SPY - 30Min View - Moving Average Prediction for DownturnUsing the 10WeekMA for SPY we can see selloff's occur the last 3 times when price was within $8.60 or less of the moving average (red zigzag).

We are currently less than $8.60 from the moving average - but no selloff.

If we use the normal moving average on 64bars, and ignore the double jump up, by 12/13 price is closer than last selloff.

Last selloff price was $6.70 from moving average, so this would imply we selloff or breakout of the yellow wedge (highly unlikely).

If we breakout to the upside of the wedge, it is possible for the lag to continue for the selloff.

But based on the current wedge being bearish, price being within range of MA for selloff, and 2 fakedowns....we are ready.

Note - If we use the 10WeekMA that is acclerated, we will cross sooner. The gray boxes are almost cut in half. I took the longest expectation here to avoid disappointment.

Exits

-After I post an update when selloff starts (best outcome)

-White top of wedge if FOMO takes us even further into unrealistic outer space

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

Shortideas

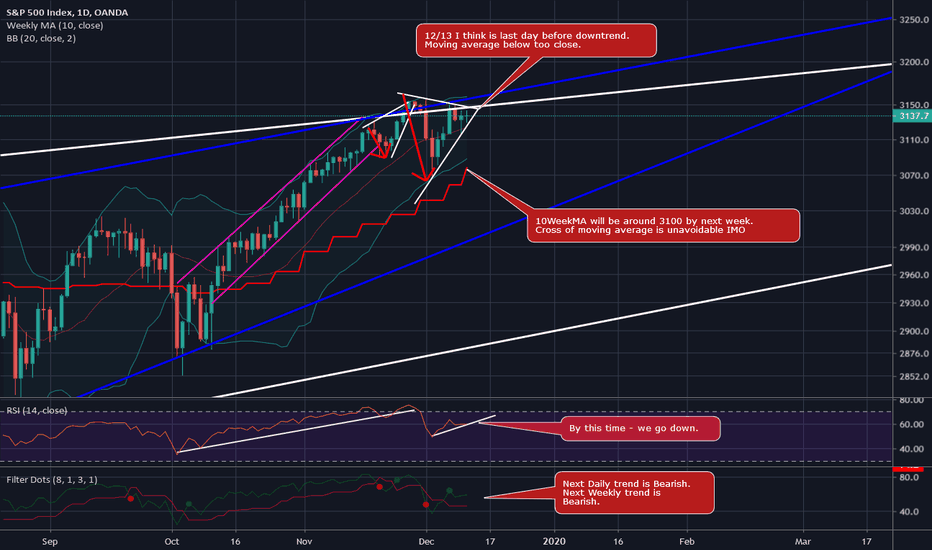

SPX / SPY - Morning Update - Moving Average Getting CloseSPX / SPY - the final wedge within a wedge pattern has little room left to expand further IMO.

Top white resistance line is multi-month resistance from Weekly view chart from 12/9 (see link below).

RSI trend is already high in position and short.

Bollinger Bands are tight. Going back in pattern, last time price angle like this with tight bands we have correction.

By next week, the 10WeekMA will be within striking distance at 3100 on SPX.

Last times we are this close in price to MA we go down.

Next Daily trend is Bearish. Next Weekly trend is Bearish, very close to flipping, and is overextended. We are close.

Exits

1- Blue support line around 3050

2- White support line 2920

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

IHI - Pullback coming mid January-Feb. 2020THIS IS NOT READY YET IMO

IHI - Medical Devices ETF

Forming an ascending wedge similar to much of the market. Bearish pattern.

Pattern runs out of room February 2020. Watch closely Jan. 15 2020 going forward for entry.

When Weekly trend turns bearish and gets close to white resistance line for breakdown, this would be entry point.

I will update getting closer to mid-January if not sooner.

After the correction, it would be good to consider long entry based on past chart (if we don't have market meltdown).

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

AAPL - 10WeekMA Cross UnavoidabaleThe fake breakdown in AAPL and SPY is getting old, but the moving average cross is becoming unavoidable.

The blue resistance line in the AAPL chart is multi-year resistance (hard to breakout).

10WeekMA is pressing upwards toward this blue resistance line, leaving price no room.

10WeekMA is moving roughly $1 per day closer ($4.90 every 5 days).

With current white trendline ending 12/13, coinciding with tariffs, the moving average will be at $261 by this time.

Price will be $5 away from Moving Average right before Xmas.

Everything is lining up - although this is cutting is closer than I prefer.

