Gold price weakens, correction 3176⭐️GOLDEN INFORMATION:

Gold’s intraday decline appears partly driven by technical selling pressure after decisively breaking below the key $3,265–$3,260 support zone. However, the US Dollar (USD) struggles to sustain any significant recovery as expectations grow for more aggressive Federal Reserve (Fed) rate cuts—fueled by an unexpected contraction in US GDP and signs of softening inflation. These factors may continue to support demand for the non-yielding precious metal, suggesting that traders should remain cautious before anticipating a deeper pullback from the recent all-time high near $3,500.

⭐️Personal comments NOVA:

Crossing the 3264 mark in the sideways price zone, gold prices continue to weaken.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3270- 3272 SL 3277

TP1: $3260

TP2: $3250

TP3: $3240

🔥BUY GOLD zone: $3178 - $3176 SL $3171

TP1: $3185

TP2: $3200

TP3: $3210

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Shortgold

continue to accumulate, gold price waiting for NF⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) continues its downward trajectory, slipping toward $3,315 during early Asian trading on Wednesday as improving global risk sentiment and signs of easing trade tensions weigh on demand for the safe-haven asset. Market participants remain cautious ahead of key US economic data releases, including the ADP Employment Change, the Core PCE Price Index, and the preliminary Q1 GDP figures, all scheduled for later in the day.

Meanwhile, US President Donald Trump is reportedly aiming to reduce the overall impact of automotive tariffs by avoiding cumulative duties on foreign vehicles and loosening restrictions on imported parts used in domestic production. Treasury Secretary Scott Bessent added that major trade partners have made “very good” proposals to avert further US tariffs. Furthermore, exemptions on select US goods from retaliatory duties suggest a growing intent to de-escalate ongoing trade disputes.

⭐️Personal comments NOVA:

Gold price maintains accumulation range of 3265 - 3360, temporary stability awaits big fluctuations

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3368- 3370 SL 3375

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3264 - $3262 SL $3257

TP1: $3280

TP2: $3300

TP3: $3318

🔥BUY GOLD zone: $3285 - $3283 SL $3280 scalping

TP1: $3290

TP2: $3295

TP3: $3300

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

What is gold waiting for? Stuck in the 3300 area⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) fails to build on Monday’s rebound from the key $3,265–$3,260 support zone, encountering renewed selling pressure during the Asian session on Tuesday. Although signals from the US and China remain mixed, investor sentiment remains buoyed by hopes of a potential easing in trade tensions between the world’s two largest economies. Additionally, signs of advancement in tariff negotiations have further bolstered optimism, dampening the appeal of the safe-haven metal.

⭐️Personal comments NOVA:

Gold price needs to be boosted by economic news to break out of the sideways price range around 3300, continue to wait today around 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3366- 3368 SL 3373

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3267 - $3265 SL $3260

TP1: $3280

TP2: $3300

TP3: $3318

🔥BUY GOLD zone: $3301 - $3299 SL $3296 scalping

TP1: $3305

TP2: $3310

TP3: $3320

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

H4 downtrend line, gold price cools down✍️ NOVA hello everyone, Let's comment on gold price next week from 04/28/2025 - 05/02/2025

🔥 World situation:

Gold prices reversed course on Friday, wiping out Thursday’s gains and slipping below the $3,300 threshold, as persistent US Dollar strength weighed heavily on the precious metal despite declining US Treasury yields. The easing of tensions in the US-China trade dispute further pressured bullion, with XAU/USD trading around $3,294, down more than 1.6%.

Market sentiment remains fragile, swinging sharply between risk-on and risk-off modes in response to comments from US President Donald Trump. Earlier, Bloomberg reported that China was considering tariff exemptions on some US goods, sparking optimism. However, the mood soured after Trump asserted that he would not lift tariffs on China without significant concessions.

🔥 Identify:

News about Russia-Ukraine peace talks this weekend will continue to put selling pressure on gold prices next week. Moving along the downtrend line H4

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3357, $3498

Support : $3228, $3155

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold price stabilized again, trading around 3300⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) found fresh buying interest during the Asian session on Wednesday, pausing its pullback from the previous day’s record high near $3,500. Attempts by the US Dollar (USD) to rebound from multi-year lows faltered, as investor confidence in the US economic outlook continues to erode amid President Donald Trump’s erratic tariff policy shifts.

Additionally, growing expectations of more aggressive monetary easing by the Federal Reserve (Fed) have triggered renewed selling pressure on the greenback. This, in turn, has reinforced demand for the non-yielding yellow metal, helping gold regain upward momentum as investors seek shelter from mounting economic and policy uncertainty.

