$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

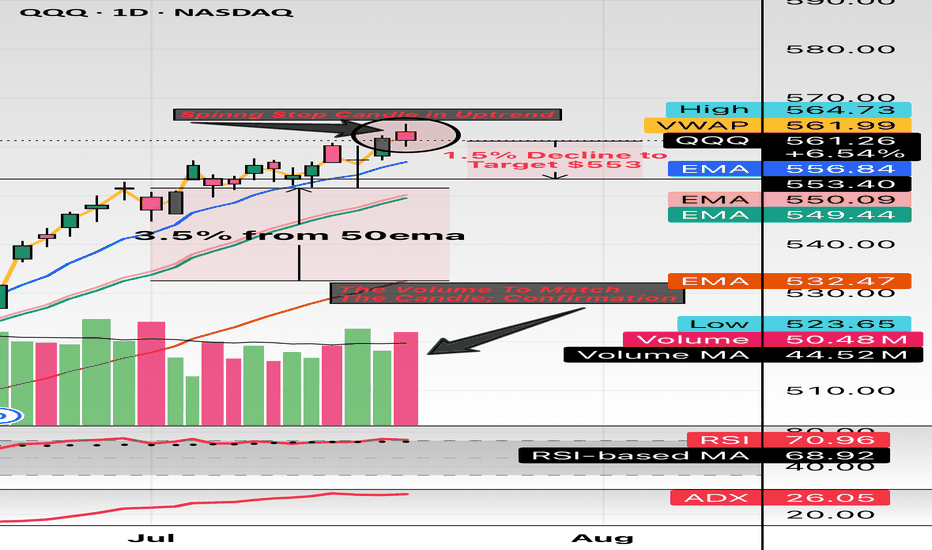

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place (green or red) in downtrends or uptrends and provide pivotal indication. The market has major earnings this week (07/21/2025 to 07/25/2025) with names like Google, Tesla, General Dynamics, Verizon, Domino’s And so forth.

This week could be a catalyst to see some great volatility. I believe staying 3% from moving averages so I have noted 3.5% from the 50EMA and revisiting the 20EMA and 21EMA in the low $550 area. My target is $553 which is only a 1.4% move which can happen in one session in this environment while staying 3.5% above the 50EMA.

My trade idea will be $553p for 07/25/2025. Good luck!

WSL

Shortidea

STMX Short Plan.STMX Short idea if not flip the zone on 1D.

Always manage your risk. the market is up side but if you have any chance short to manage your risk then go for Banana.

gbpusd - long idea (just a short and snappy one)as we are late into the break there's still profit to be made in this trend (even if it is a short and snappy one) on a lower timeframe we can wait for the right price and grab a buy at the price stated on my chart and look for a long position! comment below, what you think?

EU - Daily Timeframe Analysis (ICT)Very nice delivery in price lately.

Wednesday reached into the Weekly Sibi and 4-day Sibi which coincided with a bearish Mitigation Block's wick. Thursday pushed up one more time to trap buyers, as well as touching the bottom of a NWOG. CPI on Thursday trapped and liquidated many buyers with it's immediate drop lower. Friday continued lower, leaving a Daily Sibi in it's wake to close the week.

I'm very interested in this created Daily Sibi if price would enter it before reaching any major objective on the higher timeframe narrative. Specifically, the Daily Bisi turned iFVG. Residing there is a NMOG, and the Mean Threshold of a clean Daily Breaker Block on Forex.com, which only shows a gap on FXCM. Planning out a swing short around there would be high-probability in my opinion.

SBUX Entry, Volume, Target, StopEntry: with price below 93.91

Volume: with volume greater than 7.825M

Target: 88.98 area (this is an area, no guarantee it reaches this price, but you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 93.70, 96.06 gets you 2/1 Reward to Risk Ratio.

This SHORT swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

WFC short candidateWFC continues its way down. The fact that it looks for financing speaks about some brewing troubles there.

I look to short it, the RR ratio is not great (1/1) but if I am correct, then the price could go further below my initial target.

These are my notes. Adjust size according to the risk taken.

What if Citron is right?Current market cap = 14.889b

FY 22 sales = $2.57b

Price to Sales ratio = 5.80

Etsy has been accused by citron research of selling counterfeit products look at the below tweet for their reasoning twitter.com

Now here are the 3 big questions to be answered

1. Will ETSY face legal problems in removing all counterfeit products?

2. What % of their 2.57b revenue comes from that products?

3. How much will they have to cut on their ads spend once they deal with this potential problem? how will that affect their sales numbers in the future?

I don't think Mr market likes companies in that kind of legal trouble!

$12 market price = $1.48b market cap ;)

P/S = 0.5-1 ???

My gain is your loss ;) it's a zero-sum game after all.

Do your own research!

Look first / Then Leap