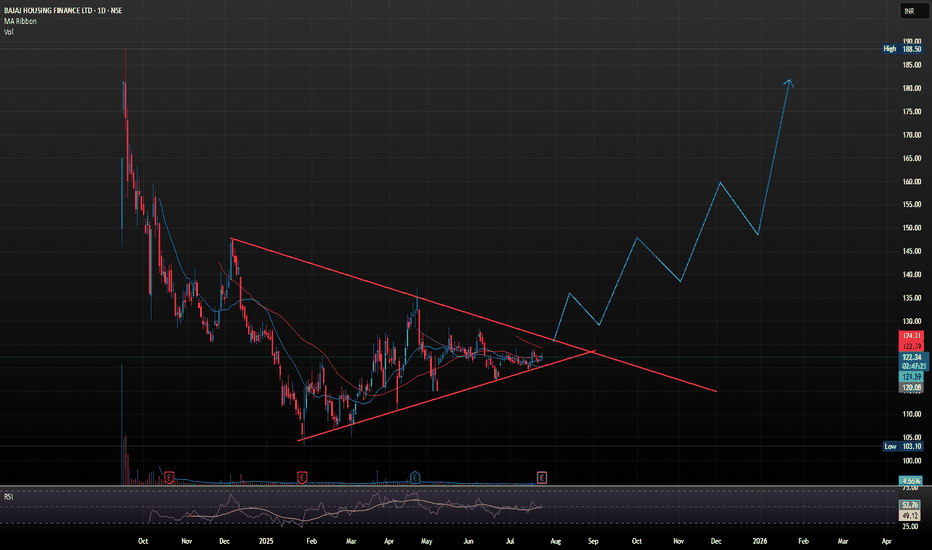

BAJAJ HOUSING FINANCE LTD GOOD TIME TO PICK IT Bajaj Housing Finance Ltd. (BHFL) is a prominent non-banking financial company (NBFC) in India, specializing in housing-related finance. It's a subsidiary of Bajaj Finance Ltd., and has been classified as an Upper-Layer NBFC by the RBI under its Scale-Based Regulations.

📊 Latest Financial Highlights (Q1 FY26 Preview)

- Assets Under Management (AUM): 1.2 lakh crore, up 24% YoY and 5% QoQ

- Loan Assets: 1.05 lakh crore, up 24.2% YoY

- Disbursements: 14,640 crore, up 22% YoY

- Net Profit (PAT): Expected to rise 19–21% YoY to 574–584 crore

- Net Interest Income (NII): Estimated to grow 24–28% YoY to 827–851 crore

- Net Interest Margin (NIM): Projected at ~3.2%, slightly compressed due to rate cuts

The company is well-positioned to benefit from the rising demand for housing loans, as more people seek to buy homes. With a focus on technology and customer service, BHFL is likely to enhance its operational efficiency, attracting more clients and growing its market share. As a result, the stock price of BHFL could rise, with steady growth by its expanding loan portfolio and strong brand recognition. In 2026, its share price target would be 253, as per our analysis.

SHORT TERM VIEW

entry - 119.50-123

stop loss - 117.60

target - 135-140

Shortterm

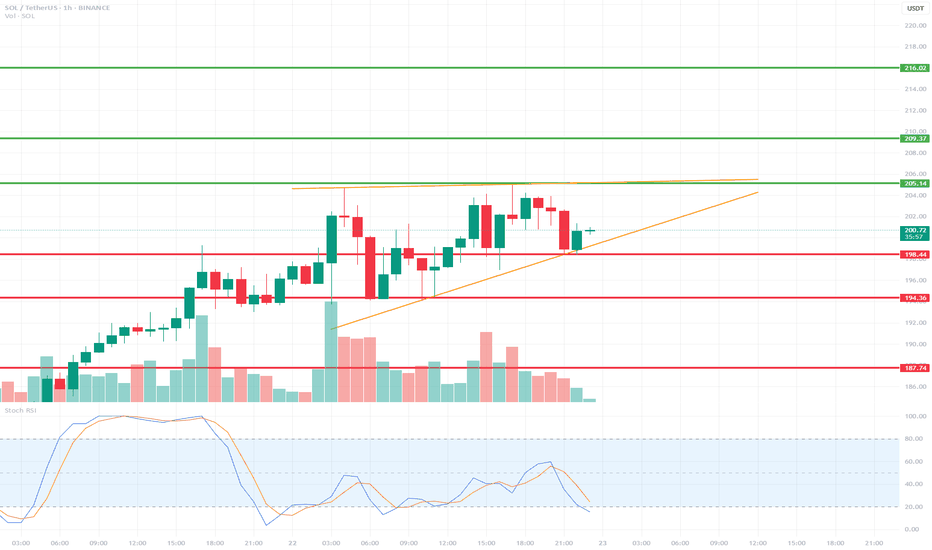

SOLUSDT 1H Short-Term🔍 Technical Structure:

