SHOP Bulls Are Back!

**SHOP Bulls Are Back! \$128 Calls Flash 80% Confidence Ahead of Earnings 🚀**

---

### 📋 **Post Body (TradingView Viral Format):**

**SHOP Weekly Options Alert — Aug 8 Expiry 💥**

📈 **Momentum Check:**

* RSI (Daily/Weekly): 🔼 Rising

* Call/Put Ratio: **1.35** (Bullish)

* Volume: Confirmed Institutional Support

* Confidence Level: **80%**

---

📊 **Recommended Trade:**

* **Type:** Buy Call

* **Strike:** \$128

* **Entry:** \$5.70

* **Stop Loss:** \$2.85

* **Targets:** 🎯 \$8.55 / 💰 \$11.40

* **Expiry:** Aug 8, 2025

* **Entry Timing:** Market Open

---

⚠️ **Key Risk:**

Major earnings event approaching — **exit before earnings** if holding through volatility isn’t part of your plan. Position sizing is **crucial**.

---

💡 **Strategy Insight:**

Strong consensus across models (Grok, Gemini, Claude, Llama, DeepSeek) aligns on bullish bias. This is a **premium setup** — watch for confirmation early in the week.

---

📦 **Trade JSON (for automation nerds):**

```json

{

"instrument": "SHOP",

"direction": "call",

"strike": 128.00,

"expiry": "2025-08-08",

"confidence": 0.80,

"profit_target": 8.55,

"stop_loss": 2.85,

"size": 1,

"entry_price": 5.70,

"entry_timing": "open",

"signal_publish_time": "2025-08-05 07:05:45 UTC-04:00"

}

```

---

### 🏷️ **Recommended Tags (TradingView Style):**

`#SHOP #OptionsTrading #WeeklyOptions #CallOptions #SHOPStock #BullishBreakout #TechnicalAnalysis #EarningsPlay #TradingStrategy #MomentumTrade #RSI #VolumeAnalysis #SmartMoney #TradingView`

Shopifystock

Shopify Inc | SHOP & AIShopify stock has seen sideways momentum for the last few weeks despite posting good results in the recent quarter. One of the reasons is the bull run in early 2023 due to which the stock has seen over 60% jump in year-to-date. Shopify has been able to reignite revenue growth in the last few quarters and there are strong tailwinds that can help the company improve its topline. At the same time, Shopify has been able to improve the conversion of Gross Merchandise Value or GMV into revenue due to better services. Shopify’s GMV has increased 11x between the last quarter of 2016 and the last quarter of 2022. During this time, Shopify’s quarterly revenue base has increased from $130 million to $1.7 billion or 13x.

Shopify’s GMV for 2022 was $195 billion and rapid growth in this key metric should help the company improve monetization. The company has also undertaken some cost-cutting which is having a positive impact on the bottom line. Analysts have forecasted Shopify’s EPS at $1 for fiscal 2025 which means that the stock is trading 60 times the EPS estimate of 2025. However, better monetization and focus on cost optimization could help the company deliver good EPS growth in the next few quarters. The PS ratio is also at 12 which is significantly lower than the pre-pandemic years. Shopify stock can deliver good returns in the long term as the company adds new services and improves its GMV growth trajectory.

Shopify reported a GMV of $5.5 billion in December 2016 quarter. This has increased to $60 billion in the recent December 2022 quarter. Hence, Shopify’s GMV has increased to 11 times within the last seven years. On the other hand, Shopify’s revenue during the December quarter has increased by 13 times, from $130 million to $1.7 billion. This growth trend shows that the company is able to convert more GMV into actual revenue. One of the main reasons behind this trend is that Shopify is adding new services and it can charge customers a higher commission for these services.

Shopify’s GMV for 2022 was a staggering $195 billion. The company has been able to reignite revenue growth in the last few quarters. The YoY revenue growth hit a bottom of 15% in June 2022. Since then the YoY revenue growth has picked up again as the company faces easier comps. In the recent quarter, the company reported YoY revenue growth of over 30% which is quite high when we consider that the GMV base of Shopify is more than $200 billion.

