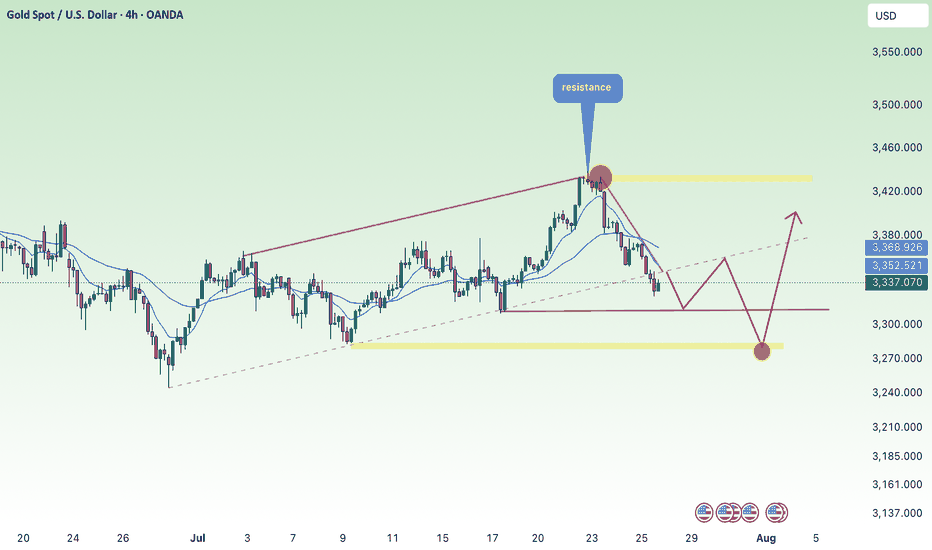

Gold price continues to decrease, keep the rate unchanged✍️ NOVA hello everyone, Let's comment on gold price next week from 07/28/2025 - 08/1/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) looks set to close the week lower, pressured by upbeat U.S. economic data and progress in trade negotiations, which have reduced demand for safe-haven assets. Despite declining U.S. Treasury yields, the U.S. Dollar regained some ground. At the time of writing, XAU/USD is trading around $3,336, down nearly 1%.

Looking ahead, the Federal Reserve is widely expected to keep interest rates steady at 4.25%–4.50% for the fifth time this year. Recent data supports this stance, with Initial Jobless Claims falling for the fourth straight week—signaling a resilient labor market—while Friday’s sharp drop in Durable Goods Orders, driven by weaker aircraft demand, adds a mixed tone to the outlook.

⭐️Personal comments NOVA:

Gold prices continue to fall as interest rates remain unchanged almost this week. Along with the H4 time frame, prices continue to break important support and continue to follow a downward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3350, $3428

Support: $3312, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Shortposition

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

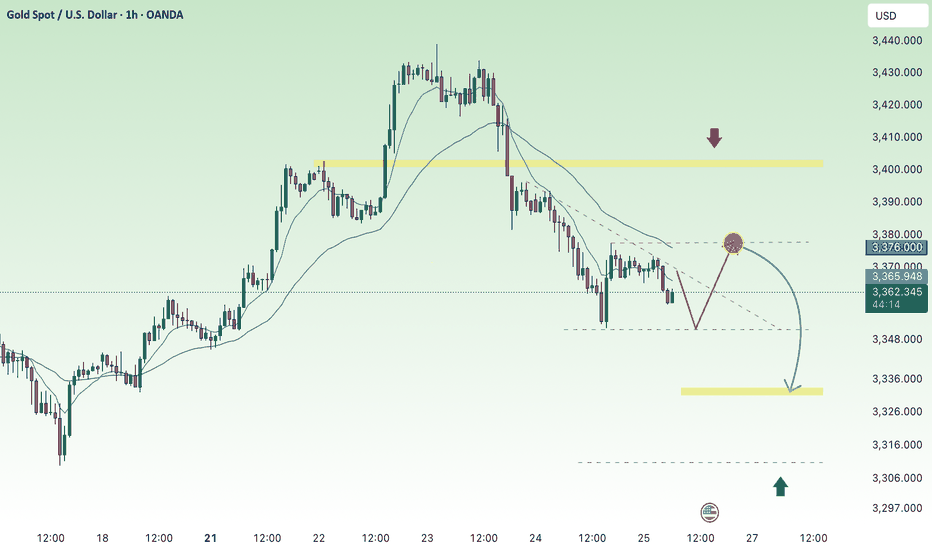

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices under selling pressure from tariff policy⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) stays under pressure during Thursday's Asian session, extending the sharp pullback from its highest level since June 16 seen the previous day. Optimism surrounding global trade continues to build, fueled by reports that the United States and the European Union (EU) are nearing a tariff agreement, following progress in the US-Japan trade deal. This upbeat sentiment has dampened safe-haven demand and is a major factor weighing on gold prices.