Exits:

If price goes over $275 or new ATH's.

Pink Support around $240

Blue Support $180 (less likely until massive market selloff)

Please see Outter Space chart below for blue support/resistance lines reference.

JUST BECAUSE I THINK AAPL NEEDS A PULLBACK DOESN'T MEAN I HATE AAPL. PLEASE BE CONSIDERATE

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

SPX/SPY - 4HR View - Wedge is Back - Could China Pump 2 Dump?SPX / SPY is overextended and on a weekly basis has been bullish over 12 weeks.

This is abnormal with RSI on Weekly in the 80's.

But we keep getting these breakdowns, which lack momentum, and form back into same pattern.

Wedge which has resumed now ends on 12/12.

My SPY Puts are for 12/27.

I am going to consider getting some out into January if price falls by selling the current Puts for profit and moving farther out, possibly waiting for a bounce up for better fill.

The 10WeekMA is getting closer to price. When price crosses this moving average, this will confirm downtrend.

Until this happens, we get strung along.

10WeekMA looks unavoidable to cross price by 12/18 on Daily view (unless price goes over 3160 SPX / $316 SPY. - THIS IS WHAT WE SHOULD WATCH

Way things are looking, there is HEAVY manipulation at play here. Price goes to patterns within a penny precision.

Two Hypothesis

1 - Investors are keeping money in to avoid capital gains for 2019. So they will probably take profits in January 2020.

2 - (New Theory) - China is invested heavily in the US market (aside from Fed QE). There is nothing preventing China (communist) from making money off the fake news and FOMO, and then shorting the market when they tank the China deal. They know when it will happen, why it will happen, and they control the strings. Is it possible China is pumping and waiting to short the market after pulling out of trade deal?

I cannot thank everyone enough for the support and positive comments I receive.

Even if we do not agree, and you can make your position with sources, I can appreciate your position.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL

MSFT - New ATH's or FAIL by 12/16MSFT showing that the breakdown last week which occurred did not confirm by breaking the lower channel.

Price needs to break pink and white lines to continue down and fill the red gap boxes.

Resistance line and trend line cross this Friday. This means we may see sideways movement until Friday/next Monday.

RSI trendline was broken last week.

RSI current trend resumed higher and is already almost overbought.

RSI over 75 is rare. Current RSI is 67.

Next Daily trend is bearish.

Next Weekly trend is bearish but spread farther apart with recent rally.

Best to exit after next drop and wait for better long-term Put/Short position in 2020.

Short term bullish after the next drop in RSI below 60.

Exits

-If price goes to new ATH's or over $152.43

-If price reaches white channel (as rebound upward may occur with further Fed QE liquidity injections)

-If price reaches yellow support line

-If we do not head lower by this Friday/next Monday

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

MTUM - Tracking Momentum - Topping Out & SlowingMTUM is the ETF ticker which tracks momentum.

The pink lines show a megaphone pattern, which is bearish when tilted up. education.howthemarketworks.com

The inner white trendlines of the megaphone show price hitting the angled resistance.

The angled resistance crosses the current white price trendline on 12/13.

Going back in history with MTUM, inside the megaphone we see the price top out end of week.

This happened on July 26th and Sept. 6th. Both which are Friday's.

Watching MTUM as an indicator of SPY, we confirm MTUM and SPY shared the same selloff on Dec. 2.

So using MTUM we see that we may stretch out to the end of week here.

I am hoping we go sooner. Theta is killing my options.

If you are getting reamed on your options contracts by waiting, looks like we have a week left here.

If you have large positions, you can either add to reduce cost basis as we get higher OR move your positions farther out for a small loss if you are worried about time.

I think the MTUM chart (for me) confirms there will be no China deal on 12/15.

Each person should draw their own conclusions and make adjustments if necessary

Thank you very much to everyone who is supporting me with positive comments while we get jerked around here.

I really appreciate this community, those who follow my posts, and anyone who leaves good vibes in comments very much.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

AAPL - Weekly View - RSI Over 80! Bullish Trend since JuneAAPL Weekly view shows how overextended this bullish trend really is.

RSI is currently over 80 and has been over 76 since October.

Yellow ascending wedge protrudes out the top of the main blue multi-year resistance line. (from Outter Space AAPL chart)

In the history of AAPL, there are no instances where price spikes out the top in such a manner.

The blue resistance and yellow wedge resistance are leaving little option for price but to go DOWN.

I play the pattern, events, and cycle.

I do not hate AAPL because I think price will go down short term as a pullback. No hateful comments please.