The revenue growth will not build a bullish momentum for the stock unless the company can deliver sustainable profitability. During the pandemic years, Shopify’s revenue growth and high EPS helped the stock reach its peak. The company would need to focus on profitability in the next few quarters in order to rebuild a long-term bullish rally. Shopify has divested from its logistics business which should help improve the bottom line. We should also see better monetization of current services as the company tries to build new AI tools.

The EPS estimates for 2 fiscal years ahead have steadily improved in the last few quarters. According to current consensus, Shopify should be able to deliver EPS of $1 in fiscal year 2025. However, it is highly likely that Shopify will beat these estimates as the company launches new initiatives to improve monetization of its massive GMV base. Shopify’s trailing twelve months EPS during the peak of the pandemic went to $2.6. If the company can get close to this EPS rate by 2025, we should see a significant bullish run in the stock. The recent cost-cutting should also help the company improve the bottom line. We have seen a similar trend in all the Big Tech companies who have reported a rapid growth in EPS as their headcount was reduced.

While most analysts agree over the long-term revenue growth potential of Shopify, some of them are wary of the pricey valuation of the stock. Shopify is trading at 12 times its PS ratio. This is quite high when we compare with most of the other tech players and even Shopify’s peer like Wix (WIX), Etsy (ETSY), and others. However, it should be noted that Shopify’s PS ratio is significantly lower than the average PS multiple prior to the pandemic when the stock had an average PS ratio of over 20.

Shopify’s revenue estimates for 2 fiscal years ahead is close to $10 billion which is equal to annualized revenue growth of over 25%. If we look at this metric, Shopify stock is trading at 7 times the revenue estimate of fiscal year 2025. This looks reasonable if the company can also manage to improve its EPS trend over the next few years.

The long-term tailwind from ecommerce growth is still very strong. Shopify will benefit from an increase in GMV and a higher ecommerce market share in key markets. This should help the company gain pricing leverage over other competitors and also improve its monetization momentum

Shopify has reported a faster revenue growth rate compared to its GMV growth in the last few years. This shows that the company is able to charge higher rate for additional services. There has been an acceleration in revenue growth over the last few quarters. Shopify has also divested from logistics services which were pulling down the profitability of the company.

Shopify could deliver over 20% YoY revenue growth for the next few years as the company gains from strong tailwinds within the ecommerce business. If Shopify regains its earlier ttm EPS of $2 by 2025, we could see a strong bull run within the stock. While the stock is not cheap, it seems to be reasonably valued and longer-term investors could gain a better return from Shopify, making the stock a Buy at current price.

LIKE I SAID: SHOPIFY WAS THE NEXT RETAIL STOCK TO FLY📢 Before all the BIG accounts start swarming all over NYSE:SHOP like flies on 💩, remember this call in the chaos! 🤪

Catalyst: Big earnings beat prediction based on NASDAQ:AAPL and NASDAQ:AMZN results and a strong consumer outlook.

Trade Setup: Entry, Stop Loss, Price Targets.

Next Retail Stock: Prediction on the next big retail stock to fly.

#HIGHFIVESETUP: My proven trading strategy.

Valuation: Detailed analysis based on my valuation analyzer.

Let's continue to crush it together in this amazing community! I appreciate you all! ♥️

Shopify ain't done yet! Pullback then Higher, 50% Move Inbound! Shopify ain't done yet! Pullback then Higher, 50% Move Inbound!

NYSE:SHOP is going higher and presenting a buying opportunity!

50% Potential Upside! 📈

In this video, we dive into NYSE:SHOP , an Ecommerce powerhouse, currently breaking out of a Multi-Year Cup n Handle Pattern!