⭐️Personal comments NOVA:

The slowdown and downward adjustment of gold are inevitable. Profit-taking psychology and cooling news of tariffs and Russia-Ukraine military forces caused gold prices to fall.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3410- 3412 SL 3417

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3281 - $3283 SL $3276

TP1: $3290

TP2: $3300

TP3: $3315

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bulls recover, gold prices grow OLD ATH ⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) climbs modestly toward the $3,080 mark during early Asian trading on Wednesday, buoyed by renewed safe-haven demand as trade tensions between the United States and China intensify.

In a fresh move, US President Donald Trump announced a 90-day delay on new tariffs—set at 10%—for most US trading partners to allow space for negotiations. However, he simultaneously escalated trade friction with Beijing, raising tariffs on Chinese imports to a staggering 125% “effective immediately,” citing China's "lack of respect for global markets."

⭐️Personal comments NOVA:

The rapid recovery and large fluctuations of gold prices show that the impact of Trump's 90-day tariff postponement news is very strong. The price zone of 3135 and 3167 will be under great selling pressure. There is not much momentum for gold prices to create new ATHs.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3164- 3167 SL 3171

TP1: $3150

TP2: $3140

TP3: $3130

🔥BUY GOLD zone: $3074 - $3076 SL $3069

TP1: $3090

TP2: $3105

TP3: $3123

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

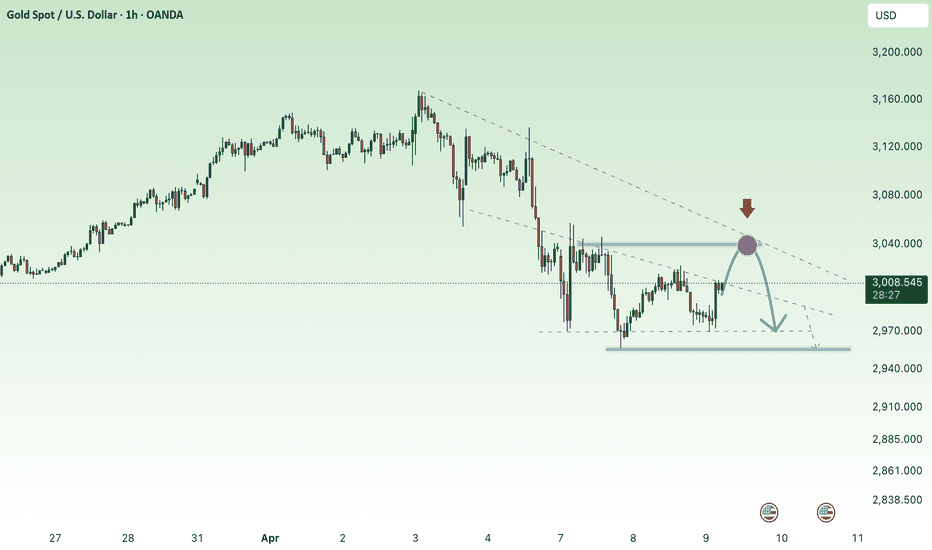

Gold price accumulates below 3038, waiting for FOMC information⭐️GOLDEN INFORMATION:

Gold prices break a three-day losing streak but remain capped below the key $3,000 level, as rising US Treasury yields dampen the appeal of the non-interest-bearing metal. Despite optimism surrounding potential trade agreements among global partners, lingering tensions in the ongoing US–China trade conflict continue to keep investors on edge. At the time of writing, XAU/USD is trading flat around $2,980 per troy ounce.

⭐️Personal comments NOVA:

Gold price moves with large amplitude, in a downward correction phase. Continues to trade below 3040 waiting for the FED's move on interest rates and agreements on tariff levels of countries around the world.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3038 - 3040 SL 3045

TP1: $3028

TP2: $3015

TP3: $3000

🔥BUY GOLD zone: $2958 - $2960 SL $2953

TP1: $2975

TP2: $2990

TP3: $3010

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices cool after tariff announcement⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) surged to a new all-time high during the Asian session on Thursday as investors flocked to safe-haven assets amid heightened risk aversion. Market sentiment took a sharp downturn after US President Donald Trump unveiled sweeping reciprocal tariffs on Wednesday evening, igniting fears of a global economic slowdown and a potential US recession.

The announcement triggered a broad sell-off in equity markets, reinforcing the risk-off mood and further fueling demand for gold as a traditional store of value.

