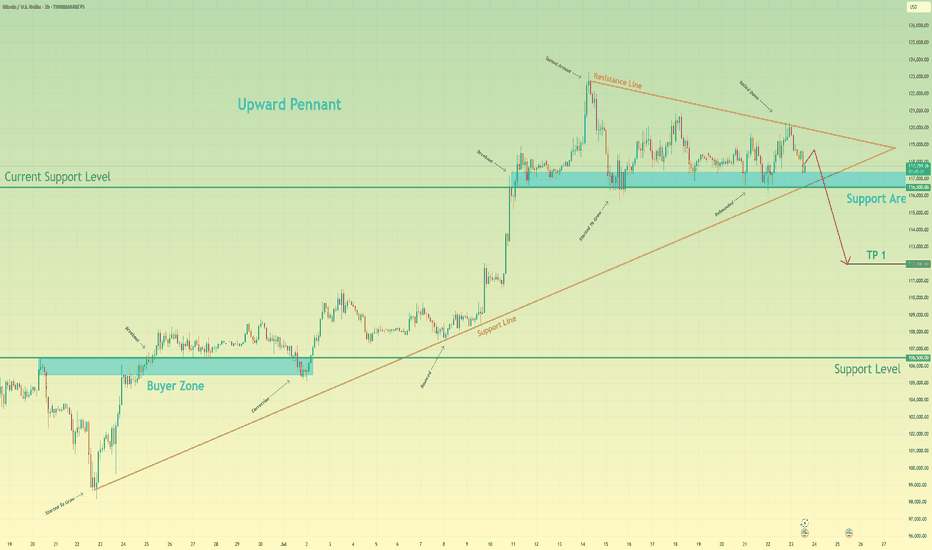

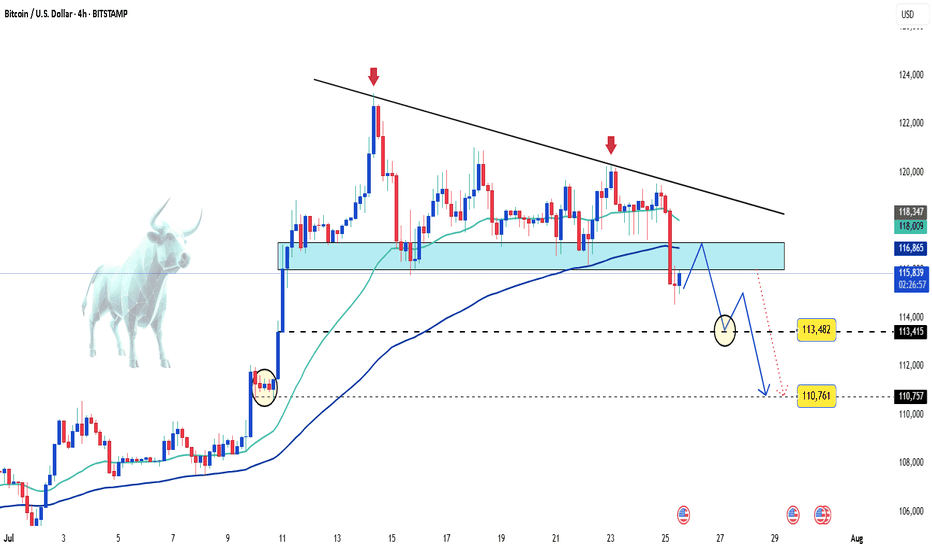

Bitcoin can start to decline and break support levelHello traders, I want share with you my opinion about Bitcoin. After completing a powerful upward impulse that originated from the buyer zone near 106500, the price action for BTC has transitioned into a corrective market phase. This consolidation has taken the form of an upward pennant, characterised by a narrowing trading range that suggests a significant directional move is forthcoming. Currently, the asset is undergoing a sequence of downward corrections within the pennant, exerting repeated pressure on the critical demand zone between 116500 and 117400. The importance of this zone is amplified by its confluence with the lower trend line of the formation itself. The primary working hypothesis is a bearish resolution, anticipating that persistent selling pressure will culminate in a decisive breakdown of this support. This event would act as a bearish breakout from the pennant, providing strong confirmation for the continuation of the downward impulsive momentum and shifting the local market structure. Therefore, the take-profit level is logically positioned at the 112000 mark. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Short