💡 Key Highlights:

-H5 Indicator: Flashing green for a bullish signal

-Flipping a 4-year resistance area to support

-Volume Insights: Massive GAP to fill

-Technical Analysis: Consolidation box formed on WR%

Targets:

🎯$110

🎯$121

📏$160

🎯$180

Don't miss out on the potential explosive growth of Shopify! Tune in to see why this stock could be a game-changer!

NFA

SHOPIFY (SHOP) Explosive Breakout Rally with Earnings Boost!The Shopify (SHOP) weekly timeframe chart showcases a massive breakout, driven by exceptional Q3 earnings performance. The stock has successfully hit Target 2 (TP2 at $109.30), with the remaining targets TP3 ($132.50) and TP4 ($146.84) in sight.

SHOPIFY (SHOP) Stock Key Technical Highlights:

Clear Entry at $71.76 : The bullish momentum initiated a long trade setup, confirmed by the breakout above critical levels.

Earnings Power-Up : Shopify's Q3 revenue surged 26% year-over-year, reaching $2.16 billion, and net income hit $828 million. This exceptional growth propelled the stock price up 22% to $109.81 post-earnings release, further cementing the breakout rally.

Dynamic Moving Averages : The RISOLOGICAL Lines (all GREEN lines) beautifully supports the rally, reflecting strong upward momentum.

SHOPIFY Trade Analysis:

Risk-Reward Balance: The stop-loss (SL) placed at $60.16 offers an optimized risk management strategy.

Profit Potential: With TP2 already achieved, the path toward TP3 ($132.50) and TP4 ($146.84) looks promising, driven by positive market sentiment and strong fundamentals.

Final Words:

Shopify's post-earnings rally demonstrates a perfect confluence of technical and fundamental strength.

Keep a close eye on volume and momentum as the next targets approach!

SHOPIFY: The next Retail Stock to Take Flight! NYSE:SHOP

🚀 SHOPIFY: The Next Retail Stock to Take Flight! 100% MOVE INBOUND! 🚀

Share this so all retail investors are prepared before earnings next Tuesday!

In this video, we’ll cover:

1️⃣ Fundamental Analysis: A deep dive into Shopify using my Valuation Analyzer.

2️⃣ Massive 3-Year Cup N Handle Pattern: What this means for $SHOP.

3️⃣ High Five Setup: How Shopify meets my proven trading strategy.

You’ve seen NYSE:PLTR at ATHs, and NASDAQ:SOFI , NYSE:HIMS , and NASDAQ:TSLA pushing higher. We’re already in these trades, but staying ahead of the curve and finding the next big opportunity is key. Shopify is that next big opportunity IMO. We’re among the first to the party, and it’s not crowded… YET.

My Mission:

I aim to build a community that empowers traders to find their path and thrive. But I need your help to make this happen.

Here’s What You Can Do:

Share this post and the FREE video analysis I’ll release after the market closes on this company like wildfire. Let’s hit 1k friends and grow this community together!

BUCKLE UP! IT'S A BANGER! 🎆

LIKE IT! ♥️ SHARE IT! 🔁 JOIN US! 📈 BOOKMARK IT!

You are amazing, and I love you all! 🫶

Shopify Surges 22% on Strong Q2 Earnings and Upbeat ForecastShopify Inc. (NYSE: NYSE:SHOP ) experienced a remarkable 22% surge in its stock price following its second-quarter earnings report, which significantly exceeded Wall Street expectations. The Canadian e-commerce giant showcased impressive growth in key financial metrics, despite a challenging consumer spending environment.

Financial Highlights

- Earnings per Share (EPS): 26 cents, surpassing the 20 cents expected

- Revenue: $2.05 billion, beating forecasts of $2.01 billion

- Gross Merchandise Volume (GMV): Rose by 22% to $67.2 billion, outpacing the $65.8 billion consensus estimate

Shopify’s success is attributed to its robust demand for services that support online merchants, including software solutions, advertising, and payment processing tools. The company's ability to navigate a mixed consumer spending landscape underscores its strong market position.

