SHOPIFY (SHOP) Explosive Breakout Rally with Earnings Boost!The Shopify (SHOP) weekly timeframe chart showcases a massive breakout, driven by exceptional Q3 earnings performance. The stock has successfully hit Target 2 (TP2 at $109.30), with the remaining targets TP3 ($132.50) and TP4 ($146.84) in sight.

SHOPIFY (SHOP) Stock Key Technical Highlights:

Clear Entry at $71.76 : The bullish momentum initiated a long trade setup, confirmed by the breakout above critical levels.

Earnings Power-Up : Shopify's Q3 revenue surged 26% year-over-year, reaching $2.16 billion, and net income hit $828 million. This exceptional growth propelled the stock price up 22% to $109.81 post-earnings release, further cementing the breakout rally.

Dynamic Moving Averages : The RISOLOGICAL Lines (all GREEN lines) beautifully supports the rally, reflecting strong upward momentum.

SHOPIFY Trade Analysis:

Risk-Reward Balance: The stop-loss (SL) placed at $60.16 offers an optimized risk management strategy.

Profit Potential: With TP2 already achieved, the path toward TP3 ($132.50) and TP4 ($146.84) looks promising, driven by positive market sentiment and strong fundamentals.

Final Words:

Shopify's post-earnings rally demonstrates a perfect confluence of technical and fundamental strength.

Keep a close eye on volume and momentum as the next targets approach!

Shopifysignals

SHOP range bound with potential for Bullish continuationHi guys so this is a Macro analysis on Shopify (SHOP). Recent weeks of price action have got my eyes on SHOP.

Lets jump right in. This analysis is done on the 1 week timeframe thus supporting a Macro lens look on whats happening.

As you can see, ive highlighted key area with an Orange rectangle.

Below it, you can see candles attempting to get into it and getting rejected few times.

However since Nov 2023 till present time, we've been inside the Orange rectangle.

Recently, we've made it to the bottom of the Rectangle to test it as SUPPORT.

We had about 3 weeks of Testing. With this weeks Candle printing a potential Large lower wicked Hammer candle.

This can be an indication of a attempt to reverse our downtrend from $90ish.

At the same time, we have Support confluence of this Ascending Channel.

And our current candle attempting to break Resistance trendline that formed since Feb and local top of $90.

Remember though a breakout above Resistance trendline is not enough. We would need confirmation of it acting as support.

On top of that, at the posting of this idea. Our weekly candle has yet to close. Maintaining price Above 73.50 would be key.

And to keep in mind that there is also Resistance Above $74.00

If things progress look to where the Upper trendline of Ascending Channel and the Upper border of Rectangle meet to potential target.

Also keep an eye for updates on further signs/ clues to take into consideration to help us make informed decisions!

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

SHOPIFY More downside to come. Where to buy?Shopify (SHOP) has been trading within a Channel Up pattern since the October 13 2022 market bottom. It recently made a Higher High but not at the top of the pattern and started to pull-back, losing most of its strength and momentum as the 1D RSI dropped to 45.50 (neutral). The price is still above the 1D MA50 (blue trend-line), which keeps it bullish but in our opinion it won't be for long as it has started to resemble the pull-back after the December 02 2022 High.

That was on the Channel Up first bullish leg and it eventually pulled-back to the 0.5 Fibonacci retracement level, before the price rebounded again and almost reached the -0.382 Fib extension for a technical Higher High. Observe how similar the 1D RSI sequences are between the two.

As a result, we expect currently a downside as low as 60.50 (Fib 0.5) at least to test the 1D MA200 and then we will buy and target $94.00 (below the -0.382 Fib, projected +56% rise, which is 20% lower than the previous rise (+76.18%), similar to the difference the Feb 03 2023 High High had from its Dec 02 2022 High).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BUY ShopifyShopify is approaching strong support levels expecting a bounce of 50-100% from those levels. I will personally buy some calls when it hits that particular area.

Position yourself accordingly, If have questions just message me.

Shopify - Keylevels - WeeklyThese are my keylevels for Shopify on Weekly.

Nothing to say about it, just a sequence of 2 Lower Highs.

Why I'm Going Long on ShopifyOn the weekly timeframe for NYSE:SHOP , I noticed four things immediately:

- A candle close above the bullish flag forming, indicator bullish momentum.

- NYSE:SHOP recently created swing highs at $53.70 and then broke it and bounced perfectly off of it showing that $53.70 is a KEY level.

- When price bounced off of $53.70, it was also at the 5 SMA, adding more confluence to my trade

- Lastly, I saw a divergence on the volume indicator, which is always a good sign of confluence for my trades.

Given these four reasons, I am bullish on NYSE:SHOP as of now.

Stop Loss / Take Profits

Stop loss:

The stop loss of this trade is set at $55.42, which is the most recent low.

Take Profits:

All of these take profits are set at levels that I felt were phycological levels.

My plan would be to scale out half of my position at TP1, 1/2 of the remaining position at TP2, and fully out at TP3

If TP3 is hit, this will be a 1:1.44 R:R trade.

Let me know what you think of this trade!

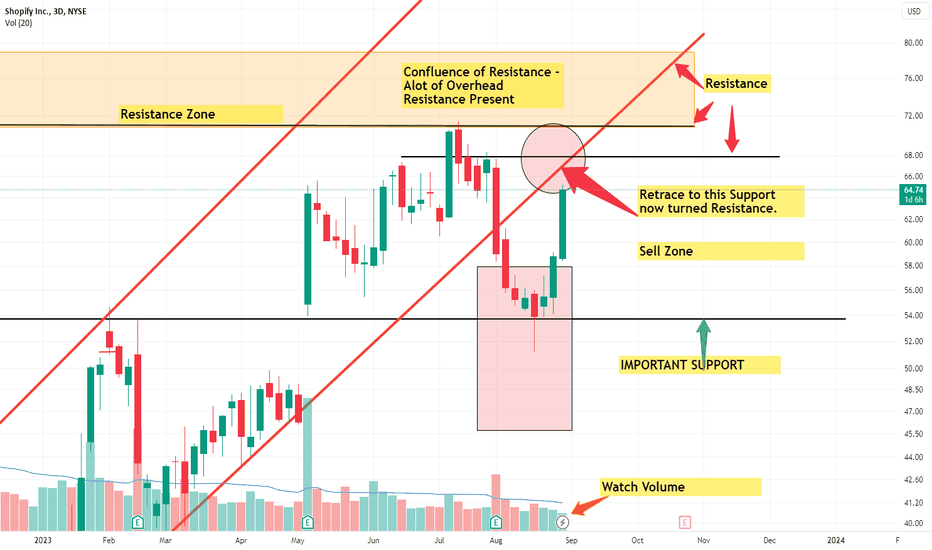

Shopify Short term Sell Target Off Major Support BounceHI guys, ive been following Shopify (SHOP), since its test of some important SUPPORT. This is a quick update from my previous idea. (Which you can find down below for more context)

We've currently bounced extremely bullish off the SUPPORT level, heading towards a SUpport turned Resistance line associated with the UPTREND channel i identified.

Normally when we break down or break above trend lines, that we have respected for some time. We tend to retrace back to that same line to Re-Test it.

Such is the case for Shopify.

Watch the Volume, an INCREASE/ SPIKE in Volume is absolutely needed to get back ABOVE, resuming our UPTREND.

But due note: we are heading into Labor day weekend, thus RISK of LOW VOLUME.

I would then consider if you were able to take positions from the SUPPORT level bounce

To think about off loading some of your position here.

If we do get back into the UPTREND channel from my previous POST. We can look to take new positions if SUPPORT is CONFIRMED.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy

Shopify Corrective Move and Potential TargetsHi guys! This is a Technical Analysis on Shopify (SHOP) on the 1 Week Timeframe.

Since its not the end of the Week, we have to wait till the end of week to see how this week's candle closes.

We ATTEMPTED to break

->1. The ORANGE resistance zone above the 1 FIB level

->2. The "MAJOR RESISTANCE" labeled line that represents a RESISTANCE trend that formed from the PRICE TOP.

WE WERE REJECTED after trying for 4 weeks (july 10th to August 7th).

The 4th weeks candle closed as an ENGULFING BEARISH candle.

Note: For price to break any trend line, it requires a minimum of atleast 3 major tests

This current one in my opinion, ONLY MAKES 2 touch points.

This strengthens the reason of why we got rejected.

So far this weeks candle is showing a much SMALLER body than previous weeks.

This can be an indication that perhaps SELLING is slowing down.

But come end of week, the CURRENT BODY cannot close larger than Today August 9th Candle.

We are currently:

-> BELOW the 21 EMA

-> Breaking the RED Channel i drew out

-> 0.786 FIB Level

Heading straight to the SUPPORT zone comprising of:

1. SUPPORT Horizontal black line

2. 0.618 FIB Level

3. The base of the DESCENDING Triangle.

***Being a confluence of 3 SUPPORT levels -> I believe us to attempt a bounce from the $53.00 area, maybe to retest the "MAJOR RESISTANCE" trendline

In my opinion, its important that we can somehow get back above these key levels come end of week.

If we cant, probabilities are pointing towards a small corrective move

Especially the 21 EMA, looking left reveals patterns where price can fall for upto couple weeks to even couple months.

Which can even validate or increase the probability of the descending triangle to play out

If that happens we will test:

1. First, the 0.5 FIB level at $47.44

2. Then the 0.382 FIB level, which is also around a intermediate Resistance turned SUPPORT line.

3. Worst case scenario = Range of 0.236 FIB level at $34.91 to about $23.90

----->*****going any lower would invalidate the current MACRO BULLISH trend****

-----> But going this low can have create some bullish patterns like a double bottom. But overall its just as of now, less probable.

But we have to just focus one step at a time, worrying about a target level, if the previous trend is broken and confirmed.

Ex). -> If we break below the 0.5 FIB level and confirm, only then is the 0.382 FIB lvl likely.

The STOCH RSI is showing BEARISH move down to the 20 level, we can continue to move below the 20 level and even stay down here for weeks to couple months. But the longer we stay at low levels especially those below 20 level, price tends to decline further.

So we need to pay attention to the level it ends up at.

The RSI is testing a SUPPORT zone, below it can indicate further price drop. Also notice that the RSI line is below the BLACK moving average. If you look left, if we are below it for extended periods RSI continues to drop, along with price. Keep this in mind.

Lastly, the ADX GREEN line, is on a decline, getting close to meeting with RED line. If a cross occurs, more BEARISH momentum can enter the stock. This could increase the probably that the correction continues for a longer timeframe.

We would need GREEN line to curve up and try to get ABOVE resistance line.

Stay tuned for more updates on SHOP in the near future.

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. When trading always spend majority of your time on risk management strategy.

Bull momentum of Shopify has been completely releasedBull momentum of Shopify has been completely released

This chart shows the weekly candle chart of Shopify stocks over the past two years. The top to bottom golden section at the end of 2021 is superimposed in the figure. As shown in the figure, since the completion of the form at the end of October 2022, it has risen by 4 small bands, and theoretically, the bull momentum has been completely released! This week, Shopify's stock has made a significant pullback, returning to below the 2.382 position in the golden section of the chart! In the future, it is likely that there will be a longer period of bull rest!

SHOPIFY targeting 75.00It's been 10 months since we last analyzed Shopify Inc. (SHOP) and called for a $60 target (see chart below):

The stock recently hit that level and we now see that it's trading within a Bullish Megaphone/ Channel Up combo pattern. With the 1D MA50 as its Support and recent strong fundamentals, we now set the next medium-term target at $75.00 to fill Gap 3. The 1D RSI has been on a Higher Lows trend-line, clearly indicating the most optimal buy entry within the pattern.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Shopify: Shopping Spree 🛍️The Shopify stock is currently wandering off to a shopping spree in the South and could get dangerously close to the alternative scenario, if it crosses the support line at $32.35. This would implicate further downward pulses until the turquoise wave alt. B hits its low. Primarily, we expect the course to get back in the saddle to exceed the resistance line at $45.43, which should be followed by the completion of the pink wave (A).

Shopify: Shop until you drop 🛒Shopify is currently on the verge of dropping further South to complete the turquoise wave B in the middle of the turquoise target zone between $34.35 and $28.22 before turning the course back North to exceed the resistance line at $45.43 in order to complete the pink wave (A). Our alternative scenario implies an earlier surpassing of the $45.43-mark instead of dropping into the turquoise target zone.

SHOP trade setup idea 19-september-2022 SHOP has consistently been taking the 29.81-31.79 levels as support multiple times.

This level might not hold longer, causing the stock to plummet to the 28 or 26 levels soon.

Short term bearish.

SHOP Tradesetup Idea for 31 August, 2022 - Short/Medium TermSHOP has consistently been taing the 29.81-31.79 levels as support multiple times.

This level might not hold longer, causing the stock to plumet to the 28 or 26 levels soon.

Short term bearish.

Shopping for profitShopify

Short Term

We look to Buy at 30.49 (stop at 28.39)

Previous support located at 30.00. There is scope for mild selling at the open but losses should be limited. We look for a temporary move higher. Preferred trade is to buy on dips.

Our profit targets will be 39.51 and 42.30

Resistance: 40.00 / 51.12 / 70.29

Support: 30.02 / 29.72 / 16.90

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

SHOPIFY approaching the end of its consolidation. Target $60+.Shopify (SHOP) has been consolidating within an Accumulation Zoen since the May 11 Low. At the same time the 1D RSI has been on Higher Lows indicating a hidden bullish sentiment. The last time we saw that recently was during the September 24 - November 29 2019 Accumulation Phase, which was also on 1D RSI Higher Lows. A strong rally followed after the pattern broke to the upside (came after the price broke above the 1D MA50 (blue trend-line)).

Currently, the bullish targets are the upper Fibonacci retracement levels, which as you see they all match the Lower Highs during the price correction. We are aiming for $60 on the short-term.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------