTR would be overall bearish and can still trade lower inside the support.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

V for Vet ⚔️ - Analysis #4/50Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

on DAILY: Left Chart

VET is overall bearish, however we are approaching a strong demand zone and previous major high. So we will be looking for buy setups on lower timeframes.

on H1: Right Chart

VET is bearish from a short-term perspective trading inside the falling red channel.

🏹 Trigger => for the bulls to take over, we need a new high to form and then a break above the upper red trendline and red zone.

Meanwhile, until the buy is activated, VET can still trade lower till the 0.02 - 0.021 demand zone.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC Detailed Top-Down Analysis - Day 134Hello TradingView Family / Fellow Traders. This is Richard Nasr, also known as theSignalyst.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Make Or Break Zone! 💣Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

As per my last video analysis, we know that the bears took over after breaking the red zone.

For now, BTC is trading inside the falling broadening wedge in orange.

For the bulls to take over short-term, to start a bullish correction, we need a break above the orange high.

🏹 For the bulls to take over again medium-term , we need a break above the upper orange trendline and red zone.

Meanwhile, until the bulls take over, BTC would be bearish and can still trade lower inside the green demand zone or even break it downward.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin Detailed Top-Down Analysis - Day 52Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

52 out of 500 days done.

I truly appreciate your continuous support everyone!

Let me know if you like the series, and if you would like me to change or add anything.

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BTC - Hold Your Breath; for one last dive! ETH chart insideHello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

As per my last picture idea, we know that BTC is still overall bullish from a medium-term perspective trading inside the bullish channel in red.

However, as time passes by, we are approaching the upper rejection zone that I have been mentioning for months now.

The more we approach the 28k, the closer the rejection would get. That's why I thought that it is a good time to share this idea now as a reminder.

This rejection zone is the intersection of the 28k-30k resistance, supply zone, and upper trendline in brown.

Around this rejection zone, we will be expecting the next bearish impulse to start to form a new swing high around the brown trendline before breaking it upward. Then and only then we can say that the bull run is about to start.

I called it a bearish "impulse" because we are overall bearish trading inside the big brown channel. However, this time I am expecting a shorter impulse compared to the previous two.

But of course, for the bearish impulse to start, we need the bears to take over by breaking below the red channel. Meanwhile we are in a bullish correction.

We can see a similar chart on ETH:

Which scenario do you think is more likely to happen? and Why?

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

NZDCAD - Top-Down Analysis!Hello everyone, if you like the idea, do not forget to support with a like and follow.

DAILY: Right Chart

NZDCAD is sitting around a strong resistance in green so we will be looking for sell setups on lower timeframes.

M30: Left Chart

NZDCAD is forming a channel in red but the lower trendline is not valid yet, so we will be waiting for a third swing to form around it to consider it our trigger swing. (projection in purple)

Trigger => Waiting for that third swing to form then sell after a momentum candle close below it.

Meanwhile, until the sell is activated, NZDCAD would be overall bullish can still trade higher inside the green resistance or even break it upward.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

AUDUSD: Buy & Sell Options 🚨This pair is on a rocket to the moon. Since we are in a bullish trend, the ideal trade would be the buy from the nearby demand created.

However, if price continues higher and targets a previous supply will rejection, we could also consider this zone for sells.

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------

EURUSD - Potential Bullish Reversal!EURUSD is sitting around a strong support in blue so we will be looking for buy setups.

on H1: EURUSD is forming an inverse head and shoulders, but it is still an idea. We are waiting for the right shoulder to form.(projection in purple)

Trigger => Waiting for that swing to form and then buy after a momentum candle close above the gray neckline.

Meanwhile, until the buy is activated, EURUSD would be overall bearish can still trade lower.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Market Structure Simplified It is easy to get confused with overflowing information about market structure in the trading world.

To simplify things we have come up with a way of analysing market structure simply by marking each high or low.

In this particular example, you can see that higher lows were being created all the way down the bearish trend, so we knew that it was a seller's market UNTIL we got our break of structure .

When the BOS became apparent, we began to shift our attention to the possibility of reversals and used our magic tool, the Fibonacci.

This technique can be used in any trend, try it for yourselves!

Please, support this post with a like and comment!