Strong Performance Amid Consumer Caution

Despite a cautious consumer spending environment, reflected in recent earnings reports from e-commerce rivals like Amazon, Etsy, and Wayfair, Shopify reported solid growth. The company’s GMV soared 22%, highlighting its ability to capture market share even as broader economic conditions impact consumer behavior.

Jeff Hoffmeister, Shopify’s CFO, remarked that the company continued to gain market share, driven by its diverse clientele and robust platform. “Our merchants are outperforming and doing better than others,” stated Shopify President Harley Finkelstein, emphasizing the benefits of the company's broad and varied merchant base.

Key Metrics and Achievements

- Merchant Solutions Revenue: Increased by 19% to $1.5 billion, driven by GMV growth and Shopify Payments adoption

- Subscription Solutions Revenue: Grew by 27% to $563 million, bolstered by a rise in merchant numbers and pricing increases

- Gross Profit: Up 25% to $1.0 billion, with a gross margin of 51.1%

- Free Cash Flow: Increased to $333 million, compared to $97 million in the same quarter last year

- Monthly Recurring Revenue (MRR): Rose 25% to $169 million, with Shopify Plus contributing 31%

Positive Outlook for Q3 2024

Shopify (NYSE: NYSE:SHOP ) provided an optimistic forecast for the third quarter. The company expects revenue growth in the low-to-mid-20s percentage range year-over-year and anticipates a slight increase in gross margin. Additionally, Shopify projects a free cash flow margin similar to Q2 2024 and expects to maintain a double-digit free cash flow margin for the remainder of the year. Shopify’s impressive performance amidst a mixed consumer spend environment highlights its strategic positioning as a leader in e-commerce solutions. By focusing on diversified merchant needs and enhancing its platform's capabilities, Shopify continues to strengthen its role in global commerce.

Industry Context

The company’s success contrasts with challenges faced by other e-commerce players, who have reported cautious consumer spending. Shopify’s ability to thrive despite these headwinds showcases its resilience and strategic advantage in the e-commerce sector.

Technical Outlook

As of the current time, Shopify stock (NYSE: NYSE:SHOP ) has experienced a notable increase of 22.3%. This significant surge is supported by a bullish Relative Strength Index (RSI) of 58, indicating the likelihood of further price escalation. Additionally, the daily price chart presents a distinct upward gap, suggesting that market dynamics may lead to this gap being filled in subsequent trading sessions.

In summary, Shopify's strong quarterly results and positive outlook reflect a company that is not only weathering economic uncertainties but also thriving in a competitive market. As it continues to expand its offerings and drive growth, Shopify remains a standout player in the e-commerce landscape.

Shopify ($SHOP) Reported Q1 Revenue for 2024Canadian e-commerce platform Shopify ( NYSE:SHOP ) has reported its slowest quarterly revenue growth in two years, with its U.S. shares slumping 20.5% in premarket trading. The company's core clientele, small and medium-sized businesses (SMBs), have been more susceptible to the hit from sticky inflation. Analysts estimated current-quarter revenue to grow 19.35%, according to LSEG data. The company expects operating expenses to be up at a low-to-mid-single digit percentage rate for the second quarter, compared with a 4% fall in the first three months of the year.

Shopify ( NYSE:SHOP ) reported first-quarter revenue of $1.86 billion, compared with analysts' average estimate of $1.85 billion. Excluding items, earnings of 20 cents per share also topped expectations of 17 cents.

Shopify Inc. ( NYSE:SHOP ) announced financial results for the quarter ended March 31, 2024. Harley Finkelstein, President of Shopify, said that the company had a strong start to the year, building on the performance of 2023, delivering year-over-year revenue growth for the quarter of 23%, or 29% when adjusting for the sale of its logistics businesses, combined with 12% free cash flow margin.