⭐️Personal comments NOVA:

Gold hits 3167 peak, buying pressure gradually decreases. Adjustment waiting for new moves from other countries on Trump's tariff policy

⭐️SET UP GOLD PRICE:

🔥 SELL 3165 - 3168 SL 3172

TP1: $3160

TP2: $3150

TP3: $3140

🔥BUY GOLD zone: $3108 - $3110 SL $3103

TP1: $3115

TP2: $3130

TP3: $3140

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold short term recovery - downtrend⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) start the week on a strong footing, rebounding further from Friday’s three-week low near $2,833–2,832. Despite US inflation data aligning with expectations, traders remain confident that the Federal Reserve will implement two quarter-point rate cuts by year-end. Additionally, renewed selling pressure on the US Dollar supports the appeal of the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold price recovers in short term, sellers are dominating, retesting liquidity zone 2883

⭐️SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2832 - $2834 SL $2827

TP1: $2840

TP2: $2850

TP3: $2960

🔥 SELL GOLD zone: $2883 - $2885 SL $2890

TP1: $2875

TP2: $2868

TP3: $2860

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Downward momentum, downtrend next week, XAU ✍️ NOVA hello everyone, Let's comment on gold price next week from 03/3/2025 - 03/07/2025

🔥 World situation:

US President Donald Trump confirmed that 25% tariffs on Mexican and Canadian goods will take effect next week on March 4. Meanwhile, the Fed’s preferred inflation gauge, the Core PCE Price Index, signaled continued progress toward the central bank’s 2% target.

Following the data, expectations for further Fed policy easing grew. According to Prime Market Terminal, the Fed is anticipated to cut rates by 70 basis points this year, with investors betting on the first reduction in June.

🔥 Identify:

Breaking the trend, gold continues to maintain a downtrend

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $2876, $2903, $2956

Support : $2810, $2773

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

SCALPING ! XAU , waiting for entry SELL 2928 , TRENDLINE⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Richmond Fed President Thomas Barkin said Tuesday he will take a wait-and-see approach on interest rates until there's clear evidence that inflation is returning to the Fed's 2% target.

Dallas Fed President Lorie Logan suggested that, in the medium term, the Fed should focus on buying more short-term securities to better align its portfolio with Treasury issuance, according to Bloomberg.

⭐️ Personal comments NOVA:

Gold price is still moving in the H1 downtrend line, the price zone is correcting and accumulating above 2900.

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2928 - $2930 SL $2933 scalping

TP1: $2924

TP2: $2920

TP3: $2915

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears return - pushing prices down at the end of the week⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) hovers near its all-time high after hitting a new peak in early European trading on Thursday. The surge follows US President Donald Trump's comments suggesting a potential trade deal with China. At the same time, geopolitical tensions rise as Trump claims Ukraine initiated the war with Russia and hints at repayment for US financial aid.

Meanwhile, the Federal Reserve's January meeting minutes had little market impact, with only a few FOMC members favoring steady rates. Expectations for a possible rate cut in June remain intact.

⭐️ Personal comments NOVA:

Gold price moves within the H1 trend line in the Asian session at the end of the week, selling pressure creates market liquidity, pay attention to important support zones: 2919, 2906

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2919 - $2921 SL $2916 scalping

TP1: $2924

TP2: $2928

TP3: $2935

🔥 BUY GOLD zone: $2905 - $2907 SL $2900

TP1: $2915

TP2: $2922

TP3: $2930

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Attempt to find ATH again for the 3rd time - gold price down⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

US real yields, which move inversely to gold prices, rose 4.5 basis points to 2.086%, putting pressure on bullion.

Fed Governor Christopher Waller expects President Donald Trump's new trade restrictions to have only a minor effect on prices. Meanwhile, Philadelphia Fed President Patrick Harker reiterated his support for steady interest rates, noting that inflation remains high and persistent.

⭐️ Personal comments NOVA:

Gold returns to ATH 294x zone, 3rd attempt to create ATH but will continue to decrease, need more tax news in the near future

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2942 - $2944 SL $2949

TP1: $2935

TP2: $2920

TP3: $2910

🔥 BUY GOLD zone: $2901 - $2899 SL $2894

TP1: $2906

TP2: $2915

TP3: $2925

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction down - gold under selling pressure⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

The World Gold Council (WGC) reported that central banks bought over 1,000 tons of gold for the third year in a row in 2024. After Trump's election win, central bank gold purchases jumped by more than 54% year-over-year, reaching 333 tons, according to WGC data.

Meanwhile, futures on money market Fed funds rates suggest the Federal Reserve is expected to cut rates by 38.5 basis points in 2025.