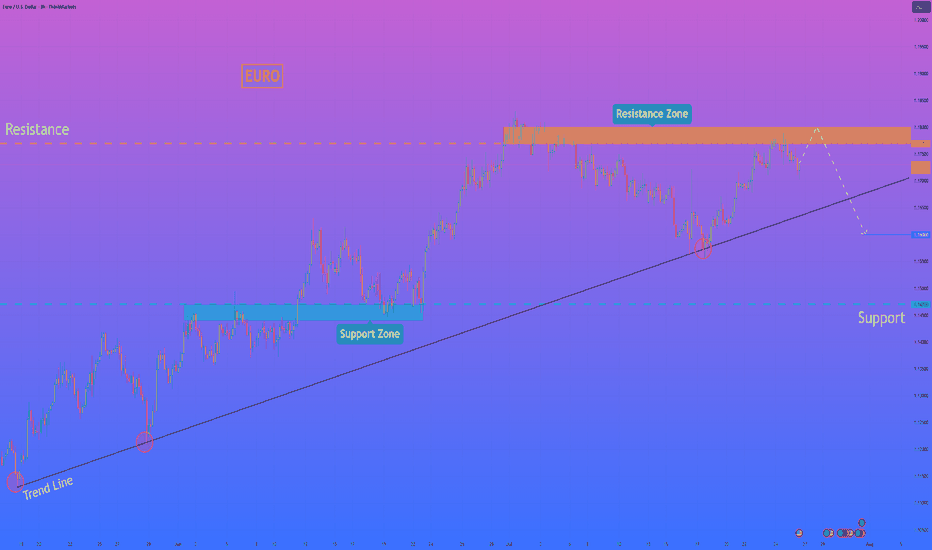

HelenP. I Euro can reach resistance zone and then dropHi folks today I'm prepared for you Euro analytics. If we look at the chart, we can observe a mature uptrend that has been supported by a major ascending trend line for an extended period. However, the momentum of this trend appears to be waning, as evidenced by the price's recent failure to establish new highs. The asset is currently trading below the critical resistance zone of 1.1770 - 1.1800, an area that has proven to be a significant barrier for buyers. My analysis for a short position is based on the condition of a final retest of this resistance zone. I believe the price will make another attempt to rally into this area, and a forceful rejection from this zone would serve as the confirmation that sellers are taking definitive control of the market. Such a rejection would likely initiate a strong downward impulse with sufficient momentum to break the long-standing ascending trend line, a pivotal event that would shift the market structure. Therefore, the primary goal for this bearish scenario is set at the 1.1600 level, a logical target for the price to reach after such a significant structural break. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

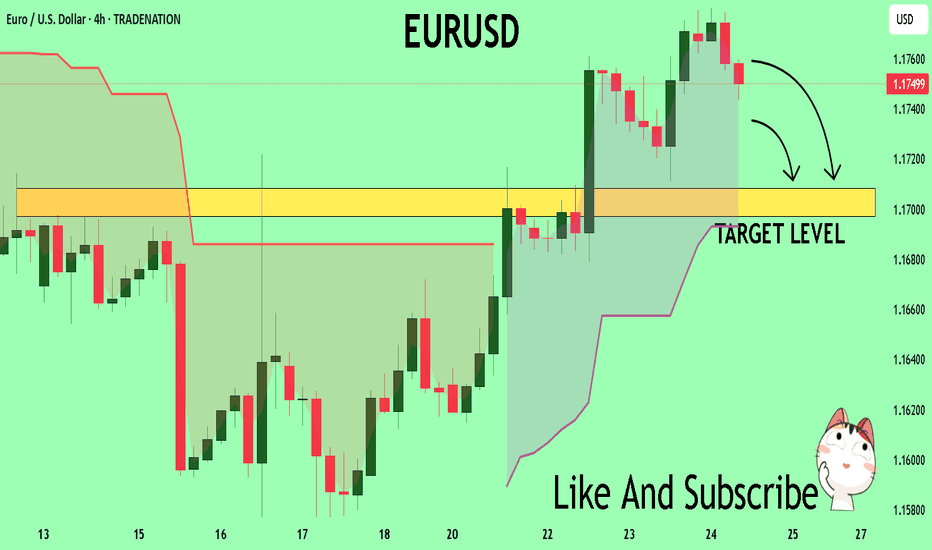

EURUSD | Time For A Pullback?The week kicked off with strong impulsive moves to the upside, leaving no room for deeper correction. Then slowly from Wednesday, we started to see a decline in strength in the bullish run.

Now, with price edging toward the next swing low for a possible bearish change of character, is this a good way to ride the stream to the downside?

Keep your A-game on as we watch price unfold, and trade reactively to price movement.

Do not forget to guard your capitals with risk management.

Good luck traders. 👍

Follow me for more and more of these analyses.

See you on the next one. 🫡

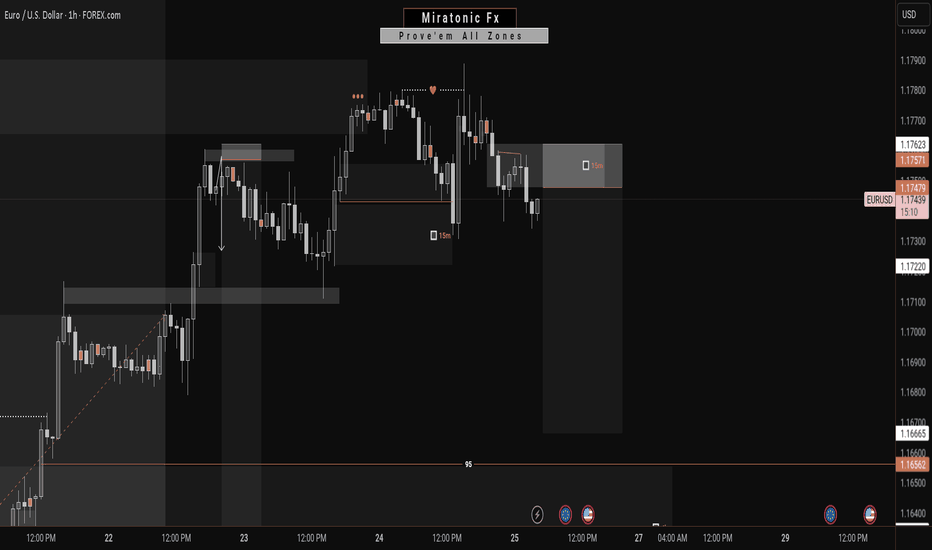

USDJPY Under Pressure! SELL!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 147.83

