S&P 500 set upThis is my first index analysis but we will continue with the same method.

First, the price formed a SHS pattern and the price is returning to the trendline/resistance so we are waiting for the price to bounce back and head into a bearish trend or wait for the rupture and confirmation of the change of trend.

If RSI crosses 70 level we should expect a buy

Shspattern

BITCOIN: Daytrade-Opportunity! Very NICE chance to SELL here!#Hey tradomaniacs,

welcome to another free signal!

Important: MARKET very volatile! Remember to keep your risk low! This is a PULLBACK-TRADE - Reduce your risk asap!

-----------------------------

Type: Day-Swingtrade

Sell-Limit: 6.930

Stop-Loss: 7.387

Target 1: 6.281

Target 2: 6.011

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

EURMXN SHS 1WA bearish trend could be expected after this SHS pattern in 1W. Support at 21.5x has already been broken. A pullback may happen in next weeks to that level as a resistance or keep going down to 20.0X support directly. This will be a very strong support which I don't think the tick is breaking. Few weeks remaining for confirmation.

USD/JPY: Swing-Setup! S/H/S and evidence for a changing trend!Hey tradomaniacs,

welcome to another free signal!

Important: Place a Sell-Stop @ entry! WATCHOUT.. Target 1 is a crucial price! Aggresive trademanagement there!

-----------------------------

Type: Swingtrade

Sell-Stop: 110.51

Stop-Loss: 110.768

Target 1: 110.000

Target 2: 109.707

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

EURUSD SHS Pattern: Sooner or Later ...Its just a matter of timeGermany slows down, the Brexit uncertainty continues, new problems with Italy… Now markets think twice about ECB’s normalisation policy in 2019.

Fourth quarter GDP numbers are due for release next week and given the central bank’s concerns and the contraction in German retail sales, the risk is to the downside for the report.

Despite the FED, U-Turn in 6 weeks on the US side, questioning its credibility, the Dollar is still attractive due to its high real interest rate compared to the Euro.

Huge SHS Pattern is emerging...

It's just a matter of time... Wait for the breakout of 1.12980.

Trading without technicals is like driving a car without the brake.

Trading without fundamentals is like driving a car in the dark with no headlights.

Trading with emotions and without a plan is "committing suicide"...

USD/TRY: Swing-Setup! S/H/S-Inverse CHANCE!Hey tradomaniacs,

welcome to another free signal!

Important: Wait for the Breakout of the Range and place a Buy-Limit!

-----------------------------

Type: Swingtrade

Buy-Stop: 5.24056

Stop-Loss: 5.19246

Target 1: 5.26382

Target 2: 5.2853

Target 3: 5.31774

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

GBP/JPY: DAY - SWINGTRADE-Setup!#LIKELYHey tradomaniacs,

welcome to another free signal!

Important: Wait for the retracement down to entry!

-----------------------------

Type: Day- Swingtrade

Sell-Stop: 143,109

Stop-Loss: 143,563

Target-Zone: 142,566 - 142,494

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

BITCOIN: Daytrade-Setup! BUY-Opportunity with this S/H/S-InverseHey tradomaniacs,

welcome to another free signal!

Important: We need to get above 3.520.. there is a lot of sell-pressure.

Either place a Buy-Stop or a Buy-Limit after the break above the Neck-Zone!

Warning: RISKY trade! Market is still a mess. Don`t risk too much!