Today's - AAPL 4Hr View chart and News

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

AAPL - 4Hr View - Current Pattern / NewsFake breakdown on AAPL still resulted in returning to overbought status quickly.

12/10 end of day appears to be when pattern runs out of room.

We may get up to $274 before a selloff.

The trade deal is what we are playing here.

This doesn't mean I don't like AAPL. It is the pattern and the situation.

The risk is to the downside for AAPL.

If you cannot handle this risk, please do not enter or take a small position you can handle losing for a possible 2x or more.

Examples of conflicting news made to confuse investors (Both from today - Both from same source)

China Renaissance bullish on Apple - $342 price target

seekingalpha.com

seekingalpha.com

Apple on watch as tariff deadline approaches - 4% hit to EPS from this one event December tariffs, 5%+ upside or downside

If we get close to $274 I will most likely pull out the close expiry puts and move back expiration.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

SPX / SPY - Weekly View - Hangman Doji SPX and SPY both confirmed a hangman doji for end of week last week. :)

This bearish doji normally signals a reversal in price trend. en.wikipedia.org(candlestick_pattern)

I am seeing a bearish pattern ending last week, bearish pattern premarket today, and bearish patterns.

Weekly view shows same view of white 30Min wedge, inside blue ascending wedge, inside white main ascending wedge.

This is a fairly complex pattern at this point.

I almost feel like the algo computers are playing chess, but running out of squares. Check mate coming soon for the downturn.

Trend dots at bottom show we are rolling over.

Once the dots actually cross, trend is confirmed on Weekly. This will be BIG.

If you look at the chart history, the max gains are achieved by entering BEFORE the downturn.

The downturn trend cross is often the huge red candle where the money is made.

Daily view on SPX / SPY is showing a bearish harami candlestick doji (but too soon to tell as we are premarket).

Article below confirms we need to watch for next day or two to see if this is the turn.

investinganswers.com

If price on SPX / SPY goes to new ATH's or over $316 ALL BETS ARE OFF.

I will be changing my Puts expiry if this happens and will update the chart.

Today's 30Min View Chart with 2 News Links

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

SPX / SPY - 30Min View - Wedge, In a Wedge, In another WedgeSPX on the 30Min is showing we are consolidating in a wedge.

An ascending wedge is a bearish pattern.

If you ask me - having a wedge, in a wedge, in another wedge should be extremely bearish. LOL

We are in a white wedge (could be ascending wedge based on support angle), inside a blue ascending wedge, which is inside the main multi-week white ascending wedge.

The white multi-week ascending wedge will be shown in the Daily or Weekly view.

10WeekMA double jumped higher which is good.

Price is closer to 10WeekMA. Price cross of MA will confirm downtrend.

I am waiting for price to break the current white wedge pattern by tomorrow. (SPX is showing after market hours 23:00).

If price breaks above wedge or goes to new ATH's, ALL BETS ARE OFF. I will be pulling out of short/puts if we go above $316 SPY.

I will update Daily and Weekly view momentarily.

News:

French riots/protests over pensions (similar to US upcoming issue with pensions funded by corporate debt).

2 days ago - www.youtube.com

Repo Crisis Fueled by 4 Banks, Fed Balance sheet increasing at SAME level as market Hmmmm - all sourced information

Today - www.youtube.com

MSFT - Weekly View - Up Before Down by XmasMSFT showing a buy signal on Daily although Weekly view showing capitulation and downtrend has started.

In my opinion, we do not see previous weeks high of $152.50 before going down into Xmas.

White channel was added to pink ascending wedge. Wick down on this week confirmed channel.

Breakdown of white channel around $146.65 will confirm downtrend.

We need to break the 10WeekMA which will occur in 2 weeks or less in my opinion.

Capitulation has started and going back in chart, does not stop until a selloff occurs.

Based on previous trends, we should start accelerating the downtrend into the Xmas week (2.5 weeks).

I am overall bullish on MSFT. However, the chart shows a pullback is warranted. This doesn't mean I don't like MSFT.

I am not active in this position. I am updating for the community.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU

AAPL - Weekly View - Bearish Continuation - Don't Be FooledWeekly view of AAPL confirms downtrend is just beginning.

RSI trend is about to be broken. Weekly RSI is overbought at 76+.

Bullish trend is overextended. Weekly Bullish trend has been going since Sept.2nd week.

16 weeks bullish trend was longest recently (after December 2018 selloff). 12 Weeks is overextended.