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 147.34

My Stop Loss - 148.12

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD/USD Sell SetupOANDA:AUDUSD

Timeframe: m30

Entry: 0.66151

SL: 0.66266

TP1: 0.66033

TP2: 0.65914

TP4: 0.65681

📊 Setup Rationale

🔺 Channel Top Rejection (8H Overlay) Price has touched the upper boundary of a descending channel visible on the 8-hour chart. This zone has historically acted as a strong resistance, increasing the probability of a reversal.

🧱 Local Structure (30min) Entry aligns with a minor double top (in lower TFs) and bearish momentum. The tight SL allows for a high R:R profile.

🔄 Momentum Shift Watch for bearish engulfing or rejection wick on lower timeframes to confirm entry.

#MJTrading #Forex #AUDUSD #Sell

Psychology always matters:

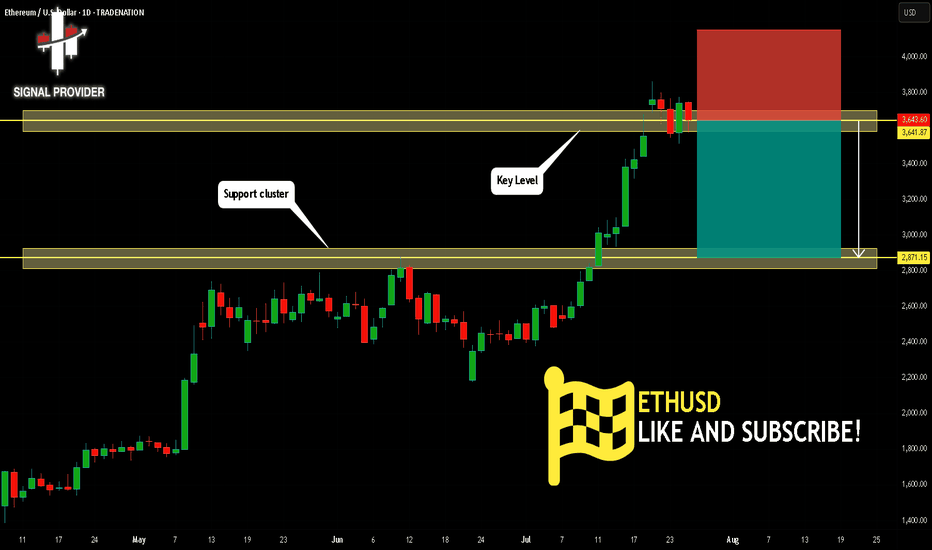

ETHUSD Will Go Down From Resistance! Sell!

Here is our detailed technical review for ETHUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 3,641.87.

Taking into consideration the structure & trend analysis, I believe that the market will reach 2,871.15 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Bitcoin on the edge – Is a sharp drop coming?Bitcoin is keeping investors on edge as price action remains volatile and primed for an explosive move once news or capital flows ignite the market.

🌍 Latest market updates:

– Whales are back in accumulation mode, with on-chain data showing large wallets growing rapidly.

– The U.S. government has just transferred a significant amount of BTC to exchanges — is a dump coming?

– U.S. spot Bitcoin ETFs are witnessing record inflows after CPI came in lower than expected, fueling hopes that the Fed will pause further rate hikes this year.

📉 Technical outlook:

– On the H4 chart, BTC formed a tightening wedge pattern, which has now broken to the downside.

– A steep drop toward the 113,000 to 110,000 USD zone is entirely possible.

This looks like a classic break-retest setup — a golden window for strategic entries. If sell volume surges, it could be the perfect moment for bears to strike.

Stay sharp — and good luck!