-----------------------------

Type: Day-Swingtrade

Buy-Stop: 3.528

Stop-Loss: 3.453

Target-Zone 1: 3.580 - 3.600

Target-Zone 2: 3.600 - 3.625

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

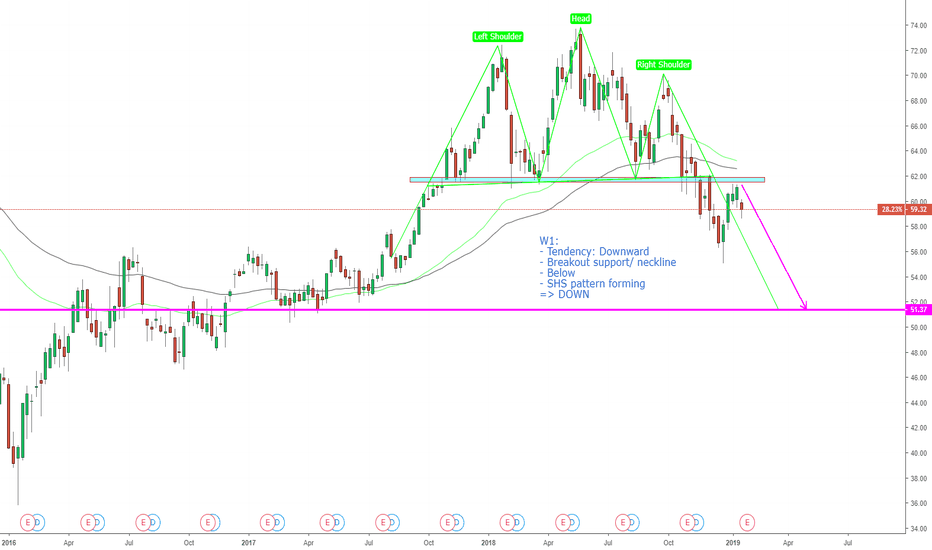

RDS.A, SHS pattern forming: SellRDS.A, SHS pattern forming: Sell

W1:

- Tendency: Downward

- Breakout support/ neckline

- Below

- SHS pattern forming

=> DOWN

EUR/USD: The years-end-analysis - Likely to see PARITY!Hey Tradomaniacs,

welcome to another weekly overview of EUR/USD!

Let`s take a look at the year and what we see is a huge Sell-Off aswell!

EUR/USD started this year @ 1,19873 and found our years high @ 1,25628 in feburary.

After that we`ve just consolidated in a range between the peak and 1,22.

FED`s rate hikes consistently punished the EUR which was affected by many different political circumstances

like Brexit, italy, france and so on.

The European Central Bank decided to quit the QE not as expected - But these might be the first signs of a hawkish policy.

But will we seriously see a rate hike this year? I don`t think so.

What is the consequence of the financial crisis in 2008?

The ECB did nothing else than shifting a problem with financial injections by a ZERO-interest-rate-policy

and the Money-Print-Rage + the QE.

I bet you`ve heared about the quantity equation.

The best way to fight inflation is to increase the interest rate. Since the recession is slowly on its way to destroy

our economy again indicated by a cooling down economy and stockmarket the ECB can not just increase the interest-rate in 2019

as planned and Draghi probably wont even increase them during his term.

Why? Because the only way to suppor the economy is cheap debts/money/credits.

Technical aspects:

--------------------------------------------------------------------------------------------------------------------

After the break through the Neckline we`ve seen a test of the 61,6% retracement and could show us the first impulse

after the breakout of this S/H/S-Pattern. the next move is a retracement back to the trendline, where we bounced off again

and created a doji aboce the candles body.

Is all this a retracement ala kissback before we continue the journey to the south called "parity"?

The FED`s policy is pretty hawkish because Jerome Powel has officially confirmed that the FED-PUT is gone.

He won`t take a look at the Wallstreet anymore and prefers to take the economy and its climate as his indicator for his monetary policy.

The S/H/S-Pattern target would be @ 1,05 which is between the 1.414 and 1.618 Fibonacci-Extension.

The time-Zones are pretty accurate and should be taken seriously.

Conclusion: I`m more bearish but it`s all up to the political situations around us in Europe plus

the ECB`s upcoming desicions.

--------------------------------------------------------------------------------------------------------------------

We will see what happens!

I WISH YOU A HAPPY NEW YEARS EVE! Enjoy the time with family and friends! :-)

---------------------------------------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

DAX: The years end analysis! *WEEKLY UPDATE*Hey tradomaniacs,

wow what a crazy and sad year for all bulls.

I hope you all had some short-certs and made a lot of money.

But yes, it is as we all had to expect! The financial crisis of 2008 got shifted by financial injections

of the FED, ECB and other central banks.

The low interest-rate and QE made it worse and worse and might be time to pop the bubble.

-----------------------------------------------------------------------------------------------------------

Technical aspects:

The year started 12.889 and the DIVA found its peek @ 13.600!

(Thank you Trump for your Tax-promises which made that possible! ;-D)

Since then the DAX has created the first double-top and turned out to be a S/H/S or Diamond-Pattern which is the first evidence of a trendchange.

It`s crazy, but after the Break through the NEckline we`ve seen another attempt called the retest or Kissback to get above 11.800 again.

That bounce and S&R-Flip was the confirmation for the market to sell-off the Diva and went down to the years-low of 10.284.

HA but look - we could fight our way back to the 61,8% retracement-level which is obviously a very common level for the bulls.

It`s been a long time since the market has been oversold like these days. When is the time for a correction?

Well - My opinion - I think it`s time to see the DIVA trying to get above 10.829 - 11.100 is possible!

The last weekly candle is a huge Doji, which indicates a lot of Buy-Pressure caused by the U.S. Market.

Overall the chart looks pretty bearish, but the price is very low and I think there might be some bulls in the tank trying to buy this one.

We will see!

I WISH YOU GUYS A HAPPY NEW YEARS EVE! Enjoy the time with friends and family!

-----------------------------------------------------------------------------------------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

XRP/BTC: Swing-Setup tradingplan! Let`s sell this S/H/S!#ChanceHey tradomaniacs,

welcome to another free signal!

Important: wait for the breakout below the Neckline and place a Sell-Limit-Order!

-----------------------------

Type: Swingtrade

Sell-Limit: 0.000093204

Stop-Loss: 0.000097088

Target 1: 0.000089963

Target 2: 0.000088288

Target 3: 0.0000885467

Remember - Market is very volatile and everything can happen! This is just a plan!

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

EUR/USD: Weekly overview - The way to parity & S/H/S-Pattern!DAX: Weekly Overview! Chance to get back to 12.000 increases!

Hey tradomaniacs,

WELCOME to the outlook of EUR/USD.

The currencypair EUR/USD seems to continue it`s downtrend and could move down to parity.

Fundamental reasons could be the siuation in Italy not willing to desist from its high budget-plan (indebtedness)

which got rejected by the E.U. which is forced to come up with consequences such as a excessive deficit procedure.

The second reason is still the Brexit and it`S possible harsh outcome.

Technical aspects:

Within the last 5 weeks we were fighting at the important mark of 1.14 and mostly closed below this level.

THIS price is a very important support-level as you can see in the history when the market went up and down in

a sideways trend.

The market tested the Fibonacci-Retracement of 61,8% (PHI) @ 1,12144 and bounced back to test the area of the previous

low in MAY 2018 @ 1,15.

The respected 200 Moving Average is right below the price and helped the market to find a support level.

Overall, the market looks really bearish and should continue it`s journey down close to parity.

If we break through the 61,8% retracement, the next logical support should be at 1.10.

A break above 1,15 could turn the market upwards in order to continue the consolidation between 1,18074 and 1,14.

The previous green candle shows a bullsih reversal which is actually a sigh of strenght.

As always, everything can happen.

Have a nice start into the week!

Peace and good trades

Irasor

Wanna see more? Don`t forgetto follow me.

Any questions? PM me. :-)

The YEARS-END-RALLY has begun! 3.000 incoming?#ChanceHey tradomaniacs,

it seems like we could see a very nice chance to trade the years-end-rally.

S&P500 shows a S/H/S-inverse pattern and could head the market up to 3.000 after a break through the neckline!

Fundamentals do look good, especially since Hardliners got "wrecked" by the white house.

Peter Navarro is told to take a big step back and stay out of the public!

Mira Ricardel recently got "removed" from the white house.

Ther armee of ANTI-CHINA-hardliners is "thinning".

The White House could change it`s behavior and try to find a good solution for the tradewar with china.

We will see. :-)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questionsd? PM me. :-)