First-Quarter Financial Highlights

Gross Merchandise Volume1 ("GMV") increased 23% to $60.9 billion, an increase of $11.3 billion over the first quarter of 2023. Revenue increased 23% to $1.9 billion compared to the prior year, resulting in a year-over-year growth of 29% after adjusting for the sale of its logistics businesses. Merchant Solutions revenue increased 20% to $1.4 billion compared to the prior year, driven primarily by the growth of GMV and continued penetration of Shopify Payments. Gross Payments Volume2 ("GPV") grew to $36.2 billion, representing 60% of GMV processed in the quarter, versus $27.5 billion, or 56%, for the first quarter of 2023. Subscription Solutions revenue increased 34% to $511 million compared to the prior year, driven by the growth in the number of merchants and pricing increases on our standard subscription plans.

Monthly Recurring Revenue as of March 31, 2024 increased 32% to $151 million compared to the prior year, driven by continued growth across all of our subscription plans. Gross profit dollars grew 33% to $957 million compared to the prior year. Gross margin for the quarter was 51.4% compared to 47.5% in the first quarter of 2023, driven primarily by the lack of the dilutive impact of the logistics businesses and changes in pricing from standard plans, partially offset by the continued growth of Shopify Payments.

Free cash flow was $232 million compared to $86 million in the prior year, and free cash flow margin for the quarter was 12% compared to 6% in the first quarter of 2023.

BUY ShopifyShopify is approaching strong support levels expecting a bounce of 50-100% from those levels. I will personally buy some calls when it hits that particular area.

Position yourself accordingly, If have questions just message me.

Shopify - Keylevels - WeeklyThese are my keylevels for Shopify on Weekly.

Nothing to say about it, just a sequence of 2 Lower Highs.

Why I'm Going Long on ShopifyOn the weekly timeframe for NYSE:SHOP , I noticed four things immediately:

- A candle close above the bullish flag forming, indicator bullish momentum.

- NYSE:SHOP recently created swing highs at $53.70 and then broke it and bounced perfectly off of it showing that $53.70 is a KEY level.

- When price bounced off of $53.70, it was also at the 5 SMA, adding more confluence to my trade

- Lastly, I saw a divergence on the volume indicator, which is always a good sign of confluence for my trades.

Given these four reasons, I am bullish on NYSE:SHOP as of now.

Stop Loss / Take Profits

Stop loss:

The stop loss of this trade is set at $55.42, which is the most recent low.

Take Profits:

All of these take profits are set at levels that I felt were phycological levels.

My plan would be to scale out half of my position at TP1, 1/2 of the remaining position at TP2, and fully out at TP3

If TP3 is hit, this will be a 1:1.44 R:R trade.

Let me know what you think of this trade!

