Bullish Bet , UnionBankBanknifty at support.

UnionBank on recent high making sideways moves, which means consolidation.

Once Banknifty Bounce back, UnionBank will break the resistance on weekly and monthly Basis and will start moving higher.

It has higher targets on a short and long term investment.

Good to hold for short term.

Short-term

Bitcoin Ascending Broadening Wedge (4H)After a clean breakout above the macro downtrend, BINANCE:BTCUSDT rallied into its supply zone — but price action has since become increasingly volatile, forming a rising broadening wedge (also known as a megaphone pattern).

Pattern Insights

• The structure is defined by diverging trendlines, with each swing becoming larger and more erratic.

• This pattern often signals instability or exhaustion, especially near key resistance.

• While it can break either way, broadening wedges in an uptrend frequently resolve to the downside, especially when supply is overhead.

Key Levels

• Resistance: ~$ 98K-$99.5k supply zone — the upper boundary of the pattern.

• Support: ~$93.5k area — prior S/R, potential flip zone.

• Reversal: A breakdown below ~$93k could confirm a short-term bearish resolution and open the door to ~$88.5k.

• Continuation: A breakout above the upper boundary with volume could trap shorts and ignite a squeeze toward new highs.

Until then, BTC remains in a high-volatility structure, best approached with caution or as a range-trading opportunity.

The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

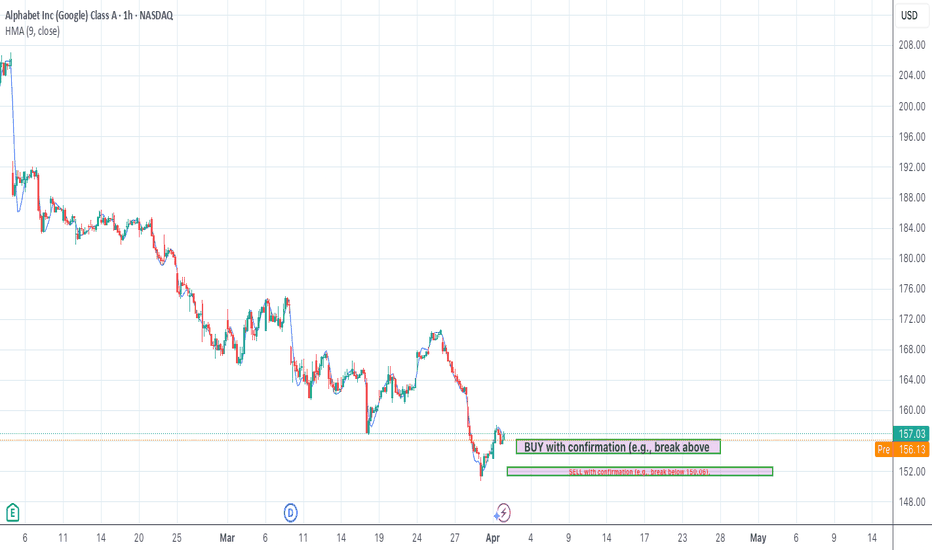

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

EURUSD - the upcoming US PCE & the ECB rate decisionAt the moment, we are seeing that the bulls are fighting hard to keep MARKETSCOM:EURUSD elevated. But they are struggling to overcome some key resistance barriers. But the upside doesn't look very promising, due to the upcoming US PCE numbers and the ECB rate decision. Let's dig into the possible near-term outcome scenarios for the $FX_IDC:EURUSD.

What are your thoughts on this?

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Tata power, good buy for long term and short term Tata power one of the best best fundamental stock now available at good demand zone one can add in portfolio if not added yet

Can add at levels of 380-405

Sl mclbs 365

Tgt atleast:1:2 & 25% to 100% expecting a blast before a Indian budget

Ask your financial advisor and broker before buying

Only for educational purposes

GBPJPY - Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast: (Daily Time-frame)

While the price is below the resistance 199.79, resumption of downtrend is expected.

Technical analysis:

The descending flag taking shape suggests we will soon see another leg lower.