⭐️ Personal comments NOVA:

Gold price recovered to the h1 trendline area, will continue to be under selling pressure, trading below 2900

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2923 - $2925 SL $2930

TP1: $2918

TP2: $2910

TP3: $2900

🔥 BUY GOLD zone: $2855 - $2857 SL $2850

TP1: $2862

TP2: $2870

TP3: $2880

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold short term recovery, bulls try⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

US real yields, which typically move opposite to gold prices, fell by four basis points to 2.039%, providing support for XAU/USD.

Meanwhile, the World Gold Council (WGC) reported that central banks acquired over 1,000 tons of gold for the third year in a row in 2024. Following Trump’s election victory, central bank purchases soared by more than 54% year-over-year, reaching 333 tons, according to WGC data.

⭐️ Personal comments NOVA:

Short recovery at the beginning of the week, still in the accumulation process, no important news, gold is not affected too much

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2916 - $2918 SL $2921 scalping

TP1: $2912

TP2: $2907

TP3: $2900

🔥 SELL GOLD zone: $2940 - $2942 SL $2947

TP1: $2930

TP2: $2920

TP3: $2910

🔥 BUY GOLD zone: $2878 - $2880 SL $2873

TP1: $2885

TP2: $2892

TP3: $2900

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold finds ATH price zone above 2880, sideways above 2835⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

The People's Bank of China (PBOC) increased its gold reserves for the third consecutive month in January, supporting gold prices as China remains the world’s largest gold consumer. Reserves rose to 73.45 million fine troy ounces, up from 73.29 million in December. Economist David Qu from Bloomberg Economics noted that the PBOC is likely to continue diversifying its reserves amid growing geopolitical uncertainty.

Meanwhile, US labor market data released on Friday indicated continued strength, which could delay Federal Reserve (Fed) rate cuts. The US added 143,000 jobs in January, below the expected 170,000, while the unemployment rate edged down to 4.0% from 4.1%. As a result, traders now anticipate only one Fed rate cut this year, potentially boosting the US Dollar and pressuring gold prices.

⭐️ Personal comments NOVA:

Gold accumulates in a good growth price zone, around 2880 and adjusts sideways at the beginning of the week.

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2884 - $2886 SL $2891

TP1: $2878

TP2: $2870

TP3: $2860

🔥 BUY GOLD zone: $2852 - $2854 SL $2849 Scalping

TP1: $2858

TP2: $2863

TP3: $2870

🔥 BUY GOLD zone: $2831 - $2833 SL $2826

TP1: $2840

TP2: $2850

TP3: $2860

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

NF - Will the BIG SELL happen or not?⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

China has imposed tariffs on select US goods in response to President Trump’s 10% levy on Chinese imports, escalating trade tensions between the world’s two largest economies and reinforcing demand for safe-haven gold.

On the economic front, the US Department of Labor (DoL) reported that initial jobless claims rose to 219K for the week ending February 1, up from the previous week’s revised 208K. Meanwhile, US Treasury Secretary Scott Bessent stated that the Trump administration is less concerned about the Federal Reserve’s rate path and is instead focused on lowering 10-year Treasury yields.

⭐️ Personal comments NOVA:

The market is too expecting a price increase - big FOMO will have high risks. NF news will shock the market today, BIG SELL will happen

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2851 - $2949 SL $2845 scalping

TP1: $2855

TP2: $2860

TP3: $2865

🔥 BUY GOLD zone: $2813 - $2811 SL $2806

TP1: $2820

TP2: $2828

TP3: $2835

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GOLD DUMP ... POSSIBILITY OR NAH?Hello everyone, hope you're all having a wonderful day !

Price is currently heading to a block of orders just around 70 and that's why M5 was used to sharpen entries for a tighter Stop... kindly use proper risk management if you're comfortable using a stop of 20 pips !

Happy new year everyone !

SCALPING ! GOLD ! Gold sideways - selling pressure pushes price ⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

US President Donald Trump directed his administration to implement emergency 25% tariffs on Colombian imports. However, the tariffs were paused after Colombia agreed to fully accept all illegal migrants returned from the US.

On Tuesday, Trump announced plans to impose tariffs on pharmaceutical and computer chip manufacturers, along with upcoming measures targeting aluminum and copper industries, with potential consideration for steel and other sectors.

These actions reignited concerns over Trump's protectionist policies, raising fears of inflation. As a result, the yield on the 10-year US Treasury bond rebounded from a one-month low, strengthening the US Dollar and pressuring Gold prices.