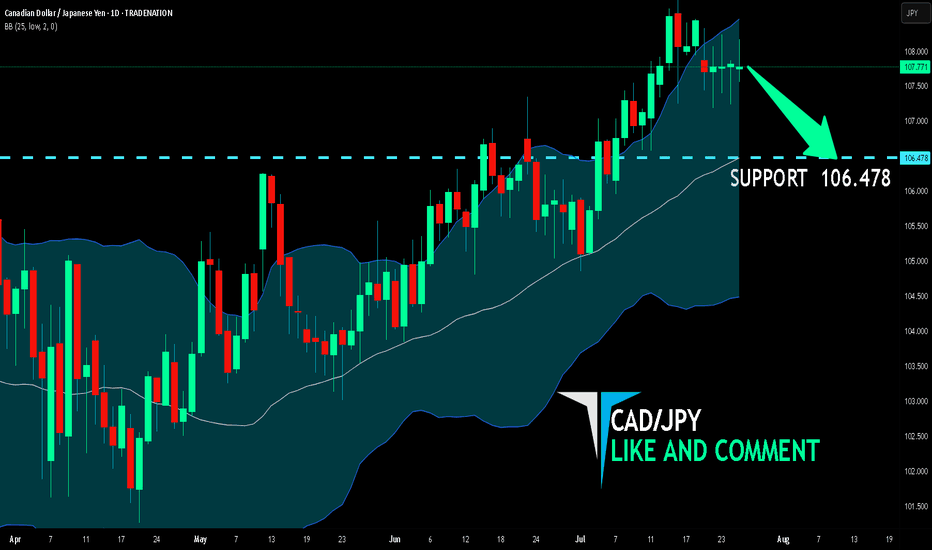

CAD/JPY BEARS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

CAD-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 106.478 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the CAD/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

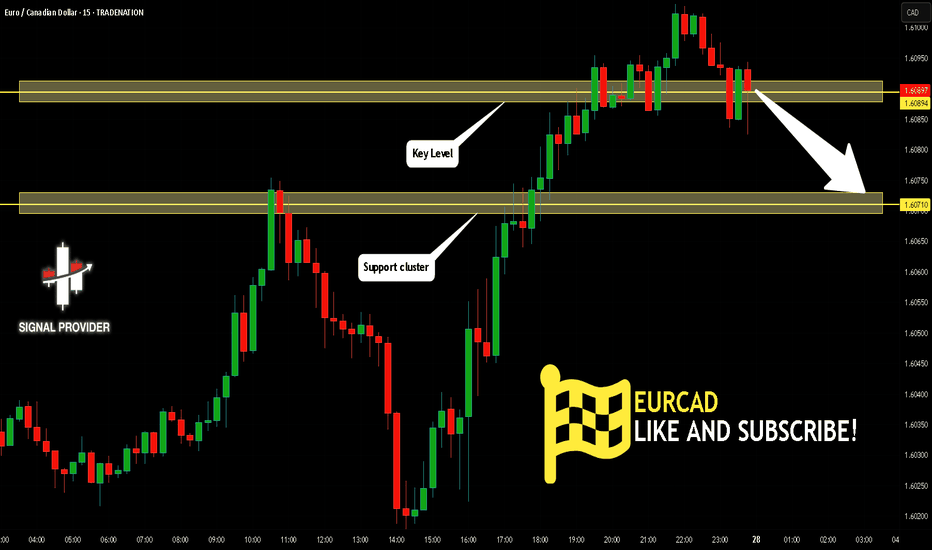

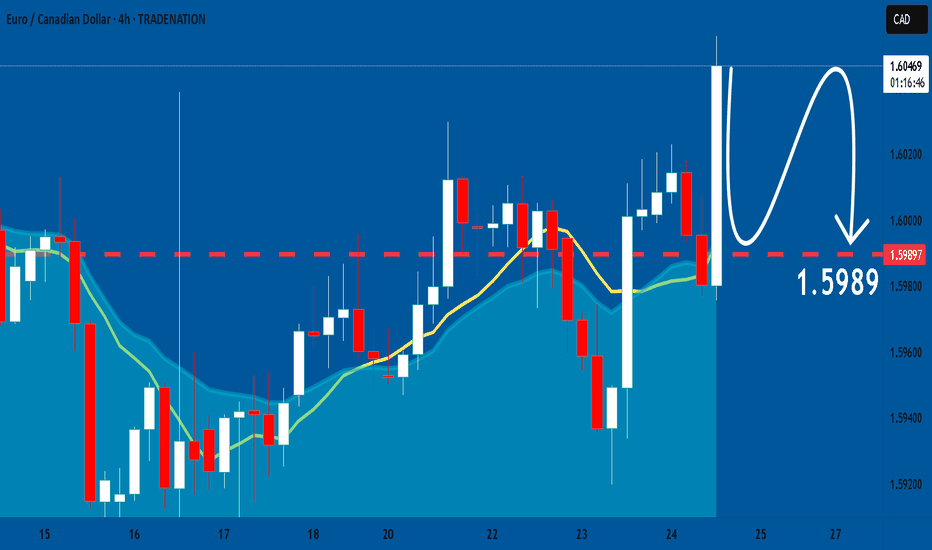

EURCAD Will Go Down! Short!

Please, check our technical outlook for EURCAD.

Time Frame: 15m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.608.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.607 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