Trading suggestion:

Price rejected from Trend Hunter Sell Zone (198.42 to 199.79). We are going to open 8 sell trade based on these Take Profits:

Take Profits:

196.00

193.51

191.88

189.47

186.23

182.78

178.41

Short Term forecast: (H4 Time-frame)

The Uptrend is broken, and the price is in an impulse wave.

Correction wave toward the Sell Zone.

Another Downward Impulse wave toward Lower TPs.

SL: Above 199.79

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 BOOST button,

. . . . . . . . . . . Drop some feedback below in the comment!

🙏 Your Support is appreciated!

Let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

EPL Ltd Breakout Alert: 52-Week High + Bullish Momentum! Ready f📈 EPL Ltd (EPL) is showing explosive bullish momentum and has recently achieved a 52-week breakout, positioning it for potential short-term gains. Here’s why EPL should be on your radar:

🔑 Key Technical Highlights:

Bullish Marubozu Candle: Strong buyer dominance, signaling a solid uptrend.

RSI Breakout (63): Momentum is building; watch for continued upward pressure.

Volume Breakout: Price surge supported by heavy volume—confirming buyer interest.

Donchian Bands: New highs suggest further breakout potential ahead.

Bollinger Bands: Positive breakout confirms the strength of the current trend.

Stochastic (94) & CCI (195): Strong overbought levels indicate market strength.

MACD Bullish Crossover: A confirmed bullish signal, pointing to sustained upward movement.

200 EMA: Price above the EMA, and both price and moving averages are trending up, showing a strong uptrend.

Bullish Candlestick Patterns:

🔥 Long White Candles across the Daily, Weekly, and Monthly timeframes indicate consistent bullish pressure and potential for further upward movement.

Why This Could Be a Great Trade:

Possible Swing Trade: Targeting short-term profits with strong bullish indicators.

Possible BTST (Buy Today, Sell Tomorrow): Perfect setup for quick gains.

📢 Don’t miss out on this breakout opportunity – EPL is trending upward, and the momentum is strong! 💥

🚀 Are you ready to take action?

💬 Share your thoughts, predictions, or trade setups in the comments below!

🔔 Follow for daily stock analysis and stay ahead of the market.

Possible levels to watch out : 324-360-396-432

[Short-Term] Cameco is bouncing right now.. Pre-Recession?Good day, welcome to my analysis on GETTEX:CJ6 current standpoint from a technical view.

Please be informed that this is just a short-term analysis, my long term analyses and fundamental analyses can be found here:

Bullish on Cameco - Show will go on

From Fibonacci retracement, we can see Cameco is bouncing around at fib 0 from November 15th indicating a possible movement of direction.

A Fibonacci retracement from Nov. 19th to yesterday's high wick shows the current movement is between fib 0.2 and fib 0.6 (open to close) with today's wick (as of now) laying just above fib 0.7.

Yes, these are pretty short term Fibonacci's, but considering Cameco is at its all-time high, no longer term analysis seems fitting for me.

Now, here are the possibilities:

Recession:

Cameco may go into a short-term recession. I would put the maximum low at around fib 0.2 or the higher low / demand zone from November 20th, which would be €54 or €53 retrospectively.

Uptrend:

Cameco may continue its uptrend until it settles at a new All-Time High. No expected numbers from me.

Update:

While writing this, MT Newswire posted an article called “RBC Raises Price Target on Cameco to CA$90 From CA$75, ”. The possibility of a short-term recession is getting lower, through the uptrend Cameco had while I'm writing this. Anyway, I don't want to have such short term prognoses, therefore I will still be listing this as a neutral.

I hope you've enjoyed this analysis, please read my longer term analyses on Cameco listed below.

Have a pleasant day and may you never exit before the bull run begins.

-- Henrik B.

NATGAS Set To Fall! SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level -2.837

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 2.760

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

GBPAUD - Now We Wait!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been bearish trading within the falling channel.

Currently, GBPAUD is approaching the lower bound of the channel.

Moreover, the zone marked in green is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the support zone and lower trendline acting as non-horizontal support.