AAPL is hitting blue resistance line which has multiple contact points back to 1999. See AAPL Outter Space chart below.

Hash Ribbons show that capitulation has started.

Based on this I have increased my Puts into January. Jan 17 2020 Puts $255 Strike.

I see AAPL going down for several weeks based on the info above and previous trends.

This also confirms for me that SPY should continue down as AAPL is a major SPY component.

If you compare AAPL and SPY (SPX) they are identical in both price action and indicators. One fall-both fall.

AAPL Outter Space Chart

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, AAPL, ROKU.

ROKU - Short Term Entry - Downgraded and OverboughtROKU has multiple gaps to fill down, was downgraded from Morgan Stanley today, and is overbought.

Morgan Stanley downgraded price target to $110.

Average Analyst Price Target - $124.93

Current price is $137+

www.marketbeat.com

We need to see ROKU break the white trendline to confirm the lower gaps may get filled.

Price may bounce off the white line back up, into the pattern to fill the gap down created today.

I am in this position for Dec 20 Call Credit Spread - 135/140 Strike (Bearish). Works out to 65% probability with 1:1 payout.

This is short notice entry, but risk is small.

My opinion - Who is going to be buying this dip in ROKU after 400%+ returns YTD, at ATH's, with a 15% downgrade, during the holidays?

Answer - I cannot think of anyone who would spend Xmas gift money on ROKU stock with issues stated above.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY.

Short SPY and AAPL....and ROKU (for now).

LMT - Pattern Failure Feb-March 2020 - Another OneTHIS IS NOT READY FOR SHORTS/PUTS YET. I WILL UPDATE WHEN I ENTER

This is a great way to play the trend down and then long again on the way back up. :)

I am overall bullish on LMT and their business model. But this chart says it's due for a correction.

There is a series of charts I am finding with patterns which end mid-2020 which also coincides with 2yr/20yr inversion anniversary (March 2019).

Lockheed Martin has a fairly repeatable pattern here.

Longer term chart shows similar pattern, although these last two were very similar.

The pattern needs to be analyzed closer when the time comes to enter.

I will be looking to enter at failure of the current yellow wedge.

I expect this to be around February or March 2020. I will update the chart at this time.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, ROKU and AAPL.

ROKU - Bear Flag on 1HR - Downtrend Continues IMOSeeing ROKU have a little retracement up made me recheck the chart.

As we see, ROKU forming a Bear Flag on the 1HR.

Price is very close to breaking 10WeekMA. Downtrend should continue once this occurs.

RSI breakdown trendline coincides with Dec. 5th, same as ROKU Bear Flag breakdown point.

RSI should not get over 70 - or consider exiting bearish Puts/Shorts.

Next trend on the 1HR is Bearish. Based on trajectory, we should fill the pattern right as trend turns bearish again.

My exit point is around ROKU $116.

I will stay in this position until next week most likely, or price target.

If Bull Flag pattern breaks up into gap above I am exiting.

Today's 50% price target increase was a joke. After yesterdays downgrade on ROKU, another analyst probably lost money and wanted to recoup some losses or exit their position.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, ROKU and AAPL.

MSFT - Update - Weekly ViewTo be clear - I like MSFT and I am long term bullish on them. I play the pattern and the chart. Chart is bearish currently. This doesn't mean I don't like MSFT.

Weekly view shows MSFT is just beginning the downtrend.

I think we go down to yellow support at least with current correction. This will fill top 2 gaps.

Bottom gaps may all fill with broader market direction.

RSI weekly trend looks to breakdown in the next week or sooner.

We normally go under RSI 50 on the weekly with a correction like we currently have.

Next trend on the weekly is bearish.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

UTX - Feb. 2020 Entry - Another Pattern Failure May 2020THIS IDEA IS NOT READY YET IMO.

Looking for ideas I came across UTX. I was hoping to play the UTX merger in a bullish way, but the chart pattern is bearish.

We have an ascending wedge looking to end around May 2020 - Same as SMH, AAPL, SPY, and others.

I think we can catch a small rebound inside the white triangle.

My entries are either breakdown of the white ascending triangle, or preferably the rebound at top around Feb. 2020.

I think the Feb. 2020 entry would be the best price position in the pattern for failure.

We should stop at Strong Support. This has held since 1973 which I consider strong.

I will update as this idea develops.

Just throwing it out there since I am seeing an overall pattern develop across multiple sectors.