Short-Term Trend:

SOL is currently in an uptrend, with local higher lows. This is evident from the orange uptrend line, which has been tested multiple times.

Local Resistance:

205.14 USDT – yellow line – a resistance level that the price has touched several times but failed to break (this could be a double-top formation).

Local Support:

198.48 USDT – the price is currently testing this level as support.

194.36 USDT – lower, more crucial support (stronger upon a trend breakout).

187.74 USDT – important support that would be tested in the event of a larger breakout.

📉 Oscillator – Stoch RSI:

The Stoch RSI is currently in oversold territory (below 20), suggesting the possibility of a local rebound.

However, there has been no upward crossover yet, so there is no strong buy signal.

🔊 Volume:

We are observing a decrease in volume during the current correction, suggesting that the declines are relatively weak – there is no strong supply impulse.

🧠 Short-term scenarios:

✅ Bullish scenario:

Price is rebounding from the trend line (orange) and the 198.48 USDT level.

A break of the 205.14 USDT resistance could open the way to:

209.37 USDT

216.02 USDT (next target)

❌ Bearish scenario:

A break of the trend line and the 198.48 USDT level with the 1-hour candle closing below.

Possible decline to:

194.36 USDT (first support)

and further to 187.74 USDT if selling pressure increases.

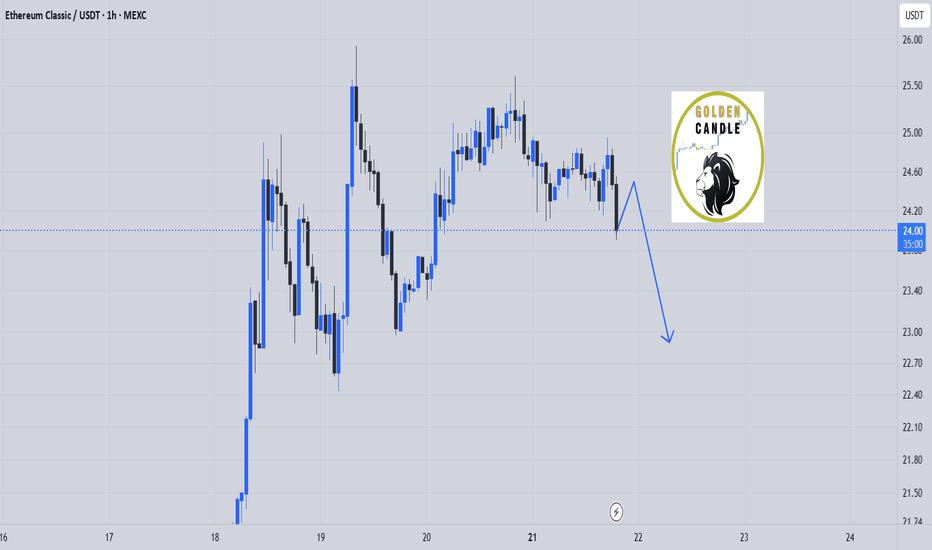

etc sell shortterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

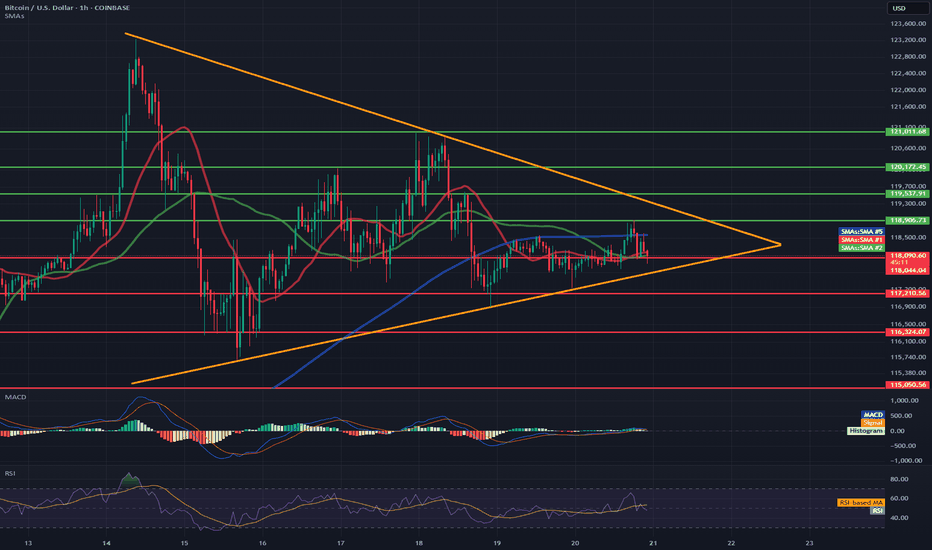

BTC/USD Short-Term🔷 Pattern: Symmetrical Triangle (Consolidation)

The price is inside the triangle formation (orange lines) and is approaching its completion.

An impending breakout (up or down) is highly probable within the next few hours.

📉 Support Levels (red lines):

117.210 – local horizontal support.

116.324 – 115.050 – strong demand zone (potential target in the event of a downward breakout).

📈 Resistance Levels (green lines):

118.900 – 119.700 – local resistance zone.

121.011 – 121.813 – higher target in the event of an upward breakout from the triangle.

📊 Technical indicators:

✅ RSI (Relative Strength Index):

Currently: 69.05 – close to overbought levels, but not yet at an extreme.

Potential for a short-term pullback unless a strong breakout occurs.

✅ MACD:

Signal lines are tightly intertwined, histogram flat → no dominant momentum.

Waiting for a breakout signal (bullish or bearish crossover).

✅ SMA:

Price currently below the 50 and 200 SMA for 1 hour → slight downward momentum.

The 50-SMA (red) is turning down, which may signal a continuation of the sideways or downward trend.

📌 Short-term conclusions (1–6 hours):

Scenario 1: Bullish breakout:

Confirmation: H1 candle close above 118,900.

Targets: 119,700 and potentially 121,000–121,800.

Scenario 2: Bearish breakout:

Confirmation: H1 candle close below 117,200.

Targets: 116,300, then 115,000–115,300.

📍 Watch for:

Breakout of the triangle boundaries with volume.

RSI behavior relative to the 70 level.

MACD crossover and histogram.

BTC/USD 1H ShortTerm🔍 Trend:

The short-term uptrend remains in effect, supported by the orange trendline.

The price has tested dynamic support but has not yet broken it.

🟥 Supports (Important Levels):

🔻 1. 119.550

Key support.

The price is currently testing it. Holding = potential upside rebound.

Breaking = greater downside risk.

🔻 2. 117.260–118.040 USD

Clear demand zone (reinforced by prior consolidation).

If the price breaks below current support, this is the next logical stopping point.

🔻 3. 115.237–115.500 USD

Strong weekly support – very important in the event of a stronger correction.

Historically, it has responded many times.

🟩 Resistance:

🔼 1. USD 121.673

The nearest local resistance – this could pose a problem for further growth.

🔼 2. USD 123.961

The last local high. Breaking it confirms the continuation of the uptrend.

🔼 3. USD 125.785

The next resistance – a potential target after a breakout to the upside.

📈 Technical Indicators:

RSI (classic):

Still below 50, but starting to reverse slightly upward – neutral with a slight potential for a rebound.

Stochastic RSI:

Gives a long signal – the lines have crossed in the oversold zone and are pointing upward.

📊 Scenarios:

🟢 Bullish:

Maintaining the current support zone (119.5–120k).

Breakout above 121.673 → target: 123.961.

Breakout of 123.961 = trend confirmation and target: 125.8k+

🔴 Bearish:

Break of the trend line and support at 119.550 → possible quick decline to 117.2k–118k.

If this doesn't hold, target: 115.2k

✅ Summary:

Decisive moment – tested trend line + support = rebound or breakout point.

The Stochastic RSI indicates a potential upside breakout, but the RSI needs confirmation.