⭐️Personal comments NOVA:

Price is currently sideways - sellers have more advantage. Wait for SIDEWAY price zone, entry SELL 2745

⭐️SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2744 - $2746 SL $2749

TP1: $2740

TP2: $2735

TP3: $2730

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold falls on inauguration day of TRUMP⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Last week's softer-than-expected US inflation data could support Gold prices by fueling speculation of more than one rate cut by the Federal Reserve (Fed). Traders are now looking ahead to President-elect Trump's inauguration on Monday for insights into the executive orders he plans to issue. "Uncertainty surrounding the policies President Trump will implement has been one of the factors supporting Gold," noted David Meger, Director of Metals Trading at High Ridge Futures.

Moreover, ongoing geopolitical tensions in the Middle East and the Russia-Ukraine conflict continue to drive safe-haven demand for Gold. According to The Guardian, the Russian military captured two additional settlements in eastern Ukraine's Donetsk region on Saturday, marking the latest progress in its westward advance.

⭐️Personal comments NOVA:

Gold short term down around 2700 area, sideways and waiting for new economic policies of the trump administration

⭐️SET UP GOLD PRICE:

🔥BUY GOLD zone: $2678 - $2676 SL $2671

TP1: $2685

TP2: $2693

TP3: $2700

🔥SELL GOLD zone: $2716 - $2718 SL $2723

TP1: $2710

TP2: $2700

TP3: $2690

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction Warning for Gold - Back Below 2700⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Initial Jobless Claims for the week ending January 10 increased to 217K, up from 201K the prior week and falling short of the 210K forecast. Recent inflation data and comments from Fed Governor Waller weighed on the US Dollar, as traders grew optimistic about an earlier rate cut. Waller suggested a rate reduction could be considered in the March meeting, noting that inflation is nearing the Fed's 2% target. Meanwhile, Chicago Fed President Austan Goolsbee expressed confidence in the labor market's stabilization during an interview with The Wall Street Journal.

⭐️Personal comments NOVA:

Gold has completed its recovery to 2724, and the large sellers in this area will push the price back below 2700 before consolidating and rising again. This is consistent with the market awaiting the inauguration of President TRUMP.

⭐️SET UP GOLD PRICE:

🔥BUY GOLD zone: $2688 - $2686 SL $2681

TP1: $2695

TP2: $2702

TP3: $2710

🔥SELL GOLD zone: $2723 - $2725 SL $2728 Scalping

TP1: $2718

TP2: $2713

TP3: $2705

🔥SELL GOLD zone: $2732 - $2734 SL $2739

TP1: $2725

TP2: $2710

TP3: $2700

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Scalping ! sideway - accumulation below 2655⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

President-elect Donald Trump's planned tariffs and protectionist measures are anticipated to drive inflation and disrupt global trade, boosting demand for safe-haven assets like Gold.

On Sunday, Ukraine launched an offensive in Russia's western Kursk region, where Russia’s Defense Ministry reported Ukrainian losses of up to 340 soldiers.

Meanwhile, Israel's ongoing strikes on Gaza show no signs of slowing, and the Israeli military confirmed it has carried out operational raids in Syria amidst allegations of cease-fire breaches.

⭐️Personal comments NOVA:

Sideway price range 2630-2655, gold price accumulates. Resistance 2655 waiting for correction

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2652 - $2654 SL $2657 scalping

TP1: $2647

TP2: $2640

TP3: $2630

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAU tries to recover above 2650 - January ,2025 ⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) inches higher during the Asian session on Tuesday, attempting to extend its rebound from the $2,615-2,614 zone seen on Monday, but with limited upward momentum. Market expectations that US President-elect Donald Trump's proposed tariffs and protectionist policies could fuel inflation support gold's appeal as a hedge against rising prices. Additionally, ongoing geopolitical tensions, including the prolonged Russia-Ukraine conflict and unrest in the Middle East, provide underlying support for the safe-haven asset.

However, the outlook for slower interest rate cuts by the Federal Reserve (Fed) in 2025 continues to drive higher US Treasury yields, creating a headwind for non-yielding gold. Moreover, renewed demand for the US Dollar (USD) limits further gains for the yellow metal. Investors remain cautious, avoiding strong moves ahead of the release of the FOMC minutes on Wednesday and the US Nonfarm Payrolls (NFP) report on Friday.

⭐️Personal comments NOVA:

Buyers and sellers are fighting over the price zone of 2600 - 2650, still maintaining accumulation today.

⭐️SET UP GOLD PRICE:

🔥BUY GOLD zone: $2615 - $2617 SL $2610

TP1: $2625

TP2: $2638

TP3: $2650

🔥SELL GOLD zone: $2647 - $2649 SL $2654

TP1: $2640

TP2: $2630

TP3: $2620

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account