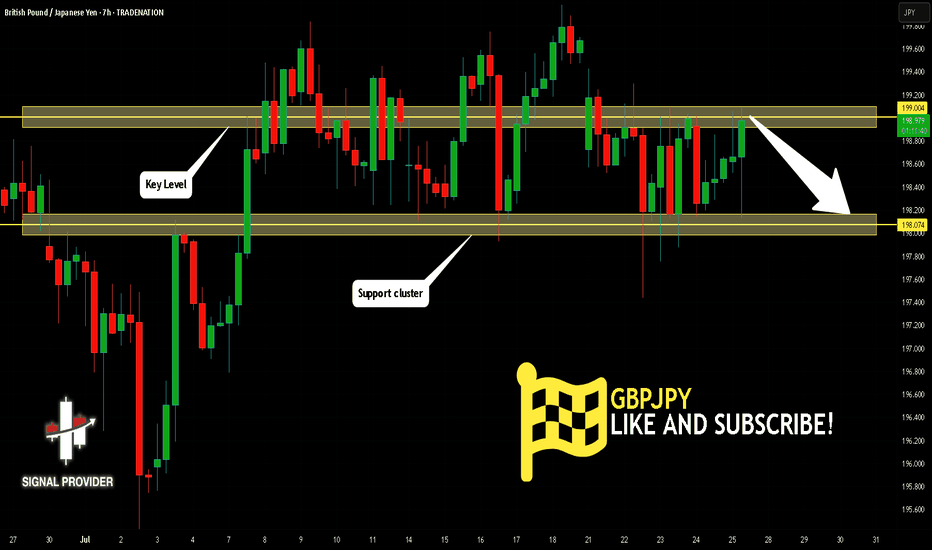

GBPJPY Is Very Bearish! Sell!

Please, check our technical outlook for GBPJPY.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 199.004.

The above observations make me that the market will inevitably achieve 198.074 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURGBP: Bearish Forecast & Outlook

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the EURGBP pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD: Expecting Bearish Continuation! Here is Why

Balance of buyers and sellers on the EURCAD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

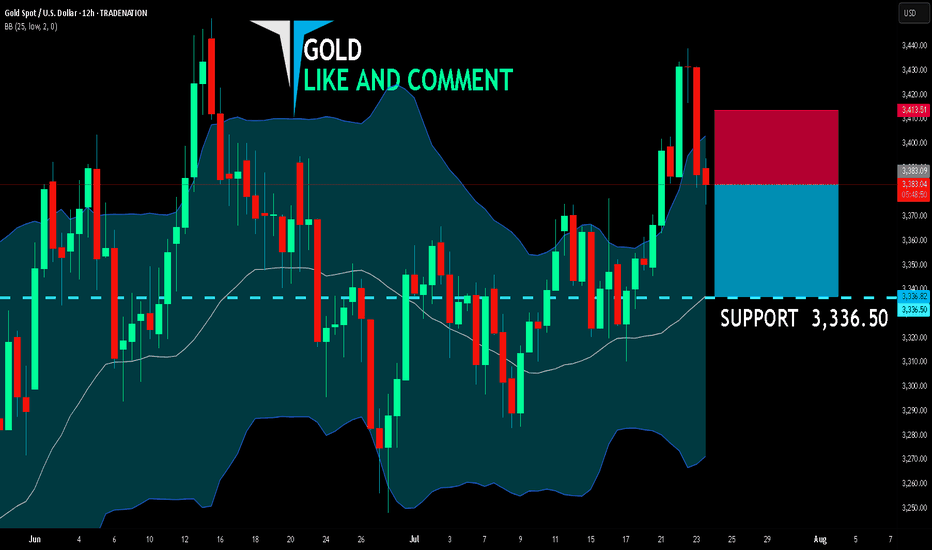

GOLD BEARS ARE STRONG HERE|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,383.09

Target Level: 3,336.50

Stop Loss: 3,413.51

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

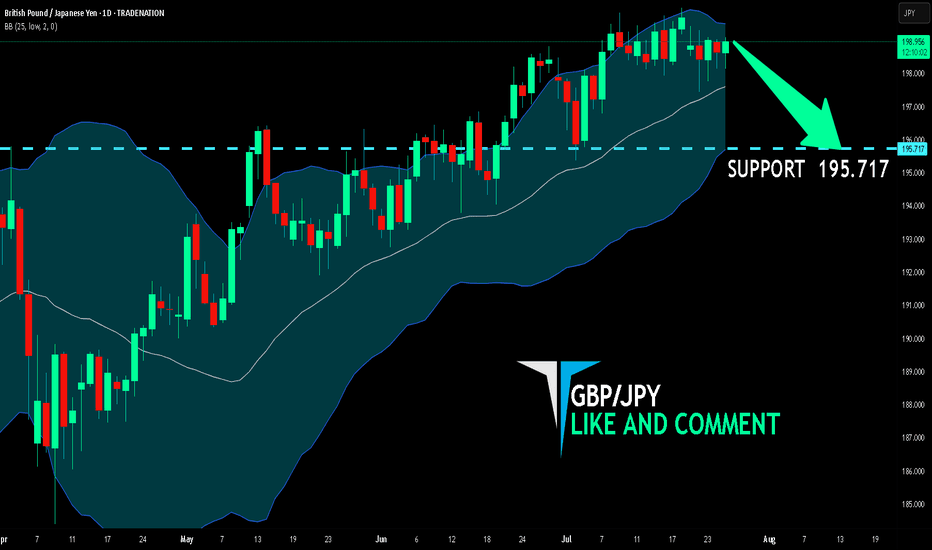

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

GBP/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 195.717 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