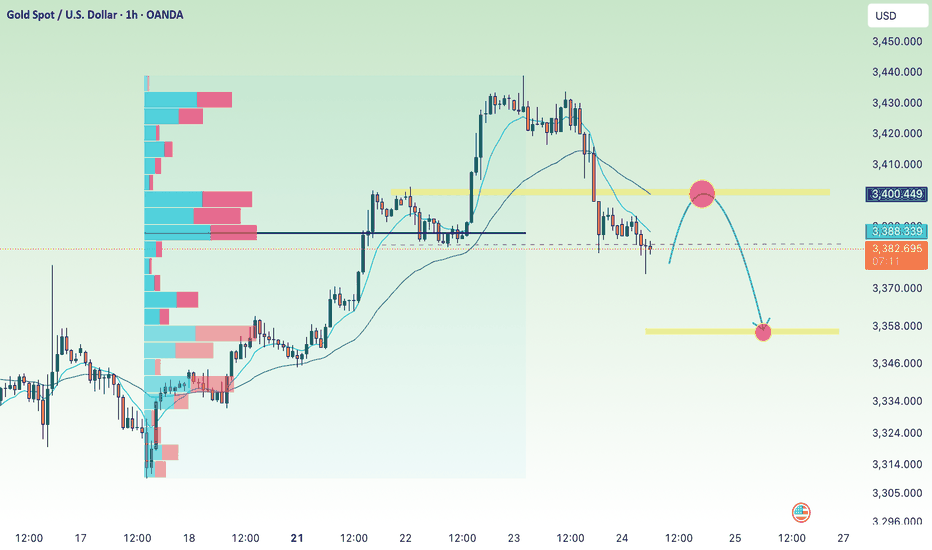

⭐️Personal comments NOVA:

Gold price adjusted down, broke support, faced selling pressure again, accumulated below 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3356-$3354 SL $3349

TP1: $3365

TP2: $3373

TP3: $3382

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

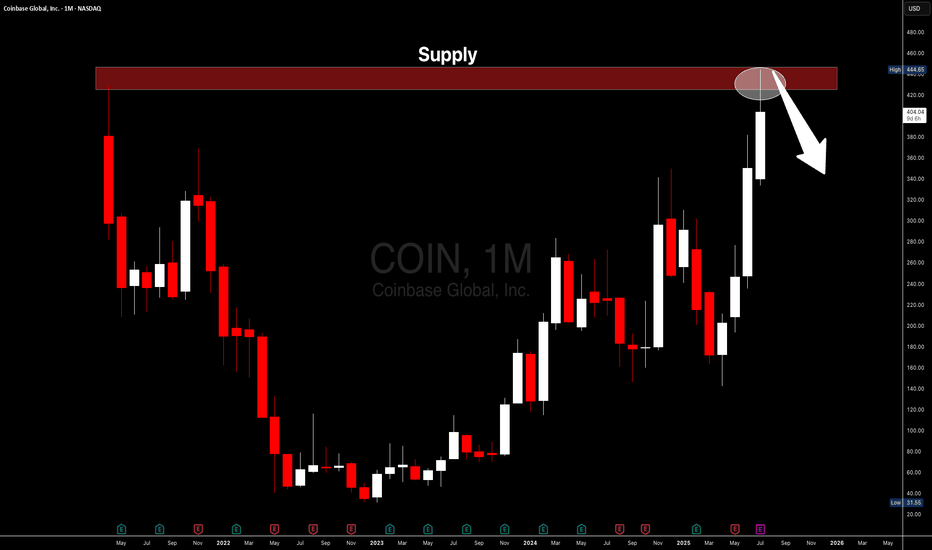

COINBASE I Strong Bearish Outlook (Take Action Now)Welcome back! Let me know your thoughts in the comments!

