Shortaud

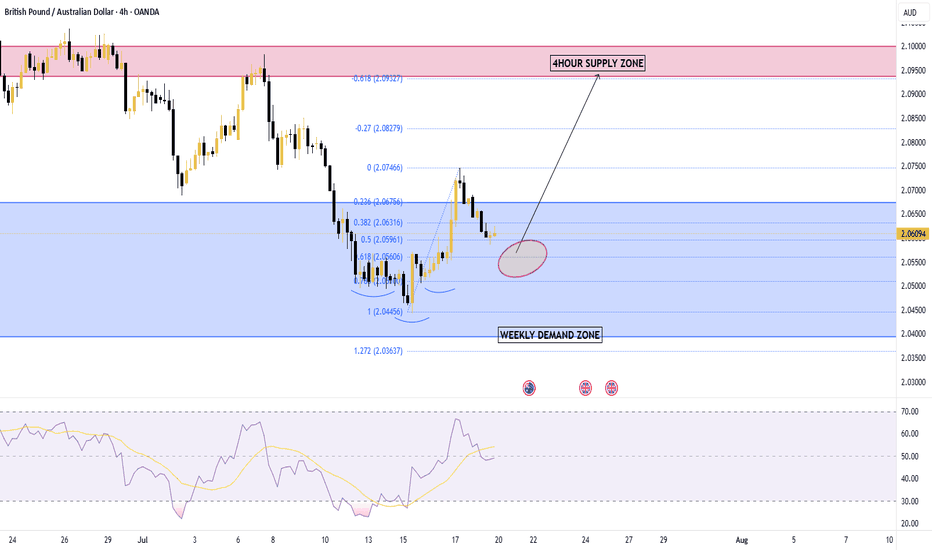

Potential areas for taking a long position in GBPAUDOk, I posted a short analysis of this symbol a few minutes ago, you can go to my profile and see it, and now I want to post a long analysis of this symbol to introduce potential points for buying!

Please place a limit position of 0.5% of your total balance in each of the specified areas and specify the stop loss and target values exactly as shown in the picture.

As always, close half of your position in the first target and risk-free the other half and open it until you reach the second target.

Thank you all

GBPAUD take off?? I think GBPAUD is about to take off.

Price appear to have formed a bullish flag on the 4hour time frame, and made a break out.

This is looking like a swing trade. If you go take a look at the weekly chart, you will notice that price was in a retracement for the pass 2-3 weeks. Price found support and is now making a push to the upside.

AUDUSD Analysis Monthly/Weekly

-Price is clearly in an overall bullish trend.

But price appears to have become overextended, after a huge breakout (through the trend line) and has since been consolidating preparing to make a possible pullback/retracement.

Daily

Price has formed a Head and Shoulders (H&S) formation which is a sign of bearish pressure or a possible move to the downside.

Remember on the higher timeframe, price has been consolidating, the H&S formation on the daily is a confirmation that price is ready to drop.

I am expecting price to make one more attempt to the upside before making the bearish move to the downside.

If you draw a Fibonacci from the beginning of the right shoulder to the blue support level where price reversed, you will notice that I am expecting price to make a final push near the 50.0-61.8 fib levels, which correlates with the area arrows I drew.

Here is where I'm expecting to enter a sell position.

AUDJPY Analysis ShortTerm Buy (Longterm Bearish Bias)As you can see my overall longterm bias for AUDJPY is bearish. But im expecting a push to the upside, before the next drop.

Price created a new low, and now im expecting price to retrace and test the previous low, meeting resistance then create a bearish continuation move to the downside. Bear

Short AUDUSD again-RELOAD AND FIREAfter last weeks successful short on AUDUSD from 0.71 down to Novembers low (blue dashed line) we sat out whilst it bounced back to 0.71 resistance level and looking to RELOAD our short here again.

The bounce has taken us to 60 area again on RSI- as per chart we have sold off at similar levels from here- looking for a retest of Nov low before seeing a break down to mid 0.69 (candle body of Jan lows)

Pair is still firmly in the long term descending trend line highlighted by the green and red lines.

Short AUD/USDFundamental Opportunity

With the RBA meeting minutes coming out next week and the recent data from the USA I am expecting this currency pair to head back down to recent support levels. The RBA kept rates on hold in the last meeting but I expect them to leave the door open to further rate cuts and the December rate hike for the US is still on the table giving us some divergence on this pair.

Technical best price

As you can see from the chart the AUD/USD pulled back to the 7615 level due to stronger than expected Chinese CPI data last week. Oil is also supporting the risk sentiment in AUD which gave it a boost. However both these aspects are temporary and I expect them to subside. The recent pull back also highlights the 50% and 61.80% Fibonnaci retracement from the latest drop away from the declining trend line so Market price is a good place to start at 7615.

Trade Management

I have kept the stop loss tight in case we retest the declining trend line where I will re-enter the trade if stopped out. For now the recent rejection is enough for me to enter at market on Monday morning I am looking to take profit on a retest of the 7440 low but will look to move the stop loss to break even at the 7500 support as well.

You can see the weekly outlook video describing this trade on my website.

Look out for updates on this post