2yr/10yr inversion was in March 2019. www.cnbc.com

We are approaching the 12 month period, where this has predicted a recession with 100% ACCURACY FOR LAST 7 RECESSIONS

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY, ROKU and AAPL. May close ROKU today.

AAPL - Just Turned Bearish on WeeklyWe are in a good position to enter a downtrend for AAPL. This fake news about China will not hold.

Chart shows we are at end of pattern on Weekly view.

White uptrend line just broke this week.

RSI trend on Weekly view just broke to downside.

Filter Dots confirm downtrend has begun, even though today we see a little rebound upwards.

We should be crossing the 10WeekMA in the next week to confirm the downtrend continues.

I have chosen to add to my AAPL Puts into the Jan 17 2020 contracts at $5.45 each (entry price based on Black Scholes).

We should be able to play 30 day - 40 day expiration periods to conserve margin/cash.

Options 60 days out are about double price of 30s.

Once AAPL takes a downturn, SPY will fall as well with AAPL being a major component.

MSFT, AAPL, SMH, and other tickers are all following same pattern and news cycle. This shows their correlation.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

SPX/SPY - Update Part 2 of 2 - Weekly Trend Turning BearishWeekly trend for SPX/SPY is turning bearish.

We flashed a sell signal on the weekly candle yesterday. This is significant as this happens AT the turn down.

0.618 Fib Extension is around same level as 10WeekMA. The blue support is around 0.50 Fib Extension. Multiple things line up. :)

Indicators

RSI trend on Weekly is maxed out and very close to breaking down through trendline.

Next weekly trend is bearish. This confirms we should break the RSI trendline.

Please see "SPX/SPY - Update Part 1 of 2 - Bear Flag on 1HR" for the other chart this morning.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

SPX/SPY - Update Part 1 of 2 - Bear Flag on 1HRPrice was moving in white channel last night and broke into yellow Bear Flag pattern.

This provided time for price to balance on the way down without shock.

It also provides time for 10WeekMA to come up and meet price. Price goes below this red zigzag line and we continue down based on past history.

Indicators

RSI Trend line will be shown in Part 2 of 2

Next trend on 1HR view is Bearish. We continue down IMO today or by end of week.

Yes - I see the "possible" trade news on China today.

No - I do not believe it after "we have deal" , "no we don't", "not until elections", "no wait we have a deal again".

My position will change when the chart bearish pattern completes OR if the pattern fails. We are still in play.

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, and VIXY.

Short SPY and AAPL.

SPY - Gap Down Today / Exit Points for Short/PutsHappy to see some of my friends on here making money this morning. Glad we saw this coming!

As we continue to work this trade, I have others into January and February. So things are stacking up nicely. :)

Top gap got filled. Two more gaps below to fill (farthest gap down is $295).

Exits for Shorts/Puts-

1st - RSI 30 - price will rebound upwards. Time exit before RSI rebounds.

2nd - At gap fills ($295)

3rd - Price going to yellow support $300, or pink support next same as gap fill $295 level.

I will update chart when trend changes to bullish.

SPX Chart from Today below (mostly similar - for reference)

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, VIXY.

Short SPY and AAPL.

SPX / SPY - Update - No China DealSPX confirming downtrend this morning - NO RETRACEMENT :)

Filter Dots show trend is already mid-level. We can get to blue support line without a break.

Watch for price to stop at 10WeekMA zigzag line. Will update chart around this time.

Looking at previous downtrends, we see that RSI normally goes to 30 before any price pause/small retracement.

We should expect a downtrend without pause until we hit RSI 30.

If we are not at support blue line or white line before we get to RSI 30, we should pause and continue downward.

I do not expect the market to tolerate this stall tactic from Trump. Article - Trump says it might be better to wait until after 2020 election for a China trade deal

www.cnbc.com

Jeff Gundlach - “In 2018, GDP grew by 5% while national debt grew at 6%. This implies the entire economic growth of 2018 was debt based.” He goes on to say that the “problem that causes the next recession will be interest rate manipulation (going to zero interest rates/QE money printing)” 7mins15sec into video www.youtube.com

Let's not forget the taxpayer bank bailouts. Goldman Sacs ruined the housing market, got a $10billion taxpayer loan never to be payed back, outsourced 1000 jobs right after getting the money screwing American's further, and NOW Goldman Sacs is having one of the biggest stock buybacks EVER ....WITH OUR TAXPAYER DOLLARS!

investorplace.com

thinkprogress.org

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Disclosure - I am long MARA, GBTC, BTCUSD, GDX, VIXY.

Short SPY and AAPL.