** COINBASE Analysis - Listen to video!

We recommend that you keep this stock on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

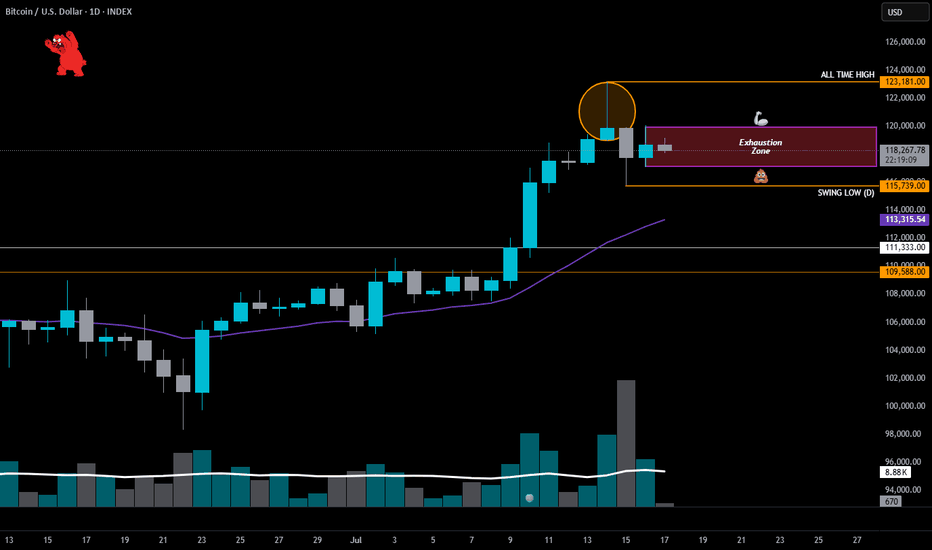

BTC Exhaustion Zone Upper Wick Rejection Candle 🔶 (Orange Circle)

🔍 Candle Breakdown | July 14, 2025

• Opened near the lows

• Rallied intraday to $123K (ATH)

• Closed well off the highs, just above $119K

• Long upper wick = rejection of higher prices

• Elevated volume = signal is valid, not noise

🧠 Translation: Bulls charged into resistance. Sellers didn’t flinch — absorbed the move and slammed price back down. The result? “Exhaustion Candle.”

📦 Exhaustion Zone (Purple Box)

This is the real battlefield. If BTC fails to close above 119.5K by Friday, we likely get Manipulation over the weAkend:

🔄 Chop & Range Behavior

• Consolidation between ~115K support and ~120K resistance

• Classic pause before either expansion or collapse

🔻 Retrace Scenarios

• 21 EMA at $113K

• Breakout retest near $111K

💡 If we close the weAk closer to $111K than $125K… gravity’s working in favor of the HIGH powered short Zone again!

MMM still sTRONg — but without a decisive breakout above $125K, I might just be dancing with the market makers for once.

🧘♂️ Breathe in. Kill the ego. sTAY sHARP. Execute.

100% not financial advice, for edutainment purposes only!

XRP is making moves!Will it break $3, or drop back to $2? Previous Cycles showed that a correction might be next in line for the crypto market as a whole. Which means, if it happens, altcoins will get affected a lot...Do not get shaken out, after the correction expect a huge rally, but for now...it might be a perfect point to secure some profit.

Not investment advice.

#xrp #bitcoin #crypto #short #analysis

TRADING IDEA - ETHUSD SHORT

ETHUSD rose towards 2,700.00 level and reached the take profit. And even went further towards 2,800.00 resistance level despite my 2,700.00 retest predict! (pic 1)

So, congrats to everyone, who stayed long here, we took the cash!💵

I am preparing for the next trade. Here is the plan: if the price rises once again towards 2,800.0 resistance level and retests it, I will open the short position with

🔽 a pending sell stop order at 2796.84 with

❌a stop loss at 2818.86 and

🤑a take profit at 2740.05

Additionally, the RSI shows divergence on 30-m timeframe.

I suppose this to be quick trade. Will see how it will work out.

Accumulated above 3300, market is sideways⭐️GOLDEN INFORMATION:

Gold prices posted modest gains on Wednesday, supported by a pullback in US Treasury yields, even as the US Dollar remained firm against major currencies. Market sentiment continued to be driven by trade developments, while the Federal Reserve’s latest meeting minutes revealed that policymakers are still leaning toward a rate cut in 2025. At the time of writing, XAU/USD is trading at $3,312, up 0.31%.