📚 As per my trading style:

As #GBPAUD approaches the blue circle, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ETH - Make or Break Zone!Hello TradingView Family / Fellow Traders,

ETH has been hovering within a narrow range in the shape of a flat rising channel around a massive resistance zone $4,000 - $4,100.

What's next?

Scenarios:

1️⃣ Bullish - Continuation

The bulls maintain control as long as ETH is trading within the rising channel marked in red.

In this case, a movement towards the $4,000 - $4,100 resistance zone would be expected.

2️⃣ Bearish - Correction

If the last low marked in green is broken downward, we will expect the bearish correction to start leading to a movement towards $3,100 demand zone.

Which scenario is more likely to happen first? and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

BTC - Bullish this Weekend⁉️Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish short-term trading within the falling channel in red.

🏹 For the bulls to regain control, a break above the last major high in red is needed.

Meanwhile, BTC can still trade lower to test the $59,000 - $60,000 demand zone before trading higher.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ETH/USDT 1HInterval Chart ReviewHello everyone, let's look at the 1H ETH to USDT chart, as we can see the price is approaching an attempt to break out of the triangle marked in yellow.

Let's start by setting goals for the near future that we can include:

T1 = $3,452

T2 = $3,576

T3 = $3,665

AND

T4 = $3777

Now let's move on to the stop loss in case of further market declines:

SL1 = $3,307

SL2 = $3227

SL3 = $3097

AND

SL3 = $3097

Looking at the RSI indicator, we can see that it remains in an upward trend, while when we look at the STOCH indicator, it looks like a return to price correction is possible.

TSLA in -12.68% downward trend, declining for three consecutive Moving lower for three straight days is viewed as a bearish sign. Keep an eye on this stock for future declines. Considering data from situations where TSLA declined for three days, in 206 of 266 cases, the price declined further within the following month. The odds of a continued downward trend are 77%.

PYTH:TSLA

Technical Analysis (Indicators)

Bearish Trend Analysis

The Momentum Indicator moved below the 0 level on December 29, 2023. You may want to consider selling the stock, shorting the stock, or exploring put options on TSLA as a result. In 55 of 72 cases where the Momentum Indicator fell below 0, the stock fell further within the subsequent month. The odds of a continued downward trend are 76%.

The Moving Average Convergence Divergence Histogram (MACD) for TSLA turned negative on December 29, 2023. This could be a sign that the stock is set to turn lower in the coming weeks. Traders may want to sell the stock or buy put options. Tickeron's A.I.dvisor looked at 43 similar instances when the indicator turned negative. In 32 of the 43 cases the stock turned lower in the days that followed. This puts the odds of success at 74%.

TSLA moved below its 50-day moving average on January 09, 2024 date and that indicates a change from an upward trend to a downward trend.

The 10-day moving average for TSLA crossed bearishly below the 50-day moving average on January 12, 2024. This indicates that the trend has shifted lower and could be considered a sell signal. In 10 of 13 past instances when the 10-day crossed below the 50-day, the stock continued to move higher over the following month. The odds of a continued downward trend are 77%.

The Aroon Indicator for TSLA entered a downward trend on January 29, 2024. This could indicate a strong downward move is ahead for the stock. Traders may want to consider selling the stock or buying put options.

Bullish Trend Analysis

The RSI Indicator shows that the ticker has stayed in the oversold zone for 10 days. The price of this ticker is presumed to bounce back soon, since the longer the ticker stays in the oversold zone, the more promptly an Uptrend is expected.

The Stochastic Oscillator shows that the ticker has stayed in the oversold zone for 18 days. The price of this ticker is presumed to bounce back soon, since the longer the ticker stays in the oversold zone, the more promptly an upward trend is expected.

Following a +4.57% 3-day Advance, the price is estimated to grow further. Considering data from situations where TSLA advanced for three days, in 292 of 349 cases, the price rose further within the following month. The odds of a continued upward trend are 84%.

TSLA may jump back above the lower band and head toward the middle band. Traders may consider buying the stock or exploring call options.

BTC short-term is going to drop from $42700 to $40k.We are in a bull market and through Dec 2023 clear a, b, c correction is being made.