Careful monitoring of volume and reaction to 120k in the coming hours.

sol sell midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BTC/USD 1H chart short-term🔻 Trend:

• Currently visible inheritance channel - confirmed by the yellow inheritance trend (decreasing peaks).

• The price tests resistance in the area 117.564 - possible to break out, but requires confirmation of the volume.

⸻

📊 levels of support and resistance:

• resistance:

• 117,564 (here we are now - resistance test)

• 117,939

• 118,206 (key level - potential breaking from the channel)

• Support:

• 117,205 - a recent hole, valid short -term

• 116,905

• 116,680 - deeper support, possible target with further decline

⸻

📉 Macd:

• The histogram begins to decrease, but the MacD line and the signal line still below zero → still weakness.

• Possibility to build a base for reversing the trend, but there is no clear signal intersection.

⸻

📉 RSI (Relative Strength Index):

• RSI below 50, but it starts to reflect slightly.

• MA RSI is still falling → no strong growth dynamics.

⸻

🔍 Applications:

• The downward trend still dominates, but the price is trying to pierce local resistance (117.564).

• If it breaks above 117,939–118,206 and persists, a possible change in the direction at a short interval.

• If he rejects the resistance - a quick descend to 117.205 or lower (116,900-116,680).

⸻

⚠️ Signals for observation:

• Closing the candle 1h above 118.206 - Bullly Breakout.

• Rejection of level 117.564 and descent below 117,200 - confirmation of further decline.

• MacD and RSI - 50 - potential change of direction.

MKR/USDT 4H Chart🔍 1. Technical Pattern:

The chart shows a descending wedge (orange lines) that has broken out upward.

The breakout occurred on increasing volume (a signal of bullish strength).

The price is currently trading above a resistance line, which is now acting as support (~1980 USDT).

📊 2. Support and Resistance Levels:

Support (red lines):

1903 USDT – local consolidation support.

1801 USDT – strong support at the previous bottom.

1727 and 1632 USDT – fallback zones in case of strong declines.

Resistance (green and blue lines):

2120 USDT – first target after the breakout.

2168 USDT – another strong resistance from the previous consolidation.

2312 USDT – high resistance, potential target if the uptrend continues.

📈 3. Indicators:

🔹 Stochastic RSI:

Close to the overbought zone, but not yet giving a sell signal.

A short consolidation or correction may occur in the coming hours.

🔹 MACD:

The MACD line is above the signal and the histogram is still rising – a buy signal.

No signs of weakening momentum.

🔹 RSI:

The RSI is rising, but not yet in the overbought zone (>70).

Shows the strength of the trend, but there is room for further upward movement.

🧠 Summary and scenarios:

✅ Bullish scenario:

If the price remains above 1980 USDT, the next targets are:

2120 USDT

2168 USDT

Potentially 2312 USDT with continued demand

⚠️ Bearish scenario (less likely at this time):

If the price returns below 1980 USDT and does not regain this level:

Possible return to 1903 or lower (1801 USDT).

Review and plan for 4th July 2025 Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 3rd July 2025 Nifty future and banknifty future analysis and intraday plan.

Swing ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

DOGE/USD 1H Short-term1. General situation on the chart

Trend: The last few dozen candles show a sideways movement with a stronger upward impulse, which was quickly corrected. We are currently seeing declines after the previous upward wave.

Current price: Approx. 0.1847 USDT.

Last structure: After the upward movement (peak around 0.205), the price dropped quite a bit, now consolidating below 0.19.

2. Formations and structures

Formation:

No clear classic formation (e.g. head-and-shoulders, triangle, flags) on the last candles.

However, something like a local peak ("double top") is visible around 0.203–0.205 — the price touched these areas twice and fell off, which suggests that this is a strong resistance.

Support and resistance:

Support: 0.1800–0.1820 — here is the last local low and the area where the price stopped before the previous upward movement.

Next support: 0.1740–0.1750 — the next low from the previous movements.

Resistance: 0.1900–0.1910 — here was the last consolidation, and then a sharp decline.

Strong resistance: 0.2030–0.2050 (recent highs).

3. Indicators

RSI:

RSI value close to 40 and is heading slightly down, but it is not oversold yet. This may suggest that there is potentially room for further decline.

MACD:

Histogram below the 0 line, MACD line below the signal, the bearish signal is still maintained.

4. Signals and potential scenarios

Base scenario (downside):

If the price breaks below 0.1820, the next target is around 0.1750.

Stop loss in this scenario: above the last resistance, e.g. 0.1910.

Alternative scenario (rebound):

If the price does not break 0.1820, and a demand reaction occurs - we may see an attempt to return to 0.1900, or even to the peaks in the area of 0.2000–0.2050.

Stop loss below 0.1800 (in the case of a long play).

5. Potential targets (by price action):

Short:

TP1: 0.1820 (nearest support, you can take some profit)

TP2: 0.1750 (next low, main target)

Long:

TP1: 0.1900 (nearest resistance)

TP2: 0.2000–0.2050 (highs, if the movement is strong)

Summary

Currently, the chart suggests a bearish scenario.

This is confirmed by the candlestick pattern, negative dynamics and indicators (RSI, MACD).

Key level to watch: 0.1820 – if it falls, we will probably go down to 0.1750.

If there is strong demand for 0.1820, a rebound to 0.19+ is possible.

Review and plan for 12th June 2025Nifty future and banknifty future analysis and intraday plan.

Positional/short term stock ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 11th June 2025 Nifty future and banknifty future analysis and intraday plan.

Positional ideas.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

BTC/USD 1H chartHello everyone, let's look at the 1H BTC chart for USD, in this situation we can see how the price moves over a strong growth trend line. However, let's start by defining goals for the near future the price must face:

T1 = 109164 $

T2 = 110207 $

Т3 = 111463 $.

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 107264 $

SL2 = 106314 $

SL3 = 105578 $

SL4 = 104781 $

Looking at the RSI indicator, we see

Return above the upper limit, which can cause an attempt to relax at the coming hours.

BTC/USD 1H Short-Term🔍1. General Context and Short-Term Trend

Short-Term Trend: The last dozen or so candles have shown strong fluctuations — a typical sideways market (consolidation) after a clear upward impulse and a quick drop. The price is currently trading in the range of around $104,900–$106,500.

Recent Strong Move: Clear upward impulse from around $104,900 to around $106,900, followed by a quick correction.

📌2. Supports and Resistances (H1)

Supports:

$105,000–$105,200 — Bottom of local wicks and several demand tests.

$104,900 — Lowest point of the last few hours, clear buyer reaction.

Resistances:

$106,200–$106,400 — Upper area of several candles, strong price rejection.

106,900–107,000 USD – The peak of the last impulse, a place of clear supply.

✅3. Candlestick formations and price action

Pin bar / long wick: Candles with long lower wicks are visible around 105,000 USD, which suggests that buyers are defending support.

Double top? (Double top): Peaks around 106,900 USD (03.06 and 04.06) – a classic signal of a potential change in direction to the lower.

Possible consolidation: The last few hours have been a series of alternating candles, signaling the lack of a clear advantage of bulls or bears.

🧠4. Technical indicators (MACD and RSI)

MACD (lower panel)

The MACD line crossed the signal line from the bottom to the top, then a quick correction and currently the MACD is close to zero – no clear trend, momentum has slowed down.

MACD Histogram: Declining, close to zero, suggesting potential lack of strong trend and possibility of further consolidation.

RSI (middle panel)

RSI value ~44–48 – not overbought or oversold, neutral market state.

No divergence – RSI generally follows price, no strong divergences are visible.

RSI bounced off 30 (tested oversold zone and returned to neutral range).

🧠5. What could be important?

Volatility Squeeze: Low volatility after a sharp move often heralds another impulse.

Potential Fakeout: If support at $104,900 is broken falsely (e.g. quick wick and return), a move up could occur.

No clear trend on the hourly chart, rather sideways market in the short term.

📊Summary and scenarios

Scenario 1 (bullish):

If the $105,000-$104,900 level holds, we can expect a test of $106,200-$106,400 and perhaps another attempt to approach $107,000.

Scenario 2 (bearish):

If the $104,900 support is broken (with a candle closed below this level), the next target is around $104,500 and below.

What to watch out for?

Timing of macro data releases - may increase volatility.

Sudden breakouts from consolidation - no trend = higher risk of sudden, false moves.

On the Cusp of a Breakout - Short-Term Buy OpportunityEntry Price:

Aggressive Entry: Around CMP (₹165.00) with a strict stop loss, anticipating the breakout.

Conservative Entry: On a confirmed breakout and close above ₹170 on a daily basis.

Target Price 1 (T1): ₹180

Target Price 2 (T2): ₹190

Stop Loss (SL): ₹157 (Closing basis below immediate support)

DISCLAIMER

This report is prepared for informational purposes only and is not intended as a solicitation or an offer to buy or sell any securities. The information contained herein is based on technical analysis and publicly available data, which are believed to be reliable, but no guarantee is made as to their accuracy or completeness. Investing in equities involves risks, and investors should conduct their own due diligence and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

Cautiously Bullish - Approaching Long-Term Resistance.Entry Zone: We recommend initiating a BUY position in TCGSRAAC only upon a decisive and sustained breakout above the major descending trendline (around ₹115 - ₹118). A daily close above this level with good volumes would be a strong confirmation.

Target 1 (T1): ₹125

Target 2 (T2): ₹132

Target 3 (T3): ₹140+ (If momentum sustains significantly post-breakout)

Stop Loss (SL): ₹105 (Strictly on a daily closing basis, for a breakout entry)

Rationale:

Long-Term Resistance Test: The stock is currently testing a significant descending trendline that has been acting as a major resistance for over several months. A successful breakout would signal a substantial shift in the long-term trend.

Support from Accumulation Zone: The stock has recently bounced from a strong demand zone around ₹80 - ₹88 (highlighted in blue), indicating underlying buying interest.

RSI Rising: The Relative Strength Index (RSI) has recently crossed above the 50-mark and is trending upwards, suggesting a buildup of bullish momentum as the price approaches resistance.

Volume Activity: While recent volumes are moderate, a significant surge in volume on the day of the potential breakout would be crucial for confirmation.

Risk-Reward: A breakout offers a good risk-reward setup for short-term traders, targeting the next set of resistance levels.

Key Risk: Failure to break above the major descending trendline could lead to a reversal and a fall back towards the ₹95 - ₹100 levels. A sustained daily close below ₹105 would invalidate the bullish breakout attempt.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. Equity investments are subject to market risks.

For Education Purposes Only

Confirmed Breakout and Retest of Channel Resistance.Entry Zone: We recommend accumulating Rolex Rings Ltd. in the zone of ₹1,460 - ₹1,500. This area represents a crucial retest of the broken descending channel's resistance, now acting as strong support.

Target 1 (T1): ₹1,580

Target 2 (T2): ₹1,650

Target 3 (T3): ₹1,750 (Extended target if momentum remains strong)

Stop Loss (SL): ₹1,400 (Strictly on a daily closing basis)

Rationale:

Clear Channel Breakout: The stock has executed a textbook breakout from a well-defined multi-month descending channel. This indicates a significant shift in the underlying trend from bearish to bullish.

Successful Retest: Post-breakout, the price has pulled back to retest the upper boundary of the channel, which is a classic technical confirmation of a valid breakout. The retest appears to be holding, suggesting the former resistance has turned into reliable support.

Volume Confirmation: The initial breakout was supported by decent volumes, and the current consolidation/retest phase is occurring on relatively lower volumes, which is typical before the next leg up.

RSI Bullish Momentum: The Relative Strength Index (RSI) is maintaining its position above the 50-mark and shows bullish bias, supporting the upward price momentum.

Favorable Risk-Reward: The current entry point offers an attractive risk-reward profile for a short-term trade, with the potential upside significantly outweighing the downside risk defined by the stop-loss.

Key Risk: A decisive daily closing below ₹1,400 would invalidate the bullish breakout and retest pattern, suggesting a false breakout or a resumption of the downtrend. Strict adherence to the stop-loss is advised.

Disclaimer : This report is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. Equity investments are subject to market risks.

For Education purposes only

Potential Reversal and Breakout Retest.Entry Zone: We recommend initiating a BUY position in AIA Engineering Ltd. around the current levels, ideally between ₹3,280 - ₹3,320. This area represents a retest of the recent trendline breakout.

Target 1 (T1): ₹3,400

Target 2 (T2): ₹3,480

Target 3 (T3): ₹3,580 (If momentum sustains above T2)

Stop Loss (SL): ₹3,200 (Strictly on a closing basis)

Trendline Breakout & Retest: The stock recently broke out of a significant descending trendline, indicating a potential end to the corrective phase. The current price action appears to be a successful retest of this broken trendline, which often acts as new support, presenting a lower-risk entry point.

Volume Confirmation: The initial breakout was accompanied by higher volumes, and while the retest phase has lower volumes (typical), sustained buying interest on subsequent upward moves would confirm strength.

RSI Bounce from Support: The Relative Strength Index (RSI) is showing a bounce from the 40-50 zone, indicating that momentum is regaining strength and potentially moving towards the bullish territory.

Positive Structure: The overall chart structure suggests that the stock is attempting to reverse its short-term downtrend and potentially resume its broader upward trajectory.

Favorable Risk-Reward: The current setup offers a reasonable risk-to-reward ratio for a short-term trade, with potential for upside gains outweighing the defined risk.

Key Risk: A close below ₹3,200 would invalidate the bullish retest scenario and could lead to further downside, bringing the previous lows into play. Traders should adhere strictly to the stop-loss.

Potential Breakout from a Symmetrical Triangl Descending ChannelEntry Zone: We recommend initiating a BUY position in JK Lakshmi Cement around the current levels, ideally between ₹880 - ₹890. This considers the strong closing above the resistance trendline.

Target 1 (T1): ₹925

Target 2 (T2): ₹950

Target 3 (T3): ₹980 (If momentum sustains above T2)

Stop Loss (SL): ₹860 (Strictly on a closing basis)

Channel Breakout: The stock has decisively broken out of a multi-month descending channel/symmetrical triangle pattern, indicating a potential strong reversal from a corrective phase. This breakout appears to be supported by a noticeable pickup in volumes.

Key Resistance Breach: The stock has also managed to close above a significant horizontal resistance level around ₹880-885, which has acted as a hurdle multiple times in the past. A sustained move above this level confirms bullish intent.

RSI Strength: The Relative Strength Index (RSI) is showing strength, trading well above the 50-mark and moving towards the overbought zone, confirming increasing buying momentum.

Positive Price Action: The overall structure suggests accumulation at lower levels, and the current breakout could initiate the next leg of the uptrend.

Favorable Risk-Reward: The setup offers a compelling risk-reward profile for a short-term trade, with significant upside potential compared to the defined stop-loss.

Key Risk: A failure to sustain above the ₹880 level or a close below the ₹860 stop-loss would invalidate the bullish view and could lead to renewed selling pressure.

Bullish - Breakout observed from a descending channelEntry Zone: We recommend accumulating FSL in the zone of ₹375 - ₹385.

Target 1 (T1): ₹405

Target 2 (T2): ₹420

Target 3 (T3): ₹450 (If momentum sustains above T2)

Stop Loss (SL): ₹360 (Closing basis)

Rationale:

Channel Breakout: The stock has successfully broken out of a prominent descending channel, indicating a potential shift in momentum from bearish to bullish. This breakout is supported by decent volumes on the breakout candle.

RSI Confirmation: The Relative Strength Index (RSI) has shown a strong move above the 50-mark and is trending upwards, suggesting increasing buying interest and underlying strength.

Support from Previous Levels: The breakout retests appear to hold the previous resistance now acting as support, which is a classic bullish reversal pattern.

Risk-Reward: The current setup offers a favorable risk-to-reward ratio for short-term traders.

Key Risk: A close below ₹360 would negate the current bullish view and could lead to further downside. Traders should adhere strictly to the stop-loss.

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. Equity investments are subject to market risks.

BTC-USD 1h chart targets and stoplossHello everyone, let's look at the 1H BTC chart to USD, in this situation we can see how the price dropped below the local upward trend line. Going further, let's check the places of potential target for the price:

T1 = 109196 $

T2 = 110644 $

Т3 = 111850 $ t4 = 112951 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 108351 $

SL2 = 107537 $

SL3 = 106390 $

SL4 = 105455 $

Looking at the RSI indicator, we see staying over the upper limit, which can give price drops, while the MacD indicator lasts at the bottom of the range and is close to returning to the upward trend.

ETC/USDT 4h chart Hello everyone, let's look at the 4h graph etc to USDT, in this situation we can see how the price came out of the top of the lasting downward trend. Going further, let's check the places of potential target for the price:

T1 = $ 17.44

T2 = $ 18.75

Т3 = 20.73 $

T4 = 22.48 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = $ 16.25

SL2 = $ 15.05

SL3 = $ 13.74

SL4 = $ 12.66

Looking at the RSI indicator, we see

As we entered the upper part of the range again, which apparently affected the slow price of the price.