The FOMC minutes indicated that the majority of Fed officials believe a rate cut this year would be appropriate, with a few members open to the possibility of initiating a reduction as early as July—provided the economic data continues to align with expectations.

⭐️Personal comments NOVA:

Gold price recovered to 3320, mainly still accumulating, waiting psychology on current tariff situation of countries

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3358- 3360 SL 3365

TP1: $3345

TP2: $3332

TP3: $3320

🔥BUY GOLD zone: $3245-$3247 SL $3240

TP1: $3256

TP2: $3269

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears pressure early week below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) face renewed selling pressure, dipping toward the $3,320 level during the early Asian session on Monday. The pullback comes as June’s stronger-than-expected US Nonfarm Payrolls (NFP) report has reshaped market expectations around the Federal Reserve’s (Fed) policy path. Investors now turn their attention to the upcoming release of the FOMC Minutes on Wednesday for further guidance.

The US economy added 147,000 jobs in June, beating expectations and slightly up from May’s revised figure of 144,000. Meanwhile, the Unemployment Rate held steady at 4.1%. These figures reinforced the view that the labor market remains resilient, thereby lowering the odds of an imminent Fed rate cut. As a result, the US Dollar has strengthened, weighing on non-yielding assets such as Gold.

⭐️Personal comments NOVA:

Downtrend at the beginning of the week, gold price returns to accumulate below 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3337- 3339 SL 3344

TP1: $3328

TP2: $3312

TP3: $3300

🔥BUY GOLD zone: $3297-$3295 SL $3290

TP1: $3308

TP2: $3320

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Strong weekend selling pressure, below 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) came under renewed selling pressure during the Asian session on Friday, retreating below the $3,300 level after a lackluster performance the previous day. The precious metal is edging closer to the two-week low seen on Tuesday, as investors await the release of the US Personal Consumption Expenditures (PCE) Price Index. This key inflation gauge is expected to offer fresh insight into the Federal Reserve’s policy outlook and could significantly influence US Dollar (USD) movements—ultimately shaping the near-term trajectory of the non-yielding yellow metal.

⭐️Personal comments NOVA:

Selling pressure at the end of the week caused gold prices to fall below 3300, maintaining selling pressure and falling today

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3326- 3328 SL 3333

TP1: $3315

TP2: $3302

TP3: $3290

🔥BUY GOLD zone: $3248-$3250 SL $3243

TP1: $3260

TP2: $3270

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

EUR/CHF Channel Breakdown – Bearish MomentumThe EUR/CHF pair has broken down from a well-defined ascending parallel channel, indicating a shift in market structure and a possible continuation to the downside. The price had been consistently respecting the resistance zone near 0.9435–0.9440 (marked in red) and the support zone near 0.9375–0.9380 (marked in green), forming an upward-sloping consolidation channel.

After multiple rejections at the upper resistance, the price decisively broke below the support line with strong bearish momentum, confirming a bearish breakout from the channel.

🔻 Breakdown Implication

The height of the channel—measured from the support to the resistance—has been used to project the next potential downside target. The projected breakdown target is marked near 0.9309, which aligns with historical price reaction zones and provides a clean structure-based price objective.

This suggests the bearish move could extend further in the coming sessions unless the price quickly recovers and climbs back above the broken support, which would invalidate the breakdown structure.

🧠 Trading Outlook

Bias: Bearish after confirmed breakdown from channel

Entry (if not in already): Consider selling on retest of broken support (~0.9375)

Target: 0.9309 (based on channel height)

Stop Loss: Above 0.9390–0.9400 (above breakdown point)

This setup is ideal for momentum traders looking to capitalize on trend continuation after a failed bullish structure.

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

Gold prices continue temporary downtrend⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) came under renewed selling pressure during Friday’s Asian session, dipping to their lowest level in over a week, near the $3,344–$3,345 range. The decline was largely driven by the Federal Reserve’s hawkish tone, which emphasized persistent inflation risks and suggested a more gradual path to interest rate cuts—dampening demand for the non-yielding precious metal. Nevertheless, fragile market sentiment and a cautious risk environment may continue to lend some support to gold, potentially cushioning it against steeper declines.