Wave a and b are clearly done.

Wave c looks like a textbook ending diagonal pattern with waves 1, 2, 3, 4 already done and now we are in the middle of wave 5.

The drop won't stop until price reaches $40k level.

It's a good trade with a very high likelihood of success and amazing risk to reward.

$42700 is a good place to short with a stoploss at $43900 (above wave 4) and take profit $40k.

Preparing For The RBNZ Interest Rate DecisionWith the upcoming interest rate announcement from the RBNZ, NZDUSD traders remain steady and not making any crazy moves yet. The expectation is for the decision to be without any fireworks and to come out neither with a hike, nor a cut. The rate is forecasted to remain at +5.50%. If so, we might not experience huge moves in NZD during the release, unless the press conference, which will follow an hour after, has something in it that could spook or excite NZD traders.

The technical picture shows that NZDUSD continues to grind higher, while running above a couple of tentative trendlines, where the shortest one is drawn from the low of November 17th. At the time of writing, the pair remains below a key resistance are, which is roughly between the 0.6086 and 0.6092 levels. The latter one is the current highest point of November. In order to shift our attention to some higher zones, a break of that resistance areas is required. Until then, we will stay cautiously bullish.

If that break happens, this will confirm a forthcoming higher high, possibly setting the stage for further advances. We will then aim for the 0.6121 hurdle, or even the 0.6132 level, marked by the high of August 4th.

Alternatively, a break of the aforementioned short-term upside line and a drop below the 0.6061 zone, marked by the current lowest point of today, may spark temporary interest in the eyes of the bears. NZDUSD could then drift to the 0.6035 obstacle, a break of which might open the way towards the psychological 0.6000 zone.

Disclaimer:

easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

BTC - The party has just Started 🎊📹Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Here is a detailed update top-down analysis for #BTC.

Which scenario do you think is more likely to happen? and Why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

MATIC.USD (SHORT-TERM)Hello friends.

How are you today?

It's the second analysis that I publish today.

Many users asked me to talk about Matic for Short-Term

So I decided to talk about that briefly.

I use Gann Fan and Ichimoko and the time frame is Weekly.

According to the data, the price still respects the Gann Fan's line. It looks nice.

Also, I use ichimoko too.

Based on Ichimoku the price is below the Tenken-sen and Kijun-sen, the future cloud is still bearish and the Chiko span is below the Candles.we had a negative swsitch between tenkensen and Kijunsen. It means we are still in a bearish trend. and the time shows us about 2-3 weeks later, the price will touch the purple line (1/3)

Also, the price action tells us the first support zone could rescue the price against more drops. As a result, I expect that the price will drop to 0.42 USD first and if this support zone could not prevent more dropping, we should see the price in the second support zone.

But in the long-term, I expect more dropping, minimum to second support zone.

So, we have to be patient and see what will happen…

Please don’t forget to write your comments ✍️✍️ Like 👍👍 and Share 👌👌 this Vision with your friends.

Have a good day

Ho3ein.mnD

🧠Short-Term EURUSD Sentiment🔥

According to the latest currency news headlines, short-term sentiment towards the Euro appears slightly downbeat against the US Dollar. While both economies face inflationary headwinds, recent data surprises have painted a relatively weaker picture for the Eurozone bloc.

German industrial orders came in lower than forecast in the latest monthly report, underscoring the challenges manufacturers continue to face from high energy costs and supply chain disruptions. Additionally, French GDP growth slowed more than anticipated in Q3, raising concerns that the second largest Eurozone economy may be slowing.

Comments from ECB officials at regional central bank conferences this week reiterated the bank's commitment to further tightening of monetary policy in the coming months. However, they maintained a cautious stance, stressing that future rate decisions will depend heavily on incoming economic data. This leaves the policy path somewhat uncertain compared to the more hawkish Fed.

In contrast, US jobless claims came in above expectations last week, pointing to underlying resilience in the labor market. This boosted views that the Federal Reserve remains on track to deliver another supersized 75 basis point rate hike at its November meeting. Fed speakers struck a firm tone that inflation must be cooled through forceful rate actions.