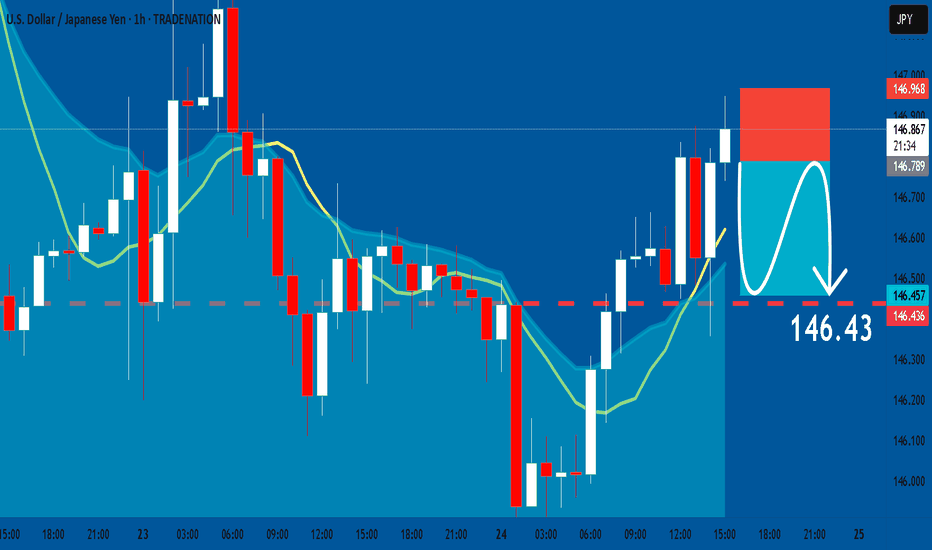

USDJPY: Short Trading Opportunity

USDJPY

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell USDJPY

Entry - 146.78

Stop - 146.96

Take - 146.43

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

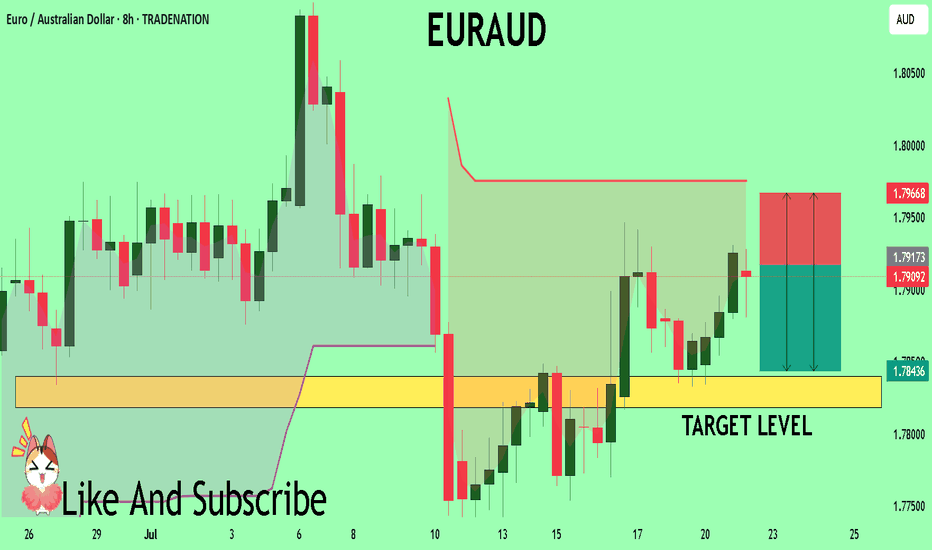

EURAUD Set To Fall! SELL!

My dear followers,

I analysed this chart on EURAUD and concluded the following:

The market is trading on 1.7917 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.7840

Safe Stop Loss - 1.7966

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

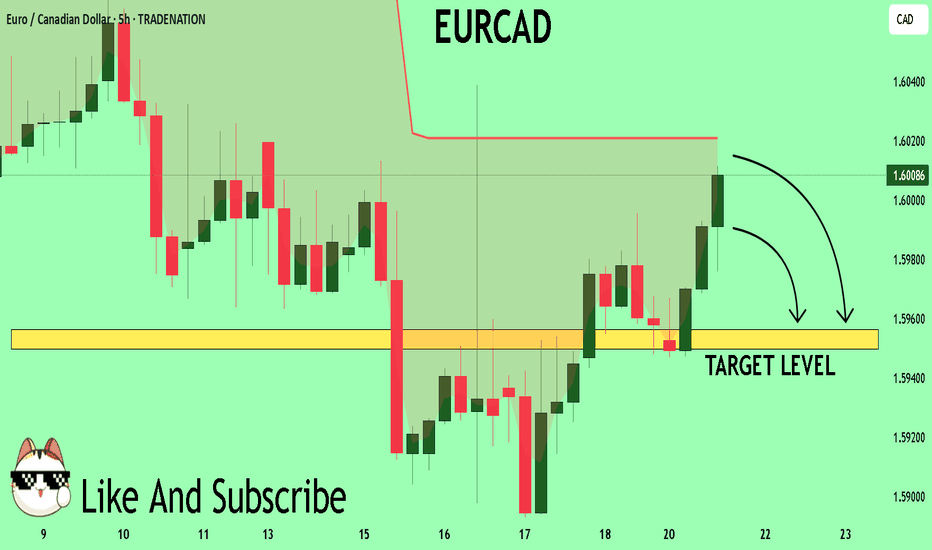

EURCAD Buyers In Panic! SELL!

My dear friends,

My technical analysis for EURCAD is below:

The market is trading on 1.6005 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.5956

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

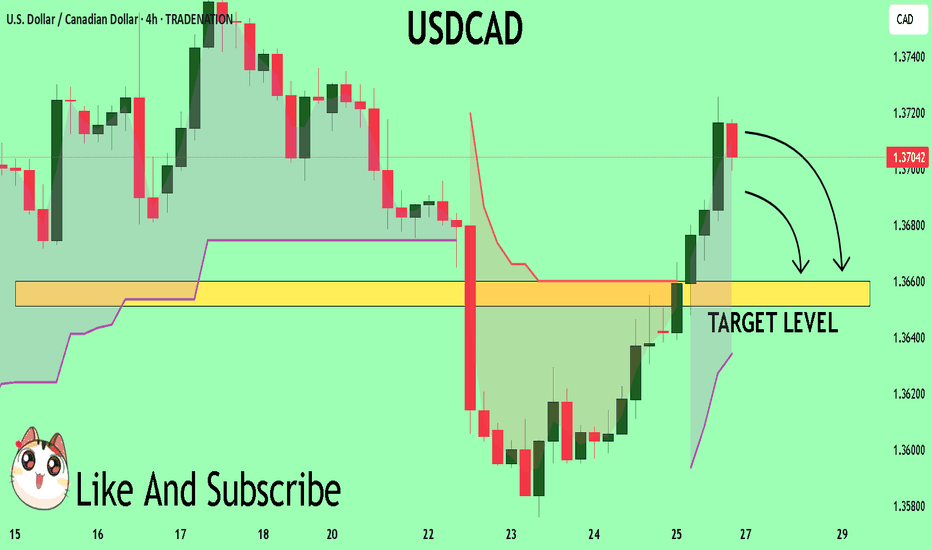

USDCAD Buyers In Panic! SELL!

My dear subscribers,

This is my opinion on the USDCAD next move:

The instrument tests an important psychological level 1.3704

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.3660

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

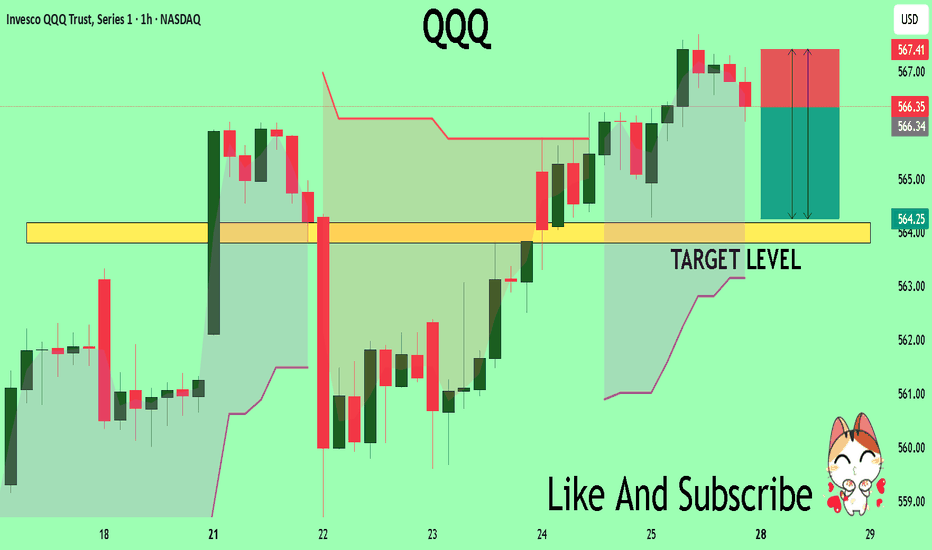

QQQ Massive Short! SELL!

My dear followers,

This is my opinion on the QQQ next move:

The asset is approaching an important pivot point 566.35

Bias - Bearish

Safe Stop Loss - 567.41

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 564.18

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

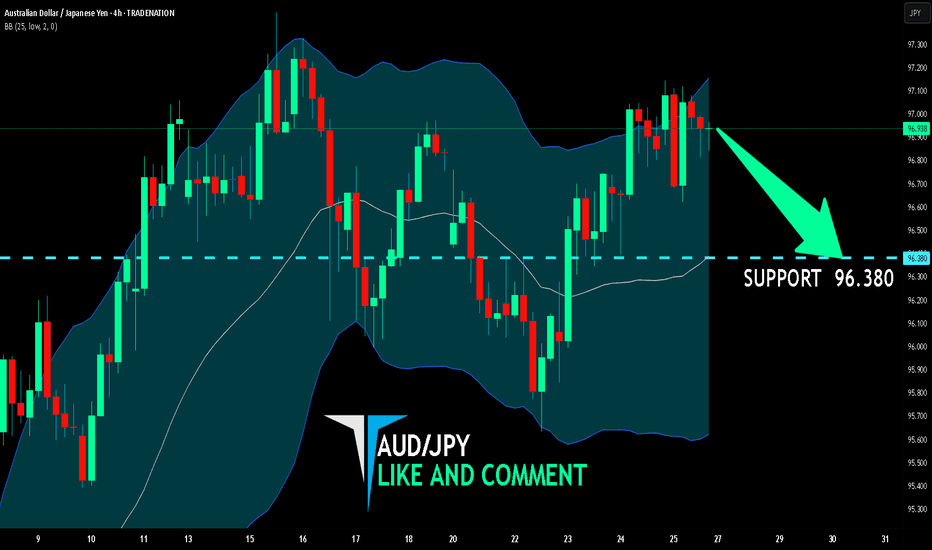

AUD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

AUD/JPY pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 96.380 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