⭐️Personal comments NOVA:

Selling pressure continues to maintain, pushing gold price down to 3304 today, the downtrend price line is maintaining well.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3418- 3420 SL 3425

TP1: $3400

TP2: $3382

TP3: $3370

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Rising Geopolitical Tension (Iran Conflict) Signals Market RiskMoving Partially to Cash (VEA, QQQ, TQQQ, SPY, TECL, SOXL)

The global market is entering a high-risk environment. Geopolitical escalation, particularly the growing threat of direct US involvement in a military conflict with Iran, is pushing global uncertainty to new highs. Tensions in the Middle East, rising oil and gold volatility, and increased friction between major world powers all point toward a potential market breakdown. On the chart, VEA ETF is showing signs of topping out within a rising wedge pattern. Meanwhile, institutional funds are starting to reduce exposure to high-risk assets. I'm taking partial profits and shifting to cash across VEA, QQQ, TQQQ, SPY, SOXL, and TECL to preserve gains. Buy-back zones are set around 53.00, 48.00, and 44.00. In an environment of global escalation and rapid risk-off sentiment, active portfolio defense is more important than passive hope.

Gold price recovers, accumulates new week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) hold steady near $3,310 during the early Asian trading hours on Monday, with the precious metal struggling to gain traction amid renewed strength in the US Dollar (USD). While a firmer Greenback poses headwinds for gold, lingering uncertainty surrounding President Donald Trump’s tariff strategy continues to offer some support.

On Friday, upbeat labor market data bolstered the dollar, pressuring dollar-denominated assets like gold. The US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls rose by 139,000 in May, outpacing expectations of 130,000 and surpassing the previous month's downwardly revised figure of 147,000 (from 177,000). The stronger-than-expected jobs report has dampened hopes of near-term Fed rate cuts, weighing on bullion’s appeal.

⭐️Personal comments NOVA:

Gold price takes liquidity 3294, below 3300 GAP zone last week. Accumulate and react at lower support zones

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3348- 3350 SL 3355

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3281- $3279 SL $3274

TP1: $3292

TP2: $3300

TP3: $3315

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC , 1D BTC has Break Down in 4Hr and Retest the lower Trendline in 1Hr , SO we think that it will Fall in Future , If BTC is Sustaining below its 1,05,600 then we confirm that it will be Fall Drastically

if BTC is falling then remaining coins , which are giving Breakdown of Patterns they will give Very Good Profit

Risk - 3% and Aim for 20 % .

Follow for More Swing Idea Like this

S&P500: Top Within ReachThe S&P has recently continued its upward movement, climbing higher into the magenta-colored Short Target Zone between 5,880 and 6,166 points. Primarily, we expect the top of the current wave (X) in magenta within this price range, after which a downtrend should follow with wave (Y). This final phase of the magenta three-part movement should lead the index into the green Long Target Zone between 4,988 and 4,763 points, completing the overarching green wave there. A rise above the upper boundary of the Target Zone and a breach of resistance at 6,675 points would trigger our alternative scenario.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Selling pressure, gold price continues to fall below 3285?⭐️GOLDEN INFORMATION:

Gold prices declined by nearly 2% on Monday, slipping below the $3,300 mark, as investor sentiment improved following U.S. President Donald Trump’s decision to postpone tariffs on European Union imports. The renewed risk appetite, coupled with a modest rebound in the U.S. Dollar from last week’s losses, placed pressure on the non-yielding precious metal.

The move came after a weekend call between President Trump and European Commission President Ursula von der Leyen, which resulted in the U.S. deferring the planned 50% tariffs on EU goods until July 9. The development eased global trade concerns, prompting a shift away from safe-haven assets—excluding the Greenback—and helped propel global equity markets higher.

⭐️Personal comments NOVA:

Accumulated price zone around 3300, under selling pressure, mainly waiting for important economic news this week: GDP, FOMC

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3363- 3365 SL 3370

TP1: $3352

TP2: $3340

TP3: $3325

🔥BUY GOLD zone: $3266- $3268 SL $3261

TP1: $3277

TP2: $3286

TP3: $3300

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAU/USD continues sideways above 3200 zone⭐️GOLDEN INFORMATION:

U.S. President Donald Trump stated on Monday that he does not anticipate reinstating the 145% tariffs on Chinese imports following the current 90-day suspension. In a Fox News interview on Wednesday, he emphasized the "excellent" relationship with China, which fueled trade optimism and weighed on safe-haven demand for Gold during the Asian session.