Looking at Eurusd technicals, downside momentum has held above 1.0300 for now. However, near-term rallies continue facing resistance below 1.0500 on cautious short-term sentiment. The outlook could brighten if upcoming Eurozone data surprises higher or there are signs inflation is moderating more quickly than expected. But for now, traders appear to favor positioning for dollar strength on a short-term basis.

Technical key aspects of the short term trend and best entry/exit strategy based on the analysis provided in the TradingView charts:

- The short term trend of EURUSD across the timeframes analyzed (weekly to 4H) remains bearish. Price action has been declining within descending resistance lines and channels.

- Best entry for short trades was suggested to be after a bounce from resistance levels or pullbacks from oversold/oversold levels on indicators like the BB bands. This reduces risk of entering at highs.

- Given volatility in currency pairs, optimal stop loss placement would be above recent swing highs or structural resistance levels, around 20-30 pips above entry to limit downside risk.

- Initial profit targets were identified as lower support levels, around 50-100 pips below entry. This provides a favorable risk-reward ratio of at least 1:2.

- Additional extended profit targets aligned with longer term analysis include monthly or weekly demand zones and support levels offered by structural patterns like descending channels over 100-200 pips lower.

- Traders are advised to exit parts of their position at initial targets and move stops to breakeven on the rest, as well as trail stops closer as the trade moves in their favor, to lock in profits and limit risks of unexpected reversals.

EURCAD Sell Short Term In this trading analysis, we will provide insights into the prevailing short-term bearish bias for the EUR/CAD currency pair. We will focus on the fundamental factors that contribute to the Canadian Dollar (CAD) strength and the support from rising oil prices. Additionally, considering that an open sell position on this pair is already established, we will assess the potential for further downside movement.

Technical Analysis Update:

a) Continuation of Downtrend:

The EUR/CAD pair has been in a downtrend, forming lower highs and lower lows on the price chart. As the sell position has already been initiated, the technical analysis indicates that the downtrend is likely to continue, given the established bearish momentum.

b) Moving Averages:

The 50-day and 100-day moving averages are sloping downward, reinforcing the bearish bias. Additionally, the current price remains below these moving averages, which suggests a continuation of the downtrend.

c) Resistance Turned Support:

Previously established resistance levels may now act as support zones for the EUR/CAD pair. Traders should closely monitor these levels as potential areas for price reversals or profit-taking points.

Fundamental Analysis Update:

a) Canadian Dollar (CAD) Strength:

Strong Economic Indicators:

The Canadian economy has shown resilience, with positive economic data such as robust GDP growth, strong employment figures, and a rebound in manufacturing and export sectors. These indicators have boosted confidence in the CAD and attracted investors seeking higher returns.

Hawkish Monetary Policy:

The Bank of Canada (BoC) has taken a more hawkish stance, signaling potential interest rate hikes to combat surging inflation. Such a policy outlook tends to bolster the CAD's attractiveness to investors.

b) Rising Oil Prices:

Positive Impact on Canadian Economy:

Canada is a major oil exporter, and rising crude oil prices have a significant positive impact on the country's economy. The surge in oil prices can lead to increased export revenue, strengthen the Canadian trade balance, and support the CAD's value.

Correlation with CAD Strength:

Historically, there has been a positive correlation between oil prices and the Canadian Dollar. As oil prices rise, the CAD tends to appreciate due to Canada's strong economic ties to the energy sector.

Conclusion:

In conclusion, the trading analysis supports the continuation of the short-term bearish bias for the EUR/CAD currency pair. The technical indicators signal a continuation of the established downtrend, and the fundamental factors, including CAD strength driven by strong economic indicators and hawkish monetary policy, as well as the support from rising oil prices, reinforce the negative outlook for the EUR/CAD.

Given the open sell position on the pair, traders should continue to monitor the technical and fundamental developments closely. Adjustments to stop-loss levels and profit-taking points can be considered to manage risk effectively. As always, prudent risk management strategies are crucial in forex trading to mitigate potential losses and maximize gains.