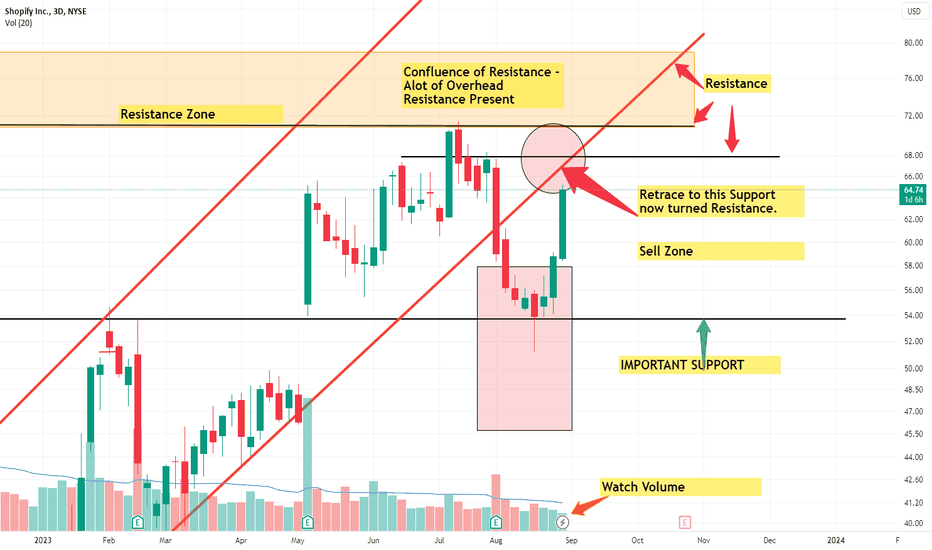

Shopify Short term Sell Target Off Major Support BounceHI guys, ive been following Shopify (SHOP), since its test of some important SUPPORT. This is a quick update from my previous idea. (Which you can find down below for more context)

We've currently bounced extremely bullish off the SUPPORT level, heading towards a SUpport turned Resistance line associated with the UPTREND channel i identified.

Normally when we break down or break above trend lines, that we have respected for some time. We tend to retrace back to that same line to Re-Test it.

Such is the case for Shopify.

Watch the Volume, an INCREASE/ SPIKE in Volume is absolutely needed to get back ABOVE, resuming our UPTREND.

But due note: we are heading into Labor day weekend, thus RISK of LOW VOLUME.

I would then consider if you were able to take positions from the SUPPORT level bounce

To think about off loading some of your position here.

If we do get back into the UPTREND channel from my previous POST. We can look to take new positions if SUPPORT is CONFIRMED.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy

Shopify Macro Pattern Bullish Until Proven OtherwiseHi Guys! This is a Macro Technical Analysis on Shopify (SHOP) on the 1 Week Timeframe.

Its to add to my previous analysis while keeping it brief and concise.

Recently we Broke through and confirmed BELOW both the Uptrend Channel and the 21 EMA.

Normally this spells TROUBLE, especially if we confirm BELOW 21 EMA, as this moving average normally holds SUPPORT through BULLTRENDS.

Even more so that the MACD has crossed BEARISH as well.

However digging deeper, its seen that the channel and 21 EMA break was followed by DECLINING VOLUME.

Normally, for Trend Reversals and for the direction of a trend to actually go that way you need a spike in VOLUME.

(Watch VOLUME in the coming weeks. Can give us hints to what will come next.)

Comparing our current move to previous moves, look to "Similar Pattern". It may be probable that we just move side ways before continuing our UPTREND.

Notice how to the T, our current move follows the previous example. The 21 EMA is also flattening out, indicating this sideways movement.

Another likely scenario, if volume picks up can be a test of the 50 SMA (Green moving average).

BUT provided this Weeks candle closes ABOVE we are testing support. So if we can stay ABOVE this, 50 SMA is less Probable. So pay attention to this weeks candle close and for CONFIRMATION.

Also NOTE we have had a BULLISH CROSS of the 21 EMA above the 50 SMA.

Along with how previous history BUllish move played out.

This makes me think we are in the Early phases of a BULL run in Shopify.

This is NOT a DEFINITE, Sure thing but we may be mirroring the "Similar Pattern".

But always remember that things that happened before does not have to happen again.

I think other than Volume, another MAJOR thing to watch is the MACD.

Particularly, the main focus should be staying ABOVE the 0 level.

Going BELOW 0 level, may indicate further price DECLINES.

So watch how the Histogram bars shape up, we want smaller RED bars that change to a lighter RED color. Eventually would like to see GREEN bars in the coming weeks. That would give confidence that BULLISH momentum is coming back to Shopify.

Take a look at how the MACD shaped up during the "Similar Pattern". If we stay ABOVE 0 level, all is good.

Keep that in the back of the mind as you follow the MACD.

RSI also gives some clues. The area between the RED & BLACK Horizontal lines, coincides with being BELOW 21 EMA.

If we are below the RED line, normally its a good area to add to your position during a BULL run.

The warning sign is if the RSI drops towards and BELOW the BLACK line, that would lead to further PRICE Declines.

Using both the MACD and RSI in combination will help remove false signals. If you see that the histograms are turning light red, to light green and the RSI curved back up towards and ideally above RED line. This would likely push Price back ABOVE 21 EMA, and continue our BULL Run.

I think this week, its important to stay ABOVE the SUPPORT line. Staying above may bring in more confidence.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

Bull momentum of Shopify has been completely releasedBull momentum of Shopify has been completely released

This chart shows the weekly candle chart of Shopify stocks over the past two years. The top to bottom golden section at the end of 2021 is superimposed in the figure. As shown in the figure, since the completion of the form at the end of October 2022, it has risen by 4 small bands, and theoretically, the bull momentum has been completely released! This week, Shopify's stock has made a significant pullback, returning to below the 2.382 position in the golden section of the chart! In the future, it is likely that there will be a longer period of bull rest!

$SHOP to move higher targeting $75, $100?NYSE:SHOP broke out of a 8.5 month inverse head and shoulders pattern back in January, then went back to test the breakout level as support and has now turned higher again.

The first target for the breakout of this pattern would be $63.89, however, after we hit that target, I think we'll see a continuation of the trend higher and get to HKEX:75 level.

And if it can flip the HKEX:75 level as resistance, I think it can get all the way back to $100. I do think $100 would be the top though as it would confirm resistance from the area it broke down from.

Let's see what happens over the next 2 months.

Shopify: Lift Your (Shopping-)Bags! 🧺🛍Shopify should lift its laden shopping bags – or are they too heavy? We expect the share to move upwards, climbing above the resistance at $57.50 and further from there. There is a 31% chance, though, for Shopify to make a detour below the support at $38.90. In that case, the share would develop a new low in the form of wave alt.(B) in magenta first before heading upwards.

Shopify: Shopping Spree 🛍️The Shopify stock is currently wandering off to a shopping spree in the South and could get dangerously close to the alternative scenario, if it crosses the support line at $32.35. This would implicate further downward pulses until the turquoise wave alt. B hits its low. Primarily, we expect the course to get back in the saddle to exceed the resistance line at $45.43, which should be followed by the completion of the pink wave (A).

Shopify: Shop until you drop 🛒Shopify is currently on the verge of dropping further South to complete the turquoise wave B in the middle of the turquoise target zone between $34.35 and $28.22 before turning the course back North to exceed the resistance line at $45.43 in order to complete the pink wave (A). Our alternative scenario implies an earlier surpassing of the $45.43-mark instead of dropping into the turquoise target zone.

SHOPIFY 30 % DROP IF THIS HAPPENS (NEW)A few days ago Shopify managed to break out of the range but it seems that it was a bull trap as the price came back into the range.

We believe that after the fake breakout to the upside that we had, it´s more likely now for Shopify to break down. We had a bearish cross on MACD and RSI on daily timeframe is not even oversold and it has more room to the downside.

Enter the short only if / when we break down the range. We expect 30 % drop.

Moreover SPX and Nasdaq finished their ´bear market rally so it´s also favoring more downside on Shopify.

SHOP trade setup idea 19-september-2022 SHOP has consistently been taking the 29.81-31.79 levels as support multiple times.

This level might not hold longer, causing the stock to plummet to the 28 or 26 levels soon.

Short term bearish.

SHOP Tradesetup Idea for 31 August, 2022 - Short/Medium TermSHOP has consistently been taing the 29.81-31.79 levels as support multiple times.

This level might not hold longer, causing the stock to plumet to the 28 or 26 levels soon.

Short term bearish.

Shopping for profitShopify

Short Term

We look to Buy at 30.49 (stop at 28.39)

Previous support located at 30.00. There is scope for mild selling at the open but losses should be limited. We look for a temporary move higher. Preferred trade is to buy on dips.

Our profit targets will be 39.51 and 42.30

Resistance: 40.00 / 51.12 / 70.29

Support: 30.02 / 29.72 / 16.90

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.