Meanwhile, on the geopolitical front, Russia and Ukraine are preparing for their first high-level, in-person negotiations since 2022, scheduled to take place in Istanbul this week. The talks come amid mounting international pressure for Moscow to accept a proposed 30-day ceasefire. Representing the U.S., Secretary of State Marco Rubio, along with special envoys Steve Witkoff and Keith Kellogg, are expected to participate in the discussions.

⭐️Personal comments NOVA:

Accumulation price zone, gold price sideways around 3200 - 3270, balance between buyers and sellers

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3282- 3284 SL 3289

TP1: $3270

TP2: $3260

TP3: $3250

🔥BUY GOLD zone: $3167 - $3165 SL $3160

TP1: $3178

TP2: $3189

TP3: $3200

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

CPI - inflation assessment, gold accumulation⭐️GOLDEN INFORMATION:

Swap markets have now fully priced in a 25 basis point rate cut by the Federal Reserve in September, with expectations for two additional reductions by year-end. This marks a slight shift from last week, when traders had anticipated the first cut as early as July and a total of three rate cuts in 2025.

On the geopolitical front, Indian Prime Minister Narendra Modi stated on Monday that military operations against Pakistan are merely on hold, warning that future actions will depend on Islamabad’s conduct. Meanwhile, Ukrainian President Volodymyr Zelensky expressed willingness to meet Russian President Vladimir Putin later this week, following US President Donald Trump's call for him to "immediately" accept a peace summit invitation in Turkey. Heightened geopolitical risks from these developments could fuel demand for safe-haven assets like gold, reinforcing the metal’s appeal amid ongoing global uncertainty.

⭐️Personal comments NOVA:

CPI assesses the level of inflation in the US economy, gold prices continue to strive to maintain the price range around 3200

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3281- 3283 SL 3288

TP1: $3270

TP2: $3260

TP3: $3250

🔥BUY GOLD zone: $3176 - $3174 SL $3169

TP1: $3185

TP2: $3198

TP3: $3210

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears are active at the beginning of the week, prices are down⭐️GOLDEN INFORMATION:

The United States and China announced “substantial progress” following two days of trade negotiations in Switzerland, marking a potential turning point in efforts to ease tensions between the world’s two largest economies. Chinese Vice Premier He Lifeng characterized the discussions as “an important first step” toward stabilizing bilateral trade, while US Treasury Secretary Scott Bessent echoed the sentiment, noting meaningful advancements were made. The US is expected to release more details about the outcome of the talks on Monday.

While signs of progress may dampen demand for safe-haven assets like gold, lingering uncertainty around the specifics of any deal could still lend some support to the precious metal. “Ongoing ambiguity surrounding tariffs remains one of the most influential factors sustaining gold,” noted David Meger, Director of Metals Trading at High Ridge Futures.

⭐️Personal comments NOVA:

The short-term downtrend is maintained, gold price accumulates around 3300 and continues to go down to lower support zones.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3315- 3317 SL 3322

TP1: $3300

TP2: $3290

TP3: $3280

🔥BUY GOLD zone: $3223 - $3225 SL $3218

TP1: $3238

TP2: $3245

TP3: $3260

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable sell order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

H4 frame accumulation 2 trend lines✍️ NOVA hello everyone, Let's comment on gold price next week from 05/12/2025 - 05/16/2025

🔥 World situation:

Gold prices advanced over 1% on Friday, rebounding as the US Dollar (USD) softened following a two-day winning streak, pressured by declining US Treasury yields. Renewed risk-off sentiment, fueled by persistent geopolitical tensions, bolstered demand for the safe-haven metal. At the time of writing, XAU/USD is trading near $3,338.

US equity markets slipped as investors adopted a cautious stance ahead of Saturday’s high-stakes meeting between US and Chinese delegations in Switzerland. While hopes for a de-escalation in trade tensions remain elevated, uncertainty continues to dominate sentiment.

Adding to the volatility, US President Donald Trump reignited trade concerns by stating on social media, “80% Tariff on China seems right! Up to Scott B.”

🔥 Identify:

Gold prices slow down, starting to accumulate more. Trade negotiations will appear more, putting selling pressure on gold prices in the near future.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3402, $3435

Support : $3282, $3203

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest