Weekly Forex Forecast: GOLD & SILVER Are Bullish! BUY Them!This forecast is for the week of Feb 10-14th.

Gold and Silver are both bullish, with Gold being the stronger of the two. I am not interested in selling either until I see a bearish BOS, as the swing structure is bullish, and the trend is up. Wait until the fractal structure is aligned with the overall market structure, which would make for higher probability buys to follow the trend.

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Si1

Could Silver's Price Soar to New Heights?In the realm of precious metals, silver has long captivated investors with its volatility and dual role as both an industrial staple and a safe-haven asset. Recent analyses suggest that the price of silver might skyrocket to unprecedented levels, potentially reaching $100 per ounce. This speculation isn't just idle talk; it's fueled by a complex interplay of market forces, geopolitical tensions, and industrial demand that could reshape the silver market landscape.

The historical performance of silver provides a backdrop for these predictions. After a notable surge in 2020 and a peak in May 2024, silver's price has been influenced by investor sentiment and fundamental market shifts. Keith Neumeyer of First Majestic Silver has been an outspoken advocate for silver's potential, citing historical cycles and current supply-demand dynamics as indicators of future price increases. His foresight, discussed across various platforms, underscores the metal's potential to break through traditional price ceilings.

Geopolitical risks add another layer of complexity to silver's valuation. The potential for an embargo due to escalating tensions between China and Taiwan could disrupt global supply chains, particularly in industries heavily reliant on silver like technology and manufacturing. Such disruptions might not only increase the price due to supply constraints but also elevate silver's status as a safe-haven investment during times of economic uncertainty. Moreover, the ongoing demand from sectors like renewable energy, electronics, and health applications continues to press against the available supply, setting the stage for a significant price rally if these trends intensify.

However, while the scenario of silver reaching $100 per ounce is enticing, it hinges on numerous variables aligning perfectly. Investors must consider not only the positive drivers but also factors like market manipulation, economic policies, and historical resistance levels that have previously capped silver's price growth. Thus, while the future of silver holds immense promise, it also demands a strategic approach from those looking to capitalize on its potential. This situation challenges investors to think critically about market dynamics, urging a blend of optimism with strategic caution.

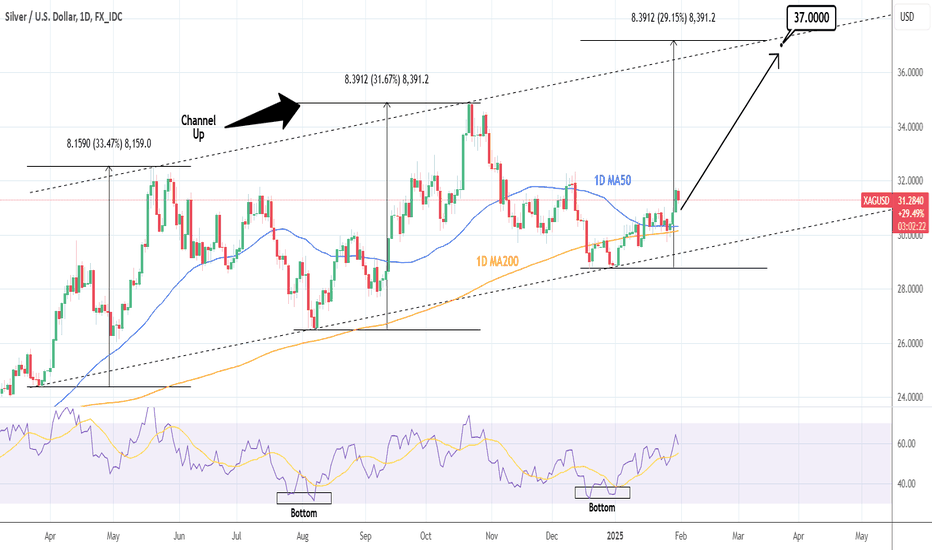

XAGUSD: Channel Up has started new rally to 37.000Silver turned bullish on its 1D technical outlook (RSI = 59.696, MACD = 0.197, ADX = 24.838) as it has validated the start of the new bullish wave of the long term Channel Up. The price has been detached from the 1D MA50 and is approaching the December 12th high. The 1D RSI is expanding a rebound from a Double Bottom much like Silver's previous low on August 7th 2024. So far the Channel Up has had two bullish legs of 33.47% and 31.67% respectively. Assuming a slight rate of decline on each subsequent bullish wave, we anticipate the current to reach +29.15% and we are targeting a little under it (TP = 37.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Weekly Market Forecast Jan 27 - 31stThis is an outlook for the week of Jan 27-31st.

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

The indices are still moving higher, as investors are moving money from the USD to the equity markets, riding the Trump Pump. We'll see how long the euphoria will last, and how the market responds to a bevy of policy initiatives and executive orders by the US President.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly Market Forecast Jan 20-24thThis is an outlook for the week of Jan 20-24

In this video, we will analyze the following FX markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

The indices look set to move higher this week, as Trump is inaugurated Monday, bringing a possible "Trump Pump" to the markets. The metals are a bit mixed, but may continue upward this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Forecast UPDATES! Jan 15, WedIn this video, we will update the forecasts for the following markets:

ES \ S&P 500

NQ | NASDAQ 100

YM | Dow Jones 30

GC |Gold

SiI | Silver

PL | Platinum

HG | Copper

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

SI - Silver Looks GoldenHow does this look?

Yep, I’m stalking a Long, just like in Gold (check out my latest Gold post).

With the price sitting at the Center-Line, it might drop a bit further to the Shift-Line. Or, it could start climbing today.

For me, this is a "building a position" scenario.

Buy… wait… buy more when the price confirms my projection. Or bail out if it doesn’t.

Trading is so simple...

...but SO HARD §8-)

Happy digging!

XAGUSD: Bottom of the Rising Wedge. Bullish.Silver is marginally bearish on its 1D technical outlook (RSI = 43.462, MACD = -0.151, ADX = 27.970) as it trades under the 1D MA50 but still over the 1D MA200. The latter is at the bottom of the long term Rising Wedge and is the technical support level. As long as it holds, we will be bullish on Silver, aiming at its top for the next HH (TP = 37.000).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAGUSD Bearish as long as it trades below the 1D MA50.Silver (XAGUSD) is on a strong correction since the October 23 2024 High, which was a Higher High on the 2-year Channel Up. This is technically the new Bearish Leg. The previous one (started on the May 05 2023 High), initially targeted the 1D MA200 (orange trend-line) and the 0.382 Fibonacci retracement level.

That was of course after a first Lower Low rebound to the 1D MA50 (blue trend-line) where it was rejected (June 09 2023). It appears that technically the price is on a similar situation, so as long as the 1D MA50 closes candles below it, the short-term trend is bearish. Our Target is 29.500 (just above the 0.382 Fib upon expected contact with the 1D MA200).

Notice also that the 1W MACD is past a new Bearish Cross, a pattern similar to the May 24 2023 Bearish Cross, which confirms the Bearish Leg.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD & SILVER Attempt To Break Higher - Moving Into EEP #3Gold and Silver attempt to break upward, moving away from the larger EPP Phase #2 (consolidation/FLAGGING) setup.

If my research is correct, we'll see a very strong rally setting up in Gold/Silver over the next 2-4+ hours - likely see GOLD rallying up to $2720+ and SILVER rallying up to $32.50-$33.

Get ready. This could be a very strong rally phase targeting new all-time highs over the next 15+ days.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

XAGUSD Bull Flag to test the strength of the MA50 (1d).Silver has completed a Cup pattern with the price breaking above it this week.

Yesterday's pull back may start a Bull Flag, delayed Handle of the Cup, same as the mid April Bull Flag that gave an excellent buy above the MA50 (1d).

Trading Plan:

1. Buy on the 1.0 Fibonacci level.

Targets:

1. 38.500 (the 2.0 Fibonacci extension).

Tips:

1. The RSI (1d) is also trading on a similar pattern as April. A neutral (1d) RSI is perhaps the most efficient buy signal there is.

Please like, follow and comment!!

Notes:

Past trading plan:

Cycles and Sentiment may no Longer Matter - SilverWatch video for more detail on the trajectory for silver's next move

EDIT: in the video I said "convert unleveraged to leveraged"

I mean to say take profit on leveraged positions and convert to unleveraged accordingly depending on how quickly we approach 35-40