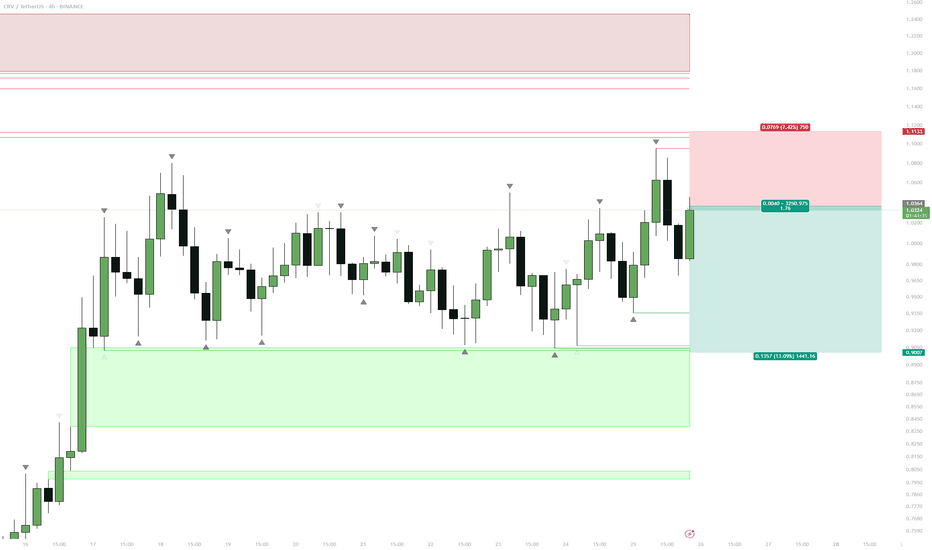

$CRV Equal Lows ShortExtended Range

CRV has been ranging for almost week with no clear direction.

Price has respected resistance above $1.10 multiple times.

Obvious Liquidity Pool

Multiple equal lows are sitting at the $0.90 level, a textbook liquidity magnet.

Market makers are likely to target this area before any substantial move higher.

Short Entry

Short from just above $1.00, stop above the range high.

Target is a sweep of the $0.90 lows.

Next Steps

Watch for signs of absorption or reversal if price wicks below $0.90.

Consider flipping long if strong buyback or deviation forms after the liquidity sweep.

Reasoning

CRV has spent week ranging, building up an obvious set of equal lows. This is classic “liquidity sitting on a platter” for larger players. Short setups are favored while the range top holds, aiming for a stop run below $0.90. After the sweep, be open to a fast reversal or potential swing long if bulls reclaim the level.

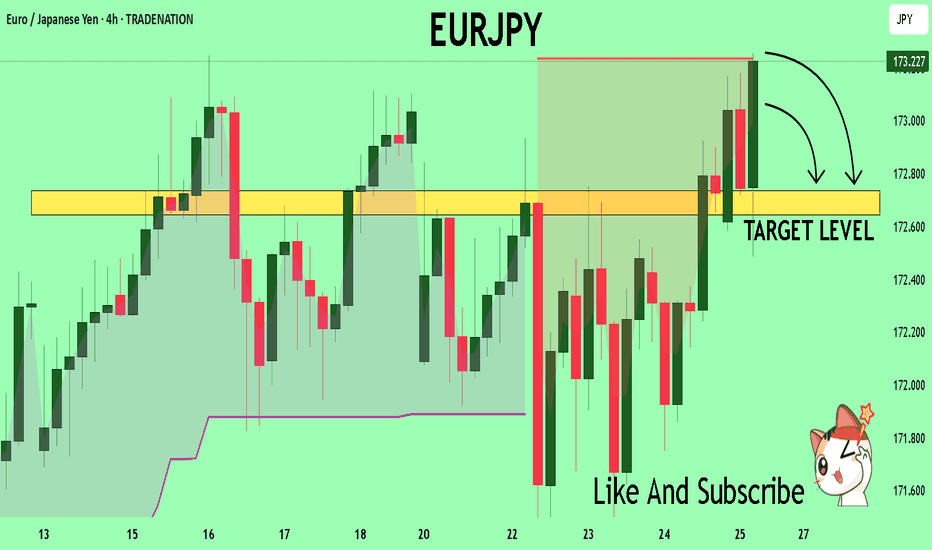

EURJPY Technical Analysis! SELL!

My dear subscribers,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 173.19 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 172.73

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD A Fall Expected! SELL!

My dear friends,

Please, find my technical outlook for EURUSD below:

The instrument tests an important psychological level 1.1751

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1708

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK